Avalanche (AVAX), the blockchain platform recognized for its scalability and infrastructure, made important strides within the fourth quarter (This fall) of 2023. In response to a report by Messari, AVAX emerged as one of many best-performing tokens, driving the protocol to file notable features in key metrics.

Report-Breaking Milestones For Avalanche

The report reveals that AVAX skilled a notable improve in its market cap, which climbed 344% quarter-over-quarter (QoQ) and 326% year-over-year (YoY), reaching $14.4 billion on the finish of the yr. This huge improve propelled AVAX’s market cap rank amongst all tokens from 20 to 9, up 11 spots (at the moment tenth behind Cardano (ADA).

One of many driving components behind Avalanche’s important income progress was the surge in inscriptions, notably Avascriptions (ACS-20 tokens).

These on-chain name information transactions noticed a major enhance, leading to a considerable improve in income. From November to December, Avalanche witnessed a surge in income, with a 2,874% improve measured in USD, from $1.9 million to $56.5 million.

The surge in income was accompanied by a major improve in every day transactions, which jumped 450% QoQ to 1.5 million. The emergence of Avascriptions additionally drove the vast majority of these transactions.

Avalanche’s C-Chain skilled a record-breaking 6.3 million transactions, with practically 6.1 million being inscriptions. This marks the very best variety of transactions ever recorded in a single day for Avalanche.

Whereas C-Chain noticed a 50% QoQ lower in every day lively addresses, this was primarily resulting from decreased exercise on LayerZero – a bridge between totally different blockchains. Nonetheless, the report highlights that Avalanche noticed a major improve in lively validators, rising 20% QoQ from 1,374 to 1,651 validators.

In response to Messari, this progress in validators, coupled with an 11% QoQ improve in AVAX stakes, signifies a promising long-term urge for food for AVAX within the coming yr.

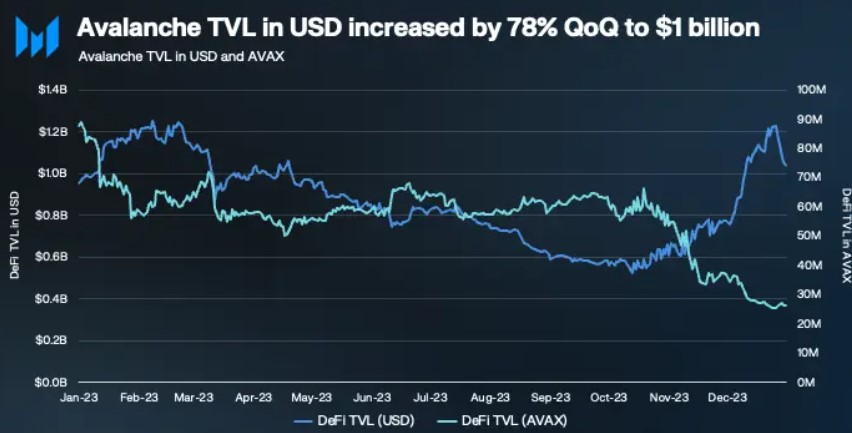

Avalanche’s TVL Surges 78%

Avalanche’s Whole Worth Locked (TVL) denominated in USD skilled a considerable 78% QoQ improve, reaching $1.03 billion by the top of This fall 2023. This positioned Avalanche because the seventh chain by TVL, denominated in USD.

Nonetheless, TVL-denominated in AVAX decreased by 71% QoQ, primarily resulting from AVAX value appreciation driving the rise in USD-denominated TVL.

The report additionally sheds gentle on the efficiency of varied protocols on Avalanche. AAVE, the most important protocol by TVL, witnessed a 60% QoQ progress, whereas Benqi and Dealer Joe demonstrated robust features of 205% and 131% QoQ, respectively. Collectively, these three protocols accounted for 79% of Avalanche’s TVL, showcasing their dominance within the ecosystem.

Smaller-sized protocols, similar to Pangolin and GMX, additionally showcased spectacular progress, whereas Balancer, aided by Benqi’s sAVAX liquidity pool, attracted important TVL on Avalanche. Moreover, This fall witnessed a surge in common every day DEX volumes, rising by 245% QoQ.

Evaluation of the 1-day chart reveals that Avalanche’s token buying and selling pair AVAX/USD skilled important progress throughout This fall, breaking free from a chronic interval of sideways value motion.

Nonetheless, following a notable uptrend that propelled the token to achieve $50, its highest degree in 20 months, on December 24, AVAX underwent a pointy correction, plunging to the $27 value degree.

The cryptocurrency has rebounded in response to Bitcoin’s (BTC) rally and the prevailing bullish sentiment out there. Over the previous fourteen days, AVAX has witnessed a 13% value improve, at the moment reclaiming the $40 zone.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site fully at your personal danger.