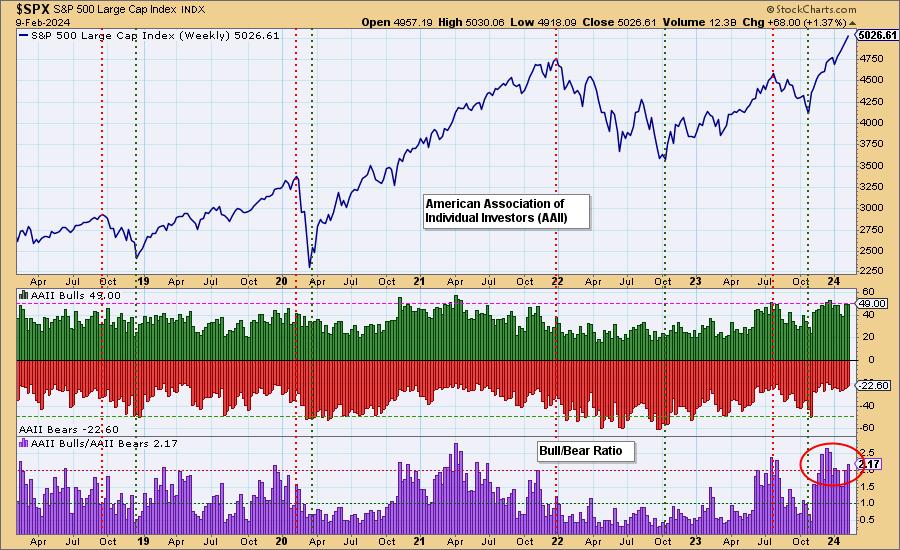

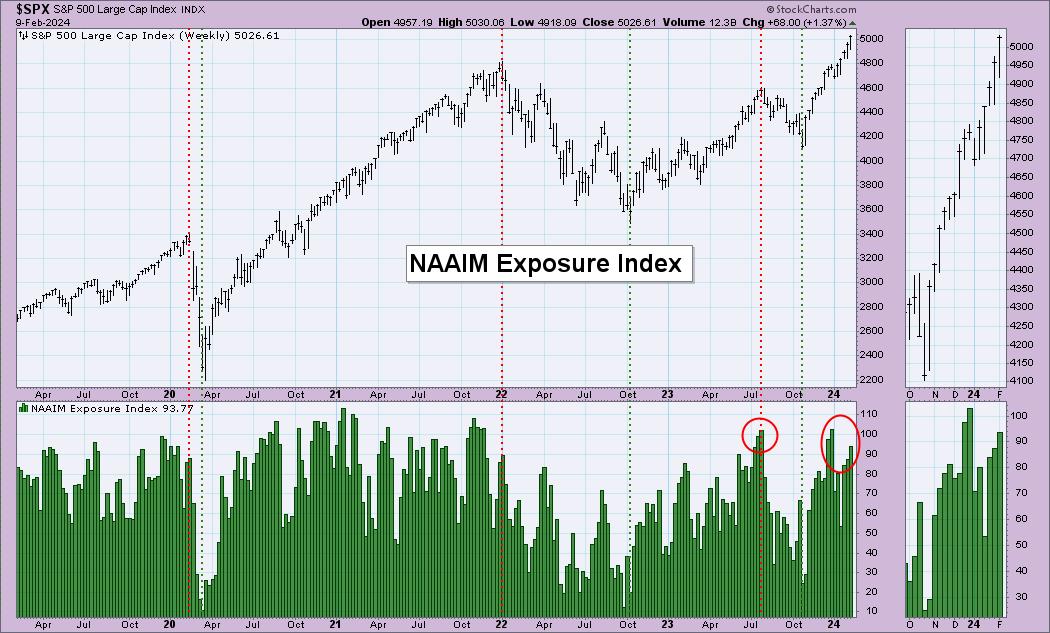

Periodically, we wish to evaluate sentiment charts, and immediately we have now two for you. One is the ballot outcomes from the American Affiliation of Particular person Buyers (AAII) and the opposite is the Nationwide Affiliation of Energetic Funding Managers (NAAIM) Publicity degree.

In each circumstances, we’re beginning to see sentiment lopsided to the bullish facet. Not a shock; given the rally out of the October lows, buyers ought to be bullish. Nonetheless, bullish sentiment turns into an issue if it hits extremes. Sentiment is contrarian. When buyers get overly bullish and hop on the wagon, the wheels will finally fall off from the burden. The reverse can be true with excessive bearish sentiment sometimes resulting in greater costs. That is obvious once you have a look at key tops and bottoms out there.

The Bull/Bear Ratio is the place to concentrate on the AAII chart. The ratio is certainly displaying pressure to the upside, however it may get extra overbought.

The NAAIM Publicity Index exhibits excessive readings of publicity. We’d level out that in a robust bull market transfer, as we noticed in 2020-2021, these readings can get very overbought and never result in draw back. We simply word that final time readings obtained to this degree, it was an issue.

Conclusion: Readings on sentiment indicators are lopsided to the bullish facet. Nonetheless, we do word that these readings can persist in a robust bull market transfer. That’s seemingly the case proper now, however we ought to be conscious that present circumstances are studying overbought for sentiment indicators. It will likely be value watching additional.

Watch the newest episode of the DecisionPointTrading Room on DP’s YouTube channel right here!

Strive us out for 2 weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Evaluation is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled. Any opinions expressed herein are solely these of the writer, and don’t in any method symbolize the views or opinions of every other individual or entity.

DecisionPoint just isn’t a registered funding advisor. Funding and buying and selling choices are solely your duty. DecisionPoint newsletters, blogs or web site supplies ought to NOT be interpreted as a suggestion or solicitation to purchase or promote any safety or to take any particular motion.

Useful DecisionPoint Hyperlinks:

Worth Momentum Oscillator (PMO)

Swenlin Buying and selling Oscillators (STO-B and STO-V)

Erin Swenlin is a co-founder of the DecisionPoint.com web site alongside together with her father, Carl Swenlin. She launched the DecisionPoint every day weblog in 2009 alongside Carl and now serves as a consulting technical analyst and weblog contributor at StockCharts.com. Erin is an energetic Member of the CMT Affiliation. She holds a Grasp’s diploma in Data Useful resource Administration from the Air Pressure Institute of Expertise in addition to a Bachelor’s diploma in Arithmetic from the College of Southern California.