Within the current previous, Singapore’s fintech sector has emerged as a beacon of innovation and progress inside the ASEAN area. Nevertheless over the previous 12 months, the fintech sector in Singapore, reflecting international traits, is at present experiencing a major funding slowdown.

This era, sometimes called a ‘funding winter’, has seen ranges of fintech funding in each international and ASEAN markets drop to their lowest since 2020. Regardless of these hurdles, Singapore has emerged as a resilient chief, accounting for a major proportion of fintech funding within the area.

The State of Fintech Funding in Singapore and ASEAN

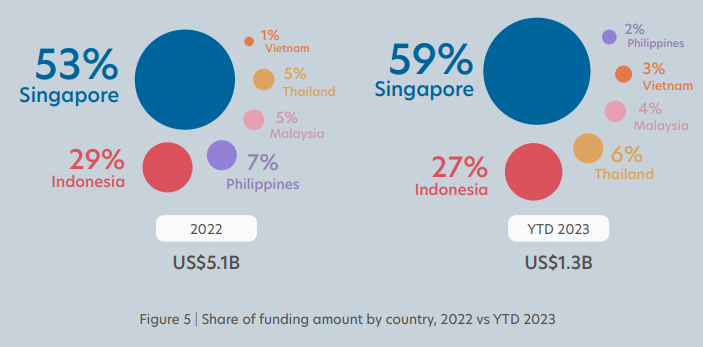

The 2023 FinTech in ASEAN report, a joint endeavour by UOB, PwC Singapore, and the Singapore Fintech Affiliation, illuminates the present funding panorama globally and within the area. It reveals that Singapore accounted for a formidable 59% of the fintech funding within the ASEAN area final 12 months, a considerable share amidst the downturn. Nevertheless, the entire funding in ASEAN was merely US$1.3 billion, representing a scant 3% of world fintech funding, marking the area’s lowest in three years.

Regionwide, the typical funding quantity among the many prime 10 funded corporations noticed a decline of greater than half in 2023 to US$94 million because the area noticed solely three mega offers valued at over US$100M, which accounted for near 50% of complete fintech funding within the sector. These mega offers have been led by Singapore fintech corporations Advance Intelligence Group, Bolttech, and Indonesia’s Kredivo Holding.

In ASEAN fintech funding, Singapore and Indonesia proceed to guide, contributing a mixed 86% to the area’s 2023 complete funding. In distinction, the Philippines witnessed a major drop in its funding share, primarily as a result of absence of large-scale offers in 2023. The funding panorama additionally underscored a shift in the direction of early-stage firms, which now command a bigger portion of the funding pie, a stark distinction to earlier years the place mature firms have been predominant.

Investor Behaviour in a Difficult Setting

Globally, the fintech sector grapples with the repercussions of financial uncertainties and high-interest charges, resulting in a noticeable decline in funding. The overall funding amassed in 2023, amounting to US$44 billion, fell in need of the US$58 billion recorded in 2020, the earlier lowest 12 months. Notably, the six greatest ASEAN markets noticed a steep 75% decline in investments, with the variety of offers halving and common deal sizes reverting to ranges seen previous to the COVID-19 pandemic.

Apparently, the highest 10 funded firms noticed their common funding fall by greater than 50% in 2023 to US$94 million. Nevertheless, a shift in the direction of early-stage corporations was famous, with six out of the highest 10 being early-stage firms, a major improve from solely two the earlier 12 months.

The prevailing macroeconomic situations have nudged buyers in the direction of a extra cautious method. There’s an elevated give attention to scrutinising the basics of firms earlier than committing to new funding rounds. This shift in investor behaviour is obvious within the diminished quantity and dimension of offers, as buyers search to mitigate dangers in an unpredictable financial local weather.

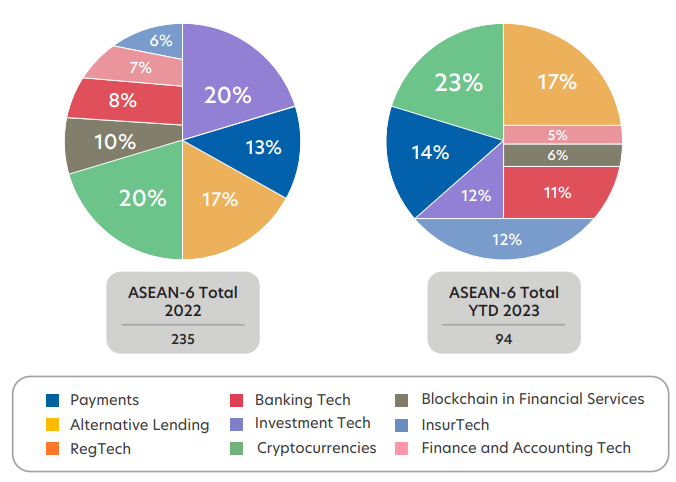

The fintech funding panorama in 2023 marked a departure from the earlier 12 months’s traits. Not like 2022, the place the funds class dominated the highest offers, 2023 witnessed a extra various distribution throughout varied fintech classes.

In 2023, 4 out of the highest 5 fintech funding offers in ASEAN have been from Singapore, with the exception being the most important deal going to different lender Kredivo’s Collection D valued at US$270 million. This diversification signifies a maturing market the place buyers are spreading their investments throughout totally different fintech options.

Prime Offers and Rising Patterns

While Singapore and Indonesia dominate in ASEAN fintech funding, collectively accounting for a whopping 86% of the regional pie, different nations like Vietnam and Malaysia are additionally creeping up as barely extra notable contributors. Various lending, representing almost a 3rd of ASEAN fintech funding, alongside insurtech, bucked the general decline in funding for 2023. In Malaysia, as an example, different lending corporations stood out, securing probably the most funding, a development noticed the earlier 12 months as nicely.

The resilience of the fintech sector is additional exemplified by the efficiency of particular sectors like different lending and insurtech. These sectors defied the general downtrend by exceeding their complete funding quantities for 2022, partly as a result of vital offers involving fintech corporations primarily based in Singapore and Indonesia.

Variety of funding offers by fintech classes, 2022 vs 2023. Supply: 2023 FinTech in ASEAN: Seeding the inexperienced transition; UOB, PwC Singapore, and SFA

Regardless of regulatory warning in Singapore relating to cryptocurrencies, this sector remained vibrant by way of deal numbers, albeit its share of funding noticed a decline. Crypto corporations inked the best variety of offers within the area, precisely a 3rd (33%) out of Singapore’s complete 51 offers final 12 months. Nevertheless, its share of funding quantity declined by 10%, as buyers steered away from overvaluation.

Whereas different lending made up almost a 3rd of ASEAN fintech funding in 2023, that was not the case for Singapore the place it was solely 12% of the entire. As an alternative, insurtech dominated Singapore with a 3rd (33%) of funding because of the aforementioned mega offers.

The Position of Singapore in Regional Fintech

Singapore’s place as a pacesetter within the ASEAN fintech area isn’t merely about funding. The nation has developed a strong ecosystem that helps fintech innovation by means of beneficial laws, a talented workforce, and a tradition of entrepreneurship. This ecosystem has enabled Singapore to draw not solely funding but in addition expertise and know-how, reinforcing its standing as a fintech hub.

Because the fintech sector navigates these difficult instances, the traits noticed in 2023 are indicative of the sector’s resilience and flexibility. The give attention to early-stage firms, diversification throughout varied sub-sectors, and the strategic positioning of Singapore and Indonesia as leaders within the area are indicators of an evolving panorama. The forthcoming years will doubtless see continued innovation and adaptation because the sector seeks to rebound from the present funding winter.

Singapore’s fintech sector, mirroring international traits, is navigating a difficult funding panorama characterised by a downturn in funding. Nevertheless, the nation’s vital affect within the ASEAN fintech funding enviornment, coupled with its strong ecosystem and durable regulatory oversight, positions it nicely to climate these challenges.

The traits and shifts noticed in 2023 underscore the sector’s resilience and flexibility within the face of world financial uncertainties. Because the business continues to evolve, will probably be crucial to watch how these traits develop and what new dynamics emerge within the fintech funding ecosystem.

Featured picture credit score: Edited from Unsplash