Within the fast-paced, usually exhilarating world of algorithmic buying and selling, it is simple to get swept up within the pursuit of fast income. The MQL5 Market, a hub for progressive buying and selling robots and indicators, provides a seemingly limitless array of instruments promising to unlock market riches. However amidst the thrill, one elementary fact stays: endurance and a conservative strategy are sometimes probably the most dependable paths to sustained success.

This is not to say that aggressive methods do not have their place, however for the overwhelming majority of merchants, particularly these trying to construct long-term wealth, embracing a extra deliberate and measured fashion could be a game-changer. Let’s discover the profound advantages of conservative buying and selling inside the MQL5 ecosystem.

The Siren Tune of Excessive Returns and Why We Ought to Resist It

Many EAs (Skilled Advisors) on the MQL5 Market will show spectacular backtest outcomes, usually exhibiting astronomical proportion positive factors over brief durations. Whereas these may be engaging, it is essential to keep in mind that previous efficiency shouldn’t be indicative of future outcomes. Furthermore, such aggressive methods usually include hidden prices:

-

Huge Drawdowns: Excessive returns regularly correlate with important drawdowns. A big portion of your capital may be worn out in a single hostile market transfer, making restoration an uphill battle.

-

Over-optimization Threat: Some EAs are extremely optimized for particular historic information, making them brittle and weak to altering market situations.

-

Stress and Emotional Burnout: Consistently monitoring extremely risky trades and going through massive drawdowns may be extremely hectic, resulting in poor decision-making and emotional exhaustion.

The Energy of “Gradual and Regular” in Algorithmic Buying and selling

Conservative buying and selling, in contrast, prioritizes capital preservation and constant, albeit smaller, positive factors. This strategy leverages the ability of compounding over time, in the end resulting in extra sturdy and sustainable development. This is the way it advantages you within the MQL5 Market:

1. Lowered Threat and Capital Preservation: The cornerstone of conservative buying and selling is strict threat administration. This implies utilizing smaller place sizes, setting tighter stop-losses, and avoiding extremely risky devices. For MQL5 EAs, this interprets to:

-

Decrease Max Drawdown: A well-designed conservative EA may have a considerably decrease most drawdown, defending your capital throughout inevitable market fluctuations.

-

Sustainable Development: By preserving capital, you make sure that you stay within the sport to profit from compounding returns over the lengthy haul. You are not making an attempt to hit a house run each time; you are aiming for constant singles and doubles.

-

Peace of Thoughts: Figuring out your capital is comparatively protected permits for a a lot much less hectic buying and selling expertise, releasing you from fixed nervousness.

2. Consistency Over Explosiveness: Whereas an aggressive EA would possibly generate a 50% return in a single month, it might simply as simply lose 30% the following. A conservative EA, aiming for a extra modest 3-5% constantly, builds wealth way more reliably.

-

Compounding at its Finest: Even small, constant returns compound powerfully over years. Consider it as planting a tree; it grows steadily, not in explosive bursts, however its roots run deep.

-

Predictable Efficiency: Whereas no buying and selling is 100% predictable, conservative methods are likely to exhibit extra secure fairness curves, making monetary planning simpler.

3. Adaptability and Robustness: Conservative EAs are sometimes constructed on extra elementary, time-tested ideas moderately than extremely particular market anomalies.

-

Much less Vulnerable to Over-optimization: They are usually much less delicate to minor market shifts, making them extra sturdy throughout various market situations.

-

Longer Lifespan: An EA designed for conservative development is extra prone to stay worthwhile and related for an extended interval, lowering the necessity for fixed technique overhauls.

4. The Psychological Edge: Maybe one of the vital underrated advantages is the psychological benefit.

-

Lowered Stress: Much less threat means much less stress. This permits for clearer considering and prevents emotional choices when issues get robust.

-

Persistence is Rewarded: Conservative buying and selling cultivates endurance. You be taught to belief your system and the ability of time, moderately than chasing each fleeting alternative.

-

Avoiding Overtrading: Aggressive merchants usually overtrade, resulting in elevated transaction prices and poor decision-making. Conservative approaches sometimes contain fewer, higher-quality trades.

Implementing Conservative Ideas within the MQL5 Market

When evaluating EAs on the MQL5 Market, look past simply the “revenue issue” and take into account these conservative metrics:

-

Max Drawdown: That is essential. Purpose for EAs with a most drawdown you might be snug with, ideally beneath 20-30% for many methods.

-

Restoration Issue: How shortly does the EA get well from drawdowns? A better restoration issue signifies a extra resilient technique.

-

Revenue per Commerce (Common): Whereas not a direct conservative metric, constant small income per commerce are sometimes an indicator of conservative programs.

-

Variety of Trades: A decrease variety of trades can typically point out a extra selective, conservative strategy, avoiding pointless market publicity.

-

Backtest Interval and Knowledge High quality: Make sure the backtest covers an extended interval (a number of years, together with numerous market situations) and makes use of high-quality tick information.

-

Technique Description: Learn the developer’s description rigorously. Do they emphasize threat administration, capital preservation, or aggressive development?

-

Dwell Monitoring: If accessible, observe stay indicators. Do they align with conservative ideas?

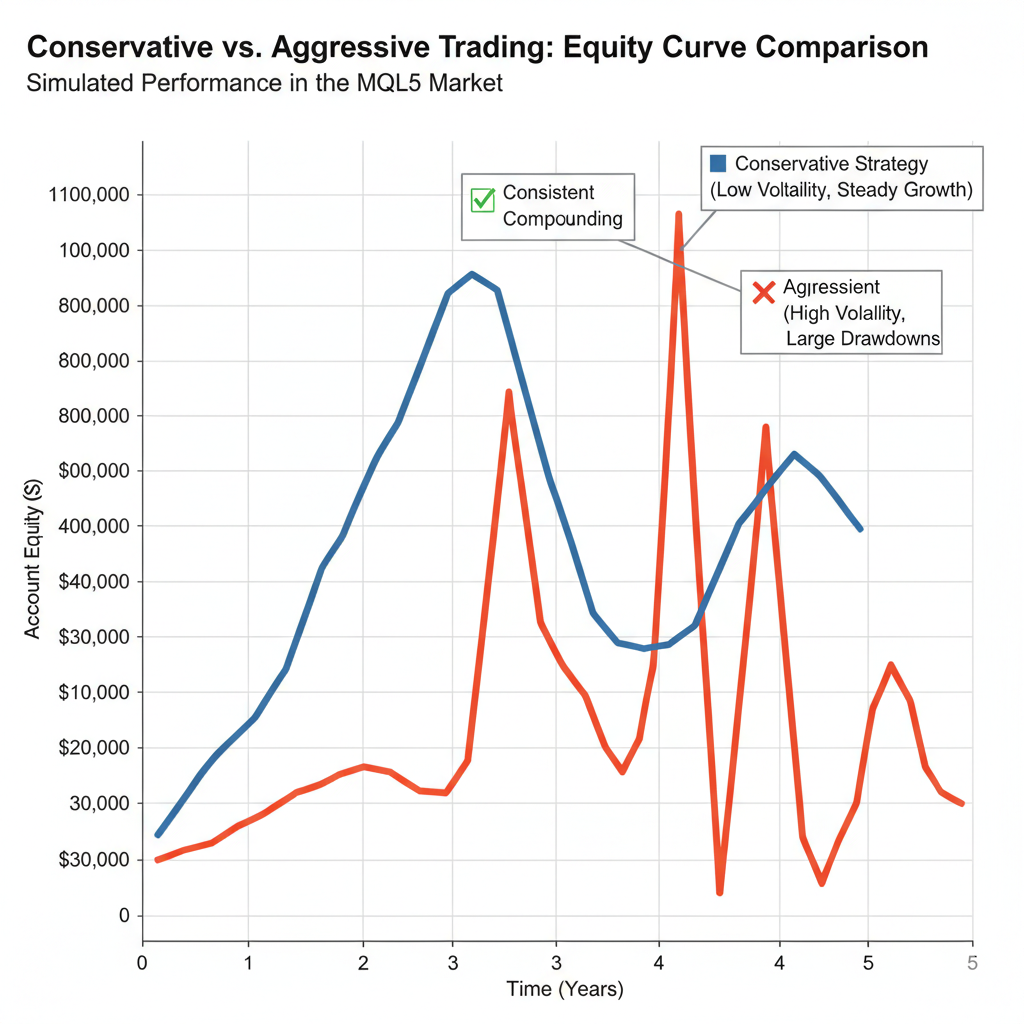

This is an instance of what a secure, conservative fairness curve would possibly seem like in comparison with a risky, aggressive one:

As you’ll be able to see, the blue line represents a conservative technique with constant, regular development and manageable drawdowns. The pink line, representing an aggressive technique, reveals fast spikes and extreme drops, making it far riskier and tougher to maintain.

Conclusion: The Marathon, Not the Dash

The MQL5 Market gives unimaginable alternatives for merchants, however success is not about discovering the EA that guarantees to make you a millionaire in a single day. It is about discovering sturdy, well-managed programs that align with a philosophy of endurance and capital preservation.

By embracing conservative buying and selling ideas, you are selecting the marathon over the dash. You are prioritizing the longevity of your buying and selling profession and the constant, compounding development of your capital. In a world the place on the spot gratification usually results in disappointment, the advantage of endurance in algorithmic buying and selling really pays off.