The Dogecoin multi-year restoration pattern is underneath stress as worth slips beneath a key ascending assist and rests on an historic horizontal degree, based on a brand new chart from dealer and analyst Rekt Capital.

Dogecoin Is Inches Away From A Bear Market

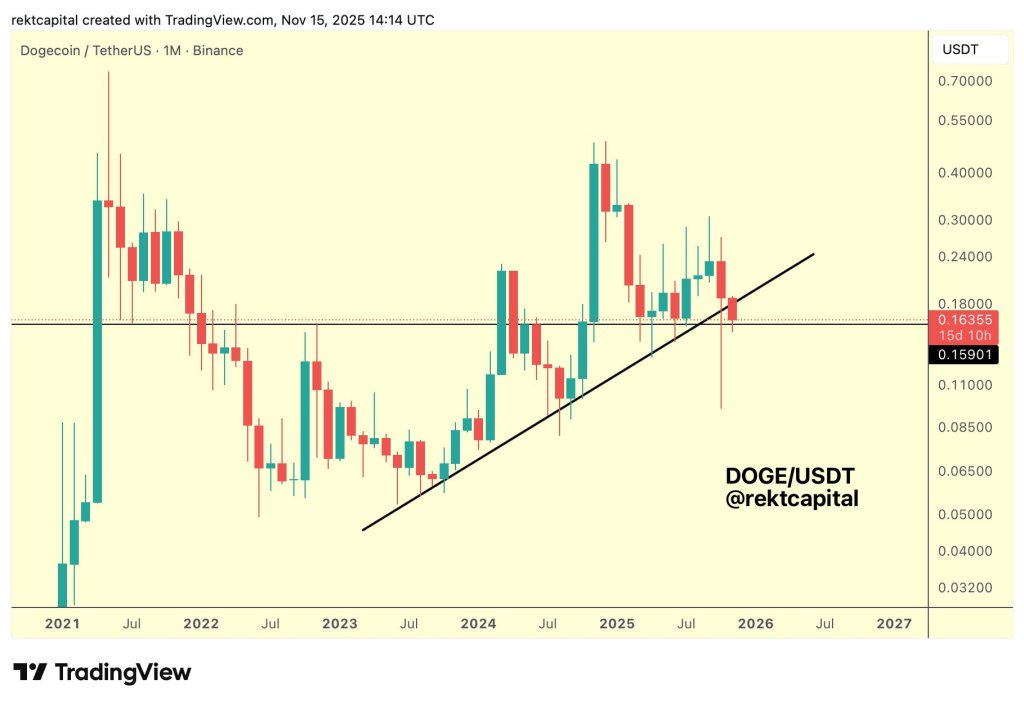

In an X put up, Rekt Capital shared a 1-month DOGE/USDT chart from Binance, created on TradingView on Nov. 15, and warned: “Dogecoin wants to guard its multi-year technical uptrend heading into December to maintain probabilities for macro upside alive.”

The chart tracks Dogecoin from the 2021 blow-off prime by way of the 2022–2023 bear market and the next restoration. A rising trendline, constructed from the bear-market lows, at the moment runs slightly below the $0.18 area and has outlined what Rekt Capital calls DOGE’s “multi-year technical uptrend.”

The most recent month-to-month candle, nevertheless, reveals Dogecoin buying and selling round $0.16355, beneath that trendline and pressed in opposition to a horizontal assist degree close to $0.159. That horizontal space isn’t arbitrary. On the month-to-month timeframe it has repeatedly flipped position between resistance and assist over the past two years.

Associated Studying

From Could to October 2024, the ~$0.159–0.16 band acted as a ceiling, repeatedly rejecting upside makes an attempt. The eventual breakout above this degree in October 2024 preceded an explosive transfer: Dogecoin’s worth practically tripled from roughly $0.16 to a December excessive of $0.4843.

In 2025, the identical zone then grew to become essential assist. Between March and July, month-to-month candles confirmed draw back wicks piercing beneath intramonth, however closes repeatedly held above the extent, confirming it as a significant structural flooring.

What To Watch Now

That historical past is what makes the present retest so important. With roughly half the month remaining, the purple November candle has already misplaced the rising trendline close to $0.18 and is now relying on the long-standing $0.159–0.16 horizontal space to arrest additional draw back. On a month-to-month chart, what issues isn’t just the intramonth tour however the place the candle closes.

Associated Studying

If DOGE can reclaim and shut again above the trendline, the sample of upper lows that has outlined the multi-year uptrend would stay largely intact. A month-to-month shut decisively beneath the horizontal degree, against this, would imply each the ascending assist and this traditionally pivotal worth flooring have failed, materially weakening the macro bullish construction.

For now, Dogecoin sits precisely on that line within the sand. As Rekt Capital put it, DOGE “wants to guard its multi-year technical uptrend heading into December” whether it is to keep away from sliding again towards a bear-market profile.

At press time, DOGE traded at $0.1626.

Featured picture created with DALL.E, chart from TradingView.com