Key Findings

- Forty-five states and the District of Columbia accumulate statewide gross sales taxes.

- Native gross sales taxes are collected in 38 states. In some instances, they will rival and even exceed state charges.

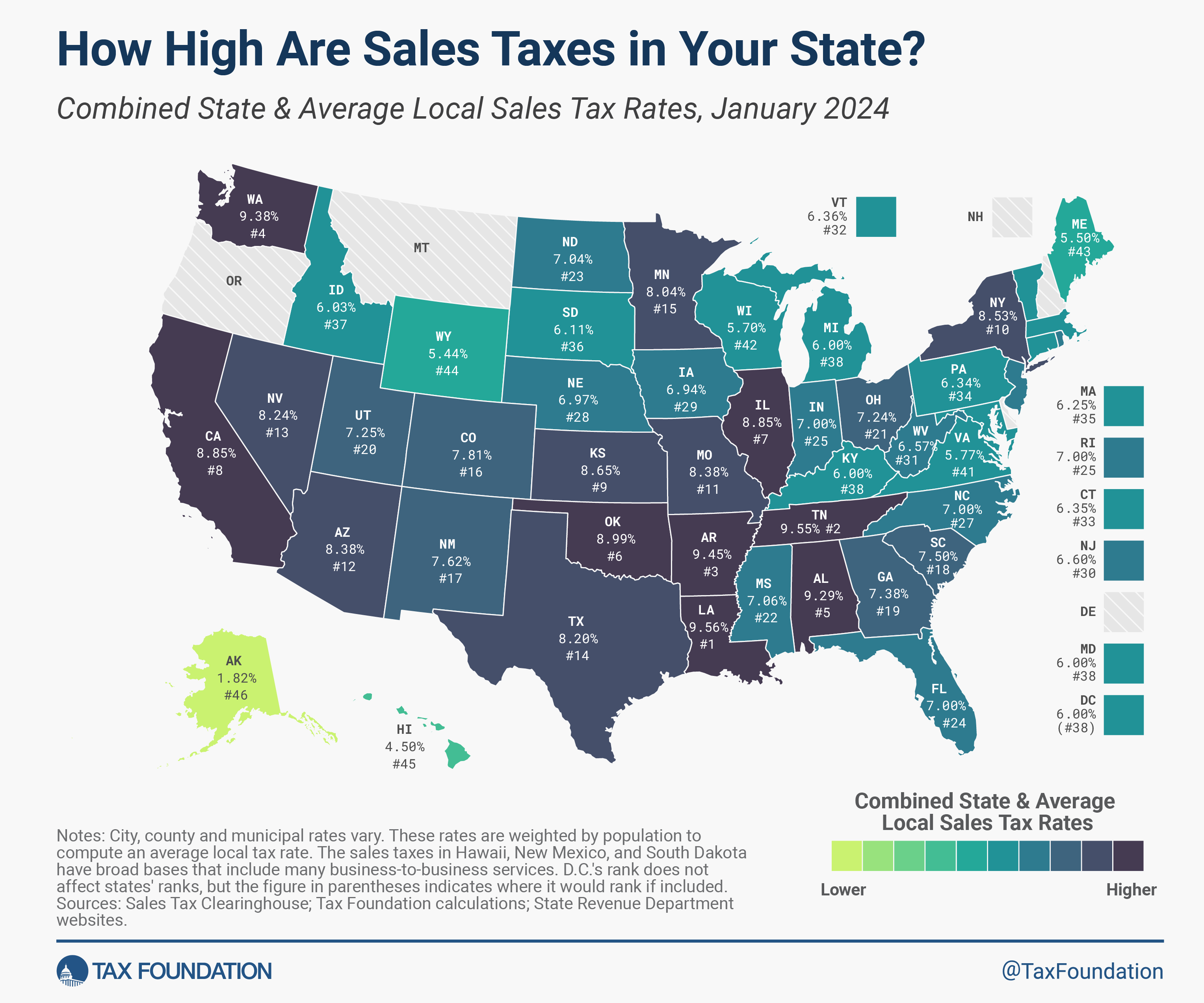

- The 5 states with the very best common mixed state and native gross sales taxA gross sales tax is levied on retail gross sales of products and companies and, ideally, ought to apply to all last consumption with few exemptions. Many governments exempt items like groceries; base broadening, comparable to together with groceries, may hold charges decrease. A gross sales tax ought to exempt business-to-business transactions which, when taxed, trigger tax pyramiding.

charges are Louisiana (9.56 %), Tennessee (9.55 %), Arkansas (9.45 %), Washington (9.38 %), and Alabama (9.29 %). - Native gross sales taxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of normal authorities companies, items, and actions.

will increase within the Twin Cities metro area of Minnesota, in addition to in Milwaukee, Wisconsin, are answerable for the best motion in states’ common gross sales tax charges prior to now six months. - Gross sales tax charges differ by state, however gross sales tax bases additionally impression how a lot income is collected from a tax and the way the tax impacts the economic system.

- Gross sales tax price differentials can induce customers to buy throughout borders or purchase merchandise on-line.

Introduction

Retail gross sales taxes are a vital a part of most states’ income toolkits, answerable for 32 % of state tax collections and 13 % of native tax collections (24 % of mixed collections). Additionally they profit from being extra pro-growth than the opposite main state tax, the particular person earnings taxA person earnings tax (or private earnings tax) is levied on the wages, salaries, investments, or different types of earnings a person or family earns. The U.S. imposes a progressive earnings tax the place charges improve with earnings. The Federal Revenue Tax was established in 1913 with the ratification of the sixteenth Modification. Although barely 100 years previous, particular person earnings taxes are the largest supply of tax income within the U.S.

, as a result of they introduce fewer financial distortions.

Forty-five states impose state-level gross sales taxes, whereas customers additionally face native gross sales taxes in 38 states, together with Alaska, which doesn’t impose a statewide tax. These native charges could be substantial, and a few states with average statewide gross sales tax charges really impose fairly excessive mixed state and native charges in comparison with different states. This report gives a population-weighted common of native gross sales taxes as of January 1, 2024, to present a way of the typical native price for every state. Desk 1 gives a full state-by-state itemizing of state and native gross sales tax charges.

Mixed State and Native Gross sales Tax Charges

5 states forego statewide gross sales taxes: Alaska, Delaware, Montana, New Hampshire, and Oregon. Of those, solely Alaska permits localities to impose native gross sales taxes.[1]

The 5 states with the very best common mixed state and native gross sales tax charges are Louisiana (9.56 %), Tennessee (9.55 %), Arkansas (9.45 %), Washington (9.38 %), and Alabama (9.29 %). The 5 states with the bottom common mixed charges are Alaska (1.82 %), Hawaii (4.50 %), Wyoming (5.44 %), Maine (5.50 %), and Wisconsin (5.70 %).

State Gross sales Tax Charges

California has the very best state-level gross sales tax price, at 7.25 %.[2] 4 states tie for the second-highest statewide price, at 7 %: Indiana, Mississippi, Rhode Island, and Tennessee. The bottom non-zero state-level gross sales tax is in Colorado, which has a price of two.9 %. 5 states comply with with 4 % charges: Alabama, Georgia, Hawaii, New York, and Wyoming.[3]

No state charges have modified since South Dakota lower its state gross sales tax price in 2023, a discount set to run out after 2026. The Mount Rushmore State follows on the heels of New Mexico, which lowered the speed of its state-level gross sales tax—a hybrid tax the state refers to as its gross receipts taxA gross receipts tax is a tax utilized to an organization’s product sales, with out deductions for a agency’s enterprise bills, like prices of products offered and compensation. Not like a gross sales tax, a gross receipts tax is assessed on companies and apply to business-to-business transactions along with last client purchases, resulting in tax pyramiding.

—from 5.125 % to five % in July 2022. Notably, if the income from the gross receipts tax in any single fiscal yr from 2026 to 2029 is lower than 95 % of the earlier yr’s income, then the state’s price will return to five.125 % on the next July 1.

Earlier than that, the newest statewide price discount was Louisiana’s lower, from 5.0 to 4.45 %, in July 2018. State lawmakers have as an alternative prioritized earnings tax cuts, which yield extra financial profit, lowering particular person or company earnings taxA company earnings tax (CIT) is levied by federal and state governments on enterprise income. Many firms aren’t topic to the CIT as a result of they’re taxed as pass-through companies, with earnings reportable beneath the particular person earnings tax.

charges (or each) in additional than two dozen states prior to now two years alone.

Native Gross sales Tax Charges

The 5 states with the very best common native gross sales tax charges are Alabama (5.29 %), Louisiana (5.11 %), Colorado (4.91 %), New York (4.53 %), and Oklahoma (4.49 %).

Solely Minnesota and Wisconsin noticed a rating change of a couple of place since July, each declining two locations on account of native tax will increase in main inhabitants facilities. Arizona, California, Colorado, Maine, New Mexico, Ohio, Tennessee, and Wyoming all improved by one place, usually on account of price will increase in peer states, whereas, along with motion in Minnesota and Wisconsin, the states of Illinois, Louisiana, Missouri, and Utah all slid one place, on account of tax will increase in a wide range of smaller jurisdictions.

In Minnesota, the seven-county Twin Cities metro space noticed a 1 proportion level gross sales tax improve, cut up between 0.75 % for transportation and 0.25 % for housing, which went into impact October 1, 2023. In neighboring Wisconsin, town of Milwaukee imposed a brand new 2 % gross sales tax on January 1, 2024, whereas Milwaukee County elevated its gross sales tax price from 0.5 to 0.9 %. In Hawaii, a 0.5 % surcharge was accredited for Maui. Many different states noticed a smattering of native gross sales tax price adjustments—largely will increase—as nicely.

Some cities in New Jersey are in “City Enterprise Zones,” the place qualifying sellers might accumulate and remit at half the 6.625 % statewide gross sales tax price (3.3125 %), a coverage designed to assist native retailers compete with neighboring Delaware, which forgoes a gross sales tax. We signify this anomaly as a adverse 0.03 % statewide common native price (adjusting for inhabitants as described within the methodology part under), and the mixed price displays this subtraction. Regardless of the marginally favorable impression on the general price, this decrease price represents an implicit acknowledgment by New Jersey officers that their 6.625 % statewide price is uncompetitive with neighboring Delaware’s lack of a gross sales tax.

The Function of Competitors in Setting Gross sales Tax Charges

Avoidance of gross sales tax is most definitely to happen in areas the place there’s a important distinction between jurisdictions’ charges. Analysis signifies that customers can and do go away high-tax areas to make main purchases in low-tax areas, comparable to from cities to suburbs. For instance, proof means that Chicago-area customers make main purchases in surrounding suburbs or on-line to keep away from Chicago’s 10.25 % gross sales tax price.

On the statewide degree, companies generally find simply outdoors the borders of excessive sales-tax areas to keep away from being subjected to their charges. A stark instance of this happens in New England, the place although I-91 runs up the Vermont facet of the Connecticut River, many extra retail institutions select to find on the New Hampshire facet to keep away from gross sales taxes. One research reveals that per capita gross sales in border counties in gross sales tax-free New Hampshire have tripled because the late Fifties, whereas per capita gross sales in border counties in Vermont have remained stagnant. At one time, Delaware really used its freeway welcome signal to remind motorists that Delaware is the “Dwelling of Tax-Free Purchasing.”

State and native governments must be cautious about elevating charges too excessive relative to their neighbors as a result of doing so will yield much less income than anticipated or, in excessive instances, income losses regardless of the upper tax price.

Gross sales Tax Bases: The Different Half of the Equation

This report ranks states based mostly on tax charges and doesn’t account for variations in tax bases (e.g., the construction of gross sales taxes, defining what’s taxable and nontaxable). States can range drastically on this regard. As an example, most states exempt groceries from the gross sales tax, others tax groceries at a restricted price, and nonetheless others tax groceries on the identical price as all different merchandise. Some states exempt clothes or tax it at a diminished price.

Tax consultants usually suggest that gross sales taxes apply to all last retail gross sales of products and companies however not intermediate business-to-business transactions within the manufacturing chain. These suggestions would lead to a tax system that’s not solely broad-based but in addition “right-sized,” making use of as soon as and solely as soon as to every product the market produces. Regardless of settlement in concept, the appliance of most state gross sales taxes is removed from this superb.

Hawaii has the broadest gross sales tax within the United States, but it surely taxes many merchandise a number of occasions and, by one estimate, in the end taxes 119 % of the state’s private earnings. This base is much wider than the nationwide median, the place the gross sales tax applies to 36 % of non-public earnings.

Methodology

Gross sales Tax Clearinghouse publishes quarterly gross sales tax knowledge on the state, county, and metropolis ranges by ZIP code. We weight these numbers in accordance with the newest Census inhabitants figures to present a way of the prevalence of gross sales tax charges in a selected state. This can be a change from earlier editions, the place we used figures obtainable each decade. Whereas adjustments because of the new weighting have been largely trivial, we present adjustments in rank based mostly on January 1 figures recalculated beneath the brand new inhabitants weighting. Because of the up to date inhabitants weighting, this report is just not strictly corresponding to beforehand printed editions, although variations quantity to minor rounding errors.

It must also be famous that whereas the Census Bureau reviews inhabitants knowledge utilizing a five-digit identifier that appears very similar to a ZIP code, that is really a ZIP Code Tabulation Space (ZCTA), which makes an attempt to create a geographical space related to a given ZIP code. That is completed as a result of a surprisingly massive variety of ZIP codes don’t even have any residents. For instance, the Nationwide Press Constructing in Washington, D.C., has its personal ZIP code solely for postal causes.

For our functions, ZIP codes that don’t have a corresponding ZCTA inhabitants determine are omitted from calculations. These omissions lead to some quantity of inexactitude however general don’t have a big impact on resultant averages as a result of proximate ZIP code areas that do have ZCTA inhabitants numbers seize the tax price of these jurisdictions.

Conclusion

Gross sales taxes are only one a part of an general tax construction and must be thought of in context. For instance, Tennessee has excessive gross sales taxes however no earnings tax, whereas Oregon has no gross sales tax however excessive earnings taxes. Whereas many elements affect enterprise location and funding choices, gross sales taxes are one thing inside policymakers’ management that may have rapid impacts.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted consultants delivered straight to your inbox.

[1] Particular taxes in Montana’s resort areas aren’t included in our evaluation.

[2] This quantity contains obligatory add-on taxes which can be collected by the state however distributed to native governments. Due to this, some sources will describe California’s gross sales tax as 6.0 %. An analogous scenario exists in Utah and Virginia.

[3] The gross sales taxes in Hawaii, New Mexico, and South Dakota have bases that embrace many enterprise companies and so aren’t strictly corresponding to different gross sales taxes.

Share