Market Pullbacks are eventualities whereby costs would revert again with a brief transfer proper after a market growth. This usually causes the market to be barely oversold or overbought on the brief time period towards the long-term pattern. These eventualities current a wonderful buying and selling alternative for merchants who can time their trades appropriately in anticipation of a market pullback. That is the kind of buying and selling technique that we’re about to debate right here.

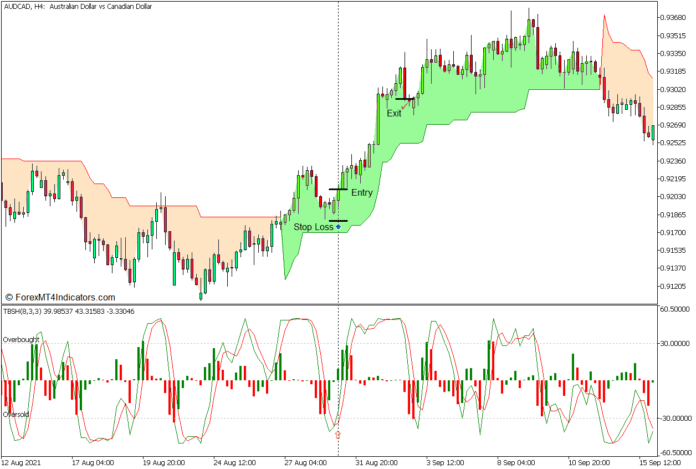

Tick Primarily based Stochastic Histogram Indicator

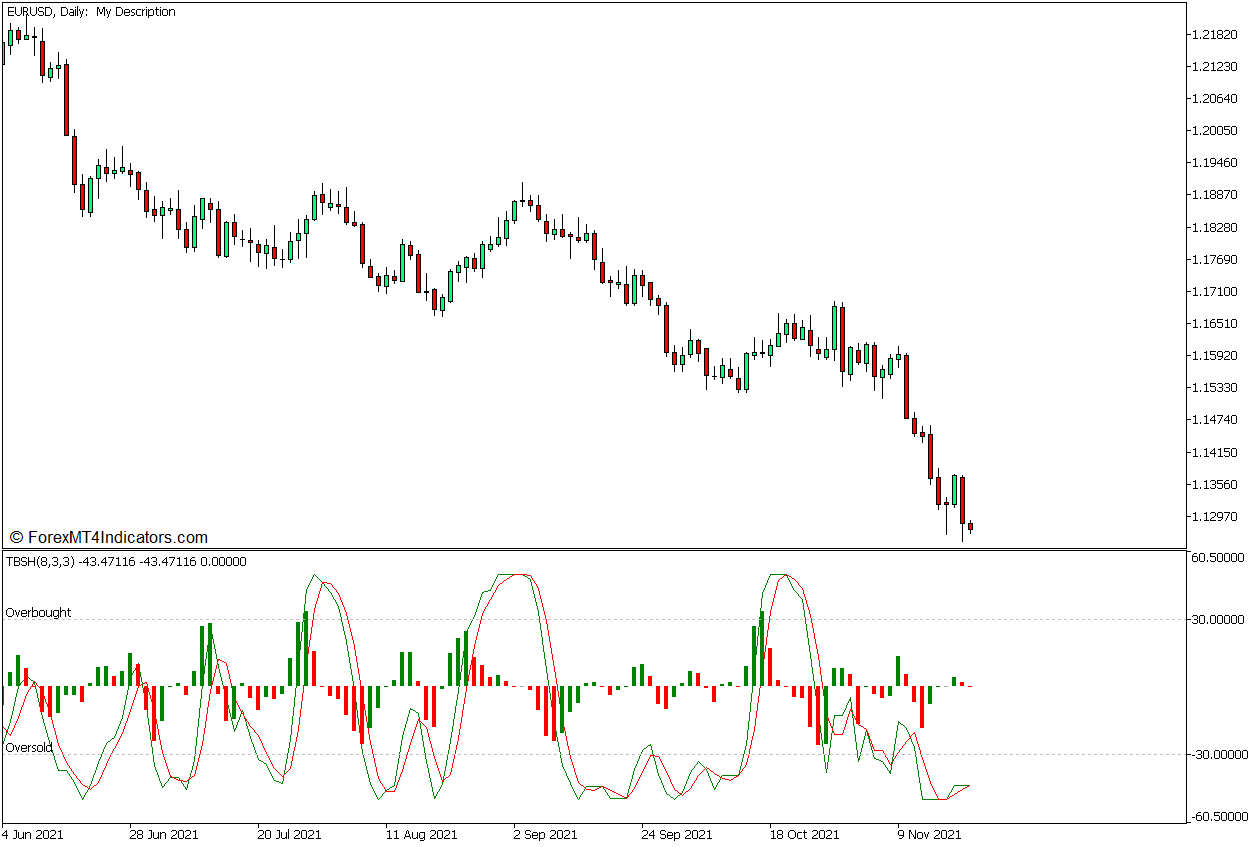

Tick-Primarily based Stochastic Histogram Indicator, additionally known as TBS Histogram Indicator, is a momentum indicator which relies on the basic Stochastic Oscillator. Simply as with the Stochastic Oscillator, TBS Histogram was additionally developed to assist us establish the course of the market’s momentum.

It additionally offers a scientific strategy for figuring out oversold and overbought markets, in addition to potential imply reversals coming from such overextended worth ranges. Each indicators plot two oscillator strains which are utilized in tandem to establish the course of the market’s momentum. These strains additionally oscillate inside a set vary. Other than this, each of them even have markers to point oversold and overbought market ranges.

The TBS Histogram strains oscillate inside a variety of -60 to +60 and has a midrange of zero. Constructive oscillator strains point out a bullish momentum, whereas unfavourable strains point out a bearish momentum.

We are able to additionally establish the course of the short-term momentum primarily based on how the 2 strains overlap. Momentum is bullish every time the inexperienced line is above the purple line, and bearish when the 2 strains overlap in reverse.

That is additionally aided by histogram bars which oscillate round zero. It plots a optimistic bar every time the inexperienced line is on the high, and a unfavourable bar every time the inexperienced line is on the backside. The colour of the bars relies on whether or not the histogram worth is rising or lowering.

The oversold and overbought markers are at -30 and +30. Strains dropping beneath -30 point out an oversold market, whereas strains breaching above 30 point out an overbought market. Crossovers between the 2 strains that develop on these areas are thought-about imply reversal alerts.

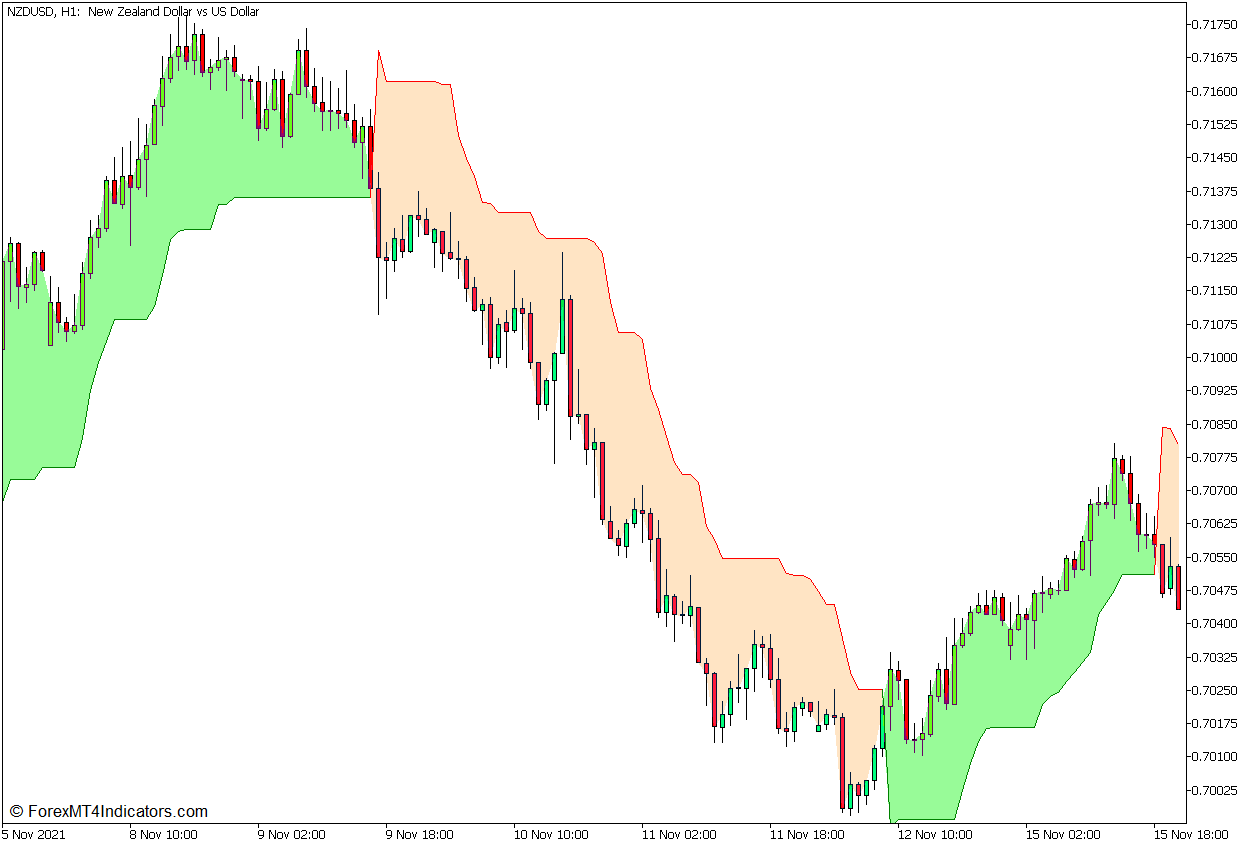

Supertrend Indicator

Supertrend Indicator is a pattern course indicator that’s primarily based on the idea of utilizing the Common True Vary (ATR) as a foundation for figuring out pattern course or the nullification thereof.

One of many methods merchants establish pattern reversals relies on the concept that worth shouldn’t reverse towards the present pattern course an excessive amount of. Value might pull again because it oscillates naturally, however the pullback shouldn’t be vital. With that in thoughts, merchants use a a number of of the ATR to quantify worth actions and qualify acceptable pullbacks and precise pattern reversals.

Some of the widespread parameters when utilizing the ATR as a foundation for figuring out developments and pattern reversals is the a number of of three. On this case, the ATR is multiplied by 3. This worth is then subtracted to the very best excessive or added to the bottom low inside a given interval, relying on the recognized pattern course. If the market is in an uptrend, we subtract the worth from the very best excessive.

Inversely, if the market is in a downtrend, we add the worth to the bottom low. The ensuing values turn into the thresholds whereby if breached, would then point out a pattern reversal. For instance, in an uptrend, if a worth drops beneath the distinction between the very best excessive and the product of the ATR multiplied by three, then the uptrend is nullified and changed by a downtrend.

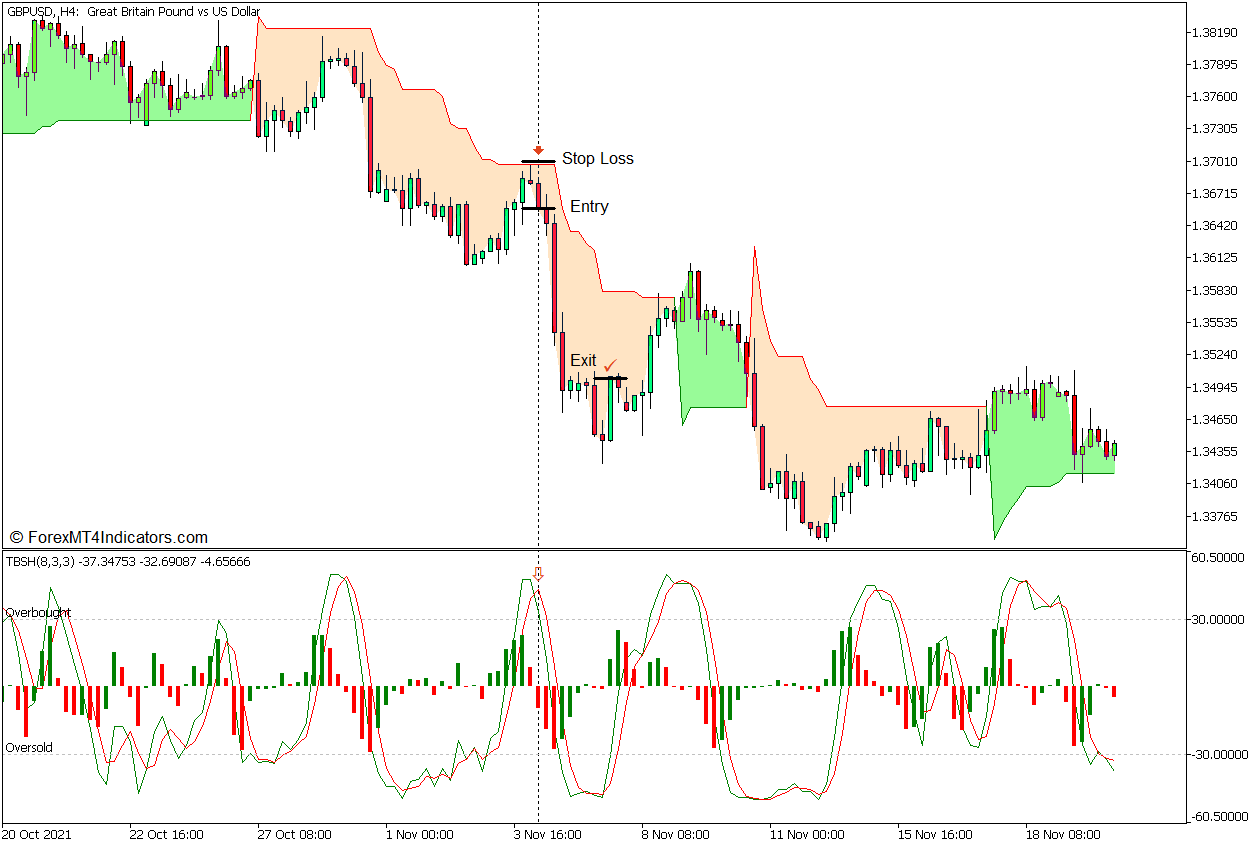

The Supertrend Indicator merely offers a visible illustration of the thresholds primarily based on the idea mentioned above. In an uptrend, it plots a inexperienced line beneath worth motion with a pale inexperienced filling between the value and the road. Then again, the indicator plots a purple line above worth motion with a bisque filling between the value and the road throughout a downtrend. Pattern reversals are recognized every time worth motion crosses over the road and closes on the alternative facet.

Given these options, we will then use the Supertrend Indicator as a pattern reversal sign indicator, a pattern course filter, or a foundation for putting and trailing our cease loss ranges.

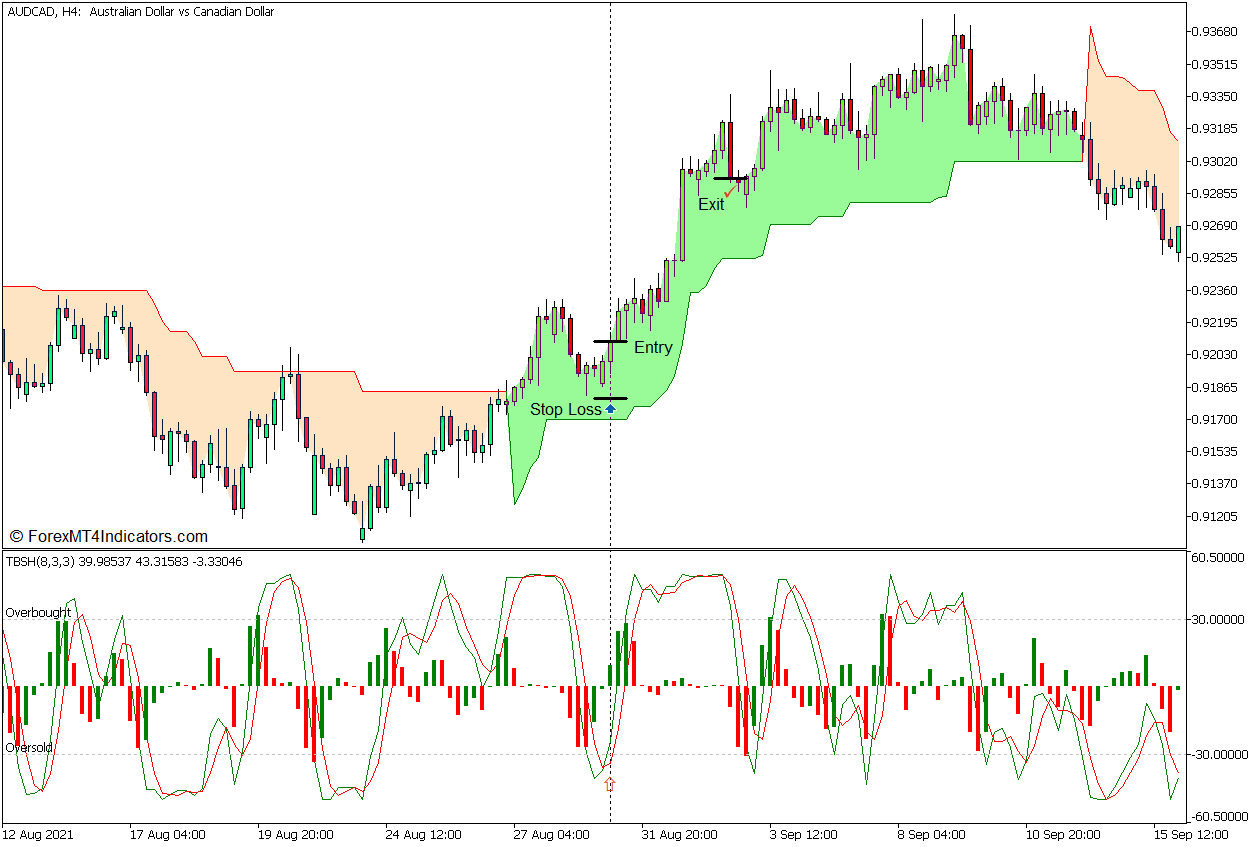

Buying and selling Technique Idea

The buying and selling technique that we’re about to point out is a pattern continuation technique that trades on the short-term imply reversal alerts which are in confluence with the pattern course. These eventualities usually happen proper on the finish of a market pullback.

We will likely be utilizing the Supertrend Indicator to establish pattern course. As such, the pattern will likely be primarily based on the placement of worth motion concerning the Supertrend line, in addition to the colour of its filling. Nevertheless, the pattern course must also be confirmed primarily based on worth motion.

After figuring out the pattern course, we may then establish buying and selling alternatives primarily based on the TBS Histogram Indicator. The market ought to pull again after a market growth section. This pullback might trigger the TBS Histogram strains to point an oversold or overbought degree, relying on the course of the pattern. The crossover between its two strains, in addition to the shifting of the histogram bars round zero, will point out our entry sign.

Purchase Commerce Setup

Entry

- Value Motion must be above a inexperienced Supertrend line.

- Value ought to pull again inflicting the TBS Histogram strains to drop beneath -30.

- Open a purchase order as quickly because the inexperienced line crosses above the purple line and the histogram bars shift above zero.

Cease Loss

- Set the cease loss on the fractal beneath the entry candle.

Exit

- Shut the commerce as quickly as worth motion reveals indicators of a momentum reversal.

Promote Commerce Setup

Entry

- Value Motion must be beneath a purple Supertrend line.

- Value ought to pull again inflicting the TBS Histogram strains to breach above 30.

- Open a promote order as quickly because the inexperienced line crosses beneath the purple line and the histogram bars shift beneath zero.

Cease Loss

- Set the cease loss on the fractal above the entry candle.

Exit

- Shut the commerce as quickly as worth motion reveals indicators of a momentum reversal.

Conclusion

Buying and selling market pullbacks in a trending market is among the most simple buying and selling methods that seasoned merchants use. This technique merely offers a structured strategy on how one can commerce on this method. If you’re eager on buying and selling market pullbacks in confluence with the pattern, then examine and check this technique utilizing the connected indicators.

Advisable MT5 Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

Click on right here beneath to obtain: