Precision Buying and selling: Introducing Our MT5 Indicators for Optimum Market Insights

Now we have set a premium worth for our MT5 indicators, reflecting over two years of growth, rigorous backtesting, and diligent bug fixing to make sure optimum performance. Our confidence within the precision and accuracy of our indicators is such that we recurrently showcase them in real-time market circumstances by each day content material on our social media channels.

Our perception in buying and selling simplicity, adhering to the precept of shopping for low and promoting excessive (or vice versa), is echoed in our indicators’ clear show of potential entry and exit factors. We persistently present each day content material demonstrating our indicators in motion. Moreover, we provide merchants the chance to hire our indicators for $66 per thirty days. This enables merchants to check the indicator for one month with their chosen buying and selling pair earlier than committing to a yearly subscription.

We’re dedicated to monitoring consumer suggestions carefully and making crucial enhancements to our indicators ought to any bugs come up, making certain that merchants have entry to the best instruments for his or her buying and selling endeavours.

Chart Readability Dashboard – CLICK HERE TO BUY

Compatibility: Chart Readability dashbaord works with all monetary devices forex pairs, indicies, equities, commodities and cryptocurrencies

The Chart Readability Dashboard gives clear insights into worth actions for numerous monetary devices like forex pairs, equities, cryptocurrencies, commodities, and indices. This dashboard shows detailed worth data in real-time, making it simpler for merchants to make choices shortly. It reveals worth actions all the way down to the second, providing you with important knowledge earlier than you commerce or analyze charts.

Chart Readability Dashboard means that you can monitor worth modifications throughout all time frames and session. Adjustments in color of numerical values point out bullish or bearish momentum, exhibiting whether or not the value is above or beneath the open worth for the given timeframe.

The dashboard additionally saves each day exercise as a CSV file inside an inside folder on MT5, making historic knowledge simply accessible for future evaluation. Please consult with our connected YouTube video for invaluable insights into the performance and detailed breakdown of how the Chart Readability Dashboard presents important data, helping merchants view charts with readability.

Key Options

- Analyze worth motion in the course of the Asia, London, and New York buying and selling classes.

- Evaluation worth motion for the present week, final week and final month.

- Observe worth motion for your complete month down to the current second.

- Monitor worth motion hourly, throughout all buying and selling classes.

- View dynamic worth motion throughout all time frames and buying and selling classes in a single place.

- View Candle shut countdown timer particular to your buying and selling time-frame.

- Save each day buying and selling exercise in a CSV file for future reference or chart evaluation.

- Expertise real-time updates.

- Rapidly visualize bullish or bearish momentum from market open, by color illustration of numerical values.

- Presents an intuitive interface for straightforward interpretation and evaluation of incoming knowledge.

- Displays fluctuations in buying and selling exercise all through completely different hours of the buying and selling session, figuring out hours with concentrated buying and selling exercise.

- Visible illustration of patterns in worth motion resembling spikes, divergences or traits to to help in making buying and selling choices.

- Can be utilized at the side of different technical indicators for complete market evaluation.

- Allows customers to research historic worth motion to establish previous buying and selling patterns and traits for chart evaluation.

- Permits customers to personalize settings resembling font color, session choice, and time durations.

Numerical Worth Color Indication

- Blue Numerical Values – Bullish Momentum: Signifies the value is above the open or optimistic for the corresponding session or time frame

- Purple Numerical Values – Bearish Momentum: Signifies the value is beneath the open or adverse for the corresponding session or time frame, a (-) minus signal will seem subsequent to the numerical worth

Observe: Any buying and selling determination made ought to be primarily based on unbiased evaluation and a radical understanding of fundamentals, moderately than solely counting on the color of numerical values.

Final Week/ Days

- Shut Open: Distinction between shut & open worth – Value gapping up or gapping down

- Open worth: Opening worth for the day

- Open Excessive: Distinction between open worth & each day excessive

- Open Low: Distinction between open worth & each day low

- Excessive Value: Highest worth for the day

- Low Value: Lowest worth for the day

- Shut Value: Shut worth for the day

- Vary: Distinction between the very best and lowest costs of the day

Classes

- Open: Opening worth for the session

- Excessive: Highest worth in the course of the session

- Low: Lowest worth in the course of the session

- Shut: Shut worth for the session

- Open-Shut: Distinction between session open worth & shut worth

- Vary: Distinction between the very best and lowest costs of the session

Hours

- Open Excessive: Distinction between open worth & hourly excessive, inside the respective session

- Open Low: Distinction between open worth & hourly low, inside the respective session

- Excessive Value: Highest worth for the hour, inside the respective session

- Low Value: Lowest worth for the hour, inside the respective session

- Open Shut: Distinction between open & shut worth for the hour, inside the respective session

- Vary: Distinction between the very best & lowest costs for the hour, inside the respective session

Time-Frames

- Open – Shut: Distinction between open & shut worth inside the respective time-frame

Extras

- Value: Present worth of buying and selling pair

- Time: Countdown timer for the subsequent candle formation, inside the respective time-frame

- Save CSV: Save whole day’s exercise as a CSV file inside an inside folder on MT5

*The connected GIF file showcases a 2.5-hour video of the Chart Readability Dashboard in motion, condensed into a couple of seconds

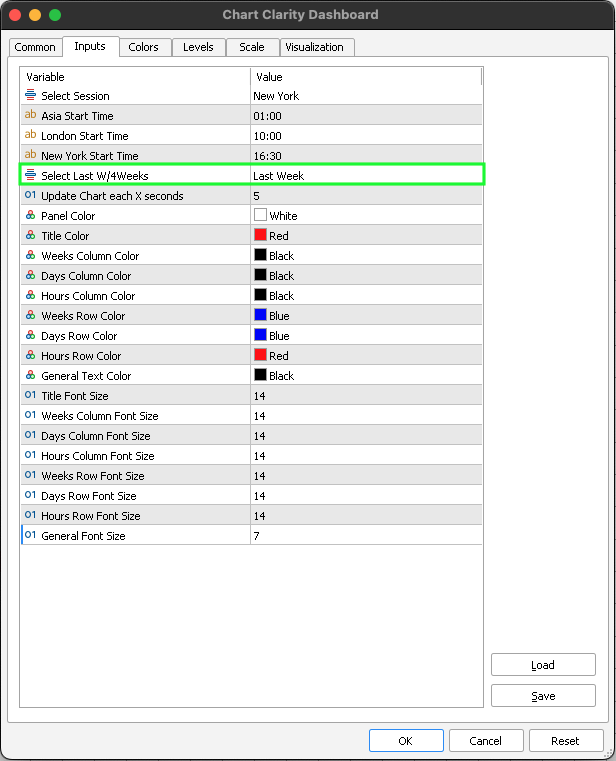

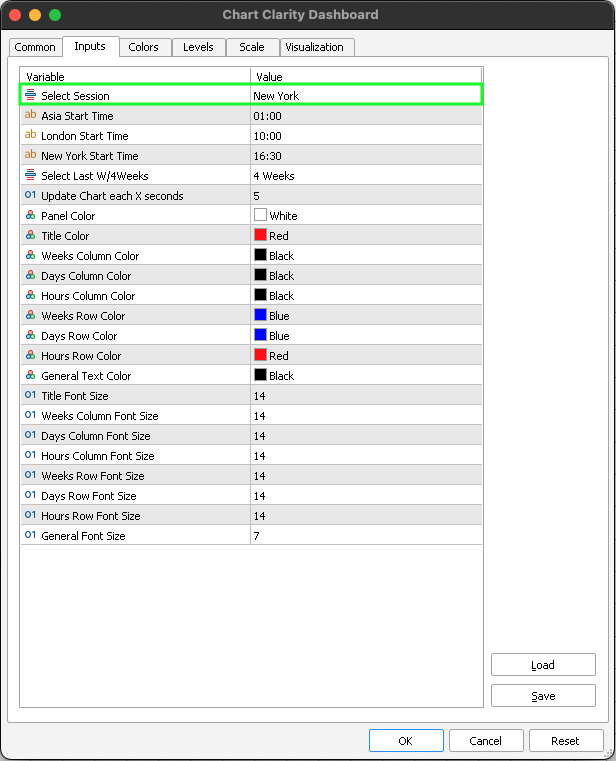

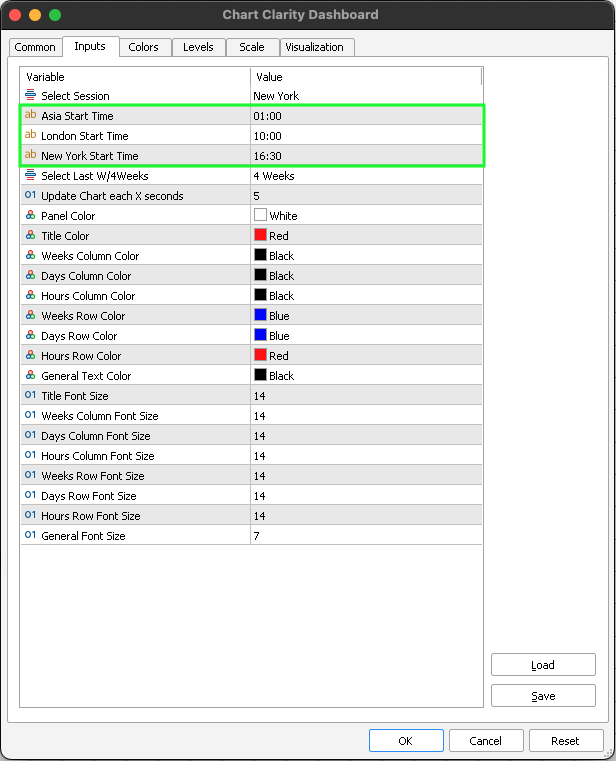

Chart Readability Dashboard Settings

Choose Session: You’ll be able to choose to view knowledge for 3 classes: Asia, London, and New York. The indicator dynamically updates, displaying real-time knowledge for the present day.

Asia Begin Time: Modify the timing for the Asia buying and selling session manually, in keeping with your nation’s time zone.

London Stat Time: Modify the timing for the London buying and selling session manually, in keeping with your nation’s time zone.

New York Begin Time: Modify the timing for the New York buying and selling session manually, in keeping with your nation’s time zone.

Choose final week or 4 weeks: You may have view to knowledge for any buying and selling pair for the previous 4 weeks in addition to particular person each day knowledge for the earlier week, offering insights into worth motion and fluctuations.

Replace chart every X seconds: The default setting for chart updates is configured to refresh each 5 seconds. This interval dictates how incessantly the dashboard reveals new knowledge. You’ll be able to select to lower the replace interval to 1 second for real-time updates.

Different settings: You’ll be able to hold the remaining settings as default, they won’t have an effect on the indicator’s efficiency or visible illustration of the market knowledge.

Chart Evaluation: Preform chart evaluation on a 4 weeks setting. The file saves mechanically, permitting you to revisit it at any time for conducting your evaluation.

Chart Evaluation: Modify the settings to final week, to analyse how your buying and selling pair responded to earnings, information occasions and financial knowledge all through the earlier week.

Day Buying and selling Settings: When you commerce within the New York session, make sure that your session setting is adjusted accordingly. You’ll be able to navigate by classes to conduct chart evaluation, reviewing worth motion earlier than buying and selling in your chosen session.

Session Time Zones: Modify the timing for the Asia, London and New York buying and selling classes manually, in keeping with your nation’s time zone. Confirm the opening time of both session in your nation and regulate the time to your most well-liked time zone primarily based in your chart time. The adjustment ensures that the indicator precisely captures the value motion knowledge for the required session.

p.p1 {margin: 0.0px 0.0px 0.0px 0.0px; font: 13.0px ‘Helvetica Neue’}