Bitcoin slid beneath the $92,000 mark on Wednesday, buying and selling at $91,500 at press time after a one-day drop of 5% that left the token down 17% within the final 30 days.

Associated Studying

Market gamers had been rattled after a stretch of heavy swings that started with a peak early in October. In line with market trackers, worth strain has pushed sentiment into deep concern as buyers reassess threat.

Winklevoss Sees Alternative

In line with posts on X by Cameron Winklevoss, costs underneath $90,000 might not final lengthy. “That is the final time you’ll ever be capable of purchase bitcoin beneath $90k!” he stated.

Cameron and his brother Tyler have lengthy in contrast Bitcoin to fashionable gold and have steered it may sooner or later attain $1 million, a view that frames the present pullback as a purchase window somewhat than an enduring setback. Some trade leaders echoed that view, calling the autumn an opportunity for long-term consumers to build up.

That is the final time you’ll ever be capable of purchase bitcoin beneath $90k!

— Cameron Winklevoss (@cameron) November 18, 2025

October Shock Nonetheless Echoes

Bitcoin’s current slide adopted a brand new excessive of $126,200 on October 6, 2025, and heavy liquidations 4 days later that erased near $20 billion in leveraged positions.

Analysts monitoring market cycles say this pullback suits a typical sample after the April 2024 halving, with main peaks usually arriving 400–600 days afterward.

Studies from The Kobeissi Letter recommend a lot of the present weak point seems to be like a routine unwinding of margin positions somewhat than a collapse in underlying demand.

Whales Are Accumulating

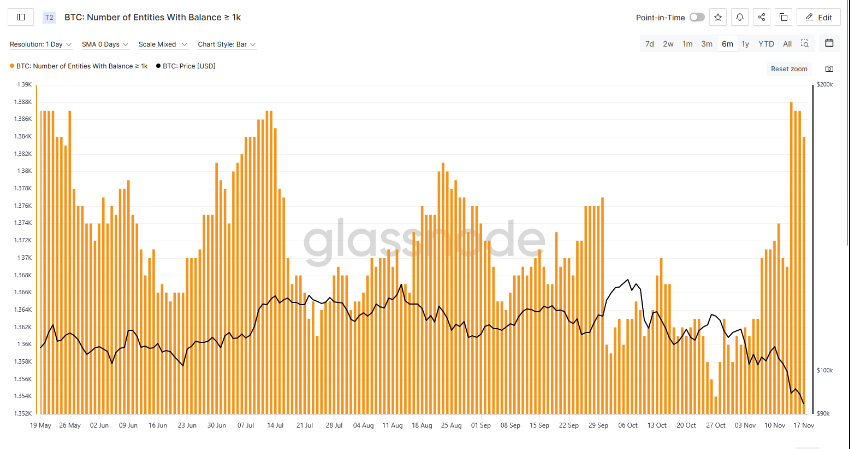

In line with Glassnode, wallets holding 1,000 BTC rose from 1,354 on October 27 to 1,384 on November 17, a rise of two.5%. On the similar time, smaller holders moved away; addresses with lower than one BTC dropped from 980,577 to 977,420 in the identical interval.

Markus Thielen of 10X Analysis stated massive holders have been shopping for whereas absorbing promoting strain. A few of the shopping for exercise has been quietly happening, and it’s being watched intently by analysts.

Associated Studying

Concern And Market Flows

Figures present that the Crypto Concern & Greed Index plunged to readings as little as 15, ranges not seen since mid-2022.

CryptoQuant analyst JA Maartun flagged the intense concern studying, whereas different trade voices pointed to ETF outflows and geopolitical tensions as added stressors.

Bitwise CIO Matt Hougan described the present worth as a “generational alternative,” a phrase that sits alongside warnings about attainable additional draw back.

Featured picture from Gemini, chart from TradingView