For many Individuals, saving is a taxing expertise. Probably the most available choice is to place cash away in a financial savings or brokerage account after which face taxes on any curiosity, dividends, or capital beneficial properties obtained. Another choice is to navigate a convoluted system of tax-advantaged accounts narrowly specified for restricted makes use of, resembling 401(okay)s and IRAs for retirement, well being financial savings accounts (HSAs) for certified medical bills, 529s for certified training bills, and the brand new Safe 2.0 provisions permitting employers to supply pension-linked emergency financial savings accounts beneath sure circumstances.

Our neighbors to the north have discovered a greater answer—and U.S. lawmakers ought to take observe. Since they started in 2009, Canada’s tax-free financial savings accounts (TFSAs) have offered Canadians a easy choice to avoid wasting taxA tax is a compulsory cost or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of normal authorities providers, items, and actions.

-free with out strings connected. TFSAs are a kind of common financial savings account (USA), during which people 18 or older can make a contribution on an after-tax foundation (i.e., non-deductible), earnings develop tax-free, and withdrawals may be made for any cause with out triggering extra taxes or penalties. The annual contribution restrict in 2024 is CAD 7,000 (about USD 5,200), and it’s listed to inflationInflation is when the overall worth of products and providers will increase throughout the economic system, lowering the buying energy of a foreign money and the worth of sure property. The identical paycheck covers much less items, providers, and payments. It’s typically known as a “hidden tax,” because it leaves taxpayers much less well-off because of larger prices and “bracket creep,” whereas growing the federal government’s spending energy.

. Any unused contribution allowance (“room”) is carried ahead to the following 12 months, and any cash withdrawn within the present 12 months additional provides to the next 12 months’s contribution room.

Whereas Canada additionally presents tax-preferred retirement account choices just like ours—registered pension plans (RPPs) which can be just like 401(okay)s, and registered retirement financial savings plans (RRSPs) which can be just like conventional (deductible) IRAs—Canadians have rapidly made TFSAs their most well-liked saving car. By 2013, the share of Canadian households contributing to TFSAs and the quantity of TFSA contributions exceeded that of both RRSPs or RPPs, and by 2020 TFSA contributions exceeded that of RRSPs and RPPs mixed.

In keeping with survey information from 2022, 58 p.c of Canada’s grownup inhabitants has a TFSA versus 46 p.c with a retirement plan. The hole is especially huge for younger adults, with 51 p.c of individuals ages 18 to 34 proudly owning a TFSA versus 38 p.c proudly owning a retirement plan, indicating {that a} main attraction of TFSAs is the quick and unrestricted entry to funds for varied functions in addition to retirement. When requested which objectives are most necessary for saving and investing, the commonest responses had been to “retire comfortably” and “construct a security web,” the latter of which is healthier addressed with TFSAs than retirement accounts.

A research primarily based on 2015 information reveals that low-income households particularly are more likely to contribute to TFSAs than tax-preferred retirement accounts. Amongst households incomes beneath CAD 80,000, about 34 p.c contributed to a TFSA, considerably larger than the 20 p.c who contributed to a retirement plan or 18 p.c who contributed to a pension plan. The distinction is much more stark for decrease earnings teams (e.g., amongst individuals incomes lower than CAD 10,000), about 15 p.c contributed to a TFSA whereas simply 3 p.c contributed to a retirement plan and 1 p.c to a pension plan.

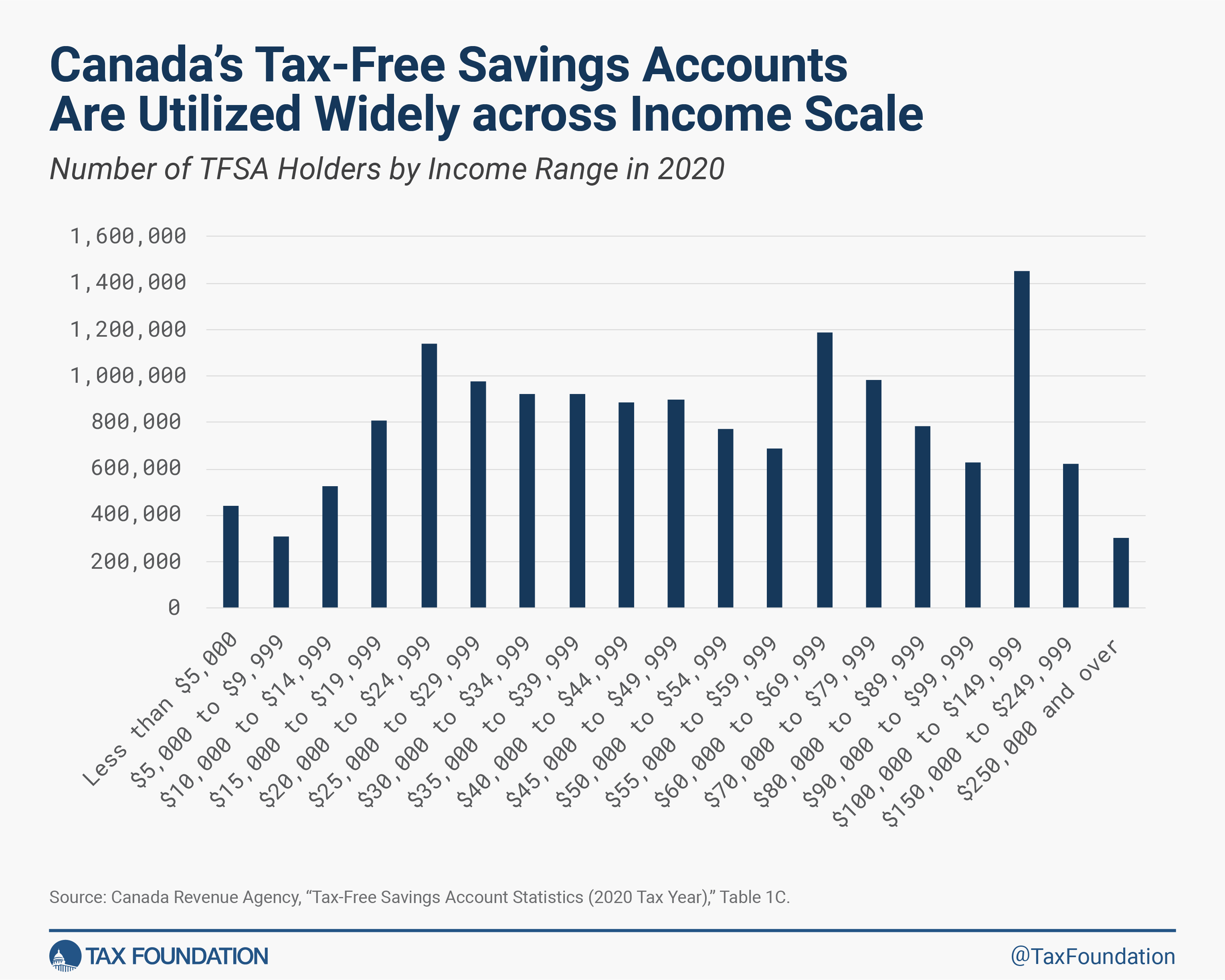

The newest statistics present Canadians throughout the earnings spectrum use TFSAs extensively. In 2020, 16.1 million Canadians owned a TFSA, greater than half of the grownup inhabitants (54 p.c of the tax-filing inhabitants, which intently matches the grownup inhabitants). Of the 16.1 million adults with a TFSA, 3.2 million earned lower than CAD 25,000, indicating about one-third of this low-income group owned a TFSA. Amongst adults incomes between CAD 25,000 and CAD 40,000, about half personal a TFSA. The share of adults with a TFSA rises with earnings: greater than 3 out of 4 adults incomes no less than CAD 150,000 personal a TFSA.

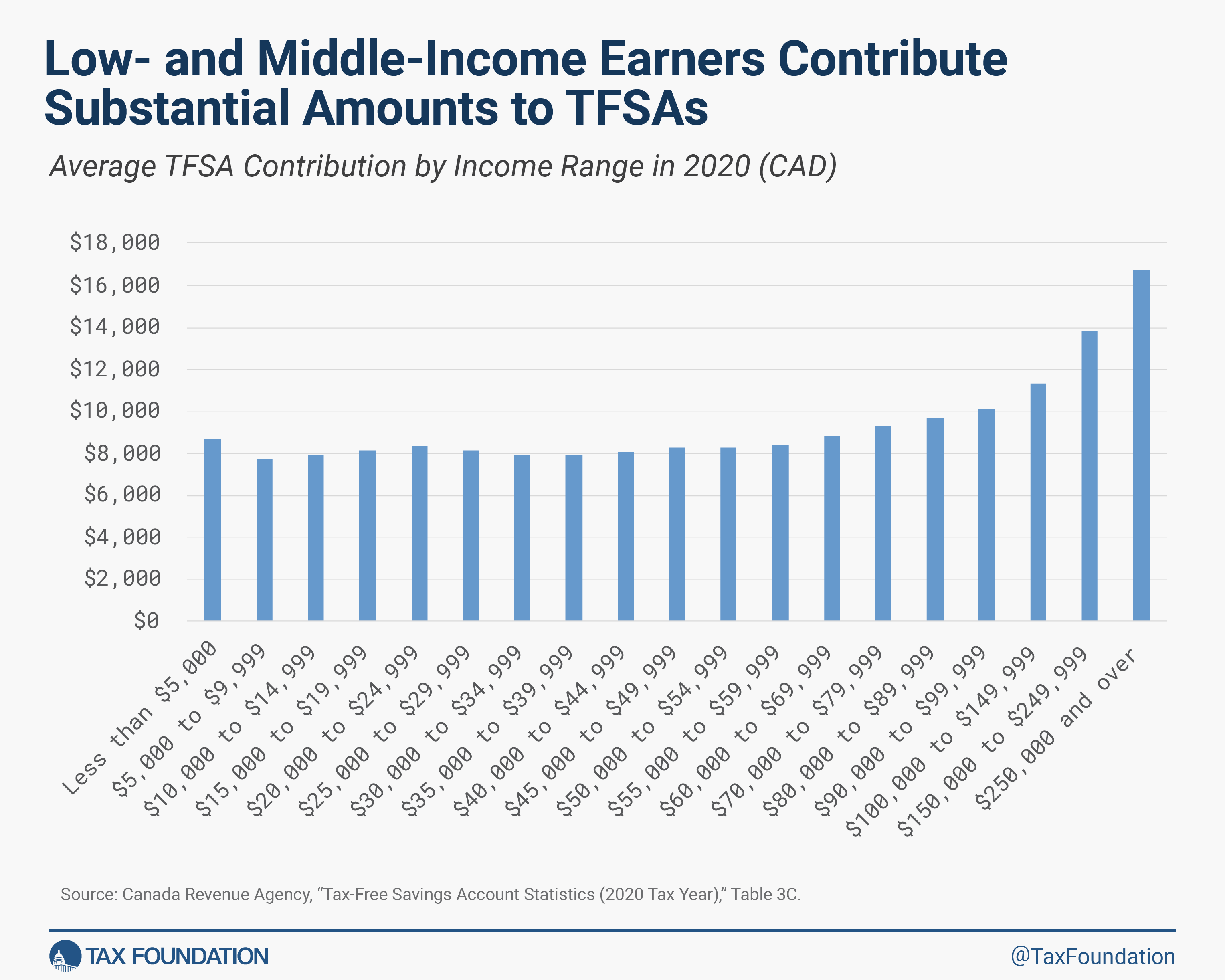

The common TFSA contribution is remarkably flat throughout the earnings scale however does rise for individuals incomes greater than about CAD 60,000. The common contribution is about CAD 8,000 for every earnings group incomes beneath CAD 60,000 and rises to about CAD 17,000 for individuals incomes greater than CAD 250,000.

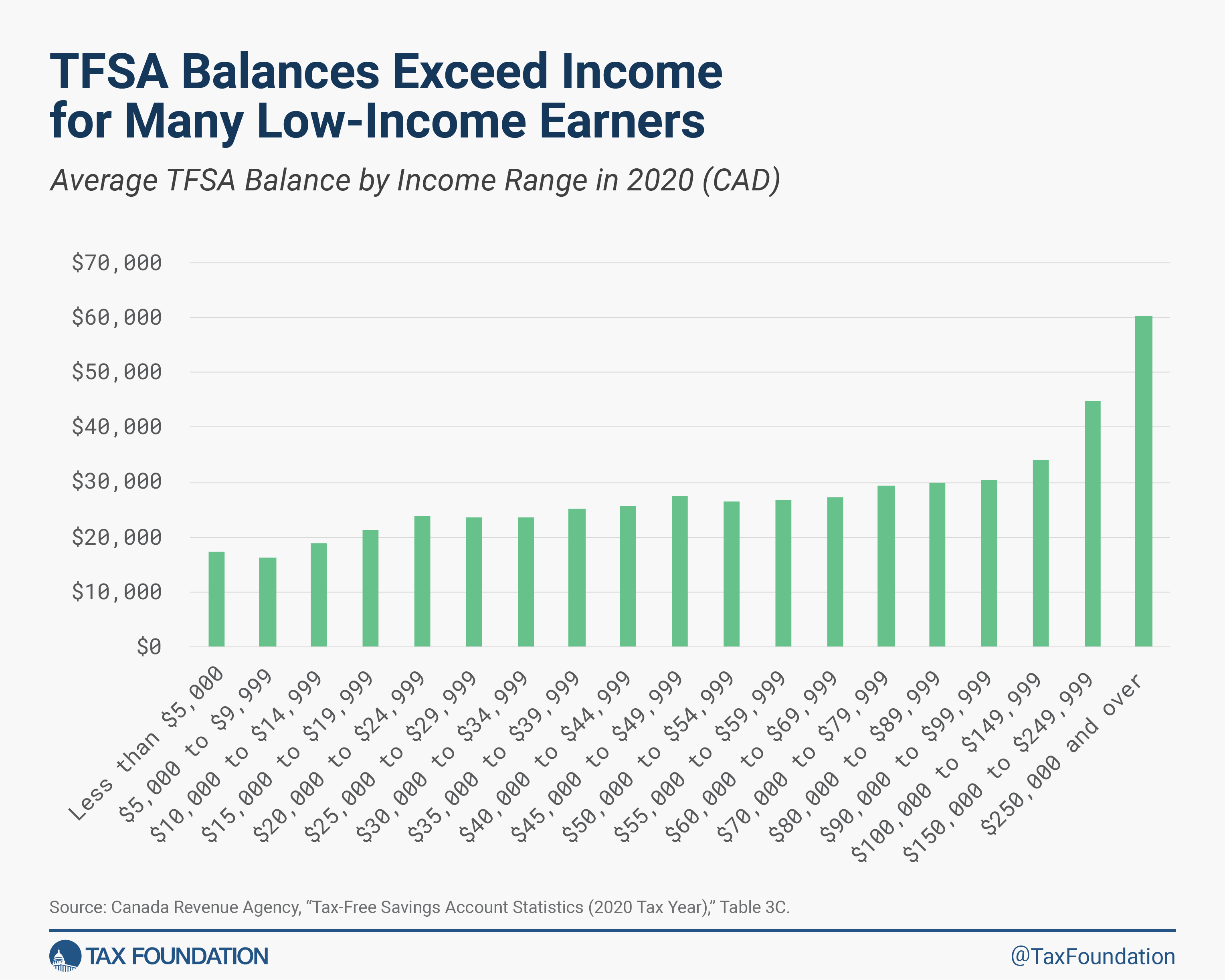

The common TFSA stability rises with earnings however remains to be fairly substantial for all earnings teams, in reality exceeding earnings for a lot of low-income earners. For the bottom earnings group—individuals incomes lower than CAD 5,000—the common TFSA stability is about CAD 17,000. For individuals incomes between CAD 15,000 and CAD 20,000, the common TFSA stability is about CAD 21,000. TFSA balances rise to about CAD 60,000 on common for individuals incomes greater than CAD 250,000.

In brief, Canada’s common financial savings accounts look like an enormous success when it comes to encouraging personal saving and monetary safety for households throughout the earnings scale, successfully establishing an accessible rainy-day fund for thousands and thousands of low- and middle-income households. Low-income households particularly strongly choose and make the most of TFSAs relatively than tax-advantaged retirement accounts.

Lawmakers within the U.S. ought to take observe: typically less complicated is healthier. Low- and middle-income households would profit tremendously from a simplified system of tax-advantaged saving, one that gives prepared entry to funds to cowl emergencies and different short-term bills with out a tax penalty. Common financial savings accounts have labored splendidly in Canada, and there’s no cause to suppose they wouldn’t work simply as effectively within the U.S.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted specialists delivered straight to your inbox.

Share