RBL Financial institution has about 10+ Bank card variants of their portfolio most of that are co-brand playing cards with not so wonderful manufacturers and hardly any of them make sense to carry for a premium bank card holder.

Despite the fact that they do have playing cards with a good ~2% reward price, that’s ain’t sufficient as their service provider affords aren’t in par with the highest gamers and most significantly they don’t have a compelling USP.

However with this new card it’s lastly altering the best way we take a look at RBL Credit score Playing cards. Right here’s the detailed overview of the identical.

Overview

| Kind | Journey Credit score Card |

| Reward Charge | 0.5% – 2.5% |

| Annual Price | 3,000 INR+GST |

| Greatest for | Worldwide & journey spends |

| USP | 0% foreign exchange markup & Worldwide journey insurance coverage |

RBL has launched a brand new journey bank card named World Safari Credit score Card and so they say its the India’s first journey card with 0% markup charges.

That’s probably not 100% proper as Axis Burgundy Non-public bank card is the primary one with that profit, however its an invitation solely card.

In order a mass providing, it’s certainly the first bank card with 0% markup payment.

Charges

| Becoming a member of Price | 3,000 INR + GST |

| Welcome Profit | 3000 INR value MMT Voucher |

| Renewal Price | 3,000 INR + GST |

| Renewal Profit | Nil |

| Renewal Price waiver | Nil |

- MMT Voucher that can be utilized on Flights/Lodges (on-line) & Holidays (Offline)

The becoming a member of payment is Offset by the MMT voucher however we get nothing for the renewal until we go for the cancellation which could set off some retention profit, relying on if you ask for.

0% Markup Price

- 0% Foreign exchange Markup Prices (however No Reward Factors on Worldwide txns)

The USP of this card is its 0% markup payment on worldwide transactions and that’s nice esp. as a result of they’re utilizing Mastercard platform which normally has higher conversion charges.

However word that you’ll not get reward factors on worldwide spends, although chances are you’ll proceed to get the milestone advantages similar to most different bank cards.

Rewards

Common Rewards

- Journey Spends: 5 RP’s for each Rs. 100 spent (~1.25% return on spend)

- Non-Journey Spends: 2 RP’s for each Rs. 100 spent (~0.50% return on spend)

- 1 RP = ~0.25Ps

- Validity: 2 years

- The common rewards on the cardboard is kind of low for sure however the milestone profit makes up for that in a great way.

Milestone Rewards

| SPEND REQUIREMENT | MILESTONE BENEFIT | Cumulative Reward price |

|---|---|---|

| 2.5 Lakhs | 10,000 Factors | 1% |

| 5 Lakhs | 15,000 Factors | 1.2% |

| 7.5 Lakhs | 10,000 eVocuher | 2% |

- Reward Voucher Choices: Taj experiences, Amazon, Croma, Myntra & Makemytrip

So on 7.5L spend, you get a pleasant 2% reward price by way of milestone spends alone, which is first rate for a card with 0% markup payment and inexpensive becoming a member of payment.

Total reward price could possibly be pretty much as good as 3.25% in the event you use the cardboard just for Journey however of-course that’s uncommon so you may get little over 2% even on non-travel spends, which is fairly first rate particularly on Foreign exchange spends.

Airport Lounge Entry

| ACCESS TYPE | ACCESS VIA | ACCESS LIMIT |

|---|---|---|

| Home (Major) | Visa / Mastercard | 2/Qtr |

| Worldwide (Major) | Precedence Move | 2/Yr |

- Get 1 extra complimentary lounge go to by way of Precedence Move on spends of Rs. 50,000/- or extra in a calendar quarter. Hmm, that’s too low to make any distinction.

Golf profit

- Complimentary Golf Video games: 4/12 months

- Complimentary Golf Classes: 12/12 months (1/month)

It is a Mastercard World privilege and never the function of the product per se. Nonetheless adequate.

Worldwide Journey insurance coverage

The complimentary Worldwide/Abroad Journey Insurance coverage is among the most helpful advantage of the cardboard because it’s accepted by nearly all embassy’s internationally to obtain the Visa.

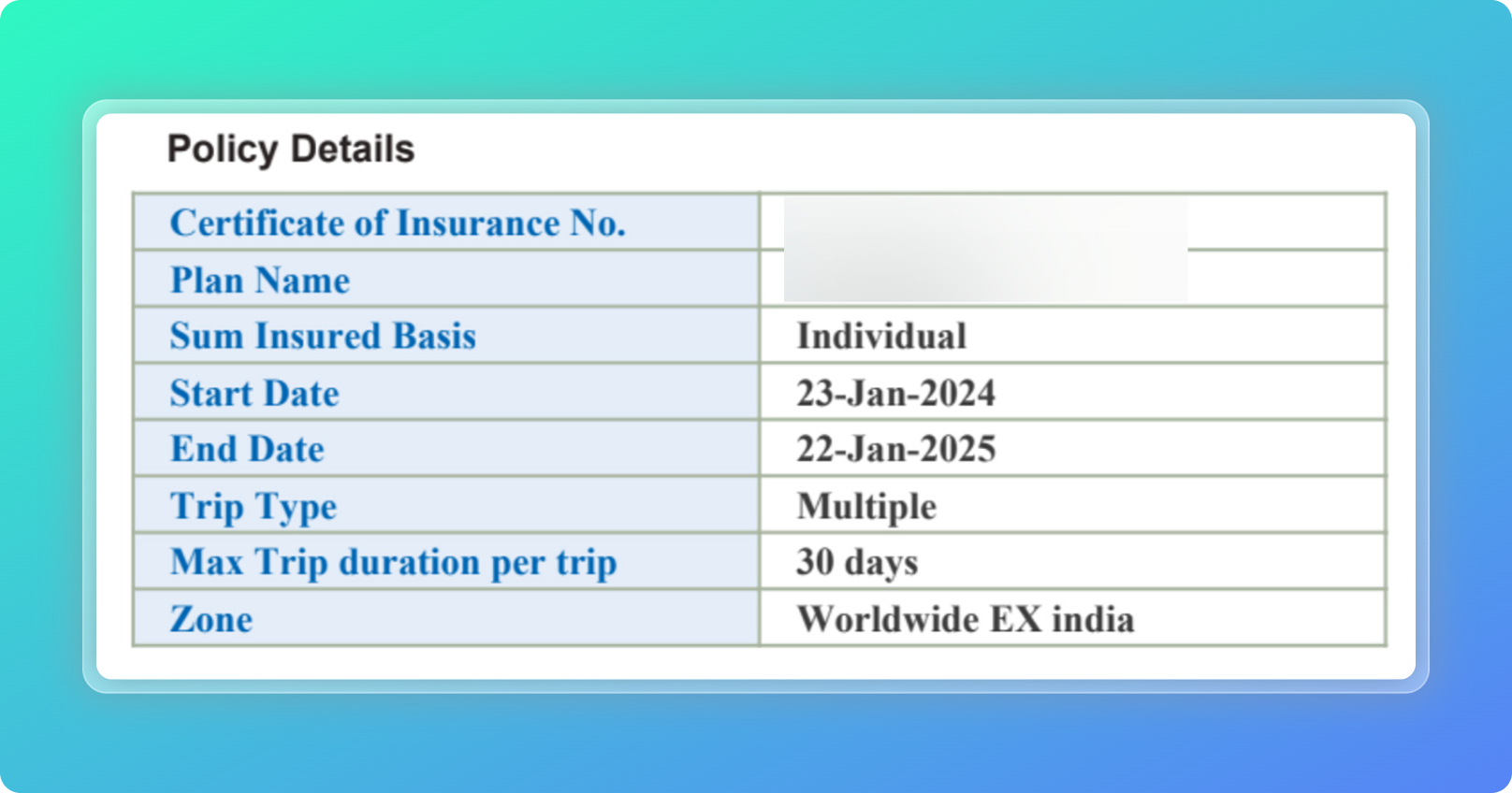

| Coverage Interval | 1 12 months |

| No. Of journeys | Multi-trip |

| Protection | Worldwide (besides nation of residence) |

| Max journey length | 30 days (per journey) |

| Recognition | Accepted by nearly all embassies |

Typical Protection which you could anticipate:

- Private Legal responsibility protection

- Journey Delay

- Baggage Loss

- Lack of Passport

- Dental Therapy & extra

Coverage is issued by Care Insurance coverage, previously Religare Well being Insurance coverage Firm Restricted. It’s a gaggle coverage with Particular person protection and so they challenge the person insurance coverage copy, which can be utilized for Visa procurement functions as talked about earlier.

The coverage is issued inside per week of card issuance submit a fast verification on the insurance coverage portal. Right here’s a fast take a look at the main points of my coverage which I acquired just lately:

Simply incase in the event you’re questioning, ideally it’s valued at 7,000 INR or extra.

Do word that this coverage is healthier than the one issued by American Categorical Platinum Cost Card because it comes with meagre limits.

So in the event you’re a global traveller doing a number of journeys in a 12 months, you may get the RBL World Safari Credit score Card with eyes closed only for this profit .

Must you get this card?

In the event you’re a global traveller who does at-least 2-3 journeys a 12 months and does about 7.5L spend a 12 months, I see no motive to not get this card. That’s since you get:

- Respectable Rewards

- 0% Foreign exchange markup Price

- Lounge Entry

- Worldwide Journey Insurance coverage (Worldwide for 1 12 months)

That’s greater than ample record of advantages for a bank card with 3K annual payment. So I’d say it’s completely value it.

Tip: In the event you’ve acquired different RBL Financial institution Credit score Playing cards with good spends, provoke card closure request and on retention name you may get the RBL World Safari Card as a First 12 months Free Card. You may thank me later. 🙂

Bottomline

It takes lot of guts to give you a bank card at 0% markup payment as a result of markup charges are one of many main income stream for the issuers. However on condition that RBL doesn’t normally have that sort of consumers, this may-not have an effect on them a lot, at-least initially.

And aside from that, the worldwide journey insurance coverage carries an actual worth for these taking a number of overseas journeys a 12 months.

That apart, it’s an incredible card for many who don’t have tremendous premium bank cards like HDFC Infinia for worldwide journey.

It’s additionally good to see the Taj voucher as part of the providing. I hope they give you extra new playing cards with good USP’s like this.

What’s your tackle the RBL Financial institution World Safari Credit score Card? Be happy to share your ideas within the feedback under.