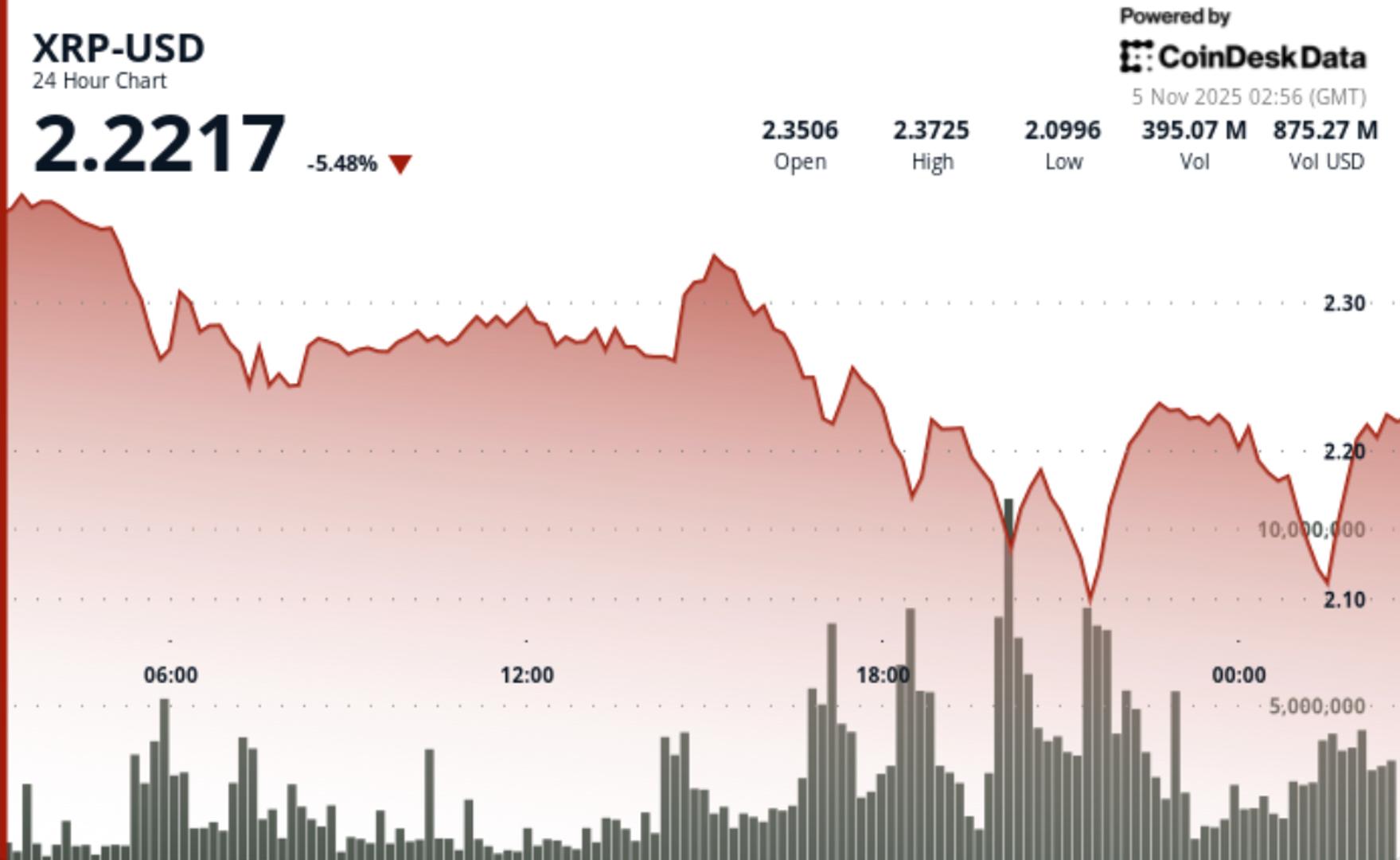

XRP plunged sharply throughout Tuesday’s session, breaking beneath key help ranges on distinctive quantity as bearish momentum strengthened and merchants focused the $2.00 psychological zone.

Information Background

- XRP fell 6.4% to $2.20 over 24 hours, sliding from an intraday excessive of $2.35 amid heavy institutional promoting strain. The token traded throughout a large 12.4% vary because the broader crypto market stabilized, underscoring XRP’s remoted weak point.

- Buying and selling quantity spiked to 356.7 million, representing a 126% surge above the 24-hour common, confirming institutional participation within the breakdown sequence.

- Sturdy resistance endured at $2.37, with rebound makes an attempt to $2.33 and $2.23 repeatedly rejected.

- The failure to maintain positive aspects above prior help marked a structural shift from accumulation to energetic distribution.

Value Motion Abstract

- Value motion turned sharply bearish after the $2.17 breakdown, driving XRP to a session low of $2.08 earlier than stabilizing round $2.20.

- Intraday information revealed a short restoration from the $2.11 base, with value climbing 4.5% to $2.209 on a short-term quantity burst of 5.8M tokens, although the rally stalled at $2.216 as liquidity light.

- The late-session bounce coincided with information that Ripple’s RLUSD stablecoin crossed $1 billion in market capitalization, however technical dynamics remained the first driver.

- Momentum loss above $2.22 signaled restricted conviction behind the restoration, leaving XRP trapped beneath prior breakdown ranges.

Technical Evaluation

- The session confirmed a decisive bearish bias as XRP fashioned consecutive decrease highs and decrease lows from the $2.37 resistance peak.

- The sample validates a short-term downtrend bolstered by quantity enlargement throughout selloffs and contraction throughout rebounds — a basic signature of institutional distribution.

- Momentum indicators turned detrimental, with the relative power index trending close to impartial after falling from overbought territory earlier within the month.

- The failure to reclaim the $2.17 line suggests additional weak point until renewed demand emerges across the $2.08-$2.11 consolidation base.

- Whereas XRP’s construction hints at a doable oversold restoration, quantity divergence and failed retests indicate rallies might proceed to face heavy resistance till broader market sentiment improves.

What Merchants Ought to Know

- Merchants are watching whether or not XRP can maintain above the $2.08 help to keep away from accelerating losses towards the $2.00 psychological degree.

- A sustained restoration above $2.22 can be required to re-establish bullish footing, whereas failure to take care of present ranges dangers one other wave of liquidation.

- Institutional quantity spikes throughout declines affirm energetic repositioning relatively than retail-driven volatility.

- For tactical merchants, the $2.17–$2.22 zone represents the important thing inflection vary that might outline short-term path.