The potential approval of spot Ethereum (ETH) exchange-traded funds (ETFs) within the US, which incorporates plans for staking, may amplify focus dangers inside the Ethereum community, S&P International Scores highlighted in a latest evaluation.

In accordance with the report, the SEC might approve ETH ETFs as early as Could. Nonetheless, as monetary heavyweights vie for a stake on this rising sector, the entry of ETFs might considerably sway the steadiness of validator energy in Ethereum, posing new challenges and alternatives.

The SEC has to resolve on VanEck’s software by Could 23 and will rule on different ETH ETF functions by that deadline.

Focus dangers

Spot Ethereum ETF proposals from Ark Make investments and Franklin Templeton intention to generate extra yield by staking ETH. Nonetheless, if these staking-enabled ETFs see sufficiently excessive inflows, they may influence participation charges in Ethereum’s validation community, S&P International analysts wrote.

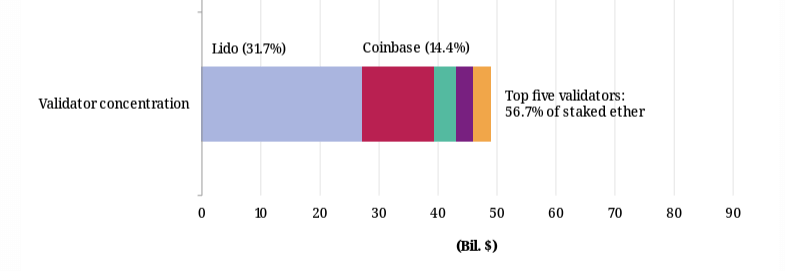

In accordance with the report, Lido presently accounts for somewhat below one-third of staked ETH and is the biggest Ethereum validator. Nonetheless, the report casts doubt on the chance of those ETFs choosing decentralized staking protocols similar to Lido.

As a substitute, a choice for institutional crypto custodians appears extra possible, suggesting a unique influence on validator focus relying on the diversification methods of issuers.

The report additionally highlighted that Coinbase — which serves as a custodian for some funds — might additionally pose a focus danger if it takes in new ETH on behalf of US ETFs.

The change is presently liable for roughly 15% of staked ETH, making it the second-largest validator total. It additionally serves because the custodian for 3 of the 4 largest non-US staking Ethereum ETFs.

The report mentioned these points are important as a result of reliance on a single entity or software program consumer can introduce dangers of validator outages and assaults. It known as for larger monitoring of focus danger and emphasised its significance.

The emergence of recent digital asset custodians might supply a pathway for ETF issuers to distribute their stakes extra broadly, which might additionally mitigate focus danger.

JP Morgan echoes issues

S&P International’s report echoes the issues not too long ago raised by JP Morgan in a related evaluation about spot Ethereum ETFs. The lender’s report additionally concluded that the dominance of Lido and Coinbase poses vital focus dangers to the ecosystem.

JP Morgan argued {that a} concentrated variety of validators might turn out to be a single level of failure, jeopardizing the community’s stability and safety. Such centralization additionally presents profitable targets for malicious assaults, starting from hacking makes an attempt to coordinated disruptions of community operations.

Moreover, the analysts at JPMorgan cautioned in opposition to the potential for collusion amongst main validators. An oligopoly of validators might manipulate the community’s governance and operational parameters to their benefit on the expense of Ethereum’s broader person base.

This might manifest in censoring transactions, partaking in preferential remedy of sure operations, or front-running — practices that might erode belief in Ethereum’s equity and transparency.

Making certain that Ethereum stays a strong, safe, and decentralized platform requires a collective effort to mitigate focus dangers and to foster an setting the place no single validator or group of validators can wield disproportionate energy.