Bitcoin (BTC), the main cryptocurrency, has made headlines this week by persistently breaking all-time highs, just lately surpassing the $126,000 mark for the primary time.

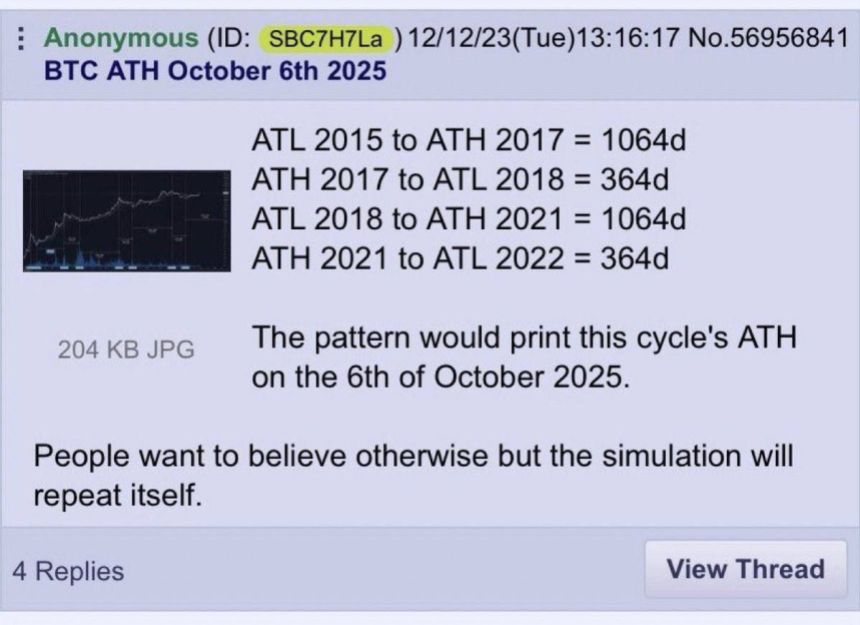

Nonetheless, the present value motion has not solely drawn consideration from buyers but in addition reignited discussions surrounding a notable prediction made two years in the past. An nameless consumer had forecasted that Bitcoin would obtain a peak on October 6, 2025—a prediction that got here to fruition simply yesterday.

Potential New Bear Market Forward

Regardless of this milestone, Bitcoin has retraced to round $121,000 inside hours after in the present day’s document, resulting in a wave of liquidations from lengthy positions throughout varied exchanges.

This fast value fluctuation has led many to take a position that the latest peak might probably mark the cycle’s all-time excessive, suggesting that Bitcoin may quickly enter a brand new bear market part.

Associated Studying

The prediction made in December 2023 posits that if historic patterns maintain true, the bear market low is anticipated to happen exactly 364 days later. This concept has gained traction amidst in the present day’s volatility, with specialists warning {that a} shift in market sentiment might be imminent.

Market analyst Physician Revenue has just lately cautioned that regardless of the present bullish pattern, the market is getting into a precarious part. He famous that whereas there’s a prevailing sense of euphoria, underlying monetary indicators are signaling a possible liquidity disaster.

Highlighting the present scenario, Physician Revenue pointed to the Reverse Repo (RRP) market, which has plummeted from a peak of $2.2 trillion in mid-2022 to a mere $8–10 billion in the present day.

This decline raises issues concerning the stability of interbank liquidity, suggesting that the monetary system might quickly face important dislocations if the RRP continues to dry up. Historic parallels from 2018, 2019, and 2023 point out that such liquidity points usually precede main market corrections.

Furthermore, US banks are reportedly grappling with roughly $395 billion in unrealized losses as of the second quarter of the 12 months, placing extra stress on their stability sheets.

Professional Sounds The Bitcoin Alarm

Within the crypto house, latest tendencies reveal substantial inflows into exchange-traded funds (ETFs), with companies like BlackRock contributing over $1 billion in Bitcoin and $200 million in Ethereum simply final week.

Nonetheless, Physician Revenue contends that the market’s broader liquidity image stays regarding. Whereas retail merchants are expressing optimism a few “liquidity flood,” the skilled cautions that the inflow of money into cash market funds might truly drain liquidity from broader markets reasonably than improve it.

Associated Studying

The present market setting can also be characterised by a notable uptick in insider promoting, in response to the skilled’s broader panorama evaluation, through which executives are reportedly offloading shares at an unprecedented fee, at the same time as retail investor inflows surge.

The skilled believes that this alleged market manipulation usually alerts a market cycle peak, creating what he believes “a extremely poisonous combine” that might have adversarial implications for future value actions.

In conclusion, Physician Revenue notes that the general sentiment paints a bearish image at a macro degree. Each the crypto and inventory markets are seen as being at an elevated threat of getting into a bear market after the fourth quarter.

Featured picture from DALL-E, chart from TradingView.com