One effective day I wished to open the HSBC Premier Account primarily for its International account privileges, as that’s an important privilege utilized by many. And that’s after I considered exploring their bank card as effectively.

So right here’s an in depth have a look at my expertise in opening HSBC Premier Account together with the HSBC Premier Credit score Card.

HSBC Premier Account

HSBC Premier Account could be opened with any department situated within the nearest metro metropolis both in similar state (or) in a distinct state. They insist for a department assembly to fulfill the account holder in particular person and to signal the kinds.

My account was opened in every week publish sharing required paperwork and it took one other week for the debit card to be delivered.

The debit card appears to be like OKAY in the dead of night gray design!

General it’s a reasonably fast course of and the cellular banking & netbanking setup was simple as effectively.

HSBC Premier Credit score Card

As soon as the account is opened and the eligibility standards is met, my RM took the appliance for the HSBC premier bank card. Infact the identical was requested throughout account opening course of.

Again then they’d a pleasant provide which might give taj epicure membership with 1 complimentary night time on HSBC premier a/c opening with bank card, publish spending 25K or so. Respectable provide I might say and it was fulfilled in ~2 months if I keep in mind it appropriately.

However earlier than that lots occurred!

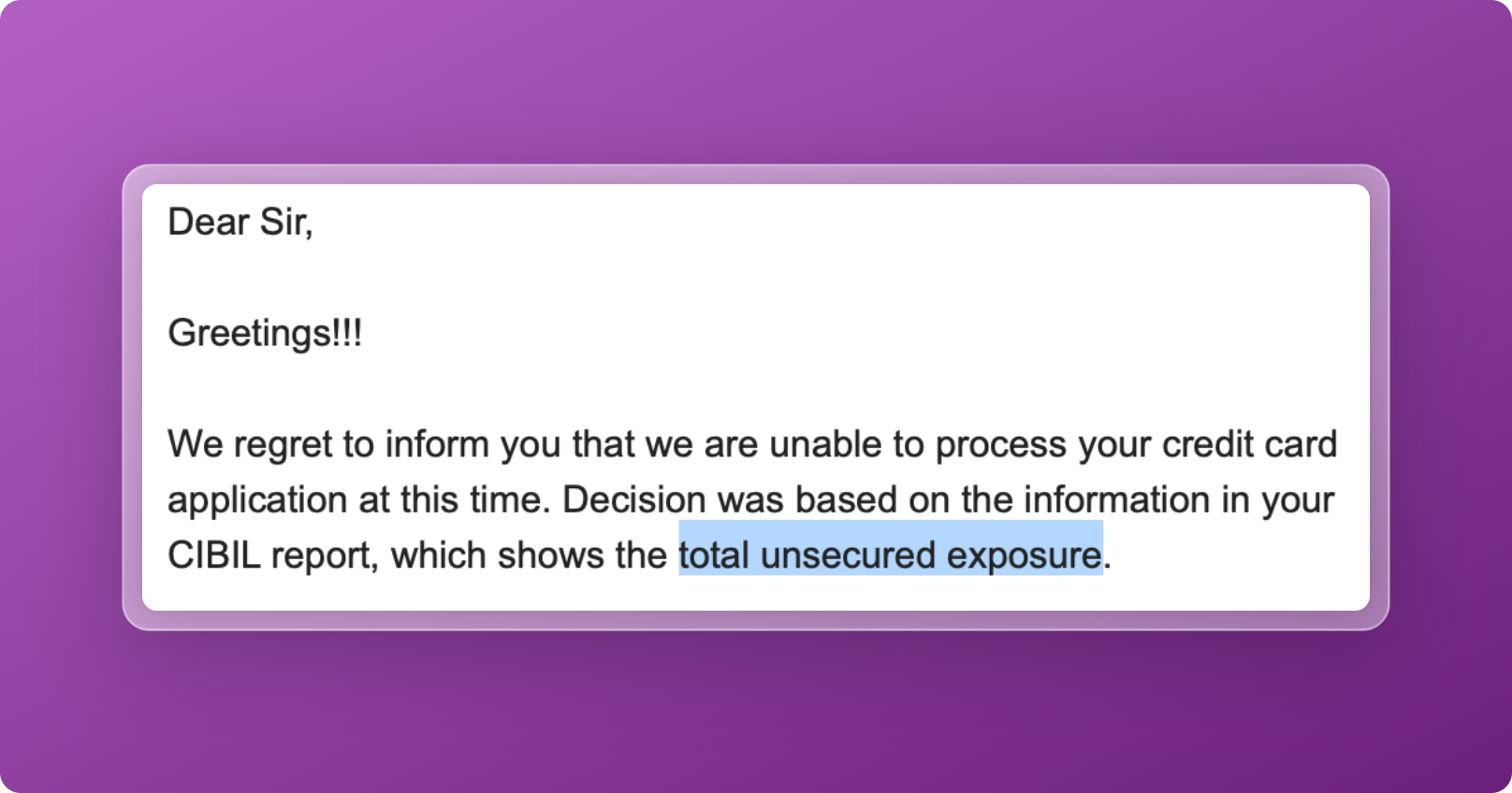

The Rejection

First, my HSBC Premier bank card software received “declined” after ready for nearly a month. And right here was the rationale given:

Mainly they don’t like seeing so many bank cards on my profile. Apparent, as a result of a typical buyer wouldn’t have 20+ open bank card accounts and a few (similar financial institution playing cards) share the credit score restrict as you would possibly know.

So I responded to the e-mail as to why I’m not a excessive threat profile together with a well mannered request for a re-consideration.

After common follow-up with RM, it took ~3 extra weeks to lastly hear a excellent news that my Credit score Card has been lastly authorised.

The Credit score Restrict Difficulty

Secondly, there was a small concern!

They gave lots decrease restrict than anticipated, within the vary of a typical “premium bank card” I might say and nowhere near a Tremendous Premium Credit score Card’s restrict.

As I anyway didn’t intend to spend a lot on it, I didn’t care about it and left it as is.

And after 2 months of utilization and re-payment, I requested my RM to look into the credit score restrict difficulty together with the opposite financial institution Credit score Card stmt. The restrict was greater than doubled and it’s now in an honest vary.

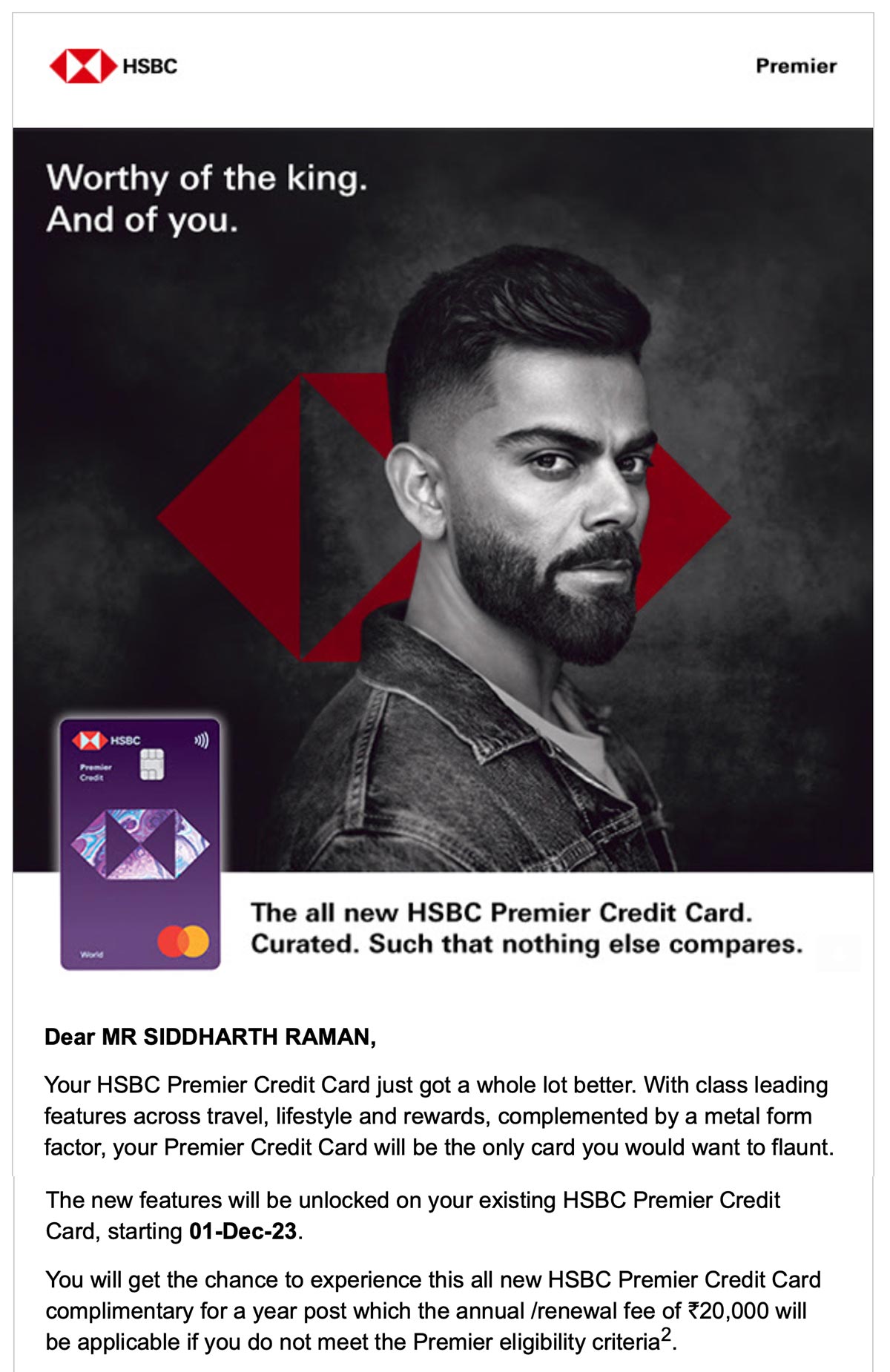

A Noteworthy Improve

HSBC just lately rolled out a beautiful improve to the HSBC Premier bank card that it’s now worthy for the HNI’s to carry them.

The excellent news is that HSBC gave complimentary improve to all the prevailing HSBC Premier Credit score Card clients with no motion to be taken. In different phrases, all HSBC Premier Credit score Playing cards at the moment are handled equal.

However the cellphone banking was not conscious of the main points of the brand new options and fortuitously the financial institution rolled out the under electronic mail for current cardholders. I want Banks alert such communications to assist executives prior, like Amex does.

That’s a terrific information for many and I’m already seeing the reward factors getting credited at 3% reward fee with my December 2023 Assertion.

That stated, one factor that HSBC needs to enhance is that they should add extra options to entry the bank card on app/web site. In the meanwhile you possibly can hardly do something besides PIN change or view stmt.

You possibly can’t request for miles switch on-line, you possibly can’t view reward factors besides on redemption catalogue web page and so many extra I may add.

Closing Ideas

It’s good to see HSBC getting aggressive of their Credit score Card choices in India. And on a fast look, it appears Indian model of HSBC Premier Credit score Card is maybe the most effective throughout the globe.

But it surely’s nonetheless not but aggressive to the aggressive competitors in India. We would wish “extra” switch companions at “higher” switch ratio, for ex, having Air India Flying Returns on listing is nice however the switch ratio is a joke.

Maybe they may run the momentary bonus miles provide on transfers sometimes to make it extra enticing.

That apart, one factor that stands out with HSBC is that the financial institution has given an excellent energy to the RM and the related group to take requests that may’t be carried out by way of on-line/cellphone banking. Compared, RM’s are often clueless in different banks!

However the responsiveness of the RM shouldn’t be one thing I’m proud of to date. I needed to follow-up repeatedly to get issues shifting and that’s not one thing I might need to see with the account that has such a excessive eligibility standards in place.

That’s my expertise with HSBC Premier Credit score Card to date. Have you ever been utilizing HSBC Premier Credit score Card? Be at liberty to share your experiences within the feedback under.