Technical breakdown accelerates regardless of institutional product rollouts as XRP checks important assist amid broader market weak point.

Information Background

- A number of XRP ETFs launched all through November, together with Franklin Templeton’s EZRP on Nov. 18, becoming a member of Canary Capital’s XRPC and a number of other Bitwise merchandise.

- Mixed first-week ETF flows exceeded $245 million, signaling substantial institutional curiosity through the rollout.

- Regardless of sturdy inflows, ETF buying and selling volumes slid 55% from peak ranges, reflecting diminishing retail enthusiasm.

- Broader crypto markets weakened as Bitcoin volatility elevated forward of its Loss of life Cross occasion, dragging altcoins decrease.

- ETF narratives created optimism, however market liquidity remained fragmented, limiting momentum for XRP regardless of elevated institutional entry.

Value Motion Abstract

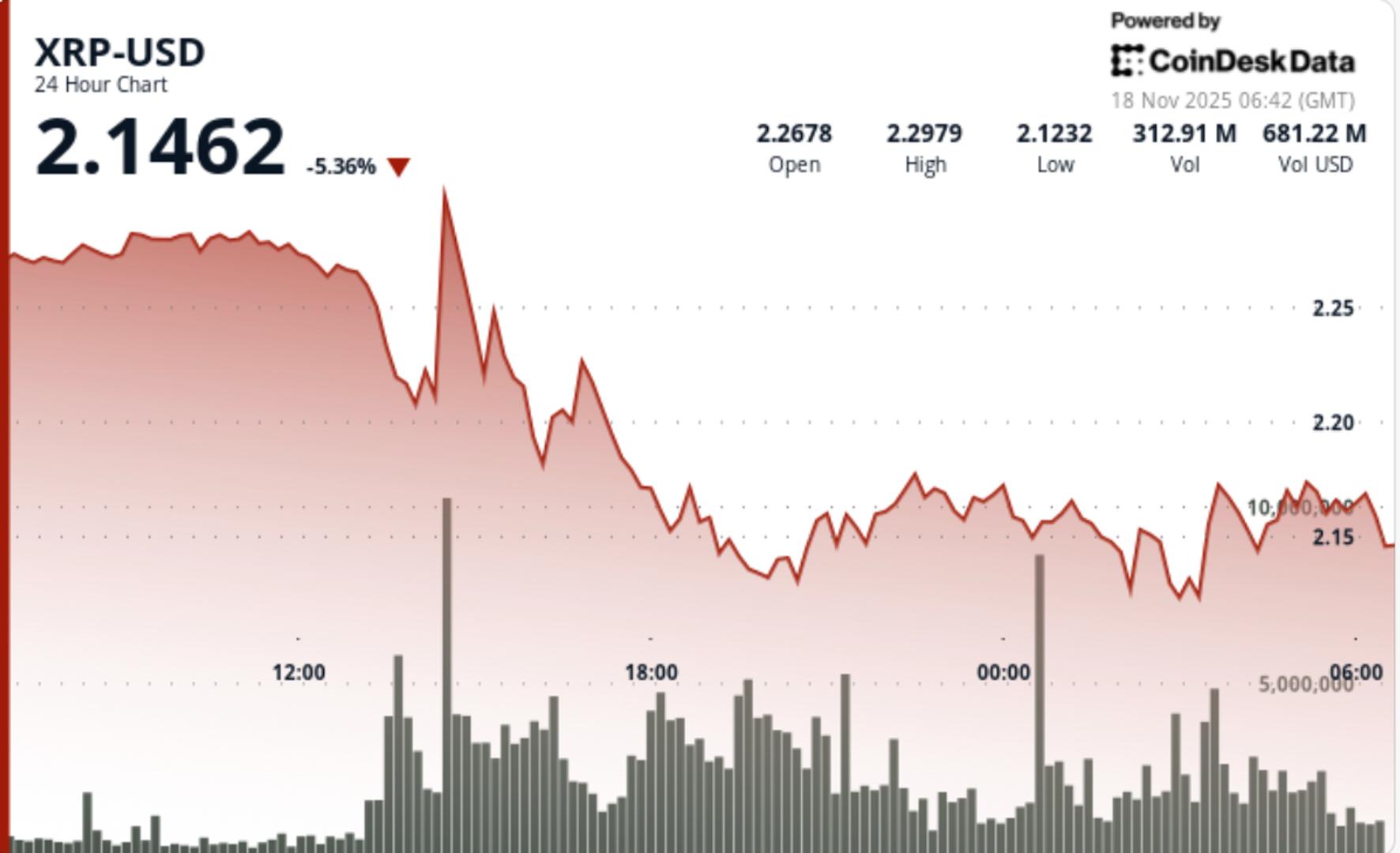

- XRP fell 4.96% from $2.27 → $2.16, breaking beneath the $2.20 assist stage.

- Whole session quantity surged 54.56% above month-to-month averages, reaching 236.6M XRP traded.

- Breakdown triggered a slide to intraday low of $2.11 earlier than recovering to the $2.15–$2.17 zone.

- Resistance fashioned at $2.28, whereas stabilization makes an attempt clustered round $2.155–$2.166.

- Submit-breakdown consolidation printed a decent vary, indicating non permanent vendor exhaustion however no confirmed reversal.

Technical Evaluation

- XRP’s reversal from $2.27 into a pointy decline towards $2.16 confirmed a full breakdown of its short-term bullish construction.

- The failure to reclaim the $2.28 resistance zone—coinciding with early-session ETF pleasure—revealed that institutional product launches had been inadequate to offset technical fragility within the underlying spot market.

- Quantity enlargement of 54.56% above month-to-month norms validated the selloff, notably because the breach of $2.20 unleashed cascading stops and compelled lengthy liquidations.

- The intraday rebound from $2.11 demonstrated that patrons stay energetic beneath key assist ranges, however the restoration lacked quantity conviction, stalling virtually instantly at $2.18.

- This lack of follow-through underscores the present imbalance: sturdy ETF flows create structural demand, but broader crypto risk-off situations overpower near-term bullish catalysts.

- A bearish pennant fashioned via compression between $2.155 assist and descending resistance at $2.18, suggesting that the market is coiling for one more directional transfer.

- Momentum indicators stay bearish with worth buying and selling beneath key EMAs and exhibiting no indicators of development reversal.

- The shortcoming to elevate past $2.18–$2.20 retains XRP weak to additional decline, whereas the tightening vary displays market indecision quite than accumulation.

- For bulls to regain management, worth should break above the pennant’s higher boundary and reclaim $2.28—a threshold that now represents structural affirmation of regained upward momentum.

What Merchants Ought to Watch Out For

- Merchants should monitor whether or not XRP’s consolidation above $2.155 represents stabilization or just a pause earlier than continuation decrease.

- The subsequent catalysts stay ETF-related, with extra Bitwise launches scheduled via Nov. 25, although current declines in ETF buying and selling exercise counsel diminishing short-term impression until broader market sentiment improves.

- The $2.15 pivot is important: holding the extent affords potential for a bounce towards the $2.28–$2.30 hall, whereas a decisive break beneath opens the door to a fast selloff towards the $1.98 structural assist cluster.

- XRP’s near-term trajectory will even rely on Bitcoin’s volatility regime—notably whether or not BTC stabilizes after its Loss of life Cross occasion or drags altcoins into deeper retracement phases.