Welcome to this week’s publication of the Market’s Compass Crypto Candy Sixteen Research #215. The Research tracks the technical situation of sixteen of the bigger market cap cryptocurrencies. Each week the Research will spotlight the technical modifications of the 16 cryptocurrencies that I observe in addition to highlights on noteworthy strikes in particular person Cryptocurrencies and Indexes. As all the time, paid subscribers will obtain this week’s unabridged Market’s Compass Crypto Candy Sixteen Research despatched to their registered e mail Sundays*. Previous publications together with the Weekly ETF Research could be accessed by paid subscribers through The Market’s Compass Substack Weblog.

*I’m sending a delayed style of the entire Candy Sixteen Crypto Candy Sixteen Research to my free subscribers immediately that went out to my Paid subscribers on Sunday.

A proof of my goal Particular person Technical Rankings and Candy Sixteen Whole Technical Rating go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and choose “crypto candy 16”. What follows is a Cliff Notes model* of the complete clarification…

*The technical rating system is a quantitative method that makes use of a number of technical issues that embody however usually are not restricted to development, momentum, measurements of accumulation/distribution and relative power. The TR of every particular person Cryptocurrency can vary from 0 to 50.

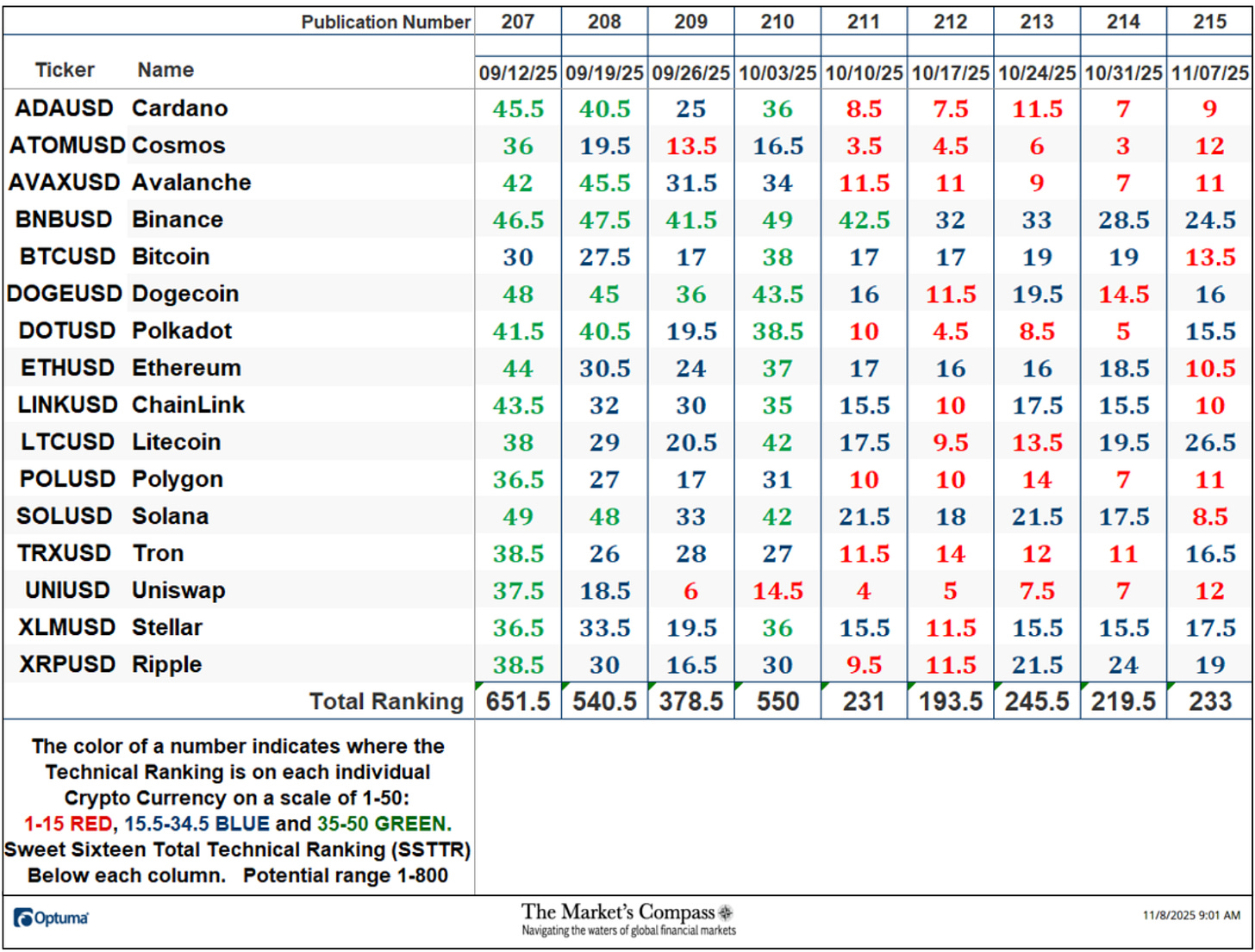

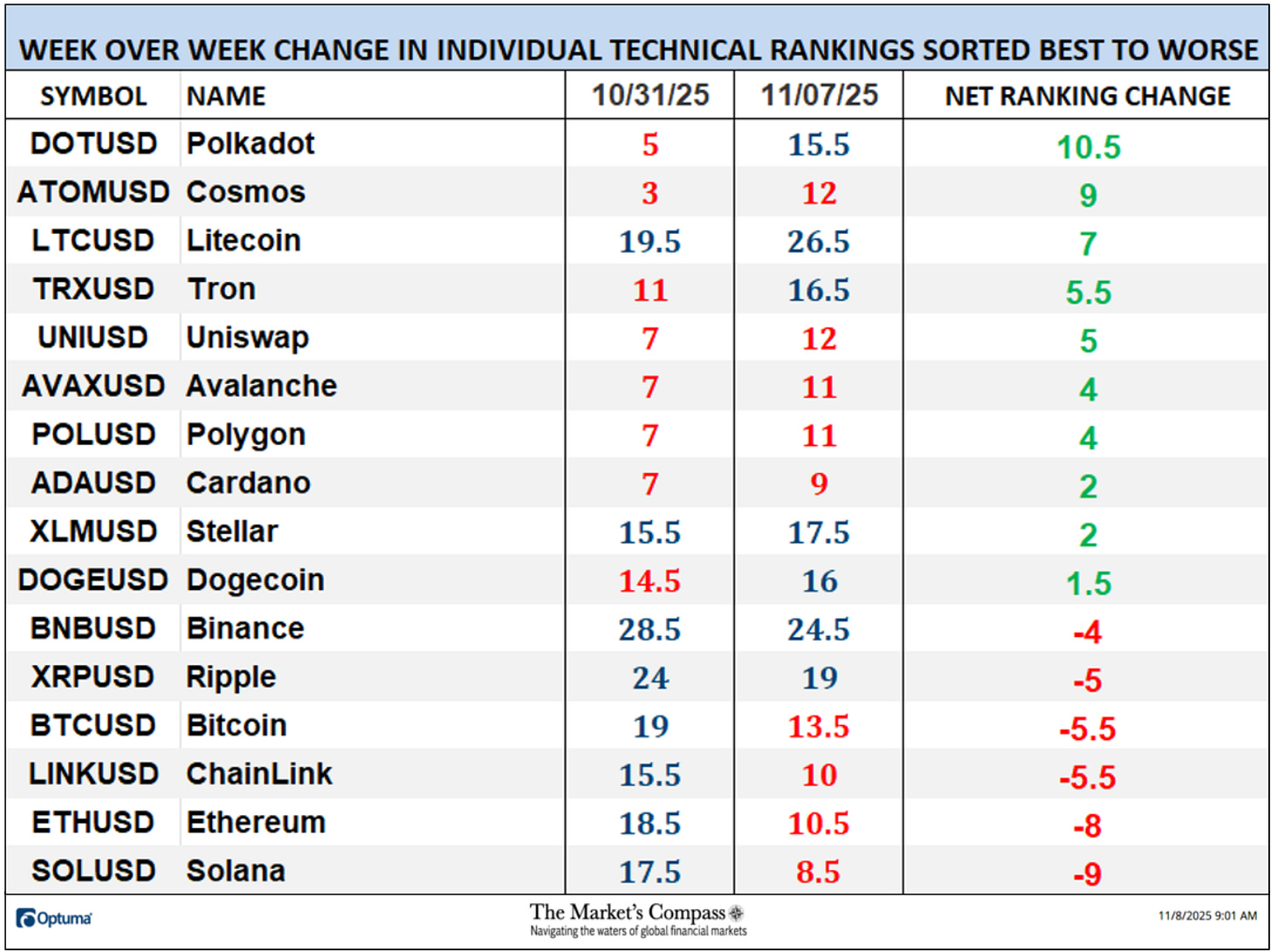

The Excel spreadsheet beneath signifies the the target Technical Rating (“TR”) of every particular person Cryptocurrency and the Candy Sixteen Whole Technical Rating (“SSTTR”) as of final Friday*. The second Excel spreadsheet signifies the week over week change within the “TR” of every particular person Cryptocurrency.

The SSTTR rose 6.15% final week to 233 from 219.5, which had fallen -10.59% from the earlier week’s studying of 245.5.

Ten of the Candy Sixteen marked positive aspects of their TRs final week, six moved decrease. The common Candy Sixteen TR achieve was +0.84 (due to Friday’s flip greater in quite a few the ALTs) vs. the common lack of -1.63 the earlier week. Not one of the crypto forex TRs I observe ended the week within the “inexperienced zone” (TRs between 35 and 50). Seven ended the week within the “blue zone” (TRs between 15.5 and 34.5) and 9 had been in “purple zone” (TRS between 0 and 15). The earlier week there have been eight within the “blue zone” and eight had been within the “purple zone”. Smells extra like rotation greater than anything.

*The CCi30 Index is a registered trademark and was created and is maintained by an impartial crew of mathematicians, quants and fund managers lead by Igor Rivin. It’s a rules-based index designed to objectively measure the general progress, every day and long-term motion of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding steady cash (extra particulars could be discovered at CCi30.com).

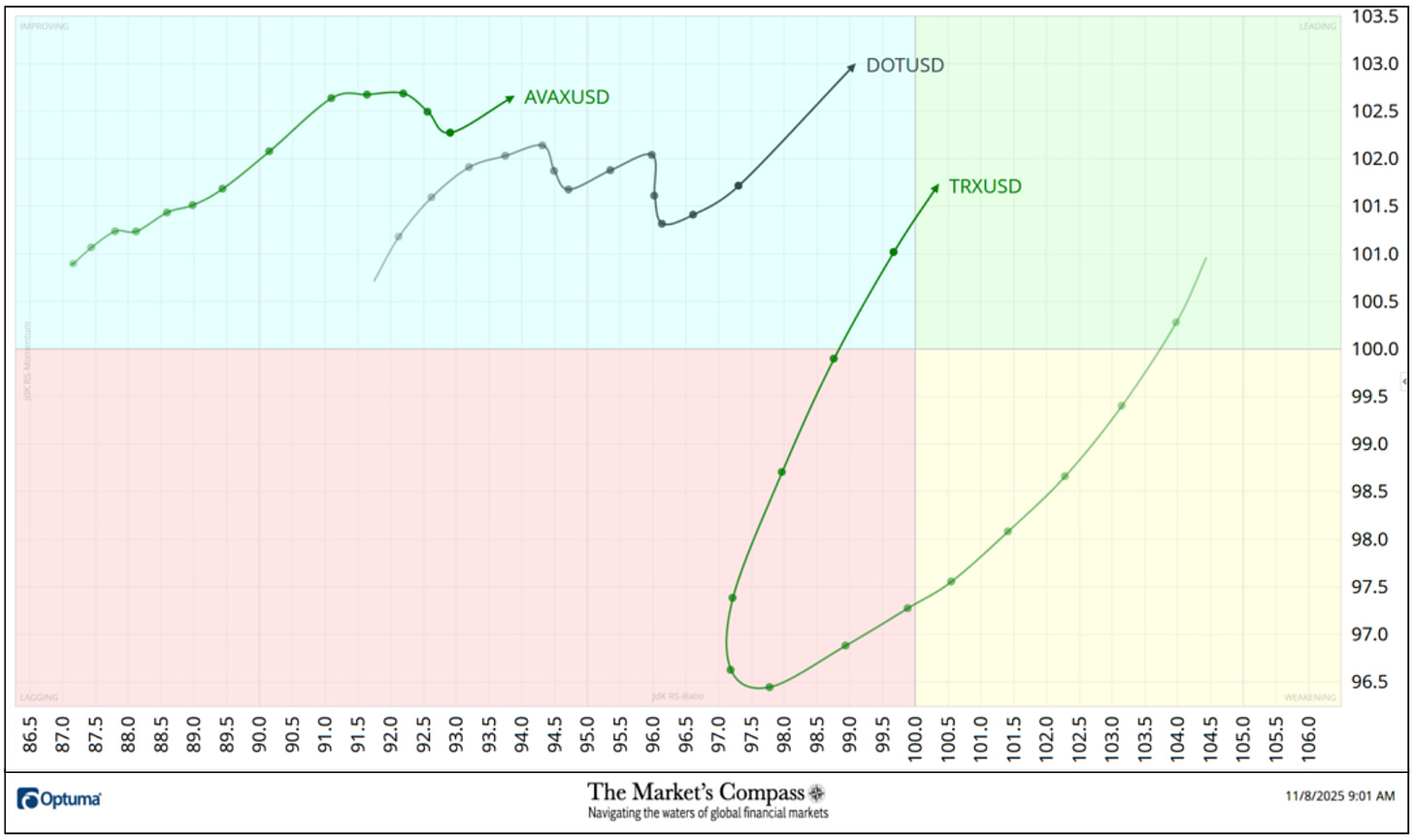

The chart beneath has two weeks, or 14 days, of relative information factors vs. the benchmark, (the CCi30 Index) on the middle, deliniated by the dots or nodes. Not all the Candy Sixteen are plotted on this RRG Chart. I’ve executed this for readability functions. These which I imagine are of upper technical curiosity stay.

Per week in the past, Tron (TRX) fell out of the Main Quadrant and thru the Weakening Quadrant ending up within the Lagging Quadrant, but it surely reversed sharply final weekend exhibiting distinctive Relative Energy Momentum (notice the space between the every day nodes). On the finish of final week, it climbed by the Enhancing Quadrant and ended the week again within the Main Quadrant in an entire spherical journey. Polkadot (DOT) had been “waffling” sideways within the Enhancing Quadrant till final Friday newfound Relative Energy Momentum. Avalanche (AVAX) had began to roll over within the Enhancing Quadrant final week till Friday when reignited to the upside.

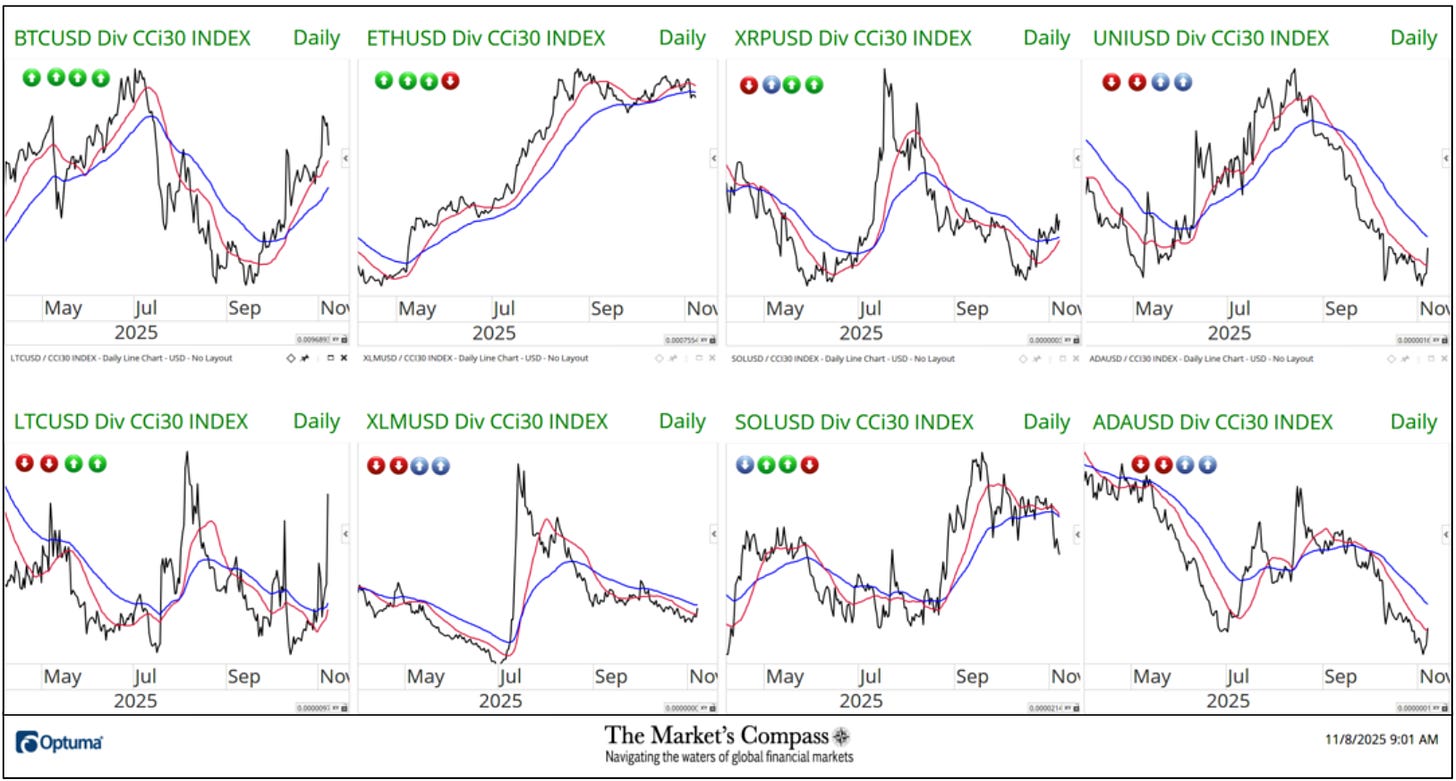

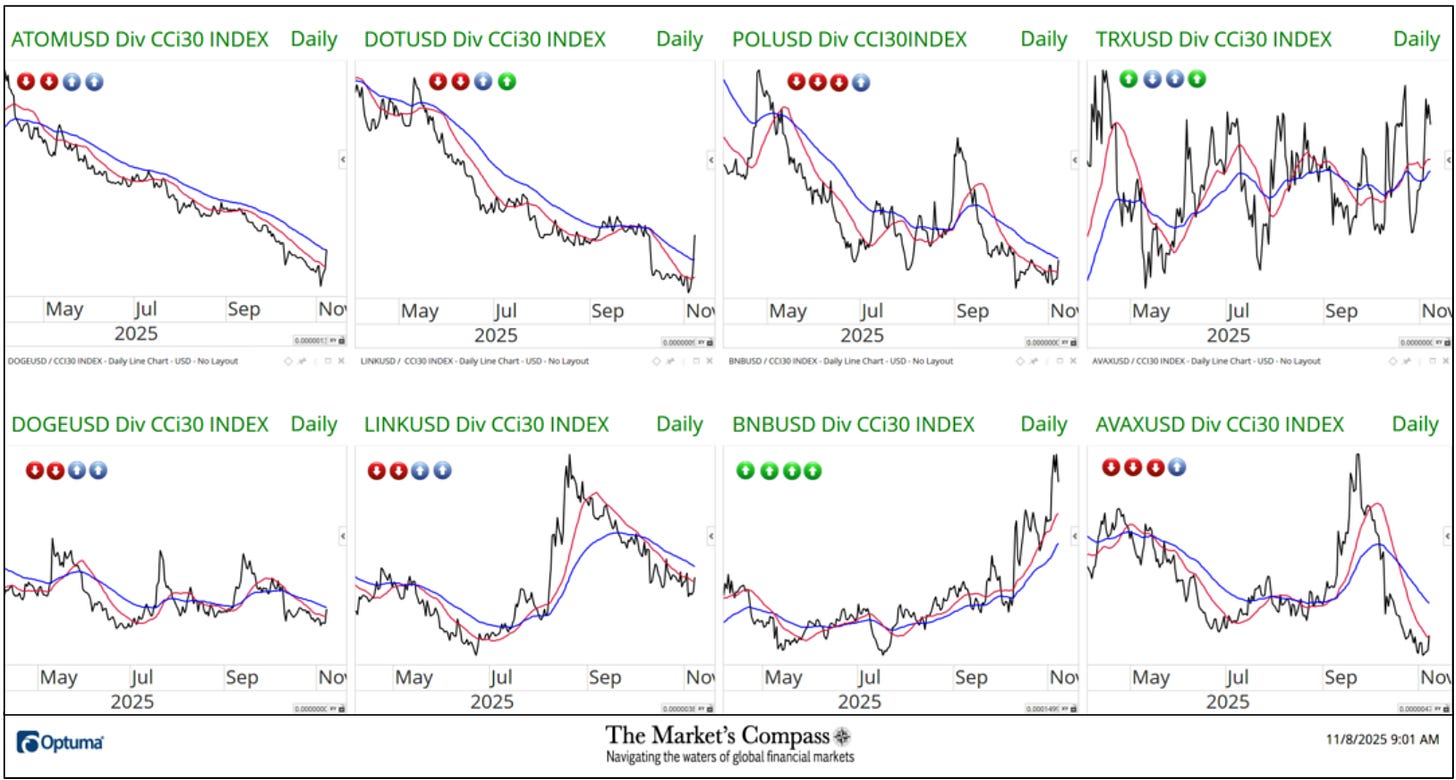

The 2 panels beneath include long term line charts of the Relative Energy or Weak spot of the Candy Sixteen Crypto Currencies vs. the CCi30 Index which can be charted with a 55-Day Exponential Transferring Common in blue and a 21-Day Easy Transferring Common in purple.* Pattern route and crossovers, above or beneath the longer-term shifting common, reveals potential continuation of development or reversals in Relative Energy or Weak spot.

I’ve added a fourth week of directional rankings to the chart. The left hand notation within the circle on the chart now references the directional score from 4 week in the past. The suitable hand circle displays the directional score on the finish of final week.

Bitcoin (BTC) and Binance (BNB) have been displaying optimistic Relative Energy vs. the CCi30 Index for the previous 4 weeks by persevering with to rise and remaining above each shifting averages.

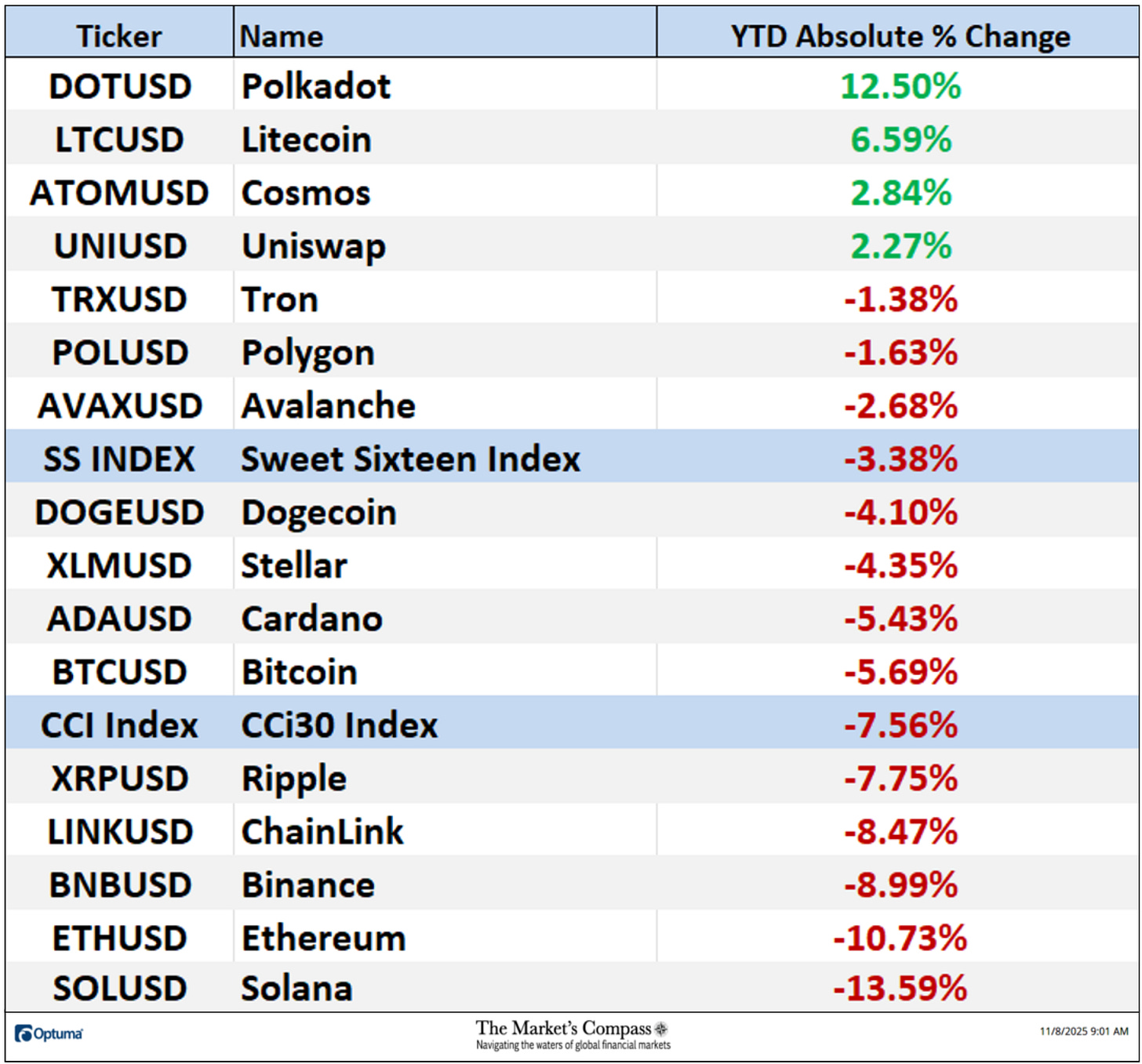

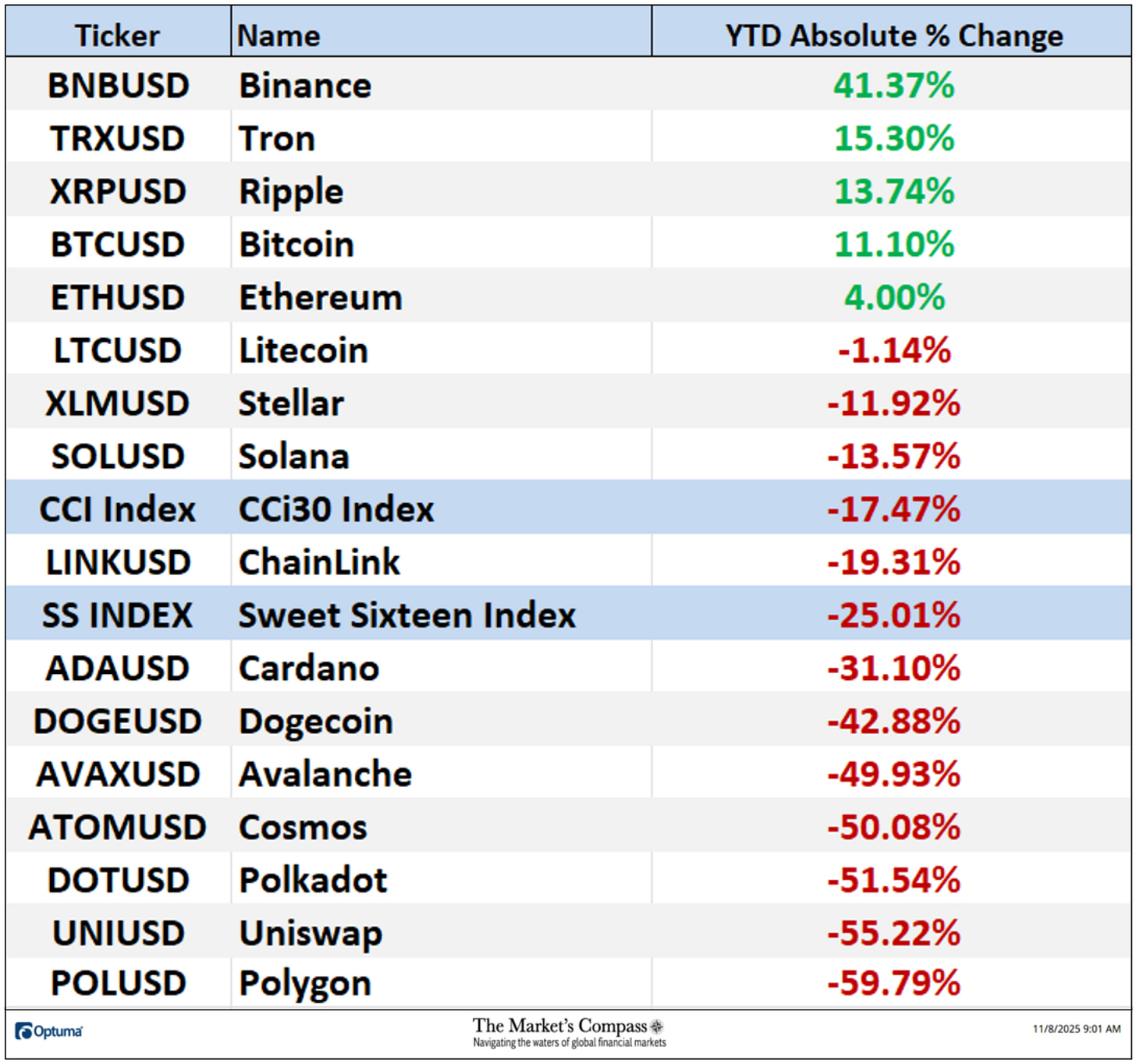

Twelve of the Crypto Currencies I observe misplaced absolute floor over the previous seven days and 4 gained absolute floor. The seven-day common absolute worth loss was -3.16% including to the -4.15% common loss two weeks in the past when just one marked an absolute achieve. Each weekly common strikes exclude the 2 Indexes.

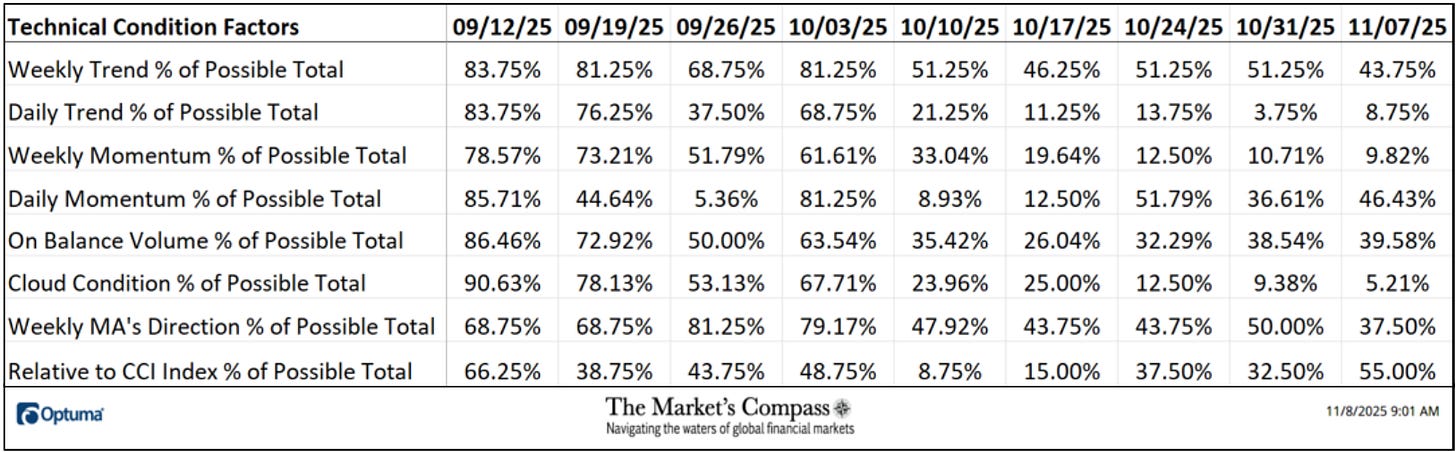

*The Technical Situation Elements are utilized within the calculation of the Particular person Crypto Currencies Technical Rankings. What’s proven within the excel panel beneath is the overall TCFs of all sixteen TRs. A couple of TCFs carry extra weight than the others, such because the Weekly Pattern Issue and the Weekly Momentum Consider compiling every particular person TR of every of the 16 Cryptocurrencies. Due to that, the excel sheet beneath calculates every issue’s weekly studying as a proportion of the attainable complete.

A full clarification of my Technical Situation Elements go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and choose Crypto Candy 16.

The Every day Momentum Technical Situation Issue or “DMTCF” rose to 46.43% or 52 out of a attainable 112 on the finish of final week from a studying of 36.61% or 41 the week earlier than due to Friday’s buying and selling motion

As a affirmation instrument, if all eight TCFs enhance on per week over week foundation, extra of the 16 Cryptocurrencies are bettering internally on a technical foundation, confirming a broader market transfer greater (consider an advance/decline calculation). Conversely, if extra of the TCFs fall on per week over week foundation, extra of the “Cryptos” are deteriorating on a technical foundation confirming the broader market transfer decrease. In a fair cut up final week 4 TCFs rose, and 4 fell.

*The “TSSTCF” Oscillator tallies the eight goal Technical Situation Elements into one overbought / oversold indicator that ranges between 0 and eight.

The CCi30 Index fell beneath Cloud assist intra-week after three weeks of being capped by the confluence of the Kijun and Tenkan Plots at 19,450 however recovered by Friday to shut off the weekly lows (which fell wanting difficult key assist at 15,265 and virtually overtook Cloud resistance (each are mior technical positives). The “TSSTCF” Oscillator has not moved a measurable quantity and stays oversold. My technical stance stays unchanged; “I stay unconvinced that the lows are in”. Provided that the index can overtake damaged worth assist on the 19,450 degree on the Kijun and Tenkan Plots and return to the confines of the Schiff Modified Pitchfork (purple P1 by P3) will it lead me to mood my cautious view”.

For a clarification on how you can interpret the Candy Sixteen Whole Technical Rating or “SSTTR” vs the weekly worth chart of the CCi30 Index within the decrease panel, go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and choose Crypto Candy 16. A quick clarification follows…

The Candy Sixteen Whole Technical Rating (“SSTTR”) Indicator (backside panel within the chart beneath) is a complete of all 16 Cryptocurrency Particular person Technical Rankings and could be checked out as a affirmation/divergence indicator in addition to an overbought/oversold indicator.

The CCi30 index efficiently examined assist on the Median Line (gold dotted line) of the longer-term Normal Pitchfork (gold P1 by P3) and closed the week off the lows. That stated, there’s nary an indication in MACD which continues to trace decrease beneath its sign line suggesting there has not been a flip in longer-term detrimental worth momentum. That in addition to the shorter-term Stochastic Momentum Index which additionally continues to slide decrease beneath its sign line. One probably optimistic technical characteristic is that the Candy Sixteen Whole Technical Rating marked a really short-term optimistic non-confirmation because it stays in deeply oversold territory however as I’ve reminded my readers advert nauseum, worth motion supersedes all secondary indicators and solely a rally that drives costs again above the 20,200 degree and the Median Line (violet dotted line) of the Schiff Modified Pitchfork (violet P1 by P3) would counsel that the index could also be out of the woods.

I’ve added a brand new shorter-term Normal Pitchfork (gold P1-P3). Final Friday the broader crypto index (boosted by a upside reversal in a number of of the ALTs) retook and closed above the Median Line (inexperienced dotted line) of the longer-term Normal Pitchfork (inexperienced P1-P3), however there are a number of technical hurdles to be overcome to start to contemplate that the correction has run its course. These embody the Tenkan Plot (purple line), damaged worth assist at 18,260.00, the Median Line (gold dotted line) of the brand new Pitchfork, and the Kijun Plot (stable inexperienced line). All three secondary indicators counsel that final Tuesday’s low could have marked a short-term promoting climax.

Final week the YTD Absolute % Worth Change fell again to finish the week at -18.81% from -15.25% the week earlier than.

The next hyperlinks are an introduction and an in-depth tutorial on RRG Charts…

https://www.optuma.com/movies/introduction-to-rrg/

https://www.optuma.com/movies/optuma-webinar-2-rrgs/

To obtain a 30-day trial of Optuma charting software program go to…

An in-depth complete lesson on Pitchforks and evaluation in addition to a fundamental tutorial on the Instruments of Technical Evaluation is out there on my web site…