It was a sloppy push to new highs for the S&P 500 this week, after a pointy drop Wednesday on Fed information was adopted by a restoration rally on the heels of sturdy earnings from choose Magnificent 7 names. All three indexes posted a 4th consecutive week of good points amid a pointy rise in rates of interest, resulting from sturdy jobs knowledge right this moment that confirmed a sizzling labor market with rising wages.

Whereas this week’s winner’s record is led by Meta Platforms (META) which surged 20% after posting sturdy quarterly outcomes and guiding progress estimates greater, the following 9 outperformers within the S&P 500 had been shares from 2 sectors which were steadily outperforming the markets since early December. These successful names every gained greater than 9% final week on sturdy earnings and a bullish outlook, and what could also be shocking is that not one is from the Know-how or Web areas.

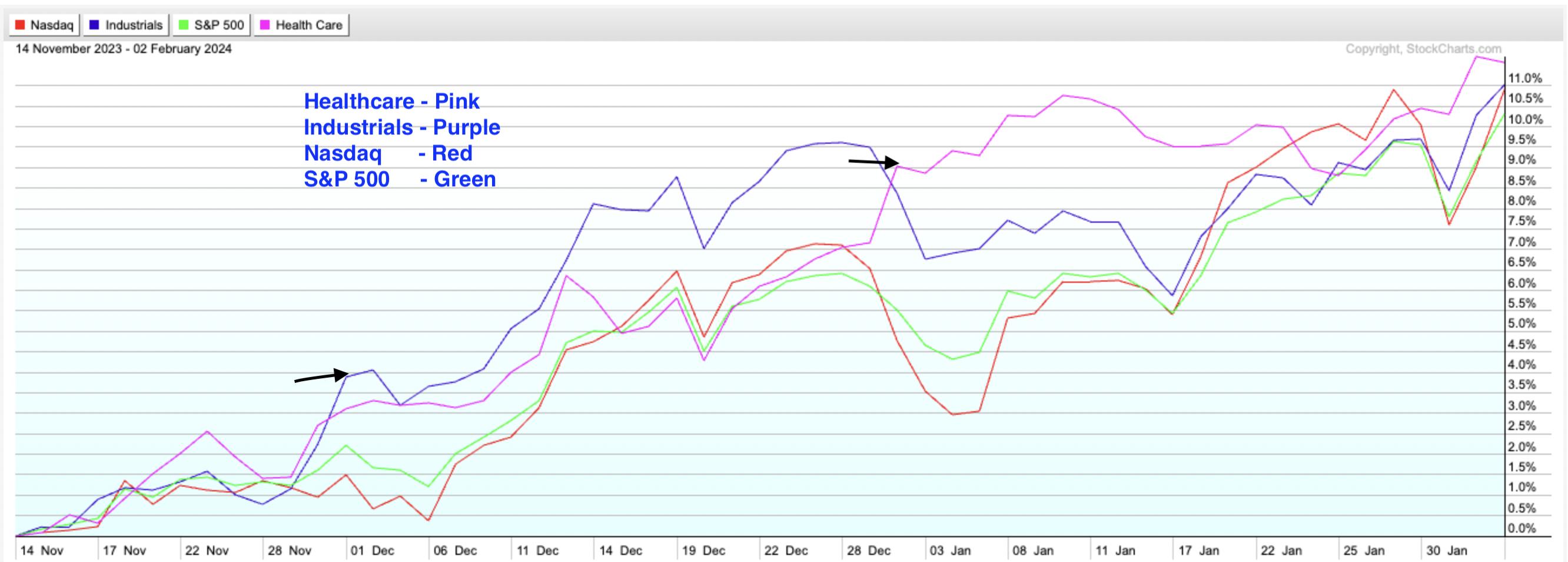

Efficiency Comparability Of S&P 500, Nasdaq, Industrial and Healthcare Sectors

Efficiency Comparability Of S&P 500, Nasdaq, Industrial and Healthcare Sectors

The chart above reveals these sectors, with Industrials (XLI) and Healthcare (XLV) each posting various levels of outperformance since early December. With headline information centered on megacap Tech names, it may need been straightforward to overlook this rotation; nevertheless, subscribers to my MEM Edge Report had been alerted after we started including Medical shares to our Prompt Holdings Checklist earlier this yr.

Among the many high ten S&P 500 gainers within the Healthcare sector final week was medical and surgical tools producer Stryker (SYK), which gapped up right into a 9-month base breakout following information that the corporate had posted earnings forward of estimates, whereas guiding progress prospects greater for this yr. Though the RSI is in an overbought place on the every day chart, the weekly chart factors to additional upside following a bullish MACD crossover from a comparatively low stage.

Day by day Chart of Stryker Corp. (SYK)

Day by day Chart of Stryker Corp. (SYK)

One other high ten gainer final week was Eaton (ETN), which is from the Industrial sector. The supplier {of electrical} energy and management tools gapped up on heavy quantity Thursday, after the corporate reported earnings forward of estimates whereas guiding estimates greater for this yr and subsequent. General, electrical energy demand progress is projected to speed up, because of knowledge facilities processing AI, EVs and warmth pumps. The bottom breakout places the inventory ready to commerce greater from right here.

Day by day Chart of Eaton Corp. (ETN)

Day by day Chart of Eaton Corp. (ETN)

Earnings season has usually marked a interval of sector rotation, as sturdy progress prospects entice cash flows into particular areas of the market. From my a few years at Willliam O’Neil & Co., and extra lately with my very own firm, it is grow to be crystal clear that earnings progress is the important thing driver amongst shares that go on to far outpace the markets.

My MEM Edge Report has a choose record of names on the Prompt Holdings Checklist, and we have highlighted most of this yr’s massive winners, similar to Deckers (DECK) and Meta (META), which each gapped up on sturdy earnings right this moment. This twice-weekly report additionally offers seasoned insights into the broader markets, which has helped traders stick with their winners regardless of sharp pullbacks similar to final Wednesday. Use this hyperlink right here to entry a 4-week trial, in addition to all earlier studies.

I hope you will make the most of this provide. It is shaping as much as be a recreation altering earnings season!

Warmly,

Mary Ellen McGonagle

MEM Funding Analysis

Mary Ellen McGonagle is knowledgeable investing marketing consultant and the president of MEM Funding Analysis. After eight years of engaged on Wall Road, Ms. McGonagle left to grow to be a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with purchasers that span the globe, together with massive names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Be taught Extra