This morning, the enterprise media is obsessive about the truth that Thames Water has didn’t make a fee due on debt owed by its mum or dad firm, with intense hypothesis about what this would possibly imply for the firm‘s future.

The dialogue focuses on how that firm’s debt could be repaid and whether or not momentary nationalisation could be required to reorganise it in order that it could be preserved inside the personal sector.

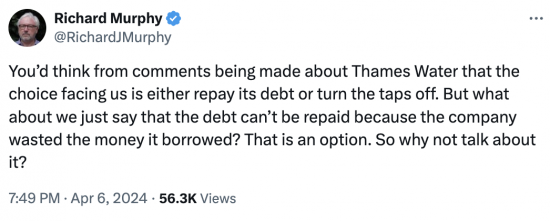

Nonetheless, as I famous on Twitter, final night time:

I put the choice ahead in all seriousness. As I demonstrated within the report that I wrote on the water business final yr, fairly actually each penny that this sector has borrowed this century has been used to make fee of dividends to shareholders. Much more cash was used to pay curiosity to these from whom funds had been borrowed to finance these dividends. The sector’s personal internet funding in new capital to offer water to the folks of this nation over the interval that I reviewed was exactly nothing.

My level is a fairly simple one. If I may work this out, then so may anybody. In that case, any establishment lending cash to those corporations or offering them with their capital clearly knew the danger that they had been taking, which was that the business that they had been offering with funds was not utilizing these for gainful functions however was as an alternative exercised in endeavor monetary engineering for the good thing about financiers, however not for the nation as a complete.

Provided that this danger was at all times obvious, identified about, and broadly talked about, the truth that loans have now failed can come as a shock to no one. This complete business is environmentally bancrupt, as I’ve described it, however can be now tottering getting ready to monetary insolvency as nicely.

In that case, obsessing about how debt could be repaid is absurd. That debt by no means funded helpful exercise. Consequently, the means to make its compensation don’t exist. It’s not repayable, as a matter of truth. That’s the reason insolvency occurs, and these corporations are bust.

The professional-market extremists within the Tories will attempt to keep away from this difficulty, determined to ensure that renationalisation of this firm takes place on Labour’s watch, for which they are going to then give it the blame.

Labour’s personal pro-market extremists will refuse to recognise that they are going to have renationalised this firm when they are going to, inevitably, be pressured to take action. As an alternative, they are going to say that it’s fairly unimaginable for the state to tackle the money owed of Thames Water and that the corporate should be returned to the personal sector for these money owed to be repaid, which might solely occur at price to customers who won’t see any profit from the fees that they are going to have imposed upon them to make sure that such compensation could be made.

Each events are pursuing insurance policies which can be excessive. Each wish to impose the price of failed monetary engineering on the folks of this nation when the truth is that they’ve an obligation to acknowledge that this firm has failed, that water privatisation has failed, that the sector can solely work sooner or later underneath state management, In that case, they need to be organising deliberate insolvencies underneath legal guidelines that recognise the financial actuality of the monetary failure that has occurred, which these in place at current don’t do as a result of they’re inherently biased in favour of the homeowners of capital on this sector.

Thames Water is bust. Its shareholders want to just accept that they’ve misplaced their cash. Most, if not all, of its debt financiers must do the identical factor. They took the danger of shedding their cash. They’ve executed so. That is how markets work, until you’re a po-market extremist, after all, when the concept the market would possibly fail can’t be tolerated.

It is just as a result of we’ve pro-market extremists answerable for this nation that we’re debating whether or not the money owed of Thames Water must be repaid or not. It must be apparent to anybody with the slightest sense that doing so is unimaginable. What we must be doing now’s figuring out the way to ship clear water, rivers and seashores. As an alternative, our flesh pressers are obsessing about the way to save financiers who had been silly with their funds from embarrassment. You can not get a clearer indication of the failed priorities of all these on the prime of our political system than that.