Since reaching its peak for the yr at $0.00004749 over a month in the past, on March 5, the value of Shiba Inu (SHIB) has fallen by roughly 40%. Nonetheless, there could also be brighter days forward. Following a meteoric rise of 390% in simply eight days from the tip of February until the start of March, a interval of consolidation was inevitable for the SHIB worth. Nonetheless, this part may very well be drawing to a detailed.

Shiba Inu Value About To Surge 65%?

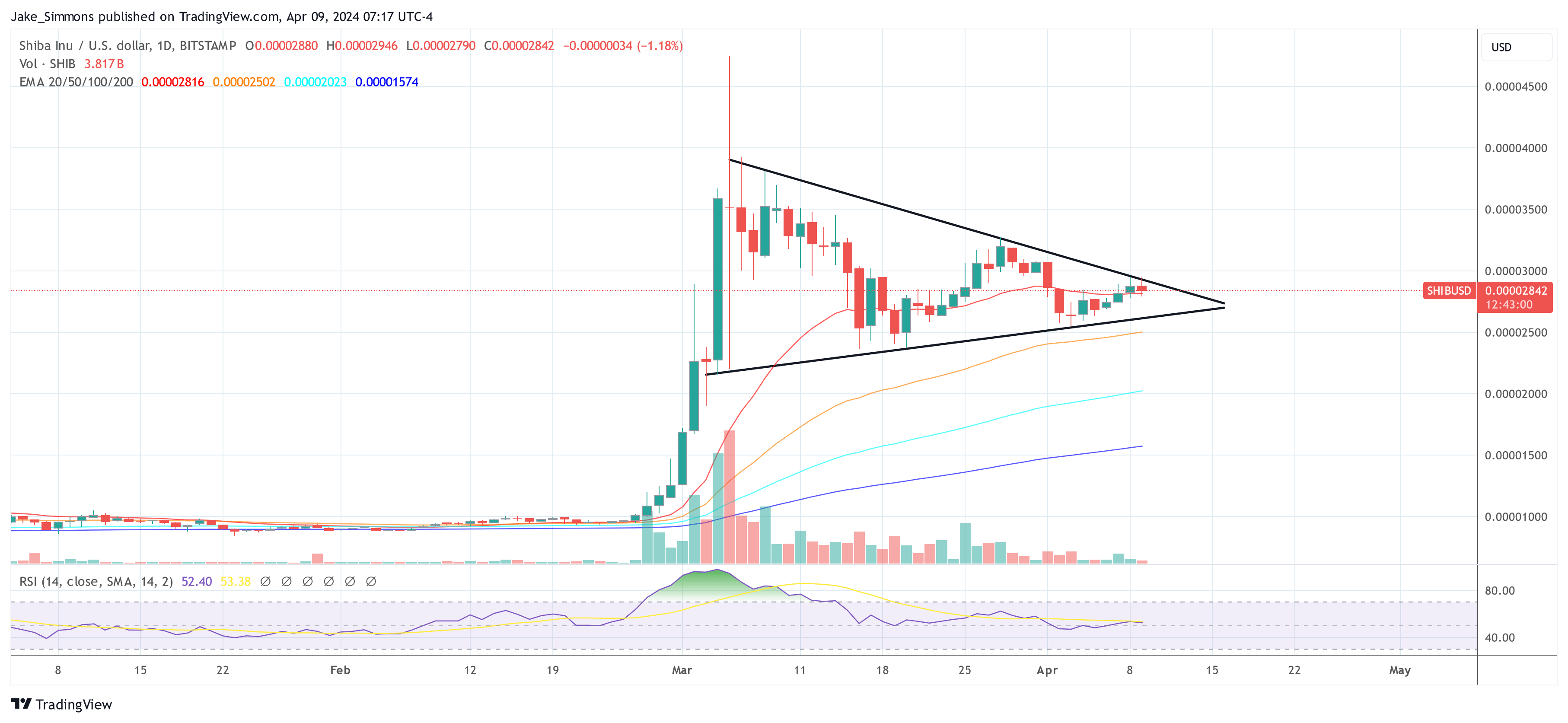

On the day by day chart, the meme coin is exhibiting a essential chart sample that means a big worth motion could also be imminent. The evaluation of the day by day SHIB/USD chart reveals the emergence of a symmetrical triangle sample. This basic chart sample is usually thought-about a continuation sample, sometimes heralding an uptick in volatility. Provided that SHIB has been on a notably sturdy uptrend, the momentum may swing again in favor of the bulls.

Over the previous 5 weeks, the value of SHIB has been making a sequence of decrease highs and better lows, which is clear from the converging pattern strains which might be containing the value motion. The apex of the triangle is quick approaching, suggesting {that a} breakout is imminent. Any such consolidation suggests market indecision, and because the sample reaches its conclusion, we will count on a big transfer in both course.

The present worth on the time of the evaluation is $0.00002842. Notably, the amount has been declining because the sample developed, which is typical throughout the formation of a symmetrical triangle and additional validates the sample.

Exponential Transferring Averages (EMAs) additionally paint an important image. The 20-day EMA is flatlining, suggesting a impartial short-term pattern, whereas the 50, 100, and 200-day EMAs are all trending upward, offering sturdy assist ranges. Significantly, the value is at the moment above the 20-day EMA, which is positioned at roughly $0.00002817, and this stage may act as a powerful assist within the close to time period.

The Relative Power Index (RSI) is hovering close to the 52.40 stage, which is barely above the midpoint of fifty that separates bullish momentum from bearish momentum. The RSI stage signifies a impartial stance available in the market momentum however leaves room for an upward thrust ought to the market sentiment sway positively.

When it comes to deriving worth targets from this sample, technical analysts sometimes measure the peak of the triangle at its widest half and undertaking that distance from the purpose of breakout.

If SHIB breaks above the triangle, the value may surge, concentrating on the peak of the triangle, which may very well be within the area of the yearly excessive at roughly $0.000048, contemplating the widest a part of the sample. This could translate right into a 65% worth rally from the present worth. Conversely, a downward breakout may ship the value to check the $0.00001500 stage, which might be the equal goal on the draw back.

You will need to point out that whereas symmetrical triangles can result in a considerable breakout, the course isn’t sure till a transparent breakout happens with an accompanying enhance in quantity. Merchants and traders want to observe for a day by day shut outdoors of the triangle’s boundaries, with elevated quantity, to substantiate the course of the breakout.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site totally at your personal threat.