As Bitcoin breached the $52,000 mark, a notable shift in investor sentiment has been noticed, with an elevated curiosity in name choices for Bitcoin at ‘bold’ strike costs. This pattern, primarily specializing in strikes above $60,000, alerts a ‘strong’ confidence amongst merchants in Bitcoin’s potential for additional good points.

QCP Capital, a famend crypto asset buying and selling agency, defined this phenomenon in its newest report, emphasizing the concentrated shopping for exercise in these high-strike name choices with varied expiry dates.

A Surge In Excessive-Strike Name Choices

Name choices are monetary contracts that give the customer the best, however not the duty, to purchase an asset at a predetermined value inside a specified timeframe.

Within the context of Bitcoin, this surge in name choice shopping for at greater strike costs suggests a bullish outlook from traders, betting on Bitcoin’s value to climb considerably greater than its present ranges.

This optimism isn’t just a speculative bubble however is backed by substantial monetary commitments, with QCP Capital highlighting near “$10 million spent on premiums for $60,000 and $80,000” strike choices alone.

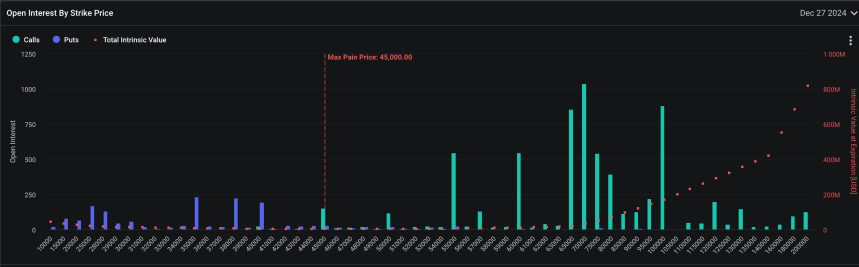

In keeping with the detailed evaluation by QCP Capital, there’s been a vital uptick within the buy of Bitcoin name choices, with strike costs towering above $60,000. This exercise is unfold from April to December expiries, indicating a long-term bullish sentiment amongst traders.

Deribit, the main crypto derivatives alternate, corroborates this pattern, reporting a considerable focus of open name choices at $65,000 and better.

The December expiry name choice cluster targets a $100,000 strike value, showcasing some merchants’ ultra-bullish expectations for Bitcoin’s year-end valuation.

The tip of March sees the most important quantity of Bitcoin choices calls at a $60,000 strike, revealing the immediacy of some merchants’ bullish outlooks. With over 1,273 contracts set for the March 29 expiry, the notional worth of those bets exceeds $67 million, highlighting the numerous capital being positioned on these optimistic market predictions.

Bitcoin Market Sentiment And Predictions

This enthusiastic choices buying and selling exercise happens amid bullish Bitcoin value forecasts. Matt Dines, Chief Funding Officer at Construct Asset Administration, identifies a ‘Cup and Deal with’ sample on the Bitcoin value chart, suggesting a possible rally to $75,000.

Cup and deal with #Bitcoin #sendit pic.twitter.com/DmYAVwmLfj

— Matt Dines (@BuildCIO) February 13, 2024

Equally, QCP Capital analysts see Bitcoin reaching new all-time highs, projecting a major surge earlier than the top of March 2024.

This collective optimism can be mirrored within the Ethereum market, the place there’s a notable accumulation of name choices across the $4,000 strike value for mid-year expiries, indicating a broader optimistic sentiment throughout main cryptocurrencies.

In the meantime, Bitcoin continues to make vital strikes, crossing the $52,000 threshold with a virtually 20% enhance prior to now week, indicating that the market’s bullish sentiment is palpable.

Featured picture from Unsplash, Chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site solely at your personal danger.