For the reason that approval of Bitcoin ETF purposes by the US Securities and Change Fee (SEC) on January 11, adopted by the graduation of buying and selling a day later, the ETF race has witnessed spectacular buying and selling volumes on every buying and selling day.

Because the market recovers from a pointy correction, latest developments point out a notable slowdown in Grayscale promoting, which might probably sign a rebound for the Bitcoin value following the latest 20% drop.

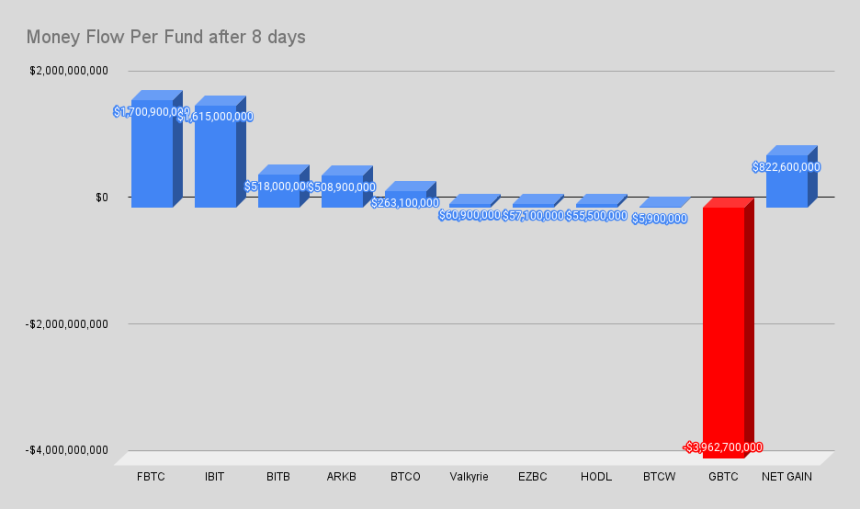

Market knowledgeable James Mullarney and Bloomberg ETF knowledgeable Erich Balchunas present key insights into Bitcoin ETF fund flows after 8 days, shedding gentle on the evolving dynamics and investor sentiments surrounding this growth.

Hope For Bitcoin Bulls

One of many key observations made by James Mullarney is the deceleration in Grayscale’s promoting actions. Whereas Grayscale continues to promote, the tempo of their promoting has considerably decreased, indicating a possible shift of their technique.

That is seen as a optimistic signal for the market, as a slowdown in Grayscale promoting might contribute to stabilizing Bitcoin costs and restoring investor confidence.

Amidst this backdrop, main gamers within the asset administration trade, similar to BlackRock and Constancy, have showcased their resilience and dedication to Bitcoin.

BlackRock, one of many world’s largest asset managers, at the moment holds 44,000 BTC in property beneath administration (AUM), indicating their rising publicity to the cryptocurrency.

Equally, Bitcoin ETF issuer Constancy, famend for its digital asset companies, stands sturdy with 40,000 BTC AUM, demonstrating their continued confidence in Bitcoin and its long-term potential.

Furthermore, the dynamics of the latest sell-off are noteworthy. Nearly all of the promoting stress noticed out there concerned FTX, which accomplished day 8 of buying and selling.

Nonetheless, because the market enters day 9, the expectation is for a big discount in promoting stress from FTX and Grayscale, probably contributing to a extra steady market atmosphere, in accordance with Mullarney.

The emergence of Bitcoin ETFs as important holders of the cryptocurrency is one other optimistic facet to contemplate. ETFs haven’t solely absorbed the 101,600 BTC bought by Grayscale however have additionally elevated their holdings by a further 21,100 BTC in simply 8 days.

Based on Mullarney, this means rising institutional curiosity in Bitcoin, as ETFs proceed to build up important quantities of the cryptocurrency.

Bitcoin ETF Issuers Counter Grayscale Promoting

Regardless of Grasycale’s promoting spree, Mullarney highlights that the Bitcoin ETF managers alone are buying 15 instances the each day Bitcoin provide, surpassing 13,444 BTC towards the 900 BTC each day creation fee.

This notable influx of BTC demonstrates the sturdy demand from institutional traders and highlights the potential affect of ETFs on the general Bitcoin market.

Curiously, the brand new ETFs have absorbed a web complete of 122,000 BTC in simply 8 days, overcoming the affect of Grayscale’s launch and contributing to a optimistic web influx.

Bloomberg ETF knowledgeable Erich Balchunas provides additional insights to the evaluation. Balchunas notes that the amount of Grayscale Bitcoin Belief (GBTC) has decreased, which might be an indication of exhaustion in promoting.

Nonetheless, $515 million was withdrawn from GBTC yesterday, leading to a complete outflow of $3.96 billion since its conversion to an ETF. On a extra optimistic be aware, there was a web influx of $409 million on the ninth day, indicating renewed investor curiosity.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site fully at your individual danger.