Because the CFO of each enterprise is aware of, your annual submitting is essential for your online business to remain compliant and in good standing with state authorities. Missed submitting deadlines, outdated data, and incorrect reporting can lead to pricey penalties and harm your popularity, jeopardizing your means to safe a mortgage, shut contracts, or broaden operations.

Finishing your annual submitting is a deeply collaborative course of that requires appreciable time and painstaking consideration to element for information validation and tag administration. With a number of contributors working in your annual report, it may be difficult to successfully observe workflows and preserve model management. Added to that, it’s a time-consuming and handbook course of that may be troublesome to handle – integrating and validating information from a number of sources can eat up plenty of assets.

5 Greatest Practices for a Profitable Annual Submitting

- Get an early head begin in your report – Don’t wait till the final minute to create and file your annual report. Create an easy-to-follow timeline in your annual submitting course of. Forestall penalties by monitoring all submitting dates and setting calendar reminders to make sure that no deadlines are missed. Outline possession of duties, communication channels, and doc templates.

- Foster robust collaboration practices – Set up open strains of communication to simply share updates and observe progress, and promptly handle issues. Empower your group members with disclosure administration instruments that allow them to take possession of their contributions and evaluation audit trails to see who did what and when. Use robust entry controls and single sign-on to make sure that solely licensed customers can change and approve the narrative.

- Prioritize high quality management and inside evaluation – Implement a sturdy inside evaluation course of earlier than closing report submission. Use a central repository for information gathering and reporting to keep away from model management points and implement workflow controls to streamline and expedite the manufacturing cycle. Test and recheck your XBRL tags to make sure correct tagging. Conduct peer evaluations, contain senior administration, and leverage know-how for information validation. Early identification and correction of errors saves time and avoids last-minute scrambling.

- Regularly consider and refine your course of – Study from every submitting cycle. Conduct post-filing assessments, determine areas for enchancment, and adapt your procedures for subsequent yr. Use roll ahead capabilities to automate the roll-forward course of period-to-period, saving effort and time and eliminating handbook processes and errors. Steady enchancment ensures effectivity and minimizes stress in future filings.

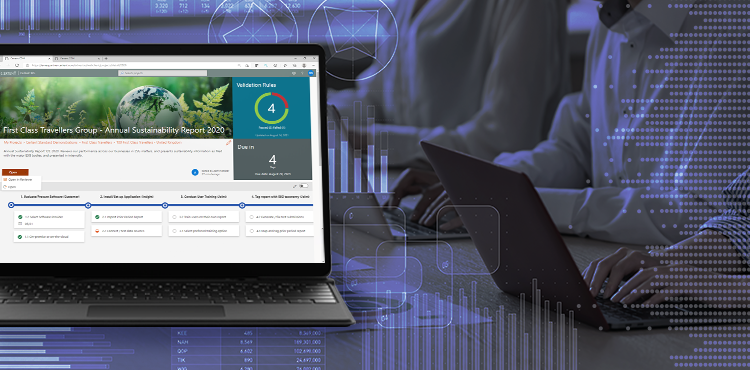

- Leverage know-how for higher pace and accuracy – Implement industry-leading software program, like Certent Disclosure Administration from insightsoftware, to automate handbook processes and scale back danger in your disclosure course of. Disclosure administration software program means that you can instantly connect with information from a number of sources, offering a single supply of fact for constant reporting. Actual-time validation on XBRL paperwork means that you can immediately flag errors and enhance general high quality in filings. Use the acquainted Microsoft Workplace integration to work throughout the merchandise you already know the way to use, resembling Phrase, Excel, and PowerPoint.

Greatest Practices for Annual ESMA Filings with CDM

Simplify and De-risk Your Annual Submitting

By leveraging disclosure administration software program like Certent Disclosure Administration to file your annual report, you’re in a position to carry pace, accuracy, and consistency to a laborious, error-prone, and difficult-to-control course of. As the one all-in-one Microsoft-based disclosure administration answer, Certent Disclosure Administration streamlines and de-risks your annual submitting in a means no different can.

- Automated Information Gathering: Streamline processes with automated information assortment and aggregation and scale back the chance of errors related to handbook information entry.

- Deadline Monitoring and Alerts: Keep on high of key submitting deadlines, avoiding late submissions and related penalties, with automated alerts and reminders.

- Regulatory Compliance: Guarantee your annual experiences adjust to the newest regulatory necessities, lowering the danger of non-compliance and related penalties.

- Information Accuracy and Audit Path: Leverage audit path options to hint adjustments and preserve a document of information modifications.

- Environment friendly Collaboration: Collaborate utilizing customary Microsoft Workplace feedback, enhancing communication and coordination between totally different groups and departments.

- Digital Submitting: Submit your annual experiences electronically to related regulatory our bodies; this not solely expedites the submitting course of but in addition helps in sustaining a digital document of submissions.

Automated software program like Certent Disclosure Administration streamlines the annual report submitting course of, reduces the danger of errors, enhances regulatory compliance, and contributes to general effectivity in managing disclosure reporting obligations. Investing in an answer like Certent Disclosure Administration is your group’s best strategy to make submitting your annual report easy and painless. Learn this whitepaper for recommendations on how to decide on the suitable answer in your group’s wants.