Meta Cipher B: The All-in-One Oscillator Suite for MT5

Estimated studying time: 5–10 minutes

TL;DR: Meta Cipher B brings professional-grade momentum evaluation to MetaTrader 5, combining 5 highly effective algorithms into one complete oscillator.

If you happen to’ve used or seen Market Cipher on TradingView and wished for one thing prefer it on MT5, your wait’s over.

The Drawback Each MT5 Dealer Faces

Let’s be sincere: we have all been there. You open your MT5 chart with good intentions, prepared to overcome the markets. You load up your RSI. Add some stochastic. Possibly throw in a MACD for good measure.

Earlier than you understand it, your display appears like a Christmas tree had an accident with a rainbow manufacturing facility.

“When your technique appears extra like summary artwork than evaluation.”

The difficulty is not that these indicators do not work, they do.

The issue is data overload. If you’re attempting to synthesize alerts from 5 completely different home windows, by the point you’ve got decided, the chance has sailed previous you quicker than a scalper on 100x leverage.

What if I advised you there’s a greater means? A solution to get all that momentum evaluation, cash circulation perception, and reversal detection in one clear, built-in oscillator panel?

Enter Meta Cipher B.

What’s Meta Cipher B?

Meta Cipher B is a customized indicator for MetaTrader 5 that condenses 5 subtle algorithms right into a single, visually intuitive oscillator.

Consider it because the Swiss Military knife of momentum indicators. As a substitute of a tiny scissors and a toothpick, you get:

- Cash Stream Evaluation (the inexperienced/crimson areas that let you know the place the good cash goes)

- Twin Momentum Waves (the blue waves that spot divergences earlier than they’re apparent)

- VWAP Oscillator (the yellow wave that cuts by way of noise)

- RSI + Stochastic RSI (working collectively to establish extremes)

- Inexperienced and Purple Dot Indicators (your “okay, NOW is the time” moments)

Meta Cipher B – The 5 Core Parts

All of those function collectively in a fantastically synchronized vary from -100 to 100, designed to provide you confluence at a look.

When a number of alerts align? That is when the magic occurs.

Breaking Down the Parts (With out Breaking Your Mind)

Let’s dive into what makes Meta Cipher B tick. Don’t be concerned, I will preserve the mathematics to a minimal and the actionable insights to a most.

1. The Cash Stream Wave: Your Market’s Temper Ring

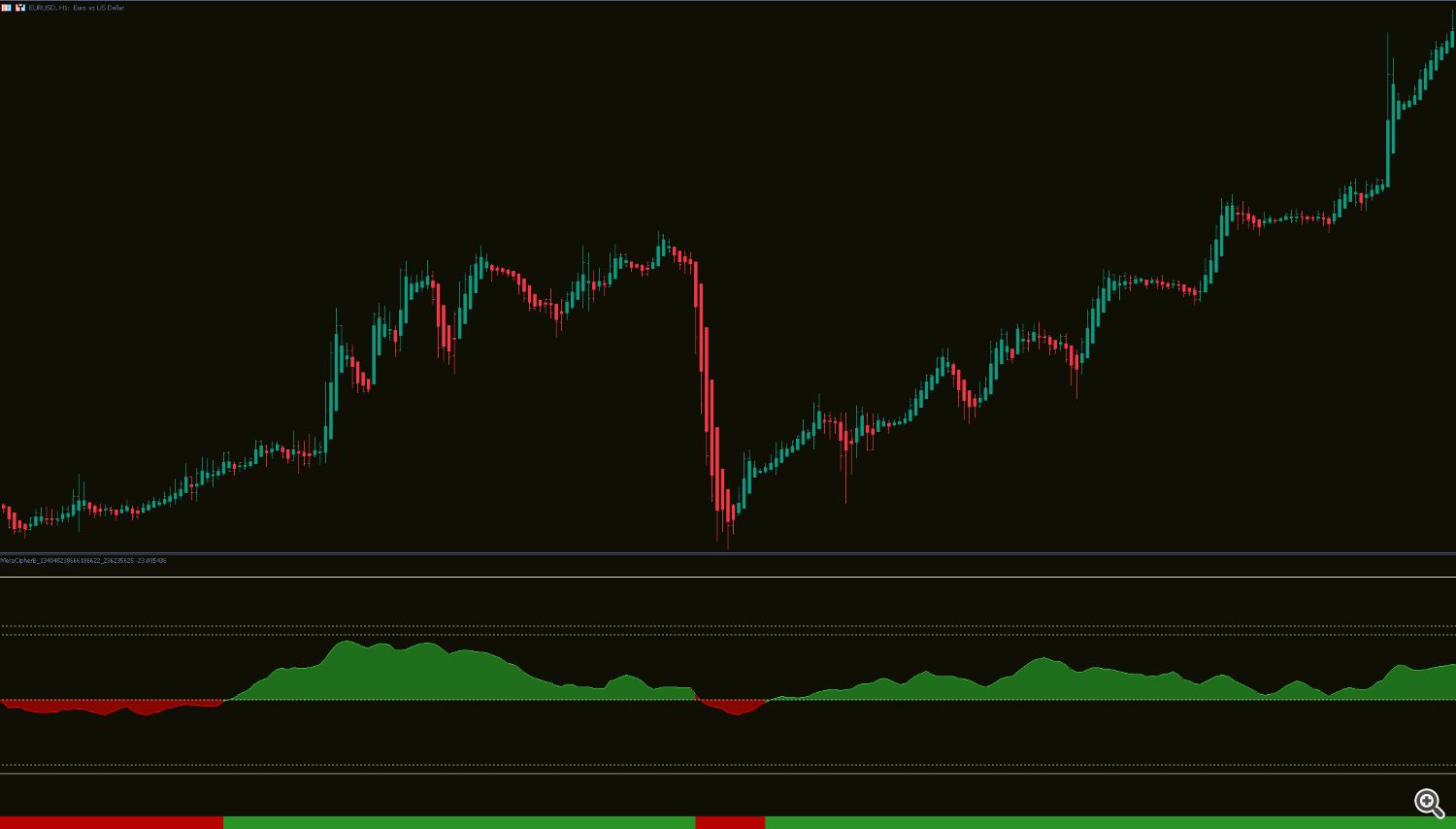

The Cash Stream Index (MFI) is displayed as that attractive inexperienced and crimson stuffed space you see on the base of the oscillator. However here is what makes it particular: in contrast to pure price-based indicators, MFI incorporates quantity. It is actually monitoring how a lot cash is flowing in versus flowing out.

The Buying and selling Philosophy:

- When the circulation is thick and inexperienced: Consider it like a rising plant, worth total needs to go up. Your technique? Purchase the dips. When inexperienced, resistance tends to interrupt simply.

- When the circulation is crimson: Value needs to go down. Your technique? Quick the peaks. When crimson, assist tends to fail.

- When the circulation is skinny (or uneven): Step away from the keyboard. Seize a espresso. This isn’t the time to commerce.

Professional tip: All the time begin your morning routine by checking cash circulation on larger timeframes (Buying and selling the 1min? Test the 15min. Buying and selling the 1H? Test the 4H or Every day). This tells you the atmosphere.

Are we in accumulation or distribution? As soon as you understand the climate forecast, you’ll be able to gown appropriately to your trades.

Meta Cipher B – Cash Stream Overview

2. The Momentum Waves: The place Divergences Come to Celebration

These lovely blue waves (mild blue and darkish blue overlapping) are the center of Meta Cipher B’s predictive energy.

They can be utilized to visualise market momentum, the push and pull between patrons and sellers, in a transparent, cyclical type.

They oscillate between –100 and +100, highlighting key zones:

- Under -60: Lengthy territory (oversold) – momentum is bottoming out, suggesting patrons could quickly regain management.

- Above +60: Quick territory (overbought) – momentum is peaking, signalling that sellers might step in.

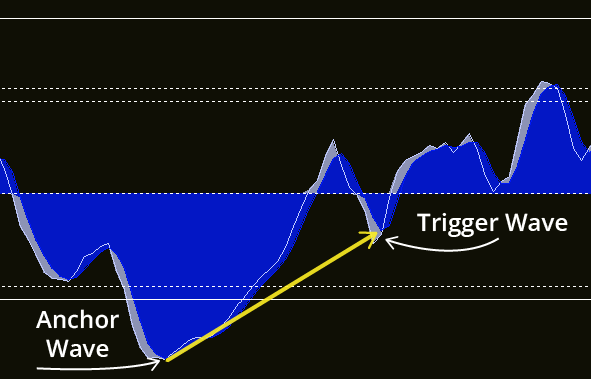

If you see a massive, dominant wave type, that is your anchor wave, it units the tone for the transfer.

The smaller waves that observe are your set off waves, reacting to new bursts of momentum inside that very same pattern.

The connection between these waves usually reveals divergences: moments when worth strikes a method, however momentum quietly hints at a reversal.

Meta Cipher B – The Momentum Waves

3. The VWAP Wave: The Momentum Rubber Band

That yellow oscillating line chopping by way of the center? That is your Quantity-Weighted Common Value (VWAP) indicator, however turbocharged for oscillator use.

The Rule is Easy:

- Yellow beneath zero and rising? Bullish momentum. Bears are operating out of steam. Time to begin planing your longs.

- Yellow above zero and falling? Bearish momentum. Bulls are stepping apart. Could possibly be time to take earnings and even search for shorts.

- Yellow crossing the zero line? That is your main timing sign. Many merchants use this cross as their set off, particularly when it aligns with cash circulation and momentum.

The Imply Reversion Play: If the yellow wave is much above or far beneath zero, it has to snap again ultimately. The additional the stretch, the stronger the rubber band impact. Use this to your benefit, do not chase extremes, anticipate the reversion.

Meta Cipher B – VWAP Crosses (Watch how these crosses lead the pattern reversal)

4. The RSI Duo for Recognizing Overbought/Oversold

Meta Cipher B options two RSI-based strains working in concord:

- Purple line: Your conventional, smoothed RSI (0-100 vary). When above 80, it signifies that the market is overbought, when beneath 20, oversold.

- Inexperienced/Purple line: Your Stochastic RSI (color-coded for immediate recognition)

Here is the genius half: as a substitute of watching two strains crossing, the Stochastic RSI adjustments colour primarily based on place:

- Inexperienced when beneath the RSI line -> Bullish momentum constructing.

- Purple when above the RSI line -> Bearish momentum taking up.

The Squeeze Indicator: Watch the house between the purple line and the inexperienced/crimson line. The smaller this hole, the steeper the pattern. A decent squeeze with each rising? Buckle up for a robust transfer.

Meta Cipher B – The RSI Duo

5. Inexperienced and Purple Dots: In Case You Blinked

These little dots on the oscillator aren’t magic entry alerts, they’re consideration markers. Consider them as alerts out of your chart saying, “Hey, one thing’s occurring right here.”

- Inexperienced dot beneath the waves: Momentum (mild blue) crosses above from a low level. It usually marks a shift towards energy, not essentially a purchase.

- Purple dot above the waves: Momentum (mild blue) crosses beneath from a excessive level. It hints at weakening momentum, not an automated brief.

Context nonetheless guidelines the sport:

A inexperienced dot with cash circulation heading up and VWAP crossing? That is a high-confluence setup value consideration.

A inexperienced dot with cash circulation heading down and oversold RSI? That is a maybe-kinda-sorta-we’ll-see state of affairs. Context is king.

The dots are weighted closely within the momentum algorithm and might set off alerts, so you will by no means miss a possible setup. However please, for the love of worthwhile buying and selling, do not chase each dot. Watch for confluence.

Meta Cipher B – The Dots!

From Idea to Commerce

Now that you understand the elements, let’s put them to work.

There are a number of methods to commerce with Meta Cipher B. I will break down one among my favorite approaches right here, and canopy others in future posts.

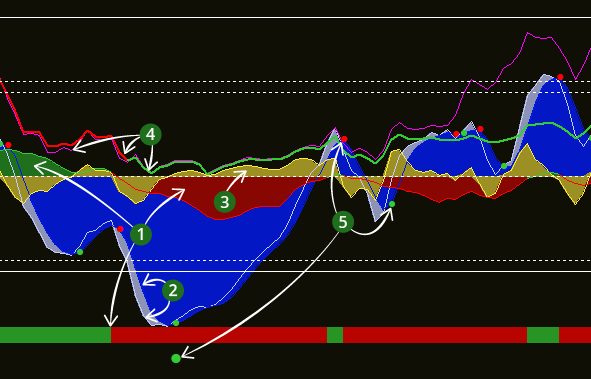

The Blue Wave Technique (Excellent for newcomers):

- Spot a giant blue wave that dips beneath -60 or shoots above +60. That is your anchor wave

- Watch for a second, smaller wave in the identical route. That is your set off wave

- Look ahead to the pinch the place the sunshine blue cuts by way of the darkish blue

- Increase, you’ve got noticed a divergence (worth makes a brand new low, however momentum makes the next low = bullish divergence)

Exit technique:

Wait for one more pinch on the other aspect (ideally utilizing different alerts to filter out weak waves). If you happen to went lengthy when the waves pinched beneath zero, exit once they pinch above zero. Easy, elegant, efficient.

After all, you’ll be able to apply your personal exit guidelines, whether or not it is a mounted take-profit, scaling out with partial exits, or utilizing the opposite Meta Cipher B alerts for affirmation. The hot button is to remain constant and let the information information your resolution.

Now, to actually see it in motion:

I will flip off the opposite indicators for a second so you’ll be able to visualise this sample clearly. However bear in mind, we nonetheless have all the opposite 4 alerts that construct on this one, including affirmation and depth to each setup.

Meta Cipher B – The Blue Waves Technique (Lengthy)

The great thing about this strategy? You are basically front-running the group. When worth makes that second low however momentum refuses to substantiate it, that is your sign that the promoting strain is exhausted. Time to go fishing for a backside (or prime)!

Talking of tops, the identical logic applies when shorting. I will use the identical instance, however be mindful we’re in an uptrend right here, and each different Meta Cipher B sign could be warning you to not go brief:

Meta Cipher B – The Blue Waves Technique (Shorting… in an uptrend?)

🧩 Placing It All Collectively

Now that you just’ve seen the Blue Wave Technique in isolation, let’s take a look at how the whole lot works collectively.

In actual buying and selling, you not often act on one sign alone, it is about confluence. When a number of elements of Meta Cipher B align, that is the place the sting comes from.

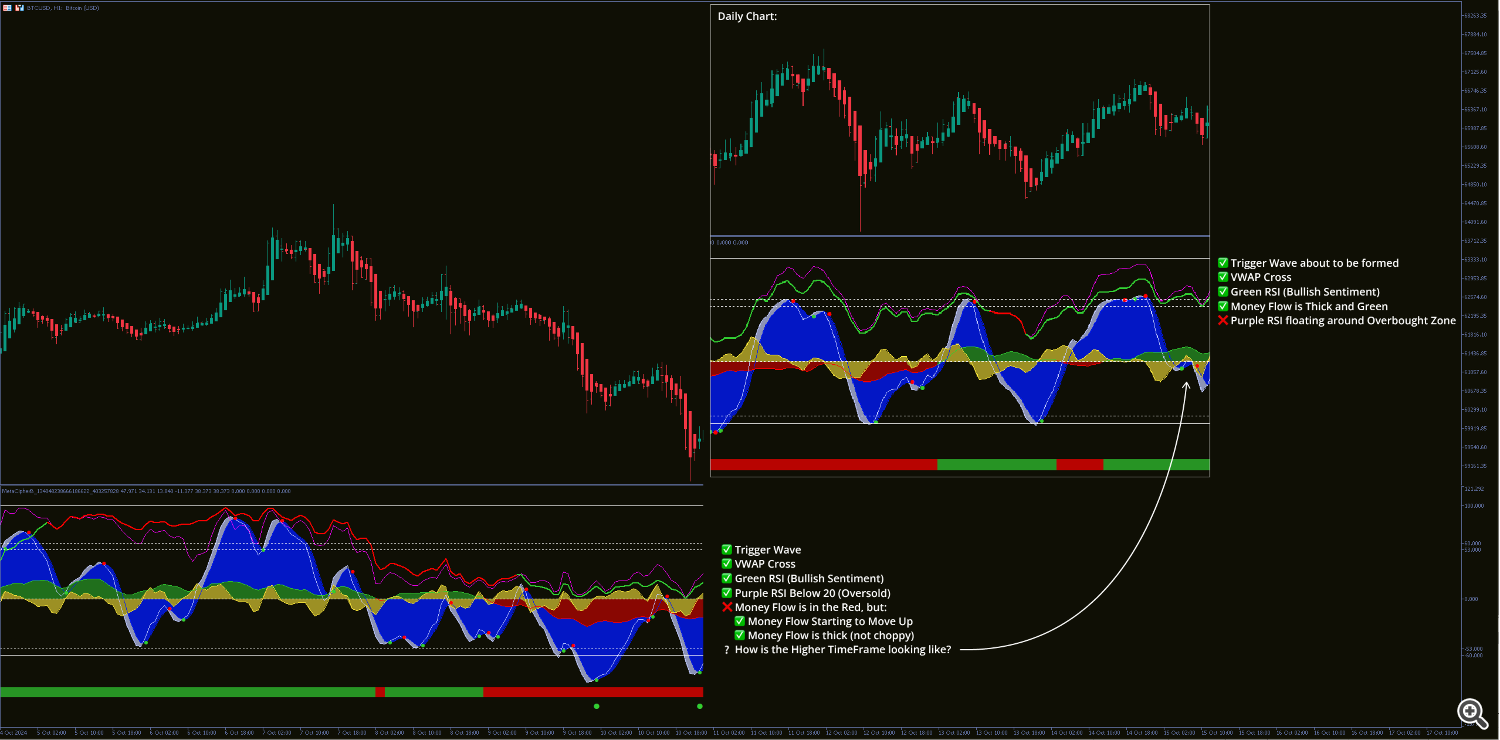

Under is a sensible instance, let’s take a look at the BTCUSD H1 chart:

Meta Cipher B – A Sensible Instance

As you’ll be able to see, we received a number of alerts aligning (not all of them, however that is okay).

Let us take a look at what performed out:

Meta Cipher B – A Sensible Instance: The Final result

As time went on, you’ll be able to see a number of set off waves forming, lots of them appearing as anchor waves as nicely. Every of those moments revealed potential entry alternatives.

I’ve additionally highlighted a couple of doable take-profit zones, although these rely in your private TP technique. Contemplating how robust and wholesome the cash circulation was throughout this transfer, a partial take-profit strategy would’ve allowed you to trip the whole pattern, proper as much as the purpose the place the cash circulation lastly began to curve downward.

💡 Professional Suggestions for Most Effectiveness

- The Morning Ritual: Begin each session by checking cash circulation on the each day chart. This tells you the market’s “temper” and guides your bias for the day.

- The Persistence Play: Do not simply leap on each inexperienced dot. Watch for at the very least two alerts to align.

- The Divergence Double-Test: If you spot a divergence on the momentum waves, verify it with the RSI strains.

- The Timeframe Stack: Preserve two charts open, your buying and selling timeframe and one larger. Keep away from buying and selling (or at the very least commerce with extra warning) when they aren’t absolutely aligned.

- Why that is necessary: Even an ideal 15-minute setup will get steamrolled if the 4-hour pattern is bearish. By confirming with larger timeframes, you are basically checking that you just’re swimming with the present, not in opposition to it. Your win charge will thanks.

Key Takeaways:

What Meta Cipher B Can and Cannot Do

Let’s set expectations straight.

What it CAN do:

- Provide you with multi-layered confluence evaluation in a single clear window

- Assist you to establish high-probability entries and exits

- Spot divergences that are not apparent from worth motion alone

- Prevent from indicator overload

- Work on any timeframe from M1 to MN1

- Warn you to alternatives mechanically

What it CAN’T do:

- Print cash

- Assure successful trades (nothing can, regardless of what the web says)

- Substitute threat administration and place sizing self-discipline

- Work nicely if you ignore confluence and chase each sign

- Make you a worthwhile dealer in a single day (this takes follow)

All the time bear in mind: Meta Cipher B is a software (a really subtle, well-designed software) however nonetheless only a software.

Your job is to grasp it, follow with it, and combine it into an entire buying and selling plan. Demo commerce with it first. Backtest your methods. Construct confidence earlier than risking actual capital.

Does This Indicator Look Acquainted?

You’ll have come throughout Market Cipher B, a massively widespread paid indicator for TradingView that is been round for years.

Meta Cipher B brings that very same highly effective ideas to MetaTrader 5, optimised for velocity, precision, and easy efficiency.

Constructed totally from the bottom up, it delivers professional-grade alerts with out lag or sluggish scrolling, even on decrease timeframes.

What devices and timeframes does this work on?

The brief reply: just about something that is tradable.

Meta Cipher B is engineered to adapt to Foreign exchange, Shares, Indices, Commodities, and Crypto. Principally, in case your dealer can chart it in MT5, Meta Cipher B can analyse it.

Timeframe-wise, the logic scales seamlessly:

-

Decrease timeframes (1-5 min): Preferrred for scalpers searching for fast momentum shifts.

-

Mid-range (15 min – 1 hour): Nice for intraday merchants who need construction with out noise.

-

Greater timeframes (4 hour – Every day +): Excellent for swing merchants and long-term pattern evaluation.

The underlying calculations modify dynamically, so whether or not you are monitoring EUR/USD, Apple, or BTCUSD, you will get constant, context-aware alerts.

Meta Cipher B vs. Different Indicators

In comparison with utilizing separate RSI + Stochastic + MFI + VWAP indicators:

- Cleaner chart (one oscillator window vs. 4)

- Built-in alerts that think about all components

- Higher visible illustration with color-coding

- Optimized calculations that work collectively

In comparison with easy transferring common programs:

- Extra main alerts (divergences predict turns)

- Higher fitted to all market situations (trending and ranging)

- Multi-dimensional evaluation vs. one-dimensional

In comparison with Market Cipher B on TradingView:

- Works natively in MetaTrader 5 (no switching platforms)

- Integrates with MT5’s alert and automation ecosystem

- Can be utilized with Knowledgeable Advisors for automation

💡 Trace: The unique Market Cipher has been round for over a decade, which suggests there is a big quantity of content material on the market: tutorials, examples, and commerce breakdowns throughout YouTube and boards. Use that collective data to your benefit. The core ideas apply simply as nicely right here.

Wrapping Up

Meta Cipher B is not simply one other indicator so as to add to your assortment. It is a full momentum evaluation system that replaces half a dozen different instruments and does it extra elegantly.

Whether or not you are a scalper searching for fast entries on the 5-minute chart, a swing dealer attempting to find multi-day setups, or wherever in between, Meta Cipher B adapts to your fashion. The core ideas stay the identical throughout all timeframes: search for confluence, respect the cash circulation, and let the momentum waves information you to divergences.

If you happen to’re uninterested in cluttered charts, conflicting alerts, and second-guessing your self, Meta Cipher B brings readability to the chaos. It is like having an expert analyst in your display, quietly declaring when situations align.

No, it is not magic, and it’s definitely not a crystal ball. However when understood and used correctly, it is a highly effective decision-support software that may sharpen your evaluation and enhance the standard of your trades.

Past Meta Cipher B

Whereas Meta Cipher B stands robust by itself, it is also designed to pair naturally with Meta Cipher A, providing full market context and deeper affirmation when used collectively.

Each are a part of the Meta Cipher suite for MetaTrader 5, bringing skilled, TradingView-style evaluation natively to MT5.

Keep tuned for upcoming posts the place I’ll dive into extra methods and discover the remainder of the suite: together with Meta Cipher A (for pattern evaluation) and extra instruments designed to finish your buying and selling framework.

💬 Have questions or insights?

Drop a remark beneath or attain out through the MQL5 market, the buying and selling group thrives on shared expertise.

You may also be part of the Meta Cipher Buying and selling Group, the place merchants share setups, focus on methods, and discover how one can mix the complete Meta Cipher suite for optimum confluence.

⚠️ Threat reminder:

No indicator replaces correct threat administration. All the time use cease losses, by no means threat greater than you’ll be able to afford to lose, and dimension your positions responsibly. Meta Cipher B helps you discover alternatives, managing the chance remains to be your job.