After I take into consideration discovering one of the best dividend shares in Canada, two colleges of thought come to thoughts.

The primary is yield-chasing—going after the best payouts attainable, no matter high quality. The second is dividend progress—proudly owning firms that won’t have the largest headline yields, however persistently increase dividends 12 months after 12 months.

Personally, I lean towards the latter. A steadily rising payout tells you administration is assured, money flows are wholesome, and the enterprise mannequin is sturdy. That’s the form of inventory I wish to maintain in my Tax-Free Financial savings Account (TFSA) for the lengthy haul.

How I would like my dividend shares to work

The perfect Canadian dividend inventory isn’t a flashy progress play. It’s a blue-chip firm with an extended historical past of rewarding shareholders.

I wish to see constant dividend hikes—not simply regular payouts—as a result of that reveals resilience throughout market cycles. On common, these sorts of firms are massive, well-capitalized, and leaders of their industries. They don’t need to dominate each headline, however they quietly compound wealth within the background.

Meaning stability sheet energy, dependable earnings, and a dedication to rising the dividend even in robust years. I don’t need one-offs or yield traps that dangle huge payouts however danger reducing them when occasions get exhausting. I would like predictability and self-discipline.

Why that issues for efficiency

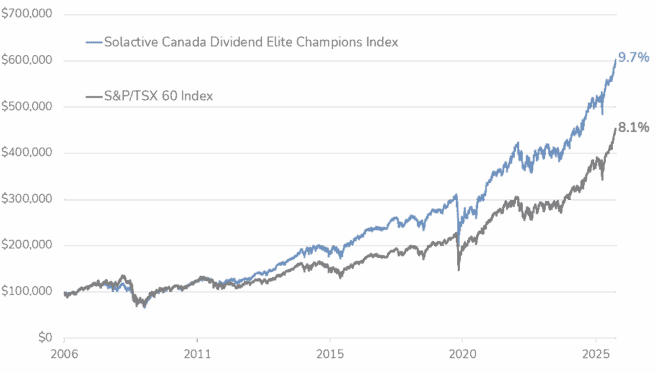

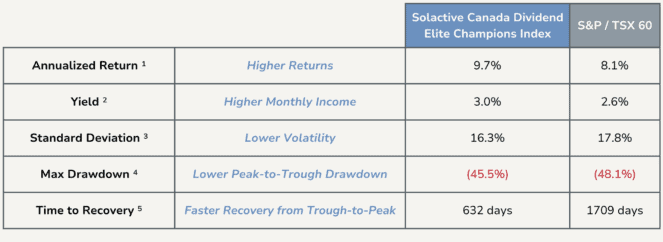

It’s not nearly consolation. Backtested information reveals that baskets of dividend progress “champions” not solely outpace the broader market but additionally accomplish that with much less volatility.

They get better extra shortly from downturns, pay extra revenue alongside the way in which, and provides buyers fewer sleepless nights. The mix of above-average yield, decrease danger, and sooner restoration makes dividend-growth shares a uncommon nook of the market the place you don’t want to decide on between security and returns.

That is the kind of compounding you need in a tax-free account. Dividends that develop sooner than inflation and portfolios that maintain up higher when markets wobble provide the edge you want over a long time.

The Silly takeaway

So, what’s one of the best ways to get all of this in a single place with out having to select particular person names? That’s the place Hamilton CHAMPIONS™ Canadian Dividend Index ETF (TSX:CMVP) is available in.

It holds a portfolio of blue-chip Canadian firms (see a few of the names beneath) which have raised dividends for at the least six consecutive years, producing the precise traits I’ve simply described.

Even higher, it comes with no administration price till January 31, 2026, after which the price is simply 0.19%. At present, the ETF is paying a 2% yield with month-to-month dividends.