Uncover the way to overcome resistance to AI adoption, construct a compelling case, and lead your staff into a wiser, extra environment friendly future with a confirmed guidelines that turns imaginative and prescient into motion.

Image your self as a younger, tech-savvy supervisor at a tax and accounting agency. You’re keen about innovation and see AI as the important thing to unlocking new efficiencies. However each time you carry up AI in conferences, you’re met with hesitation: “It’s too costly.” “It’s too sophisticated.” “We’ve at all times accomplished it this manner.”

You’re not alone. Throughout the {industry}, professionals like you’re stepping up as AI champions decided to drive change from inside. Right here’s how your journey would possibly unfold, and the guidelines that can information you.

Leap to ↓

Understanding the AI panorama in tax and accounting

Your story begins with curiosity. You discover how main companies are utilizing AI to automate workflows, analyze paperwork, and ship exact solutions. You examine instruments like CoCounsel Tax, an industry-trusted AI-powered tax assistant, which assist professionals work smarter and quicker.

Advantages of AI:

-

- Automates repetitive workflows

- Analyzes complicated paperwork in seconds

- Delivers on the spot, correct solutions to shopper queries

Actual-world success tales:

You understand that AI isn’t only a buzzword—it’s a sensible resolution that’s already remodeling the {industry}.

Constructing the case for AI adoption

You determine to construct your case. You collect key metrics and tales to share with management:

Guidelines for constructing your case:

-

- Quantify effectivity features (e.g., hours saved per week)

- Spotlight accuracy enhancements (e.g., discount in errors)

- Show value financial savings over time

- Share case research from companies who’ve succeeded with AI

With information and empathy, you’re able to reply each concern.

Speaking with stakeholders

The pivotal second arrives: presenting your imaginative and prescient to management. You already know that numbers matter, however so does the story. You body AI adoption as a technique to align with the agency’s targets; development, effectivity, and shopper service.

You’re not simply pitching know-how; you’re inviting your staff to affix a journey of innovation.

Overcoming resistance

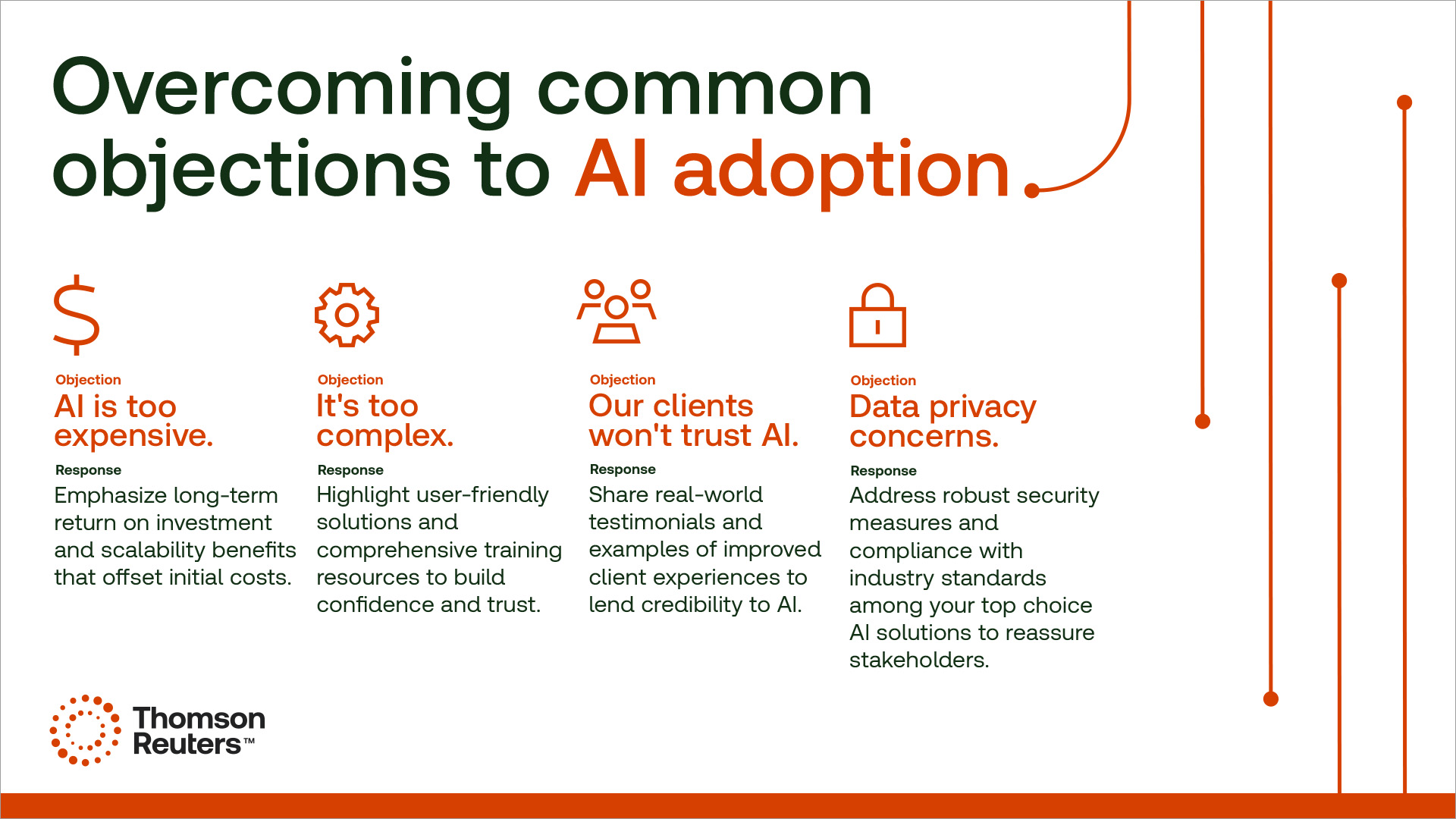

Change is difficult. Some colleagues fear about job safety, and others are skeptical of latest know-how. You acknowledge these fears and handle them head-on.

Guidelines for overcoming resistance:

-

- Establish sources of resistance (concern, skepticism, lack of expertise)

- Contain colleagues early within the course of

- Provide coaching and help sources

- Have fun small wins and share success tales

- Talk frequently and transparently

Steadily, belief grows. Resistance fades. The agency begins to see AI not as a risk, however as a possibility.

Implementing AI options

With buy-in secured, you lead the cost. You analysis and choose the proper AI instruments, making certain they suit your agency’s wants. You combine them into current workflows and supply ongoing help. Now, transformation is underway and also you’re on the helm.

Begin championing AI in your tax and accounting agency at the moment

Your journey as an AI champion is greater than a collection of duties. It’s a narrative of management, imaginative and prescient, and perseverance.

Utilizing the steps outlined right here, begin your journey as an AI champion at the moment and assist your agency unlock the total potential of synthetic intelligence.

Prepared to steer the change? Study extra about CoCounsel Tax at the moment.

|

|