Whats up and welcome to The GTMnow E-newsletter – the media model of VC agency, GTMfund. Construct, scale and make investments with the very best minds in tech.

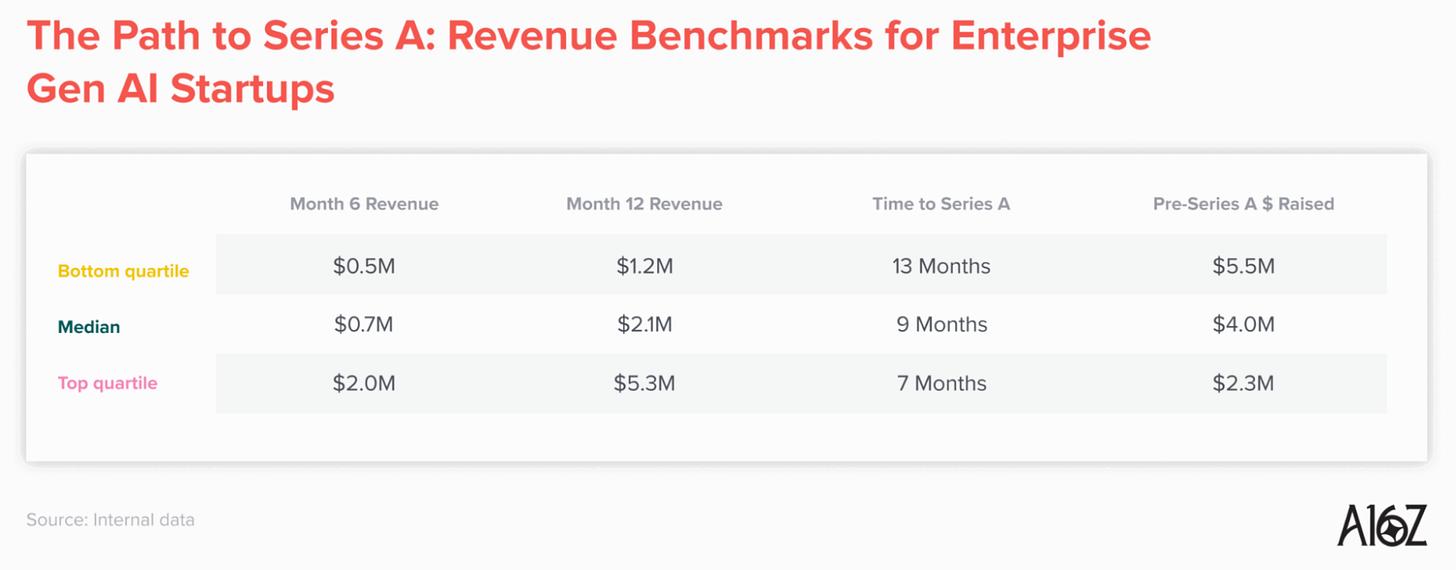

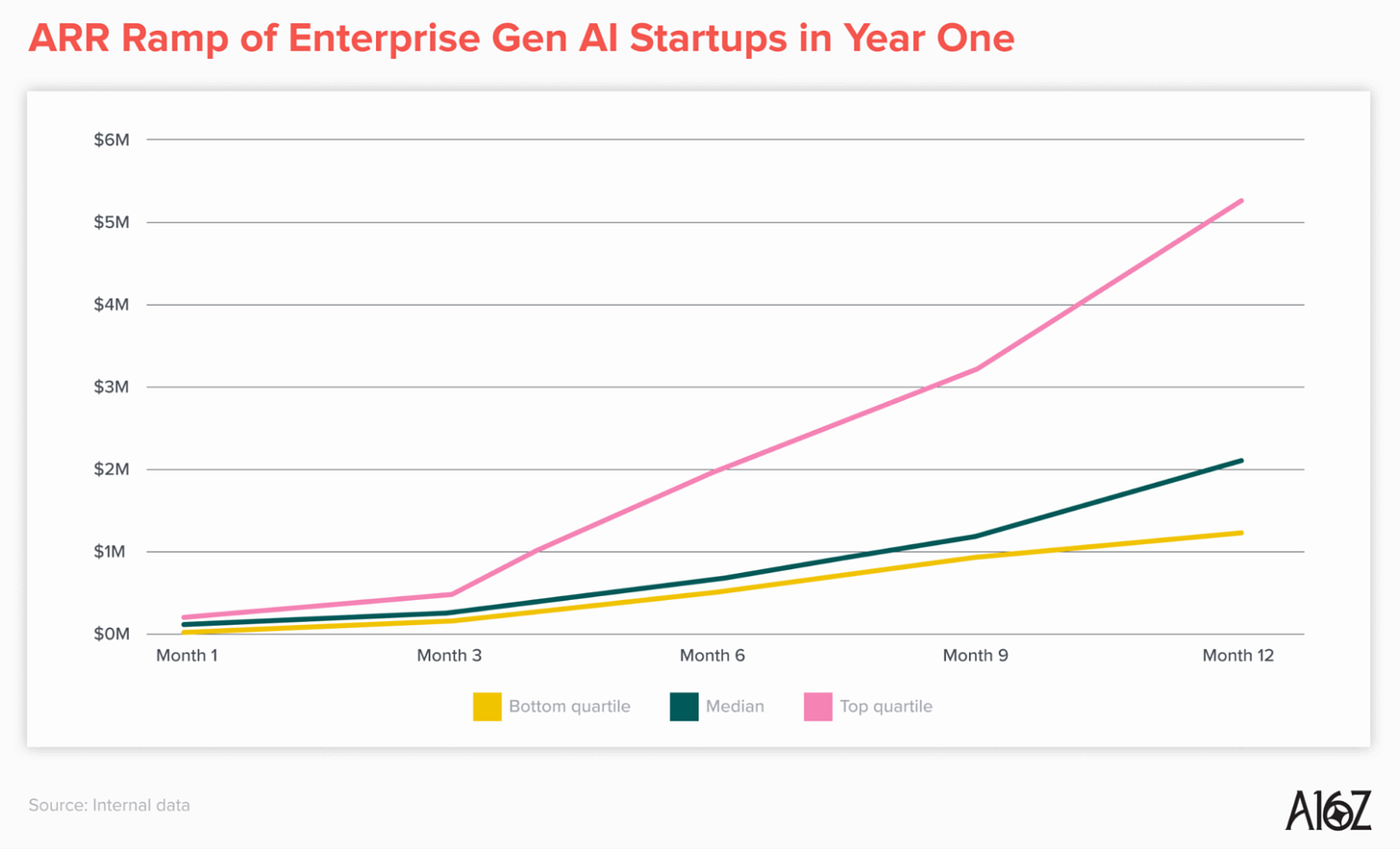

A couple of months in the past, a16z launched new development benchmarks for early-stage corporations: What “Working” Means within the Period of AI Apps.

It (rightfully) induced some commotion. A few of that was validation of what lots of buyers and founders have been sharing anecdotally. Firms are rising sooner than ever within the period of AI and sometimes attending to market sooner than ever with a viable product. A few of the commotion was the ecosystem lamenting the demise of the triple-triple, double-double playbook.

It’s an thrilling and equally difficult proposition.

“Nice” is now not nice anymore.

The bar has been raised for corporations throughout the complete early-stage ecosystem. And whereas we agree with the unbridled optimism of what’s potential at present for startups, we additionally suppose lots of the takeaways miss an necessary nuance. Greater than ever, each firm is totally different. Their GTM motions are totally different. Their buyer shopping for cycles are totally different, and their potential to develop at breakneck tempo is totally different.

Nonetheless, earlier than we get into takeaways, let’s take a look at a few of these numbers. It’s undoubtedly an thrilling time to construct.

The median B2B AI startup is attending to $2M+ in ARR of their first 12 months of monetization. The median. The highest quartile is attending to $5M+ in ARR of their first 12 months. The earlier benchmark for “nice” was $1M ARR within the first 12 months.

Effectivity has improved as nicely. The perfect corporations are solely burning $2 – 4M to get to the income marks above, placing them into an effectivity class we’ve not often seen earlier than. We’re clearly in a distinct period.

Even when that’s true, we imagine there is a crucial nuance to this dialogue to name out:

Not all B2B corporations are the identical.

For the needs of this report, startups had been grouped into two classes: B2C and B2B. The issue is, not all B2B corporations are the identical.

For those who’re an engineering chief shopping for Cursor, you might be an knowledgeable purchaser. You’ve examined AI coding instruments, and also you’re conscious that you’ll want to make a purchase order earlier than your crew will get left behind. You’re additionally snug making that buy with out going via an elongated gross sales course of. Your crew wanted the software yesterday, and you realize what you’re shopping for. You’re blissful to pay $20-$40 per developer, and also you wish to do it quick.

Most of Something and Lovable’s clients are signing up with a bank card. Similar with Gamma. Mercor is a transaction/commission-based market. They generate most of their income via profitable placements, and once more, you don’t must undergo a conventional gross sales movement to change into a “buyer.”

Now, let’s say you promote an AI information platform to enterprise monetary companies corporations. Or maybe it’s healthcare or pharma corporations. Even with a top-tier AI-native product, lean crew, and aggressive GTM movement, you continue to need to undergo enterprise gross sales. It’s important to undergo the procurement, authorized, IT, and govt sponsorship phases of the method. Your limiting issue is your buyer’s shopping for cycle.

We now have a few corporations within the GTMfund portfolio that match this description. They’re each nonetheless crushing it within the context of a16z’s new benchmarks, however after we undergo board conferences and GTM help, their gross sales motions nonetheless appear to be enterprise gross sales motions – simply with extra urgency.

Will the investor market catch as much as this nuance? We’ll see. We imagine sensible buyers already are. Not each B2B AI/software program firm is similar, as a result of not each B2B buyer is similar. To a sure extent, you’re going to be outlined by the market you promote into.

A few different takeaways we’re watching intently:

1. Founders want GTM help sooner than ever.

Founders are producing income earlier and sooner than ever, which implies the significance of GTM execution is heightened from day one. That’s the place now we have the very best community in enterprise capital, and that’s the place we spend our time supporting. We’ve felt it in each founder dialog we’ve had up to now 12+ months. They’re weighing the significance of GTM help increased than ever earlier than.

2. Churn is increased than ever.

The client urgency in lots of of those classes is palpable. Firms know they should transfer quick to undertake AI and reap the advantages of this transformational expertise wave. The flip aspect of that urgency? They appear to be extra keen than ever to attempt to take a look at instruments earlier than making a long-term funding. That means, early income seems to be much less sticky than earlier than. Numerous these corporations elevating Sequence A lower than 12 months after producing income have additionally by no means been via a full renewal cycle.

We don’t know the way sticky these experimental AI budgets are, or how “experimental” they’re. Time will inform. We are likely to imagine the budgets are right here to remain, however precisely the place the {dollars} will find yourself long-term is a bumpier highway than earlier SaaS scaling journeys.

Tag @GTMnow so we will see your takeaways and assist amplify them.

The Friction Report reveals what’s slowing down international software program gross sales, and the best way to repair it. On this new trade report, Cleverbridge analyzed a whole bunch of SaaS corporations to uncover the important thing friction factors hurting income development. From checkout drop-offs and localization challenges to subscription churn, it’s filled with data-backed insights on how main software program corporations are optimizing each step of the digital commerce journey. Verify the total report right here.

Manny Medina (Founding father of Paid, ex-Outreach) argues that ACV is future. Most startups chase fast wins and small offers, however actual scale comes from fixing a CEO’s prime one or two issues and proudly owning outcomes end-to-end. Paid solely builds what issues most to clients, retains its core tech free, and deploys engineers till the issue is solved. The end result: large ARR per rep and CAC payback measured in weeks, not years.

Linear scaled to a $1.25B valuation with simply 80 individuals by specializing in readability, effectivity, and deliberate development. That is their playbook behind how the corporate stayed small, worthwhile, and quick whereas constructing one of the vital admired merchandise in SaaS.

Get a sneak preview right here. For the total factor, hear on Apple, Spotify, YouTube or wherever you get your podcasts by looking “The GTMnow Podcast.”

Oureon – raised a $3.5M pre-seed led by GTMfund and got here out of stealth to construct a real-time communication layer for the sky. The platform connects manned and unmanned plane to allow them to talk, predict, and deconflict in actual time as 800M new drone flights enter international airspace.

Casium – raised $5M to assist employers rent and onboard international expertise sooner. The platform streamlines worldwide hiring, compliance, and payroll, giving corporations a less complicated solution to increase groups throughout borders.

-

RevOps Lead at Ona (previously Gitpod) (Distant – UK/Germany)

-

Named Accounts Supervisor at Gorgias (Hybrid – Toronto)

-

VP, Gross sales & Success at Pavilion (Distant – New York)

-

Head of Associate Advertising at Atlan (Distant – US/London/Eire)

-

Strategic Buyer Success Supervisor, Life Sciences at Author (Hybrid – London)

See extra prime GTM jobs on the GTMfund Job Board.

Upcoming occasions you received’t wish to miss:

-

Momentum Ebook Tour: Management Dinner: November 5, 2025 (New York, NY)

-

Momentum Digital Occasion: Ignite your GTM with AI: November 12, 2025

-

GTMfund Dinner (personal registration): November 18, 2025 (Toronto, ON)

-

GTMfund Dinner (personal registration): November 19, 2025 (New York, NY)

-

GTM x Founder Occasion (personal registration): November 20, 2025 (New York, NY) – should you’re an AI-focused founder in NYC, hit reply to get the main points.

-

Above the Fold (for entrepreneurs): February Sep 11, 2025 (Fort Lauderdale, FL)

-

Spryng (for entrepreneurs): March 24-26, 2025 (Austin, TX)

Some GTMnow group (founder, operator, investor) love to shut it out – we respect you.