Bitcoin (BTC) witnessed a slight surge earlier at this time, climbing from $113,000 to round $117,000 on the time of writing, in distinction to expectations of a number of crypto analysts who have been predicting a decline in risk-on property because of the US authorities shutdown.

Bitcoin Rises Regardless of US Authorities Shutdown

The US federal authorities shut down at midnight on September 30, as President Donald Trump and Congress failed to achieve a deal on funding. Particularly, the 2 camps have been at odds over enhanced Obamacare subsidies, with neither get together keen to take the blame.

Associated Studying

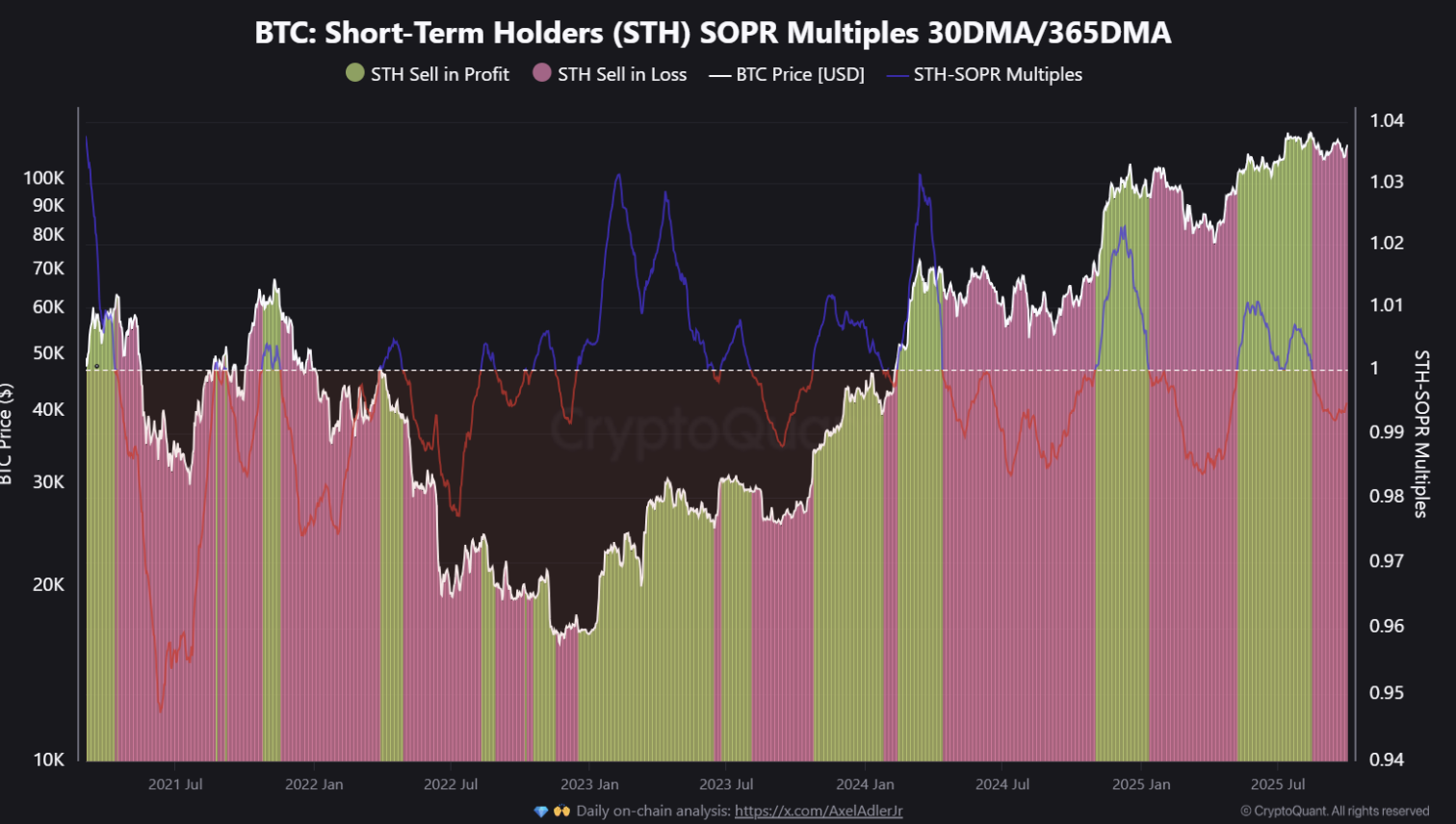

Nonetheless, Bitcoin made a shock transfer to the upside regardless of the unsure surroundings created by the US authorities shutdown, recording robust positive factors earlier at this time. CryptoQuant analyst Kripto Mevsimi acknowledged that September noticed deeper losses amongst short-term holders (STH), as their Spent Output Revenue Ratio (SOPR) fell as little as 0.992.

In consequence, most of September was marked by STH persevering with to promote their BTC holdings at a loss. Nonetheless, the metric recovered barely to 0.995, though it’s nonetheless beneath August’s studying of 0.998.

The present STH-SOPR studying is displaying indicators of stabilization after a interval of despair. It’s attention-grabbing to notice the timing of this restoration, because it occurred at a time when BTC is buying and selling within the excessive $110,000 vary, barely beneath a heavy resistance zone.

Previous knowledge reveals two potential situations that may occur following such a reset within the STH-SOPR. First, it might be early warning indicators of a weakening momentum for BTC, as prolonged loss realization can precede corrective phases the place weak palms capitulate.

The opposite, extra bullish situation, is that it might be a wholesome reset. Fast absorption of realized losses typically paves the best way for extra sustainable rallies, which may catapult BTC to new all-time highs (ATH) within the close to time period. The CryptoQuant analyst added:

With BTC consolidating beneath resistance, this rebound in STH-SOPR is a key barometer of market well being. If patrons proceed to soak up weak-hand promoting, it may mirror previous resets that paved the best way for the following leg larger.

Will BTC Decline In This fall 2025?

Whereas the dwindling energetic circulating provide of Bitcoin provides some hope to the bulls, others will not be as optimistic. In keeping with latest evaluation by fellow CryptoQuant contributor Axel Adler, demand for BTC cooled after it failed to carry above $115,000.

Associated Studying

In the meantime, crypto analyst Physician Revenue not too long ago remarked that BTC is prone to expertise one other 20% decline from its present value, reaching his projected goal vary between $90,000 – $94,000. At press time, BTC trades at $117,226, up 3.5% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com