We have put collectively one other video that can assist you while you’re representing a consumer. On this video, we cowl some tips about easy methods to fill out IRS Type 2848 to ensure your request for energy of lawyer will get permitted the primary time. Watch it beneath and subscribe to our Youtube channel to be notified after we put out different useful movies.

Get IRS Type 2828 right here

Video Transcript:

Hi there and welcome!

On this video, we’re going to speak about IRS Type 2848: Energy of Lawyer and Declaration of Consultant.

We are going to clarify what this way authorizes, who ought to use it, plus some useful tricks to ensure that the IRS will approve your request for Energy of Lawyer.

Let’s bounce in.

Tip 1: What’s IRS kind 2848 and who ought to use it?

Solely sure folks might be granted Energy of Lawyer utilizing kind 2848. For tax professionals that group consists of attorneys, CPAs, and enrolled brokers. The shape permits these tax professionals to characterize their consumer earlier than the IRS as in the event that they had been the taxpayer.

There are a variety of causes this kind of illustration could also be vital. Possibly your consumer is in a foreign country throughout tax season or they’re restricted of their potential to speak due to a medical situation. Possibly you characterize an organization or particular person with unresolved tax debt. The 2848 permits you to outline and restrict the scope of the authority your consumer needs to grant. Extra on that in a second.

A efficiently filed 2848 additionally offers a tax skilled the authority to obtain confidential tax info for his or her consumer, together with tax returns, transcripts, and IRS notices. Nevertheless, in case you’re solely in search of entry to your consumer’s tax paperwork, you could be higher off utilizing the a lot less complicated kind 8821.

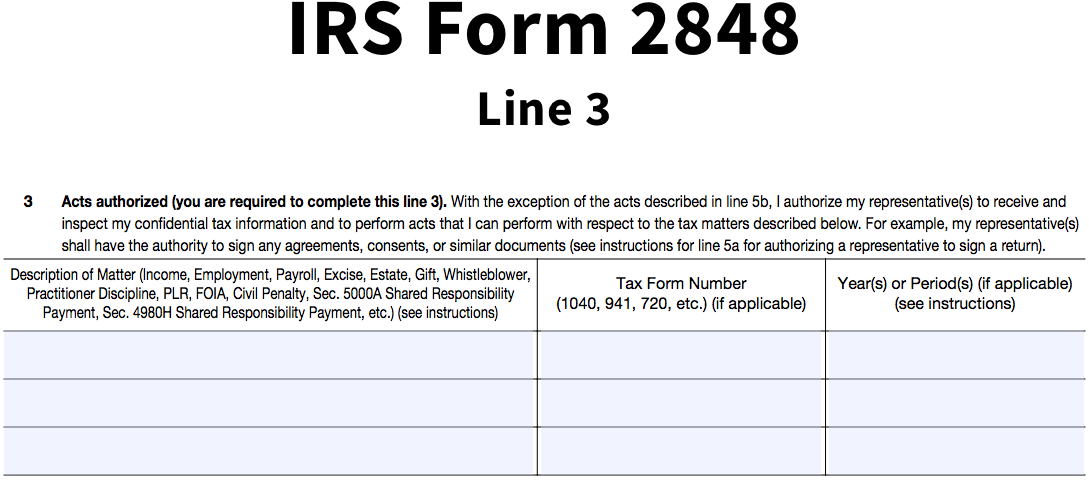

Tip 2: Be Particular on Line Three

The 2848 will get rejected rather a lot and it’s normally as a result of folks don’t observe the directions when filling out line three. Whereas filling out this part, you should clearly state the particular situation or points that you’re requesting authorization for. This consists of the character of the difficulty, the forms of types concerned, and the particular time frame that this authority shall be granted.

In line three you should be particular. Utilizing basic phrases like “all taxes” or “all years” on this part will lead to a rejected POA request.

Let’s undergo line three column by column in order that this doesn’t occur to you.

Column 1

That is the place you describe the kind of tax or situation you’ll be coping with. Widespread descriptors on this column can embody earnings, employment, civil penalty, and round 230 violation. Should you’re representing a consumer with regard to a penalty or different collections situation, you’d listing the kind of tax related to the difficulty. For example, if you’re helping a person who owes again taxes to the IRS you’d listing “earnings” in column one.

Column 2

For the second column, you’ll listing the types that you simply want entry to. When filling it out, it’s extraordinarily essential to particularly listing the shape numbers. Plenty of folks write the title of a kind as a substitute of the shape quantity, leading to a denied request. For example, in case you’re representing an organization and wish entry to their company tax return, write kind 1120 in column two, not “company tax return.” Should you want entry to a number of types, ensure that to listing all of them within the rows offered.

Column 3

This column identifies the particular durations for which you’re approved to entry types. You’ll be able to specify calendar years, quarterly durations, and even intermittent time durations. If you wish to have the authority to tug types from 2014 to 2016, merely write “2014 through 2016” within the third column.

Tip 3: Intermediate Service Suppliers

One other part price being attentive to is line 5 – particularly the brand new checkbox on line 5a. There are a number of bins you possibly can verify, however we’re going to concentrate on the one coping with accessing IRS paperwork from an intermediate service supplier.

By checking this field, tax info (equivalent to transcripts) might be simply accessed by means of third get together software program like Cover. If this field is left unchecked, you possibly can solely acquire tax info the old style means—straight from the IRS.

Should you’re undecided whether or not or to not verify this field – verify it! Checking this field offers you a number of choices for retrieving your consumer’s tax paperwork.

Tip 4: The place to file the 2848

So that you’ve completed filling out kind 2848 with all the right info. Now the place does it go?

This way nearly all the time will get despatched to the regional CAF unit related to the state the place the Taxpayer resides. Until you’re coping with the IRS straight they usually particularly request the shape, you’ll mail this doc to the consumer’s regional CAF unit—both Ogden, Utah or Memphis, TN—based mostly in your consumer’s house handle. If the Taxpayer lives exterior the US, it’s best to ship the 2848 to the CAF unit in Philadelphia. To discover the handle of the CAF unit assigned to your Taxpayer’s state, verify the hyperlink in our video description.

Let’s recap:

IRS kind 2848 is designed to provide attorneys, CPA’s, and enrolled brokers authority to obtain confidential tax paperwork and characterize their consumer earlier than the IRS.

Be particular when filling out line 3. Clearly state the difficulty, types, and time durations to keep away from getting your energy of lawyer request denied Basic info just isn’t your buddy right here.

Decide the place your tax paperwork shall be retrieved from. If an intermediate service supplier shall be used, verify that first field in line 5a.

Be sure to verify the directions for kind 2848 to see which CAF unit it’s best to ship your completed kind. The hyperlink to the directions is within the description.

And that’s all we now have for you on IRS kind 2848! Thanks for watching.

Remark beneath when you’ve got any ideas for the 2848 that we didn’t get to. Additionally, be at liberty to remark when you’ve got any ideas for movies you wish to see sooner or later.

See you subsequent time!

Cover is a one-stop-shop for your whole accounting agency’s wants. Enroll free at the moment to see how our full suite of companies may help you.