Nasdaq CEO Adena Friedman sees blockchain reshaping the standard monetary system in three key methods: by overhauling post-trade infrastructure, unlocking trapped capital via higher collateral mobility and enabling sooner, extra seamless funds.

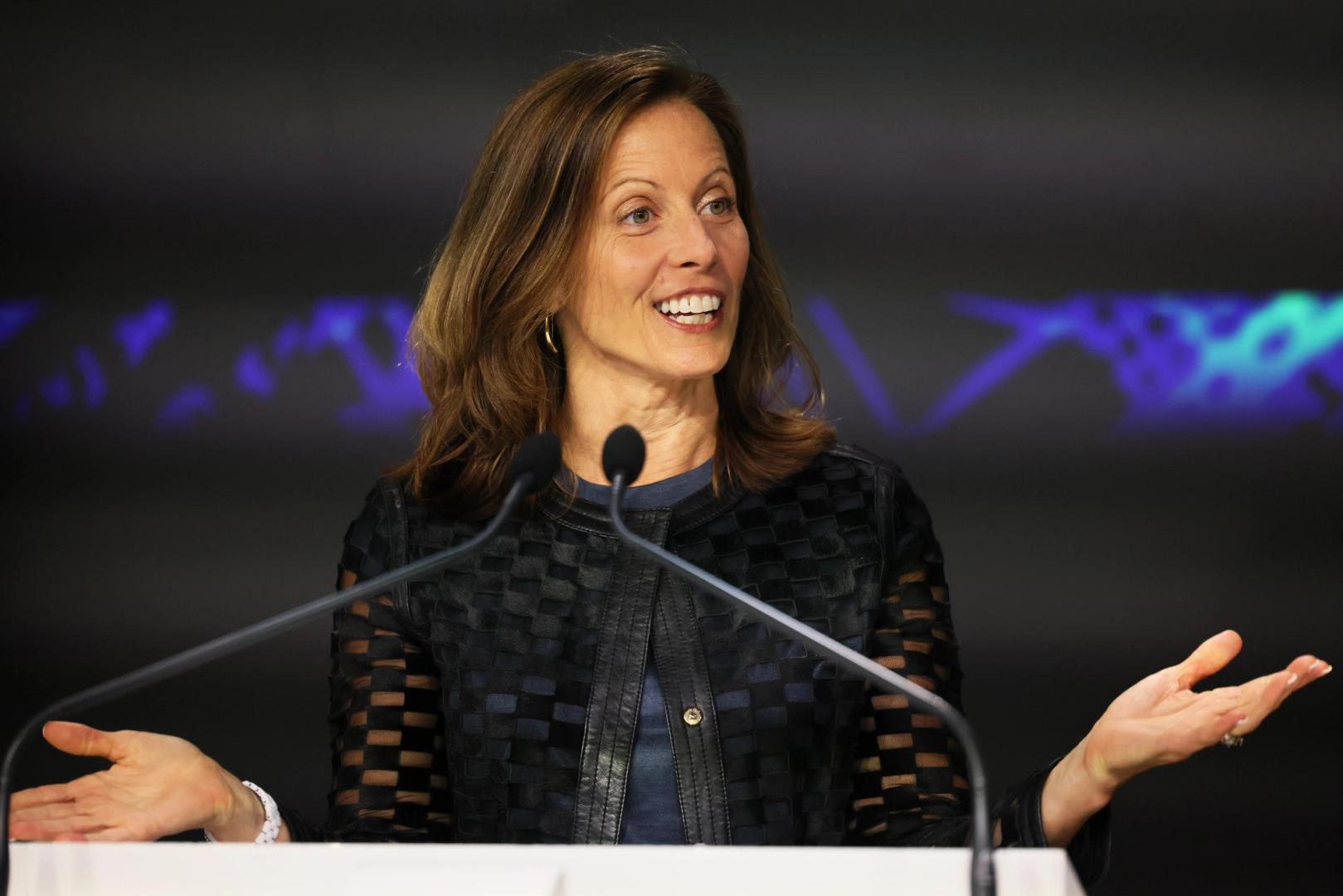

“There’s simply a lot capital trapped, whether or not it’s in clearinghouses or clearing brokers,” Friedman stated throughout a dialogue with Ripple President Monica Lengthy on the Swell convention in New York on Tuesday. “If we do it proper, we will truly make that a possibility to ship extra capital to the system.”

Put up-trade processes — the methods that finalize and settle securities transactions — stay deeply fragmented and infrequently depend on decades-old infrastructure. Friedman famous that whereas some complexity is intentional, typically for causes like danger administration or allocation monitoring, a lot of the friction is pointless. She believes blockchain may assist unify and streamline these workflows, chopping down on inefficiencies that tie up capital and decelerate monetary exercise.

The second main alternative lies in enhancing how monetary establishments transfer and handle collateral — the property pledged in buying and selling and lending transactions to mitigate danger. In accordance with Friedman, digital property may make it simpler to switch collateral rapidly throughout platforms and borders. “What we actually love in regards to the thought of digital property is having the ability to transfer that collateral,” she stated. “We are able to create a collateral mobility effort and … free a whole lot of capital.”

Funds are the third space ripe for change. Whereas Nasdaq would not function within the funds sector, Friedman emphasised that smoother, extra environment friendly fee methods are key to permitting traders to take part in international markets with out friction.

She described immediately’s fee infrastructure as a bottleneck, slowing down the circulation of capital. If these methods might be improved or rebuilt utilizing blockchain, she stated, it may unlock important quantities of capital presently tied up in outdated processes. That, in flip, would assist traders transfer funds extra simply throughout platforms, borders and asset courses — making the monetary system extra open and environment friendly.

Nasdaq has already begun laying groundwork. The change operator not too long ago filed with the U.S. Securities and Change Fee to assist buying and selling of tokenized securities. Below the proposed framework, an investor may flag a commerce for tokenized settlement, and the post-trade system — together with clearinghouse DTCC — would route it accordingly, permitting for supply right into a digital pockets. This strategy, Friedman stated, maintains the core construction of present securities whereas providing traders larger flexibility.

She was fast to level out that the objective is not to switch or fragment U.S. fairness markets, which she described as “extraordinarily resilient” and “extremely liquid,” however to boost them by layering in know-how that reduces friction and improves investor alternative.

Tokenized markets might start in post-trade features, she stated, however may ultimately reshape how securities are issued and traded. “Let’s hold all these nice issues [about the U.S. markets], after which let’s put the know-how in the place we will truly cut back friction.”