On January 14, 2019, the Singapore Parliament handed its complete Fee Companies Act (PS Act), changing the previous Fee Programs Oversight Act and Cash-Altering and Remittance Companies Act to broaden the scope of regulated fee actions to incorporate rising traits and industries like digital property and cryptocurrencies.

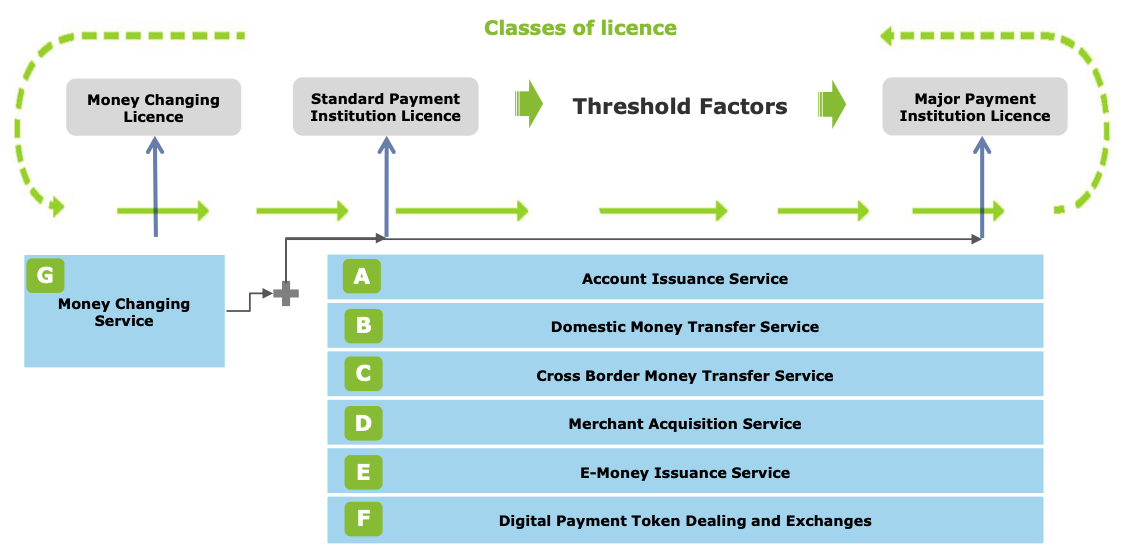

The laws, which goals to supply regulatory certainty and client safeguards about fee actions, all of the whereas encouraging innovation and progress of fee companies and fintech, regulates seven companies: account issuance, home cash transfers, cross-border cash transfers, service provider acquisition companies, e-money issuance, money-changing, and so-called digital fee token (DPT) companies.

It additionally lays out a modular licensing framework comprising three totally different license courses. Every license permits the holder to conduct a number of particular fee companies.

The Cash-Altering License will allow companies to conduct money-changing companies; the Normal Fee Establishment License permits them to conduct a number of fee companies beneath specified thresholds, and the Main Fee Establishment License permits companies to conduct a number of fee companies with none transaction quantity or float limits.

Singapore’s Fee Companies Act licensing framework for fee service suppliers, Supply: Deloitte, 2019

For the reason that PS Act got here into impact on January 28, 2020, the Financial Authority of Singapore (MAS) has obtained over 580 functions for fee companies licenses and accomplished the evaluation of greater than half of them, MAS board member Alvin Tan mentioned on April 4, 2022.

He added that 87 functions had been authorised, 11 had been rejected, and 147 entities withdrew their functions. Round 179 entities remained exempted from licensing and are nonetheless awaiting regulatory evaluation.

Information from MAS’ Monetary Establishments Listing present that as of August 01, 2022, 231 Cash-Altering, 13 Normal Fee Establishments, and 175 Main Fee Establishment licenses had been issued. Of those, solely ten corporations had been permitted to supply DPT companies.

As well as, desk analysis means that a minimum of 4 corporations have obtained in-principle approval for both a Normal or Main Fee Establishment license.

These figures counsel that regardless of early claims {that a} clear regulatory framework would offer a strong basis for Singapore to consolidate its place as Asia’s crypto hub and permit the nation to see the emergence of a thriving crypto sector, the principles have weeded out an terrible lot of startups, amongst which Binance and Huobi.

Additional highlighting Singapore’s altering stance in the direction of crypto companies, a number of new guidelines have been launched this yr, which forbid DPT service suppliers to advertise their companies to most people and require crypto service suppliers within the city-state that solely do enterprise abroad to be licensed regardless.

In Could 2023, the MAS launched a Session Paper on amendments to the Fee Companies Laws 2019, introducing new measures for Digital Fee Token (DPT) companies, together with a requirement for buyer asset safekeeping beneath statutory belief.

The transfer goals to guard towards monetary crime and loss, notably in digital fraud, and consists of broadening DPT service definitions and enhancing Anti-Cash Laundering (AML) protocols comparable to Buyer Due Diligence and transaction monitoring.

Moreover, the MAS’s latest proposals, efficient mid-2024, set stringent pointers for DPT service suppliers, specializing in conflict-of-interest administration, itemizing standards, criticism dealing with, and buyer danger consciousness.

Per FATF (Monetary Motion Activity Power) requirements, compliance with the Journey Rule mandates DPT companies to share consumer data for transactions, guaranteeing additional security in digital transfers. Entities offering DPT companies earlier than 28 January 2020 are quickly exempted from licensing beneath particular situations.

Suppliers should segregate and shield buyer property beneath a statutory belief, guaranteeing operational independence from different enterprise models, thereby lowering asset loss dangers and facilitating asset restoration in insolvency circumstances.

In November 2023, MAS mandated that DPT service suppliers cease accepting bank card funds from native issuers, aiming to curb cryptocurrency hypothesis amongst retail purchasers. That is a part of MAS’s broader technique to strengthen client safeguards and mitigate dangers within the digital foreign money area.

Following its newest suggestions publication on DPT laws, MAS has launched guidelines specializing in enterprise conduct and know-how danger administration. These guidelines require DPT suppliers to handle conflicts of curiosity, keep clear DPT itemizing insurance policies, and have strong buyer complaint-handling processes.

Further measures embrace prohibiting buying and selling incentives and bank card funds, demanding a radical evaluation of shoppers’ danger consciousness and internet price, and limiting financing or leverage choices.

Singapore’s 13 licensed crypto companies suppliers

As of 24 January 2024, MAS had given the inexperienced gentle to 13 crypto service suppliers. These entities comprise 11 Main Fee Establishment licensees and two Normal Fee Establishment licensees.

Eleven Main Fee Establishments permitted to supply DPT Companies

DBS Vickers Securities is a securities and derivatives brokerage agency owned by DBS that permits purchasers to put money into inventory exchanges, preliminary public choices (IPOs) and personal placements. It’s additionally the operator of the DBS Digital Alternate, a supplier of member-only exchanges providing skilled buyers with entry to digital property comparable to safety tokens and crypto.

Digital Treasures Middle (DTC) is an enterprise options supplier providing retailers on-line companies for accepting digital fee options, together with fee settlement, debit playing cards, digital wallets, and cryptocurrencies.

FOMO Pay supplies a digital fee processing platform that permits retailers and monetary establishments in rising markets to simply accept a full suite of cell funds, together with cryptocurrencies.

Unbiased Reserve is a regulated crypto trade serving over 200,000 clients in Australia, New Zealand, and Singapore.

Revolut is a digital financial institution from the UK that’s trying to introduce DPT companies in Singapore quickly, together with the power for native clients to purchase, promote, and maintain cryptocurrencies.

Sparrow Tech Non-public affords digital asset merchandise and options. These embrace enabling PayNow transactions for institutional and high-net-worth purchasers who purchase and promote cryptocurrencies utilizing fiat on its buying and selling platform, in addition to working with monetary establishments and household workplaces to design bespoke digital asset options.

Paxos is a New York-headquartered monetary establishment and know-how firm specialising in blockchain know-how. The corporate’s product choices embrace a cryptocurrency brokerage service, asset tokenisation companies, and settlement companies. Its subsidiary, Paxos Digital Singapore, has gained in-principle approval from MAS to supply digital fee token companies and is about to difficulty a USD-backed stablecoin, compliant with the nation’s proposed stablecoin regulatory framework.

Hako Expertise operates the Coinhako crypto trade platform, which permits buyers to purchase and promote cryptocurrencies utilizing varied fee strategies together with financial institution transfers and bank cards.

MetaComp, previously referred to as Cyberdyne Tech Companies, will now be capable of supply an end-to-end suite of digital asset companies to corporates, in addition to conventional and crypto-native institutional buyers.

Upbit, operated by Dunamu, is a digital asset trade primarily based in South Korea, which is energetic in Singapore, Indonesia, and Thailand. The platform helps cryptocurrency buying and selling, together with Bitcoin and Ethereum, and supplies an internet interface, cell functions, an NFT market, and staking companies.

Upbit, operated by Dunamu, is a digital asset trade primarily based in South Korea, which is energetic in Singapore, Indonesia, and Thailand. The platform helps cryptocurrency buying and selling, together with Bitcoin and Ethereum, and supplies an internet interface, cell functions, an NFT market, and staking companies.

Ripple operates a blockchain-based digital fee community and protocol, primarily recognised for its native cryptocurrency, XRP.

Two Normal Fee Establishments permitted to supply DPT Companies

BHOP Consulting runs BHex, a monetary decentralized digital asset buying and selling platform. The corporate supplies crypto property, in addition to custody and clearing infrastructure companies.

Triple A Applied sciences supplies a white-label crypto fee answer, serving e-commerce retailers, retailers, recreation suppliers, fee companies suppliers, fintech corporations, marketplaces and tech corporations.

A minimum of 9 crypto corporations have obtained in-principle approval

Crypto.com is a crypto trade headquartered in Singapore that helps buying and selling, investing, staking, wallets, non-fungible tokens (NFTs), and extra. It claims 50 million clients.

Coinbase is a digital asset trade firm initially headquartered in San Francisco, California, and has turn into a remote-first firm. They dealer exchanges of Bitcoin, Ethereum, Solana, and different digital property.

Coinbase is a digital asset trade firm initially headquartered in San Francisco, California, and has turn into a remote-first firm. They dealer exchanges of Bitcoin, Ethereum, Solana, and different digital property.

Blockchain.com, previously referred to as Blockchain.information, is predicated in London, England. It has cryptocurrency buying and selling companies, a blockchain pockets for storing digital currencies, lending companies, and varied knowledge creation programs for the blockchain financial system.

Circle is a monetary know-how firm that makes use of blockchain know-how for its peer-to-peer funds and cryptocurrency-related merchandise, enabling companies and people to make use of digital foreign money. The corporate is headquartered in Boston, Massachusetts.

Sygnum is a digital asset know-how group with a Swiss banking license and a Singapore Capital Markets Companies (CMS) license.

Its services and products embrace a digital asset administration platform, a digital foreign money buying and selling platform, and a spread of different services and products.

BitGo Inc., primarily based in Palo Alto, California, supplies regulated custody, lending, and infrastructure companies to over 1,500 institutional purchasers throughout 50 international locations. The corporate additionally affords crypto schooling, prompt shopping for, staking, and investor safety options.

Moomoo permits investments in shares, ETFs, and American depositary receipts, with buying and selling choices within the US, Hong Kong, and China. The agency is operational within the US, Malaysia, and Australia.

Moomoo permits investments in shares, ETFs, and American depositary receipts, with buying and selling choices within the US, Hong Kong, and China. The agency is operational within the US, Malaysia, and Australia.

XREX Singapore, a blockchain-based fintech centered on cross-border funds, is getting ready to supply varied fee companies, comparable to digital fee tokens. The corporate can be enhancing its BitCheck instrument to facilitate transactions involving fiat, stablecoins, and cryptocurrencies.

StraitsX supplies digital asset fee infrastructure in Southeast Asia, issuing StraitsX SGD and StraitsX USD. These will turn into “MAS-regulated stablecoins” following legislative amendments.

Crypto corporations that withdrew their license functions

Hodlnaut is a Singapore-based fintech startup that permits crypto buyers to earn curiosity on their crypto holdings by lending them to vetted establishments.

Nonetheless, it has withdrawn its Main Fee Establishment License software from MAS and halted withdrawals, token swaps, and deposits with fast impact citing “market situations” as its purpose.

Hodlnaut and its administrators are at present being investigated by the police for doable dishonest and fraud offences.

Luno is a worldwide crypto trade headquartered in London that serves over 10 million clients throughout greater than 40 international locations.

Luno is a worldwide crypto trade headquartered in London that serves over 10 million clients throughout greater than 40 international locations.

In 2023, the corporate determined to halt its companies in Singapore, withdrawing its beforehand submitted license software to the MAS and ceasing operations for its Singaporean clientele.

Genesis Buying and selling is a blockchain advisory and funding agency headquartered in Singapore known as Genesis Asia Pacific Pte. Ltd.

The corporate supplies a single entry level for digital asset buying and selling, derivatives, borrowing, lending, custody, and prime brokerage companies.

Nonetheless, following the fallout from the FTX implosion, the agency halted withdrawals in its lending enterprise and subsequently filed for Chapter 11 chapter.

Regardless of these challenges, Genesis Asia Pacific, a Genesis Group subsidiary, has obtained in-principle approval to supply digital fee companies beneath Singapore’s Fee Companies Act 2019.

Regardless of this, the Financial Authority of Singapore (MAS) clarified that each Genesis Asia Pacific and Gemini Belief Firm, which holds an exemption from licensing, are at present unlicensed. MAS said that it’ll take into account all important developments throughout their licence software assessments.

Featured picture credit score: Edited from Unsplash

Editor’s Be aware: This text was final up to date on 25 January 2024 to mirror latest modifications in licensing standing