SUMA Wealth now has $2.2 million in new capital to proceed creating monetary instruments, content material and reside and digital activations for younger U.S. Latinos to construct wealth.

Radicle Influence led the funding with participation from Vamos Ventures, OVO fund and American Coronary heart Affiliation Influence fund. They be a part of buyers from earlier rounds, together with Ulu Ventures, Feminine Founders Fund and Chingona Ventures. This brings SUMA’s complete funding to $5.5 million {dollars}.

We first profiled the California-based fintech firm when it exhibited as a part of the Battlefield 200 at TechCrunch Disrupt 2022. Beatriz Acevedo began the corporate with Mary Hernandez and Javier Gutierrez a number of years in the past to construct a monetary app designed for Latinos — a demographic she believes is usually neglected.

It presents in-culture monetary content material, merchandise and experiences to assist them achieve management of their financial energy and construct wealth. SUMA Wealth additionally works with monetary establishments, together with Morgan Stanley, JP Morgan and Wells Fargo, trying to have interaction with the Latino demographic.

“We actually lean exhausting into the AI options to have the ability to extremely personalize the way you spend your cash and the way you are able to do higher, but additionally that our neighborhood comes from so many alternative nations of origin,” Acevedo instructed TechCrunch. “It was crucial that even on the options, even on the tone and the voice, even on the content material that we serve you for schooling on what you’re making an attempt to be taught and achieve, we do it in a method that’s absolutely personalized and customized.”

That implies that in case you’re Venezuelan, the app is aware of that and makes use of references and examples of issues which are acquainted to that tradition or makes use of a tone just like considered one of your loved ones members, she defined.

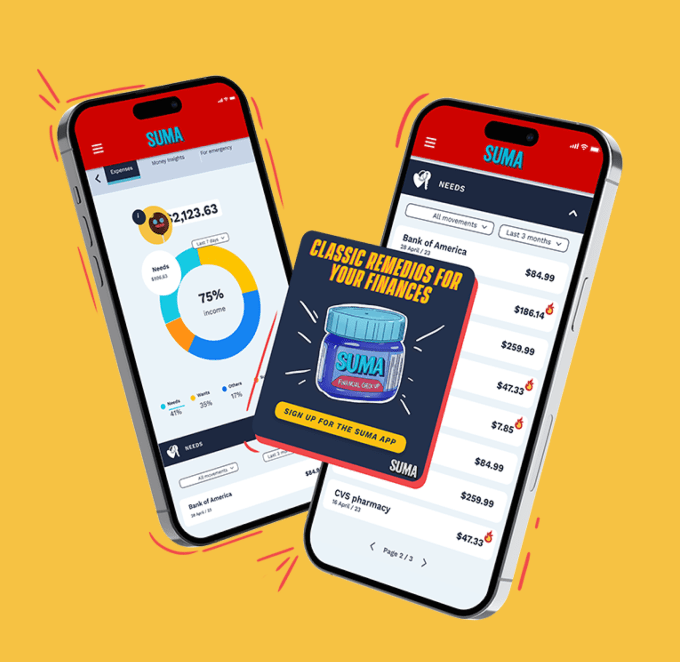

SUMA Wealth’s monetary planning app. Picture Credit: SUMA Wealth

Along with the buyer app, Acevedo was additionally engaged on an enterprise providing. That has since launched, as did a brand new model of the app in December, and each of these entities have now reached 1 million customers.

Apparently, that personalization is catching on with customers. SUMA Wealth’s platforms have seen 62% annual person development. The app continues to be free for customers, nonetheless, the corporate is monetizing its partnerships with completely different manufacturers, together with relationship app Match.com, or for options comparable to extra customized teaching. The enterprise app can be subscription-based for firms to purchase for workers or their very own prospects.

And whereas Acevedo constructed SUMA Wealth for younger U.S. Latinos and their households, what has stunned her is the adoption of the app by non-Latinos.

“Thirty p.c aren’t Latinos, regardless that our jokes, our insights and our photos are very unapologetically Latino,” Acevedo stated. “It is a place the place folks really feel welcome. We’re excited to see that not simply Latinos have gravitated to the app and discover our instruments and our content material helpful.”

Along with the shopper development, SUMA Wealth’s income elevated almost 5 instances prior to now yr. It has additionally made some acquisitions: Intellecto, a studying administration system to additional personalize the person studying expertise.

This adopted the February 2023 acquisition of financial savings and private finance platform Reel. As a part of that acquisition, Reel co-founder and CEO Daniela Corrente joined SUMA as chief technique and enterprise officer.

In the meantime, this new funding will go towards the Intellecto acquisition as nicely on new hires throughout engineering, product and gross sales. The corporate can be engaged on increasing its know-how choices for extra AI personalization, knowledge and analytics.