KEY

TAKEAWAYS

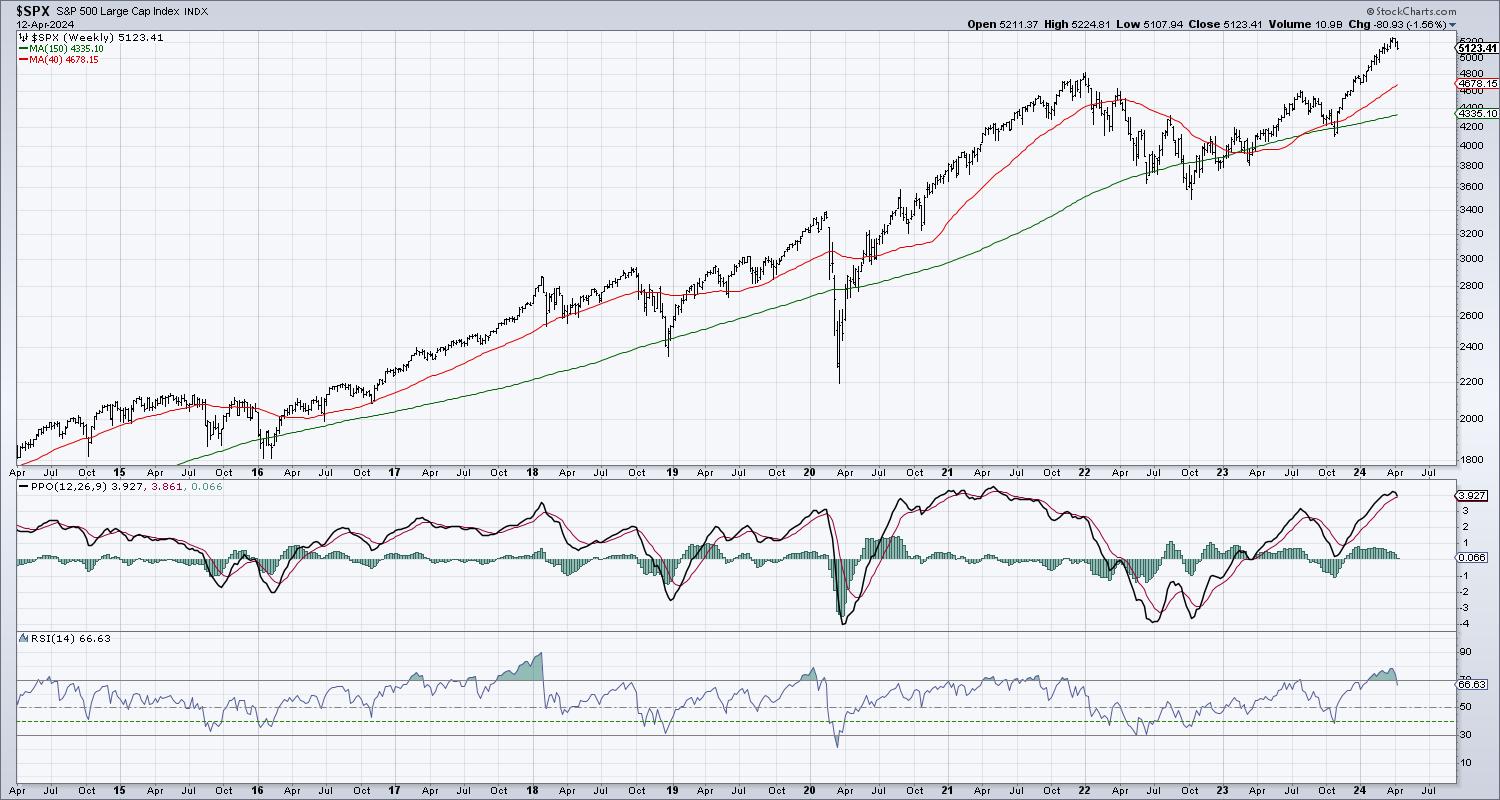

- The weekly RSI has signaled an exit from overbought circumstances, however the weekly PPO has not but indicated a bearish reversal.

- A break under the 200-day shifting common would validate the weekly promote alerts, and align with earlier market tops because the 2009 market backside.

Towards the underside of my Conscious Investor LIVE ChartList, there’s a collection of charts that hardly ever generate alerts. So why would I embrace issues just like the Hindenburg Omen and Coppock Curve, that are normally a nonfactor throughout my common chart assessment, in my most important checklist of macro charts? As a result of I’ve realized that when these uncommon alerts do really happen, it is best to concentrate!

As I checked in on the markets this week throughout Spring Break, I observed that the weekly S&P 500 chart confirmed that the RSI had simply damaged down out of the overbought area. And whereas the weekly PPO has not but registered a promote sign, it completed the week by virtually doing so.

At main market tops, you may normally see overbought circumstances main into peak, as costs transfer aggressively increased within the later levels of the bull market. The weekly RSI (backside panel) pushed above the 70 stage in mid-January, and has remained above that threshold till this week.

The weekly PPO is an adaptation of Gerald Appel’s incredible MACD indicator, which makes use of a collection of exponential shifting averages to establish the first development and point out development reversals. If we’d get a confirmed promote sign subsequent week, with the PPO line crossing down by way of the sign line, that will be the primary sign because the market peak in August 2023.

Let’s herald some further worth historical past to think about how typically this twin promote sign has triggered, and what has normally adopted this bearish affirmation.

This sample has occurred ten instances because the 2009 market backside, with 5 of these alerts leading to a number of the most significant drawdowns of the final 15 years. The opposite 5 instances ended up being pretty transient pullbacks inside a longer-term uptrend.

How can we differentiate the profitable alerts from the much less profitable indications? Nicely, the profitable alerts have been adopted quickly after by a break of the 40-week shifting common, used on the weekly chart to emulate the 200-day shifting common from the day by day chart.

In the course of the false promote alerts, we by no means noticed a confirmed break under the 40-week shifting common, as patrons appeared to come back in to purchase on weak point and push costs again increased. Wanting ahead to the approaching weeks, that will imply that an S&P 500 under 4680 or so would point out a excessive probability of a lot additional draw back for shares.

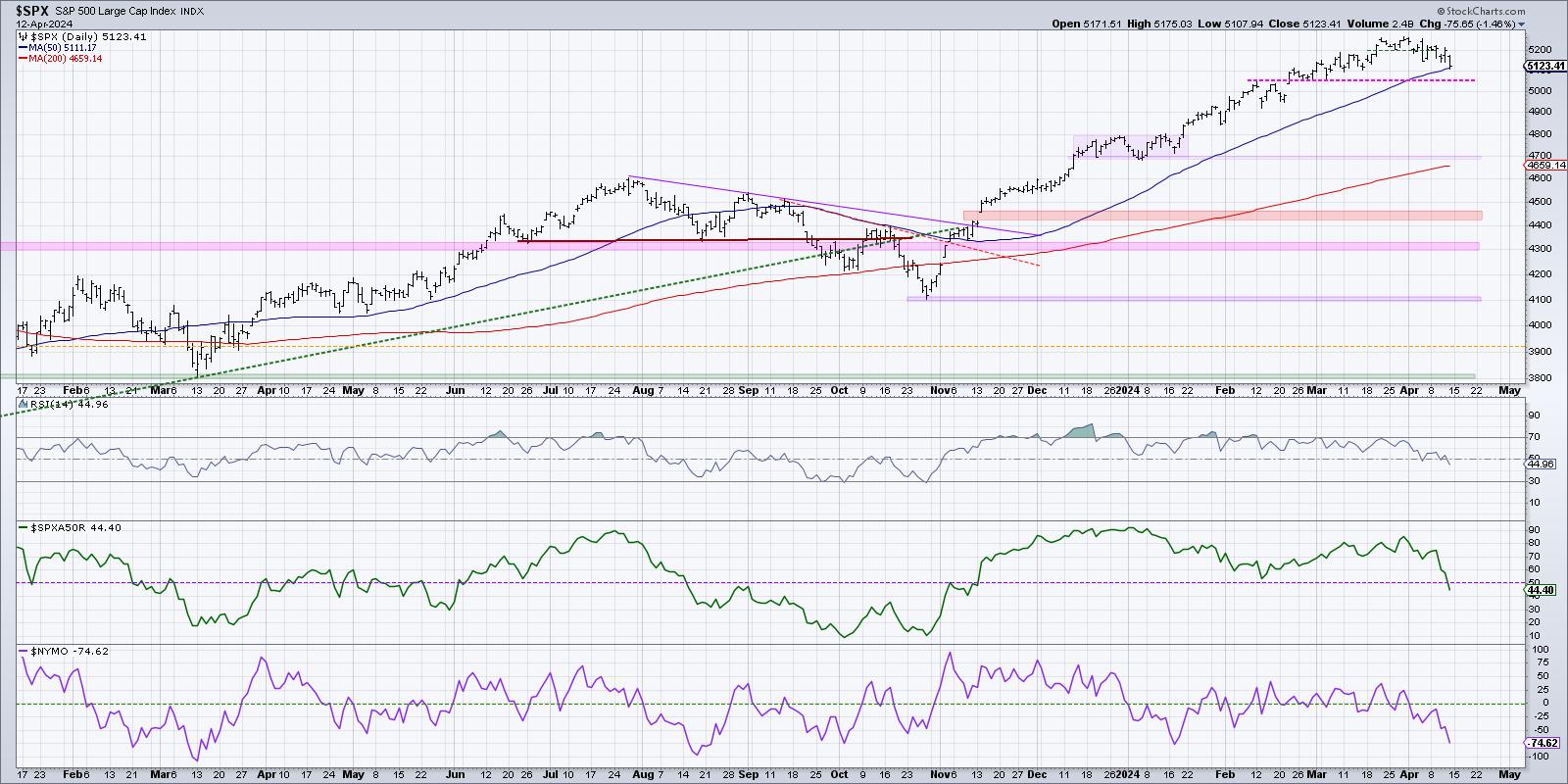

It additionally tells me to focus in on different macro technical indicators, utilizing breadth indicators and the day by day S&P 500 chart to additional validate the short-term worth momentum.

S&P 5050 stays a key short-term help stage, as this served as a key pivot level in February and March. Because the SPX has begun an obvious rotation all the way down to this help stage, it is value noting that the day by day RSI is now under 50. The p.c of shares above the 50-day shifting common is now under 50%, and the McClellan Oscillator is properly under the zero stage.

All of those short-term alerts converse of a market in a corrective section. If and when the S&P 500 would break under its 200-day shifting common (lower than 500 factors away after Friday’s shut!), that will imply the short-term deterioration has fueled sufficient of a breakdown to set off our weekly promote alerts.

In both case, I’ve seen sufficient after this week’s overheated inflation numbers to think about a a lot stronger downdraft as we enter the meat of earnings season. No matter you assume could come subsequent for the S&P 500 and Nasdaq 100, now may very well be an ideal time to be sure you have exit technique in thoughts!

RR#6,

Dave

P.S. Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.

The writer doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the writer and don’t in any method characterize the views or opinions of every other particular person or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps buyers decrease behavioral biases by way of technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness strategies to investor resolution making in his weblog, The Conscious Investor.

David can also be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency centered on managing threat by way of market consciousness. He combines the strengths of technical evaluation, behavioral finance, and knowledge visualization to establish funding alternatives and enrich relationships between advisors and shoppers.

Be taught Extra