Knowledge reveals cryptocurrency quick traders have suffered giant liquidations through the previous day as Bitcoin and altcoins have made a restoration.

Bitcoin, Ethereum Have Surged In The Final 24 Hours

Bitcoin and different cryptocurrencies have witnessed a rally through the previous day, breaking away from the hunch the market had earlier fallen into. On the top of this surge, Bitcoin broke previous $116,000, whereas Ethereum touched $4,250.

The property have since seen a small retracement. The chart beneath reveals how BTC’s newest trajectory has regarded.

At its present value of $115,400, Bitcoin is up about 4% on the weekly timeframe. Equally, Ethereum at $4,160 is in a revenue of three.4%. Most different digital property have seen equally constructive returns, though there are some outliers like Tron, which is down greater than 7%. The market-wide restoration through the previous day has meant that a considerable amount of quick liquidations have piled up on the derivatives exchanges.

Crypto Market Liquidations Have Totaled At $467 Million

In accordance with knowledge from CoinGlass, about $467 million in cryptocurrency-related derivatives contracts have been liquidated during the last 24 hours. A contract is alleged to be “liquidated” when its platform forcibly shuts it down after it accumulates losses of a sure diploma (as outlined by the alternate).

Provided that cash throughout the board have rebounded, the contracts crossing this threshold would largely be the quick ones. And certainly, the information would verify so.

As is seen above, liquidations associated to bearish cryptocurrency bets have reached $358 million on this window, representing 76.6% of the entire flush within the sector. Bitcoin led the liquidations with $177 million in contracts concerned, whereas Ethereum contributed the second most with $130 million in contracts. Out of the remaining, Solana witnessed the most important flush at $34 million.

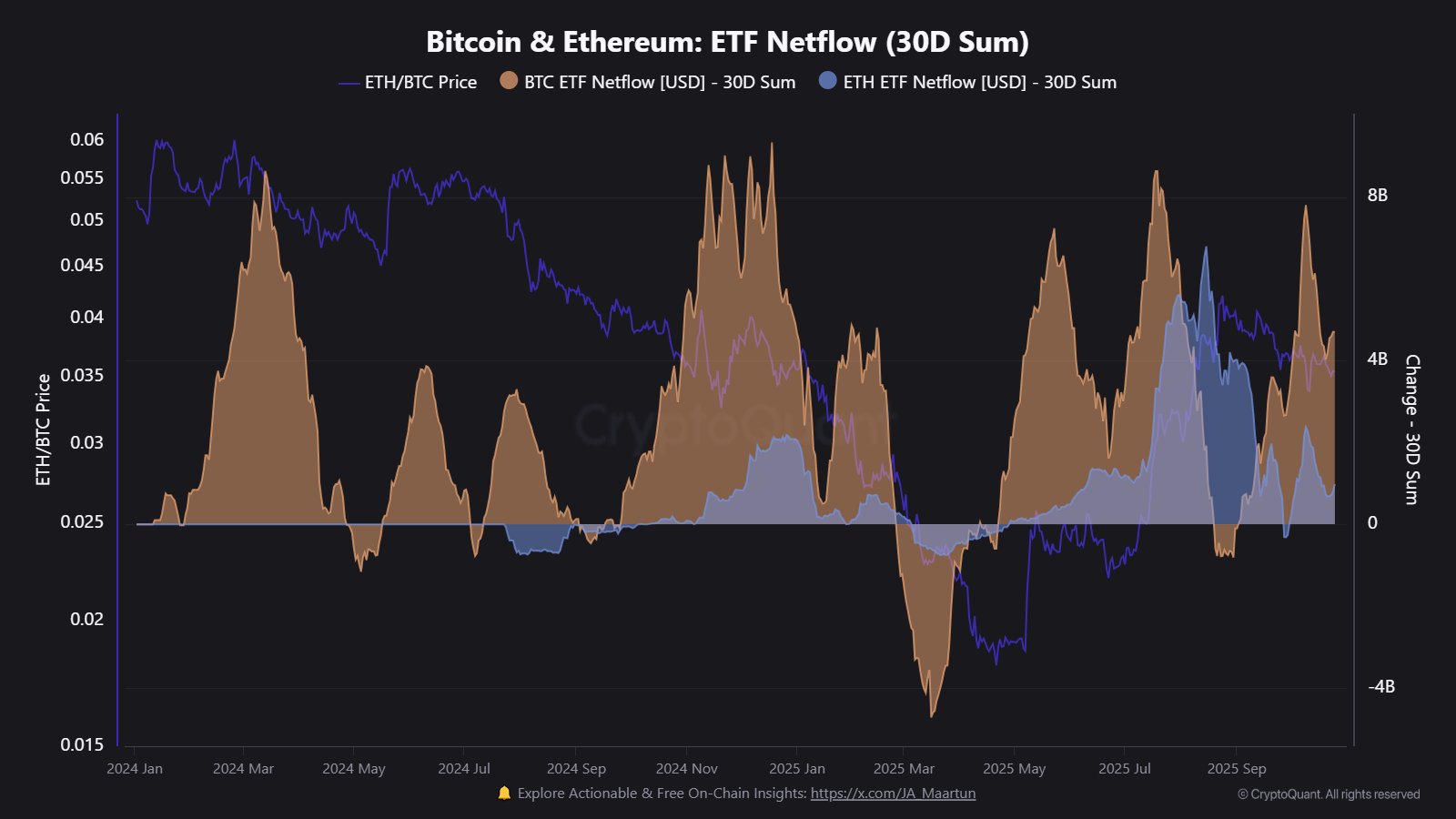

In another information, Bitcoin spot exchange-traded funds (ETFs) have noticed a notable quantity of inflows over the previous month, as CryptoQuant neighborhood analyst Maartunn has identified in an X put up.

Spot ETFs confer with funding automobiles that permit traders to realize publicity to an asset with out having to straight personal it. The US SEC authorised BTC spot ETFs in January of 2024. Right here is the chart shared by the analyst that reveals how the 30-day netflow for these automobiles has fluctuated since:

As displayed within the above graph, Bitcoin spot ETFs have seen inflows of $4.7 billion through the previous month. Ethereum spot ETFs, which gained approval in mid-2024, have additionally loved inflows on this interval, though their worth of $983 million is considerably lower than BTC’s.