This text first appeared on our U.S. web site.

After posting unimaginable returns in 2023 and 2024, Palantir (NASDAQ: PLTR) stochas had one other sturdy yr. It’s up 150% up to now in 2025, and knocking on the door of all-time highs once more.

Whereas buyers would possibly really feel like they’ve missed out on one of many largest winners of the substitute intelligence (AI) funding pattern, Palantir’s progress fee has been steadily rising, and there’s much more enterprise it could actually seize, which might result in a better inventory value.

We’ll get an replace from Palantir on Nov. 3 about its Q3 outcomes, which might ship shares hovering once more if it broadcasts progress that exceeds expectations. So, do you have to scoop up shares earlier than this announcement?

Palantir’s platform is seeing monster progress from business and authorities purchasers alike

Palantir began off as an AI knowledge analytics program for presidency use solely. These early contracts helped construct and form Palantir into the enterprise it’s at this time. Ultimately, the corporate figured on the market was a business use case for its product lineup as nicely, so Palantir expanded to seize that viewers, too. Each segments contributed to sturdy progress at instances, however every is rising quickly, because of the large AI buildout that’s ongoing.

In Q2, Palantir’s business income rose 47% yr over yr to US$451 million. Authorities income rose 49% yr over yr to US$553 million. So, not solely is Palantir’s authorities division nonetheless the biggest by income, it additionally has a barely sooner progress fee. Mixed, they delivered 48% progress to US$1 billion, permitting Palantir to surpass the US$1 billion quarterly income mark for the primary time.

Not like many rising software program firms, Palantir emphasised changing into worthwhile. Throughout Q2, Palantir’s revenue margin totaled 33%, a stage most software program firms goal.

That is clearly the signal of a rising and dominant enterprise, and it’s laborious to search out fault with any of Palantir’s outcomes. Administration has a robust observe file of outperforming expectations it lays out, so one other earnings beat appears possible on Nov. 3. A beat might ship the top off, making it a no brainer purchase at this time.

Nevertheless, progress isn’t all the pieces in an funding, and there’s one huge crimson flag that buyers can not ignore.

Palantir’s valuation is unbelievable

Even the very best firms purchased on the flawed value can change into horrible investments. Palantir has an extremely excessive valuation that few firms have ever reached, particularly with Palantir’s comparatively “sluggish” progress fee in contrast with firms which have reached these sky-high ranges.

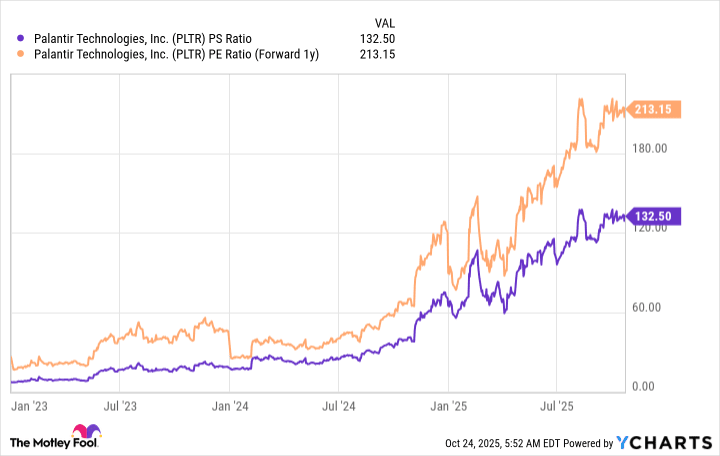

Palantir’s inventory trades for 132 instances gross sales and 213 instances 2026 earnings.

PLTR PS Ratio knowledge by YCharts

These valuation metrics are laborious to consider, particularly for an organization with Palantir’s progress charges. Corporations that obtain a 100 instances gross sales or larger valuation are uncommon, however while you discover them, they’re sometimes doubling or tripling their income yr over yr for a number of quarters.

Whereas Palantir’s income progress may be very sturdy, it’s nowhere close to the speed that a few of its friends that traded for 100 instances gross sales or extra have achieved. This makes the inventory extremely dangerous as a result of as quickly as progress reveals indicators of weak spot, the inventory value will come tumbling down. This hasn’t occurred but, so buyers have continued to drive up the inventory value of an unimaginable enterprise that has simply uncoupled from its inventory.

If I’m a Palantir shareholder, I’m taking among the monster features I’ve achieved and transferring that cash into a unique funding. Whereas Palantir will possible be a profitable firm and construct out its AI platform throughout authorities and business purchasers, there are a number of years’ value of progress already priced into Palantir’s inventory. This considerations me, I believe and buyers ought to steer clear of this one till after Q3 outcomes are launched; then we’ll see how the expansion fee is doing and make one other evaluation.