Over the subsequent few years, dozens of nations will likely be rolling out mandates for e-invoicing and steady transaction controls (CTCs) as a part of a world development towards the whole digitalization of tax reporting and remittance. Multinational firms (MNCs) should be ready when these regulatory modifications go into impact, however the path to compliance isn’t precisely straight—the truth is, it’s extra like a complicated zig-zag of presidency laws, technical specs, unsure timelines, and lack of communication.

Worldwide tax managers and their departments are the personnel most immediately affected by these digital tax initiatives. To assist them perceive the evolving worldwide panorama for e-invoicing/CTC mandates, Thomson Reuters just lately carried out a webinar outlining a number of methods MNCs can use to arrange for any mandates they could encounter within the months and years forward.

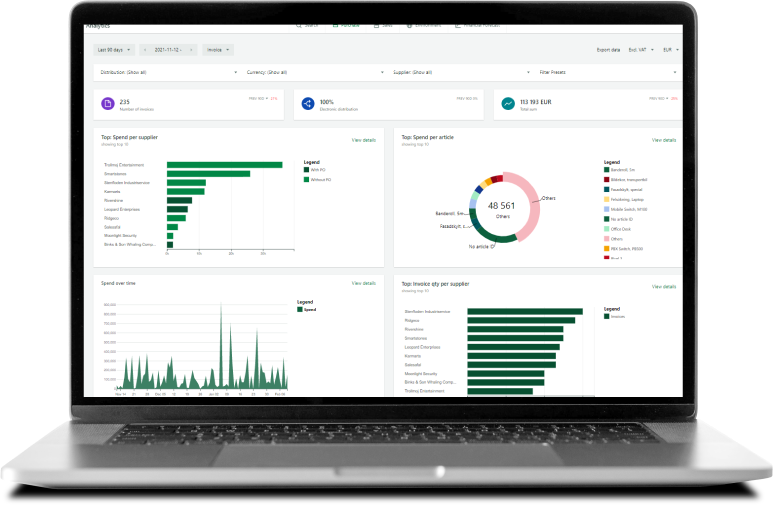

Illustrative instance of e-invoicing mandate challenges

For example a few of the hurdles firms are quickly prone to face in the event that they haven’t already, Pagero’s director of gross sales, Brad Colie, begins the webinar by introducing listeners to a hypothetical character named Stephen, who represents a tax division that’s within the midst of its digital transformation however nonetheless unprepared for the difficulties that lay forward within the type of e-invoice/CTC mandates.

General, Stephen and his crew are proud of the work they’ve finished to get their information flowing seamlessly by way of the corporate’s ERP and prolonged enterprise ecosystem. However then Stephen begins getting calls from colleagues in Poland, France, Spain, Australia, Japan, and elsewhere, asking him: how may e-invoicing/CTC mandates impression our operations?

Stephen doesn’t know, precisely, and when he begins investigating, he discovers not all international locations which can be initiating e-invoicing are coupling it with CTC, which provides real-time tax reporting to the combo. Moreover, many international locations are phasing of their necessities, for instance, beginning with the most important firms right down to the smallest.

What’s a tax director to do?

After a lot frustration, Stephen realizes that he must know extra to work proactively together with his firm and crew to arrange for these upcoming mandates.

“There’s no normal with the federal government authorities and what they’re requiring and mandating,” explains Jesse Shannon, Senior Product Supervisor for oblique tax at Thomson Reuters. Shannon says the query many firms are asking is: “How, as a multinational, can we method all of those international locations globally? Can we centralize tax with our headquarters workplace, or can we take a extra regional, country-by-country method?”

As Pagero’s Brad Colie explains, utilizing a country-by-country, or “point-to-point” method, firms should construct a separate integration module to adjust to every authorities tax authority’s particular person specs.

The benefit of the point-to-point method, Colie says, is that firms are “extracting information in precisely the format the federal government asks for.” The draw back, he says, is that these integrations are time-consuming, costly, and could be tough to handle if a tax crew is coping with multiple or two international locations, and inevitable modifications to every nation’s guidelines and specs solely add to the burden.

“A variety of these governments, they go reside with e-invoicing understanding that there will likely be modifications inside 12,18, or 24 months,” Colie says—and in a point-to-point method, because of this a tax crew should “return to the drafting board each time they alter their system or the federal government modifications their necessities.”

An alternative choice, says Colie, is a “community” resolution that employs a third-party service supplier to handle invoices and join an organization’s monetary programs to the programs of the host authorities. If an organization employs a special service supplier in every nation, nonetheless, tax groups should handle these relationships and settle for that third-party suppliers have “restricted capabilities to counterpoint and validate the information . . . all of which suggests extra upkeep and work.”

_____________________________________________________________________________________________

REGISTER NOW to the webinar, and be taught extra about upcoming e-invoicing / CTC mandates and the way to handle them

_____________________________________________________________________________________________

A ”common” resolution to e-invoicing mandates

A 3rd, higher possibility, says Colie, is a “common” community resolution that funnels transaction information by way of a centralized platform after which converts it to satisfy the specs of every authorities’s tax authority. This method “creates a really scalable resolution and reduces loads of the prices” related to different, extra piecemeal options, Colie explains; it’s additionally preferrred for firms that need to handle e-invoicing inside their current automation technique.

“Organizations are on the lookout for a cloud-based resolution that makes it simpler to deploy and simplify administration of the information and necessities for international locations world wide,” says Shannon. MNCs are additionally on the lookout for an answer that makes compliance simpler and extra dependable, he says.

Pagero and Thomson Reuters have partnered to create simply such an answer – a common e-invoicing module that works inside the Thomson Reuters ONESOURCE tax platform. Along with supporting the trade of digital paperwork between companies, governments, and clients, the Thomson Reuters/Pagero resolution additionally helps firms handle any modifications a authorities might make to the system, community, or information specs they require.

Regarding upcoming e-invoice/CTC mandates, “Compliance is an obligation that organizations and tax departments should get proper on day one,” Shannon emphasizes. “By having a common resolution for the oblique tax life cycle—from tax calculations to compliance reporting and e-invoicing—now they’ll get it proper.”

Adjust to world e-invoicing mandates by leveraging a totally built-in digital bill compliance resolution