The buying and selling markets are sometimes described as chaotic and unpredictable. Some even ascribe to the “Random Stroll Idea”, which in a nutshell compares the markets to a drunk strolling randomly whose subsequent step could be very unpredictable. Nevertheless, even Random Stroll Idea merchants additionally imagine that the route of value actions can nonetheless be predicted if based mostly on the long-term horizon.

It’s true, the market could be very unpredictable. It’s just about unimaginable to precisely predict the place value would transfer as a result of it’s a product of the beliefs of 1000’s of merchants world wide appearing on what they assume value would do getting into a buying and selling place. Predicting value actions is like studying the minds of 1000’s of merchants. Not possible, proper?

Nevertheless, in case you would look intently, regardless of all of the seemingly chaotic and unpredictable nature of the foreign exchange market, there are nonetheless cases the place value strikes fairly predictably wanting on the cycles of peaks and troughs of every value oscillation. These are the forms of markets that many merchants would need to commerce. It offers them an edge permitting them to constantly revenue from the market over the long term.

Probably the most predictable forms of market situation is a trending market. It’s fairly straightforward to evaluate the place the market can be usually shifting if wanting on the development. The query that is still is the place to take the commerce. If you happen to would look nearer, you’ll discover that value swings typically oscillate in a predictable method making it simpler for merchants to plan their trades.

Parabolic Pattern Foreign exchange Buying and selling Technique is a development following technique which supplies is a scientific technique for merchants to establish potential entry and exit factors. It makes use of a few technical indicators which filters out low likelihood trades and supplies entry indicators for commerce setups with descent possibilities.

Parabolic SAR

Parabolic Cease and Reverse, often known as Parabolic SAR or PSAR, is a development following indicator which is predicated on the idea of a parabola.

This indicator principally plots dots known as a parabola on the value chart, shadowing the development route of value motion fairly distantly. The concept is that these dots or parabola symbolize an Excessive Level (EP) in value actions. If value breaches these factors, then the development may very well be reversing.

Dots plotted under value motion point out a bullish development, whereas dots plotted above value motion point out a bearish development.

Parabolic SAR assumes that merchants could be available in the market on a regular basis. Merchants can maintain trades when the development remains to be in place and shut the commerce as quickly because the development reverses. Thus, it’s known as “Cease and Reverse”.

Merchants can path their cease losses behind the dots and enter a brand new commerce within the route of the development at any time when the cease loss is hit and the dot shifts to the alternative facet of value motion.

Though this indicator assumes that merchants can all the time maintain a commerce, it’s best used solely when the market is trending as this permits merchants to carry trades for greater earnings and keep away from losses on erratic reversals.

De Munyuk

The De Munyuk indicator is a customized technical indicator used to establish development route.

It’s a development following indicator which signifies instructions by plotting bars by itself window. These bars change shade relying on the route of the development. Lime bars point out a bullish development or momentum, whereas orange crimson bars point out a bearish development or momentum.

The essential use of a De Munyuk indicator is as a development or momentum reversal sign indicator. Merchants can take trades as the colour of the bar modifications. Nevertheless, it’s best to mix this indicator with different development indicators coming from different indicators or based mostly on value motion.

The De Munyuk indicator can be used as a development route filter indicator. Merchants can keep away from trades that aren’t aligned with the present development by utilizing the De Munyuk sign as a filter for a commerce setup.

Buying and selling Technique

This buying and selling technique is a development following technique which makes use of the confluence of the De Munyuk indicator and the Parabolic SAR as an entry sign.

The 50-period Exponential Transferring Common (EMA) is used as a development route filter. Traits are based mostly on the final location of value motion in relation to the 50 EMA line, the slope of the EMA line, in addition to the sample of the value swings.

As quickly because the development is established, we anticipate a confluence of the De Munyuk and Parabolic SAR indicators to substantiate a commerce setup.

Indicators:

- Parabolic SAR

- 50 EMA

- !De_Munyuk

Most well-liked Time Frames: 30-minute, 1-hour, 4-hour and every day charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

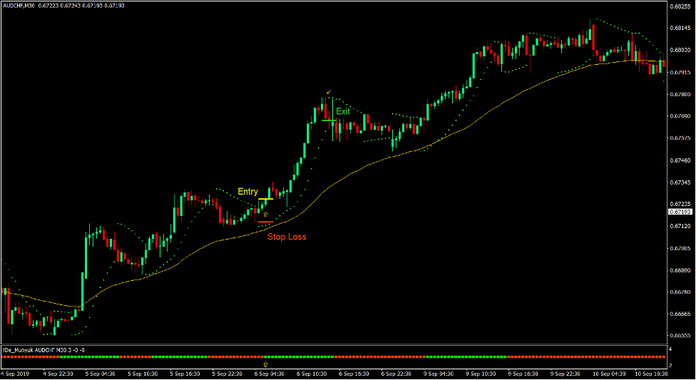

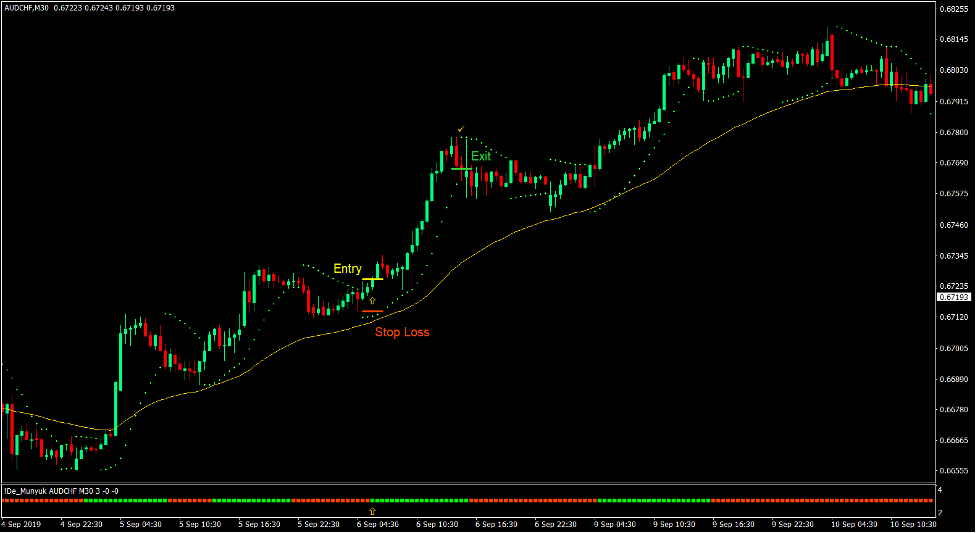

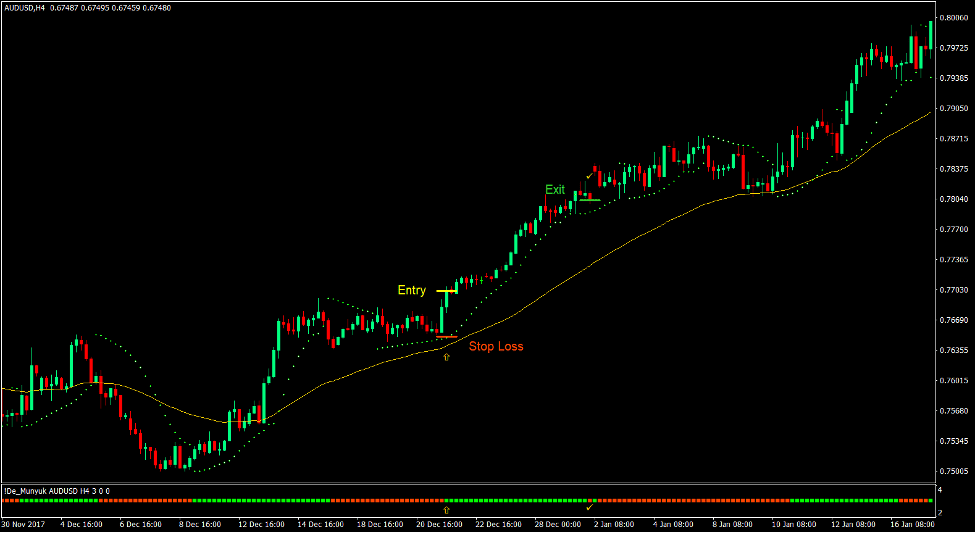

Purchase Commerce Setup

Entry

- Value motion must be above the 50 EMA line.

- Value motion must be forming increased swing highs and swing lows.

- The 50 EMA line ought to slope up.

- The Parabolic SAR dots ought to shift under value motion.

- The De Munyuk bars ought to change to lime.

- Enter a purchase order on the confluence of those situations.

Cease Loss

- Set the cease loss on the assist degree under the entry candle.

Exit

- Shut the commerce as quickly because the Parabolic SAR dot shifts above value motion.

- Shut the commerce as quickly because the De Munyuk bar modifications to orange crimson.

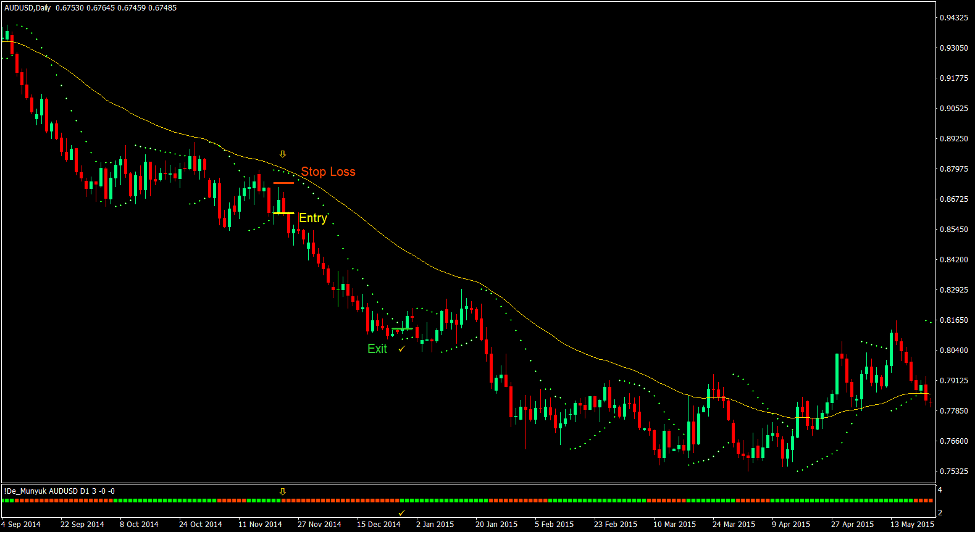

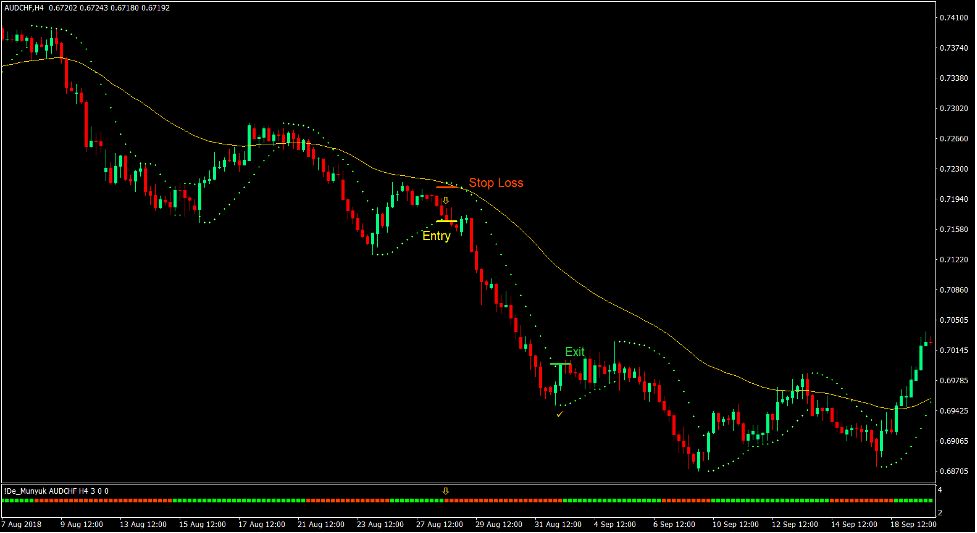

Promote Commerce Setup

Entry

- Value motion must be under the 50 EMA line.

- Value motion must be forming decrease swing highs and swing lows.

- The 50 EMA line ought to slope down.

- The Parabolic SAR dots ought to shift above value motion.

- The De Munyuk bars ought to change to orange crimson.

- Enter a promote order on the confluence of those situations.

Cease Loss

- Set the cease loss on the resistance degree above the entry candle.

Exit

- Shut the commerce as quickly because the Parabolic SAR dot shifts under value motion.

- Shut the commerce as quickly because the De Munyuk bar modifications to lime.

Conclusion

Pattern following methods based mostly on the mid-term development corresponding to it is a highly effective kind of buying and selling technique. It’s dependable sufficient to supply good high quality trades, whereas hanging the steadiness with a responsive development route indication. This enables for a commerce setup that has an honest strike fee and common risk-reward ratio.

The important thing to buying and selling this technique efficiently is in being proficient with figuring out trending market situations. This technique wouldn’t work if utilized in a uneven market. Nevertheless, if utilized in a decently trending market, this technique may constantly produce worthwhile trades repeatedly.

Really useful MT4 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90

Click on right here under to obtain: