October is a busy month for the inventory market, as a result of it’s when firms begin reporting their working outcomes for the quarter ended Sept. 30. As has been the case for the previous couple of years, Wall Road might be laser-focused on the tech giants powering the substitute intelligence (AI) revolution, as a result of they usually ship the quickest income and earnings progress.

Meta Platforms (NASDAQ: META) is a type of firms. It’s scheduled to launch its third-quarter outcomes on Oct. 29, and administration’s steerage factors to an extra acceleration in its income progress, thanks largely to AI. The upcoming report could possibly be a really optimistic catalyst for Meta inventory, so right here’s why traders may wish to listen.

Search for accelerating income progress

Greater than 3.4 billion folks use at the least one among Meta’s social media apps each single day, which embody Fb, Instagram, and WhatsApp. Contemplating that’s almost half the inhabitants of your entire planet, discovering new customers is getting more durable and more durable, which is why the corporate is targeted on boosting engagement as an alternative.

Merely put, the longer every person spends on Meta’s apps, the extra advertisements they see, and the more cash the corporate makes. AI is a large a part of that technique; Meta makes use of the expertise in its algorithms to study what content material every person likes to see, so it will possibly present them extra of it. Through the second quarter of 2025 (ended June 30), this drove a 6% enhance within the period of time customers spent on Instagram in comparison with the year-ago interval, and a 5% enhance for Fb.

Meta adopted the same technique for its ad-recommendation engine to focus on customers extra precisely on behalf of companies. Throughout Q2, this led to a 5% enhance in conversions on Instagram, and a 3% enhance on Fb. This usually means Meta can cost more cash per advert as a result of companies are yielding a better return on their advertising spend.

The social media large generated $47.5 billion in whole income in the course of the quarter, which was a 22% enhance from the year-ago interval. That marked an acceleration from the primary quarter when income jumped by 16%. Administration’s steerage suggests the corporate delivered as a lot as US$50.5 billion in income in the course of the third quarter, which might signify even sooner progress of 24%.

That will be a really bullish outcome for Meta inventory on Oct. 29.

Right here’s an much more vital quantity to look at

Meta’s AI technique additionally includes creating new options, like its Meta AI chatbot which might reply advanced questions, generate photographs, and even be part of your group chat to settle debates. It solely launched in late 2023, but it already has nearly a billion month-to-month lively customers.

Meta AI is powered by Meta’s Llama household of enormous language fashions, that are bettering so quickly that they already rival a number of the greatest fashions from main start-ups like OpenAI and Anthropic, despite the fact that these firms had a multiyear head begin on growth. However to ensure that the Llama fashions to proceed bettering, Meta has to speculate closely in knowledge middle infrastructure and chips to unlock the required computing energy.

The corporate got here into 2025 anticipating to allocate someplace between US$60 billion and US$65 billion to capital expenditures (capex) for the yr, but it surely has since revised these numbers to US$66 billion and US$72 billion. Meta would solely spend that type of cash on AI infrastructure if it anticipated a optimistic monetary return, and the indicators are already there contemplating the corporate’s rising engagement, increased advert conversions, and accelerating income progress.

An additional upward revision to Meta’s 2025 capex forecast on Oct. 29 would in all probability be bullish for its inventory, as a result of it is perhaps a sign that administration expects an excellent larger payoff than initially anticipated.

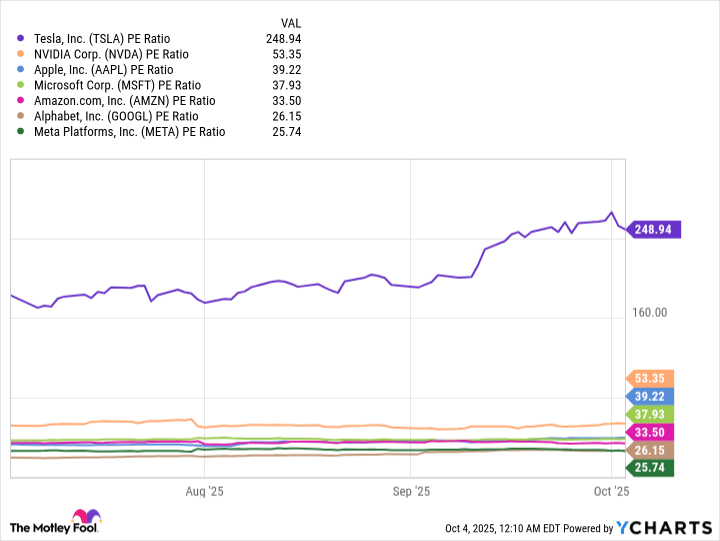

Meta shares are buying and selling at a price-to-earnings (P/E) ratio of 25.7 as I write this, making it the most cost effective inventory within the “Magnificent Seven,” which is the group of tech titans driving the AI revolution ahead.

PE Ratio knowledge by YCharts

Personally, I feel Meta deserves a a lot increased valuation contemplating it grew its earnings per share by a whopping 38% within the second quarter, outpacing the earnings progress of each different Magnificent Seven firm besides Nvidia.

Usually, traders pays a premium for a corporation that’s rising rapidly, so there is perhaps some upside on the desk for Meta inventory via a number of growth alone. If the corporate’s third-quarter outcomes match or exceed the excessive finish of administration’s steerage on Oct. 29, that could possibly be the spark that ignites a robust rally for the inventory into the tip of the yr.