This text (and the following) focuses on traits available in the market—a proof as to why markets pattern, the explanation why it’s good to know that markets pattern, then lastly, a big analysis part into how a lot markets pattern. This evaluation will initially be proven on 109 market indices that contain home, worldwide, and commodity sectors. Following that the total listing of all S&P GICS sectors, business teams, and industries are proven following the identical format. There’s a large amount of information in these two sections. I attempt to slice by means of it with easy evaluation, holding in thoughts that plenty of knowledge doesn’t equate to data.

Why Markets Development

Traits in markets are usually attributable to short-term supply-and-demand imbalances with a heavy overdose of human emotion. Whenever you purchase a inventory, that somebody needed to promote it to you. If the market has been rising not too long ago, then you’ll in all probability pay a better value for it, and the vendor additionally is aware of he can get a better value for it. The shopping for enthusiasm is way better than the promoting enthusiasm.

I hate it when the monetary media makes a remark when the market is down by saying that there are extra sellers than patrons. They clearly don’t perceive how these markets work. Primarily based on shares, there are all the time the identical variety of patrons and sellers; it’s the shopping for and promoting enthusiasm that modifications.

Trending is a optimistic suggestions course of. Even Isaac Newton believed in traits together with his first legislation of movement, which acknowledged that an object at relaxation stays at relaxation, whereas an object in movement stays in movement, with the identical velocity and in the identical path until acted on by an unbalanced pressure. Hey, an apple will proceed to fall till it hits the bottom. Constructive suggestions is the direct results of an investor’s confidence within the value pattern. When costs rise, buyers confidently purchase into greater and better costs.

Provide and Demand

A purchaser of a inventory, which is the demand, bids for a specific amount of inventory at a sure value. A vendor, which is the provide, gives a specific amount at a sure value. I believe it’s honest to say that one buys a inventory with the anticipation that they will promote it later to somebody at a better value. Not an unreasonable want, and possibly what drives most buyers. The client has no concept who will promote it to him, or why they’d promote it to him. He could assume that he and the vendor have a whole disagreement on the longer term worth of that inventory. And that is likely to be appropriate; nevertheless, the customer won’t ever know. The truth is, the customer simply is likely to be the vendor’s one that buys it from him at a better value.

The explanations for purchasing and promoting inventory are complicated and unattainable to quantify. Nevertheless, once they ultimately agree, what’s it that they agreed on? Was it the earnings of the corporate? Was it the merchandise the corporate produces? Was it the administration crew? Was it the quantity of the inventory’s dividend? Was it the gross sales revenues? Because it seems, it was none of these issues; the transaction was settled as a result of they agreed on the value of the inventory, and that alone determines revenue or loss. Adjustments in provide and demand are mirrored instantly in value, which is an instantaneous evaluation of provide and demand.

What Do You Learn about This Chart?

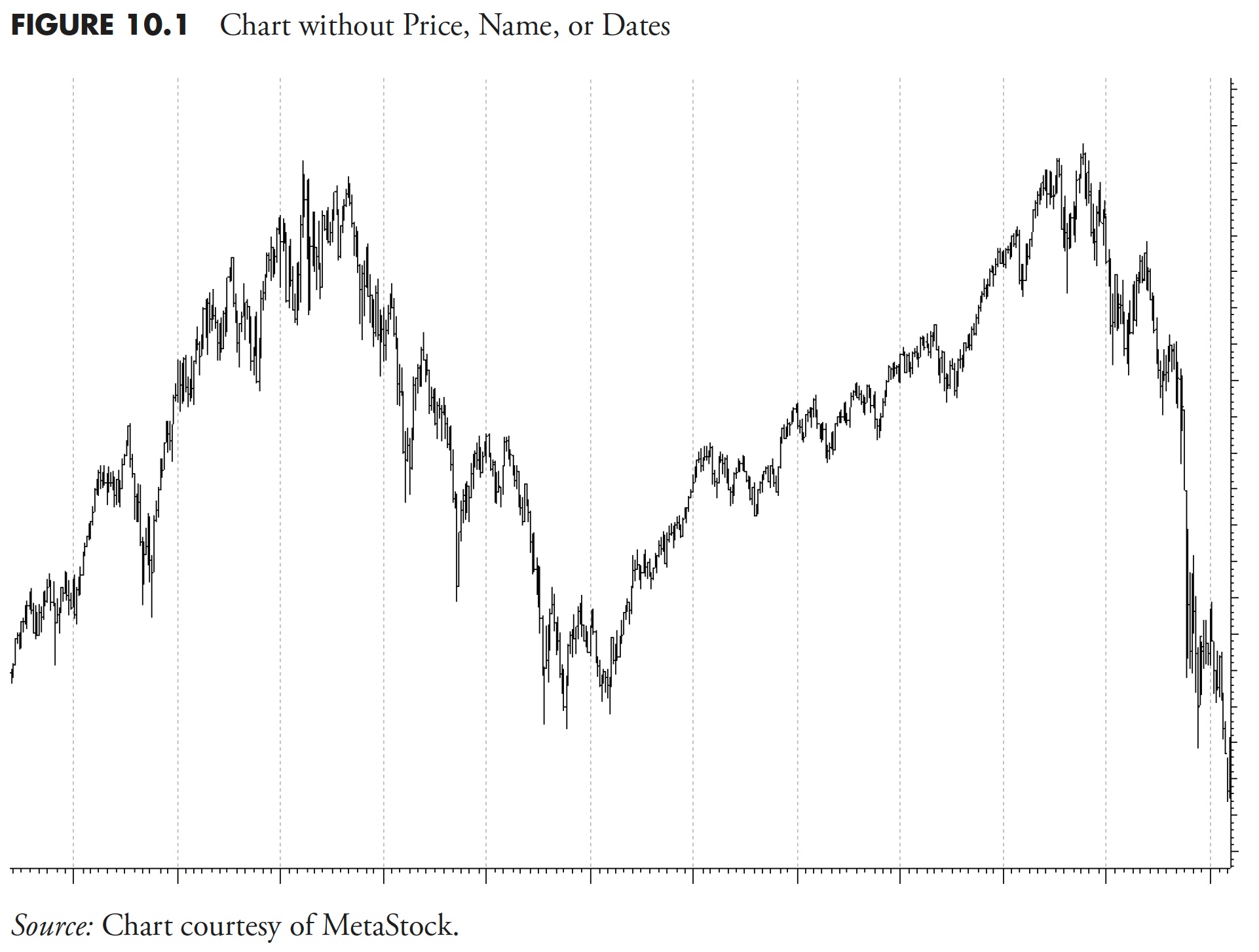

In Determine 10.1, I’ve eliminated the value scale, the dates, and the identify of this difficulty; now let me ask you some questions on this difficulty.

- Is that this a chart of day by day costs, weekly costs, or 30-minute costs?

- Is that this a chart of a inventory, a commodity, or a market index? (Okay, I will provide you with this a lot, it’s a day by day value chart of a inventory over a interval of about six years.)

- Throughout this time period, there have been 11 earnings bulletins. Are you able to present me the place a type of bulletins occurred and, when you may, whether or not the earnings report was thought of good or unhealthy?

- Additionally through the time period for this chart, there have been seven Federal Open Market Committee (FOMC) bulletins. Are you able to inform me the place certainly one of them occurred, and whether or not the announcement was thought of good or unhealthy?

- Does this inventory pay a dividend?

- Hurricane Katrina occurred throughout this era displayed on this chart; are you able to inform me the place it’s?

- Lastly, would you need to purchase this inventory at the start of the interval displayed after which promote it on the finish of the interval (proper facet of chart)?

I doubt, in reality, I know you can’t reply many of the above questions with any software apart from guessing. The purpose of this train is to level out that there’s all the time and ever noise in inventory costs. This noise is available in tons of of various colours, sizes, shapes, and media codecs. The underside line is that it’s simply noise. The monetary media bombards us all day lengthy with noise. I don’t assume they do it maliciously; they do it as a result of they consider they’re providing you with worthwhile data that will help you make funding choices. Nothing might be farther from the reality.

After all, query quantity 7 is the one query that the majority can reply, as a result of from the chart a buy-and-hold funding through the knowledge displayed clearly resulted in no funding progress.

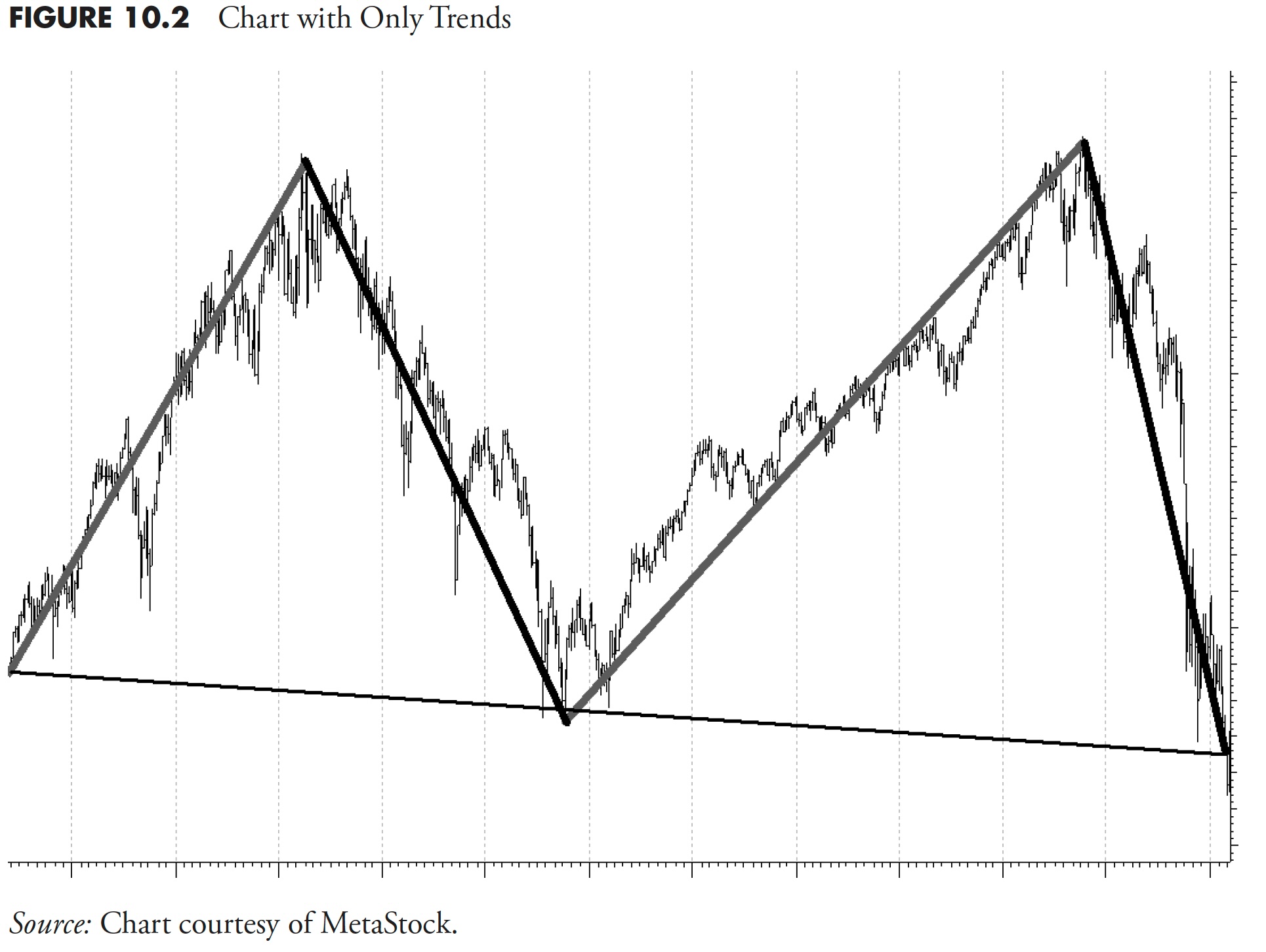

Nevertheless, let me inform you what I see as proven in Determine 10.2. I see two actually good uptrends and, if I had a trend-following methodology that might seize 65 % to 75 % of these uptrends, I’d be blissful. I additionally see two good downtrends, and if I had a technique that might keep away from about 75 % of them, I’d even be blissful. In the event you may try this for the period of time proven on the chart beneath, you then would come out significantly higher off than the buy-and-hold investor. I usually solely take part within the lengthy facet of the market and transfer to money or money equivalents when defensive. Nevertheless, a long-short technique may presumably derive even better revenue.

Development vs. Imply Reversion

I favor to make use of a market evaluation methodology referred to as pattern following. Typically it must be referred to as pattern continuation. Why? Development evaluation works on the completely researched idea that after a pattern is recognized, it has an affordable chance to proceed. I do know that’s the case as a result of, more often than not, markets are trending markets, and I see no purpose to undertake a distinct technique throughout a interval of imply reverting, corresponding to is skilled available in the market sometimes.

You’ll be able to consider pattern following as a optimistic suggestions mechanism. Imply reverting measures are people who oscillate between predetermined parameters; oftentimes the choice of these parameters is the issue. Imply reversion methods are clearly superior throughout these unstable sideways instances, however the implementation of a imply reverting course of requires a stage of guessing that I refuse to be part of. You’ll be able to consider imply reversion as a damaging suggestions mechanism.

In technical evaluation, there are numerous imply reverting measures that might be used. They’re those the place you regularly hear the phrases overbought and oversold. Overbought means the measurement reveals that costs have moved upward to a restrict that’s predefined. Oversold means the alternative—costs have moved right down to a predetermined stage. The issue with that sort of indicator or measurement is {that a} parameter must be set beforehand to know what the overbought and oversold ranges are. Additionally, when you consider one thing imply reverts, you’ll in all probability have issue in figuring out the speed of reversion. For imply reversion to be related, there have to be a that means tied to common (imply) and, since most market knowledge doesn’t adhere to regular distributions, the imply is not as significant (sic). Form of like charting web value and eradicating billionaires to make the information much less skewed and subsequently a extra significant common.

Clearly, imply reverting measurements would work higher in extremely unstable markets, corresponding to we witness sometimes. One may ask the query: Why do not you incorporate each into your mannequin? A good query, however one which reveals the inquiry is forgetting that hindsight isn’t an evaluation software that may serve you nicely. When do you turn from one technique (pattern following) to the opposite (imply reversion)? Therein lies the issue.

One other query that is likely to be requested is why not use adaptive measures to assist determine the 2 forms of markets. Once more, one other honest query! I believe the lag between the 2 forms of markets and the truth that typically there isn’t a clear interval of delineation is the difficulty. It’s a pure intuition to need to change the technique with a view to reply extra rapidly from one to the opposite. Pure instincts are what we are attempting to keep away from, just because they’re usually incorrect, and painfully incorrect on the worst instances.

The transition from pattern following to imply reversion may be tough to see besides with 20/20 hindsight. For instance, while you view a chart which clearly has gone from trending to reversion, from that time, if we had used a easy imply reverting measurement, we’d have seemed like geniuses. Nevertheless, in actuality, durations like which have existed many instances prior to now in general trending markets. Then the following drawback turns into when to maneuver away from a imply reverting technique again to a pattern following one. Once more, hindsight all the time provides the exact reply, however in actuality this can be very tough to implement in actual time.

The underside line is that with markets that usually pattern more often than not, holding a algorithm and cease loss ranges in place will in all probability all the time win over the long-term. Sharpshooting the method is the start of the tip. Development following is considerably just like a momentum technique besides for 2 vital variations: one, momentum methods usually rank previous efficiency for choice, and two, typically they don’t make the most of stop-loss strategies, as an alternative shifting out and in of high performers. They each depend on the persistence of value habits.

Development Evaluation

If one goes to be a pattern follower, what’s the very first thing that have to be carried out (rhetorical)? As a way to be a pattern follower, you could first decide the minimal size pattern you need to determine. You can’t comply with each little up and down transfer available in the market; you could resolve what the minimal pattern size is that you just need to comply with. As soon as that is carried out, you possibly can then develop trend-following indicators utilizing parameters that may assist determine traits available in the market primarily based on the minimal size you’ve gotten selected.

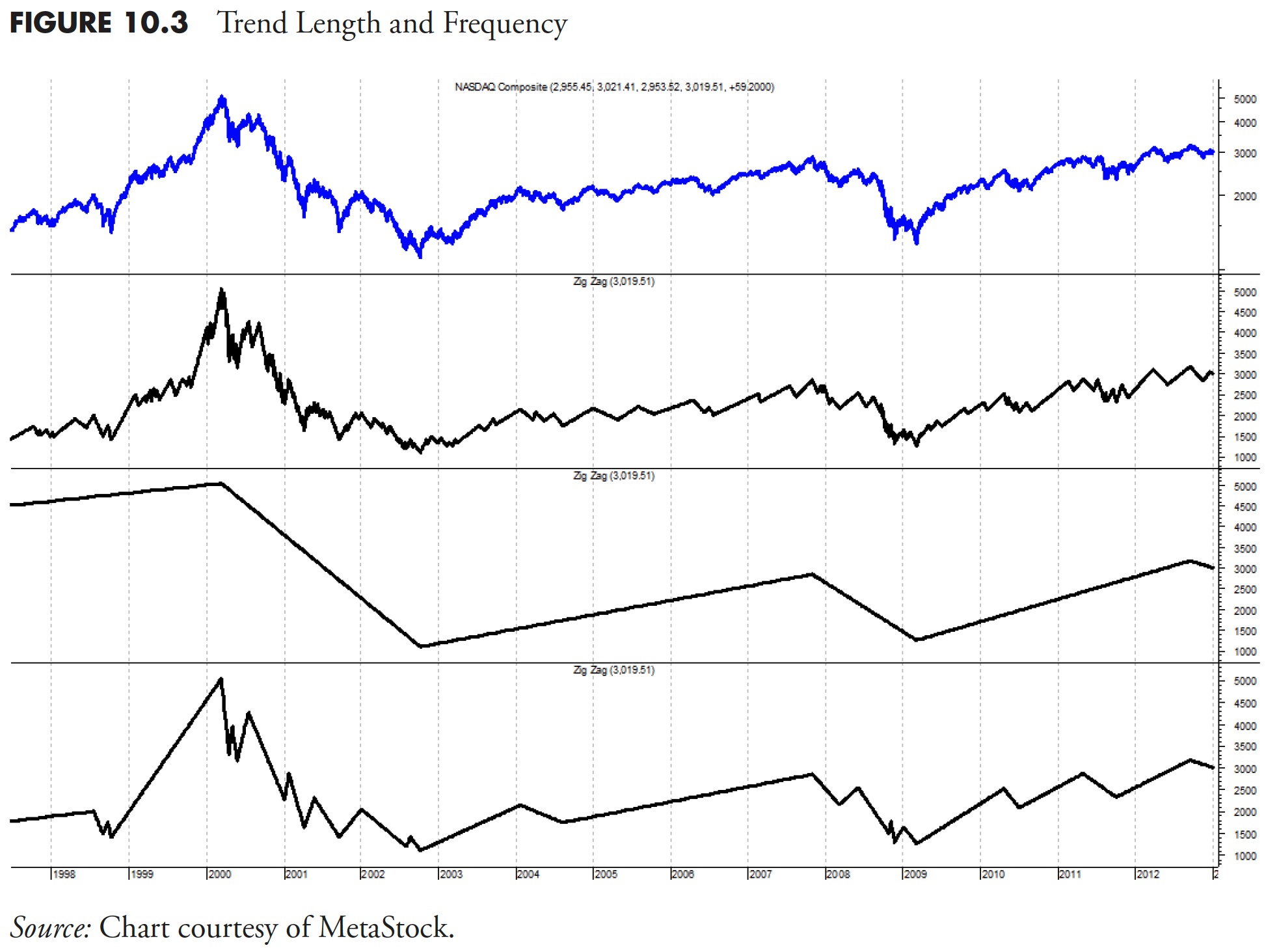

Determine 10.3 is an instance of varied trend-following durations. The highest plot is the Nasdaq Composite index. The second plot is a filtered wave displaying the pattern evaluation for a reasonably short-term-oriented pattern system. That is for merchants and people who need to attempt to seize each small up and down available in the market; a course of that’s not adopted by this writer. The third plot is the perfect pattern system, the place it’s apparent that you just purchase on the long-term backside and promote on the long-term high. You could understand that this pattern evaluation can solely be carried out with good 20/20 hindsight, and might be much more tough than the short-term course of proven within the second plot. The underside plot is a pattern evaluation course of that’s on the coronary heart of the ideas mentioned on this guide. It’s a trend-following course of that realizes you can’t take part in each small up and down transfer, however attempt to seize many of the up strikes and keep away from many of the down strikes.

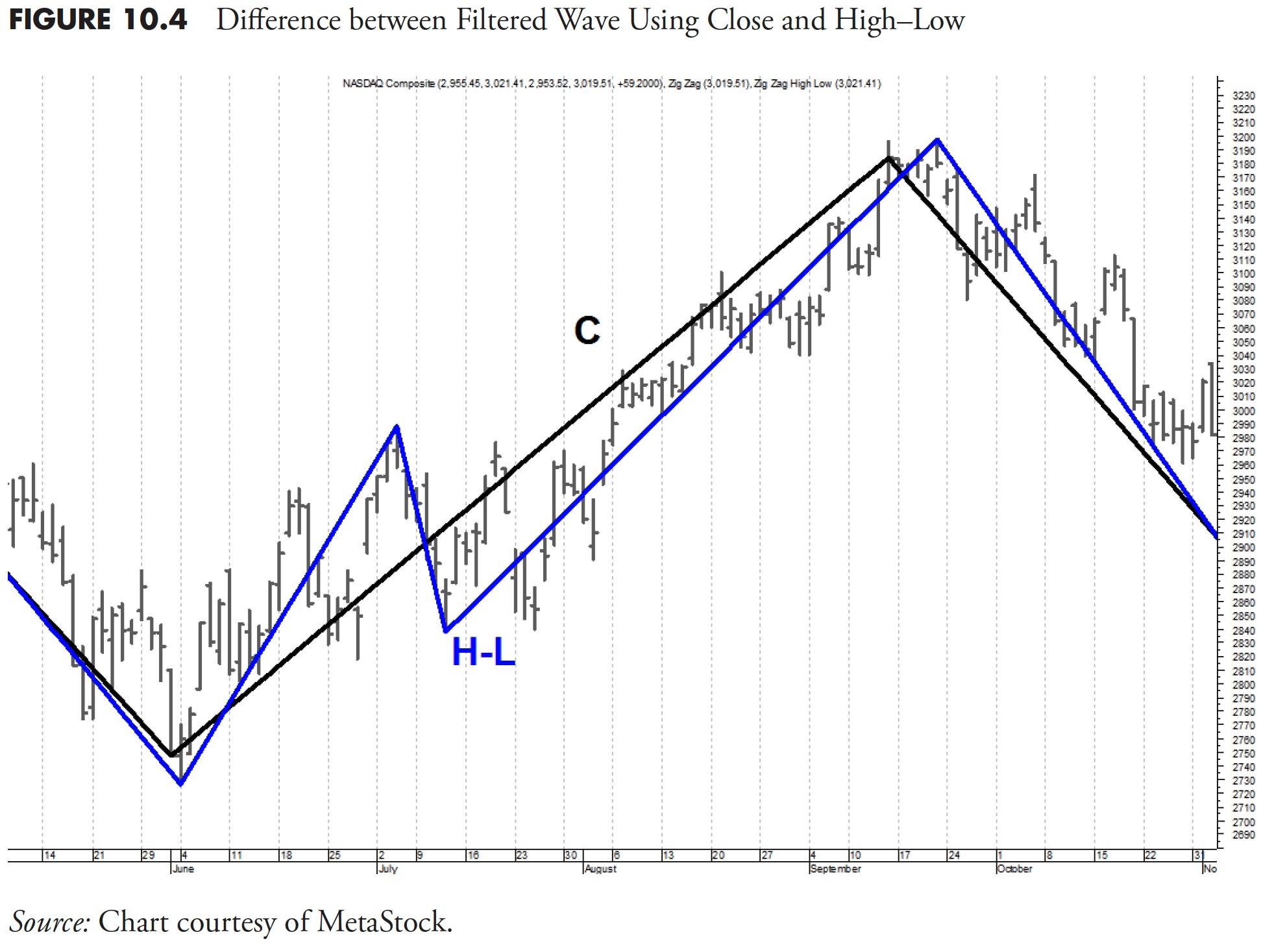

There’s a idea developed by the late Arthur Merrill referred to as Filtered Waves. A filtered wave is the measurement of value actions through which solely the motion that exceeds a predetermined share is counted. The value part used on this idea must be selected as as to if to make use of simply the closing costs for the filtered wave or use a mix of excessive and low costs. This could imply that, whereas costs are rising, the excessive could be used, and whereas costs are falling, the low value could be used. I personally favor the excessive and low costs, as they honestly replicate the value actions, whereas the closing costs solely would get rid of a number of the knowledge.

For instance, in Determine 10.4 , the background plot is the S&P 500 Index with each the shut C and the excessive low H-L filtered waves overlaid on the costs. You’ll be able to see that the H-L filtered wave strategies picks up extra of the information; in reality, it reveals a transfer of 5 % in the course of the plot that the Shut solely model didn’t present. On this explicit instance, the zigzag line makes use of a filter of 5 %, which signifies that every time it modifications path, it had beforehand moved no less than 5 % in the wrong way. There’s one exception to this, and that’s the final transfer of the zigzag line (there’s a related dialogue in an earlier chapter). It merely strikes to the latest shut whatever the share moved so it have to be ignored.

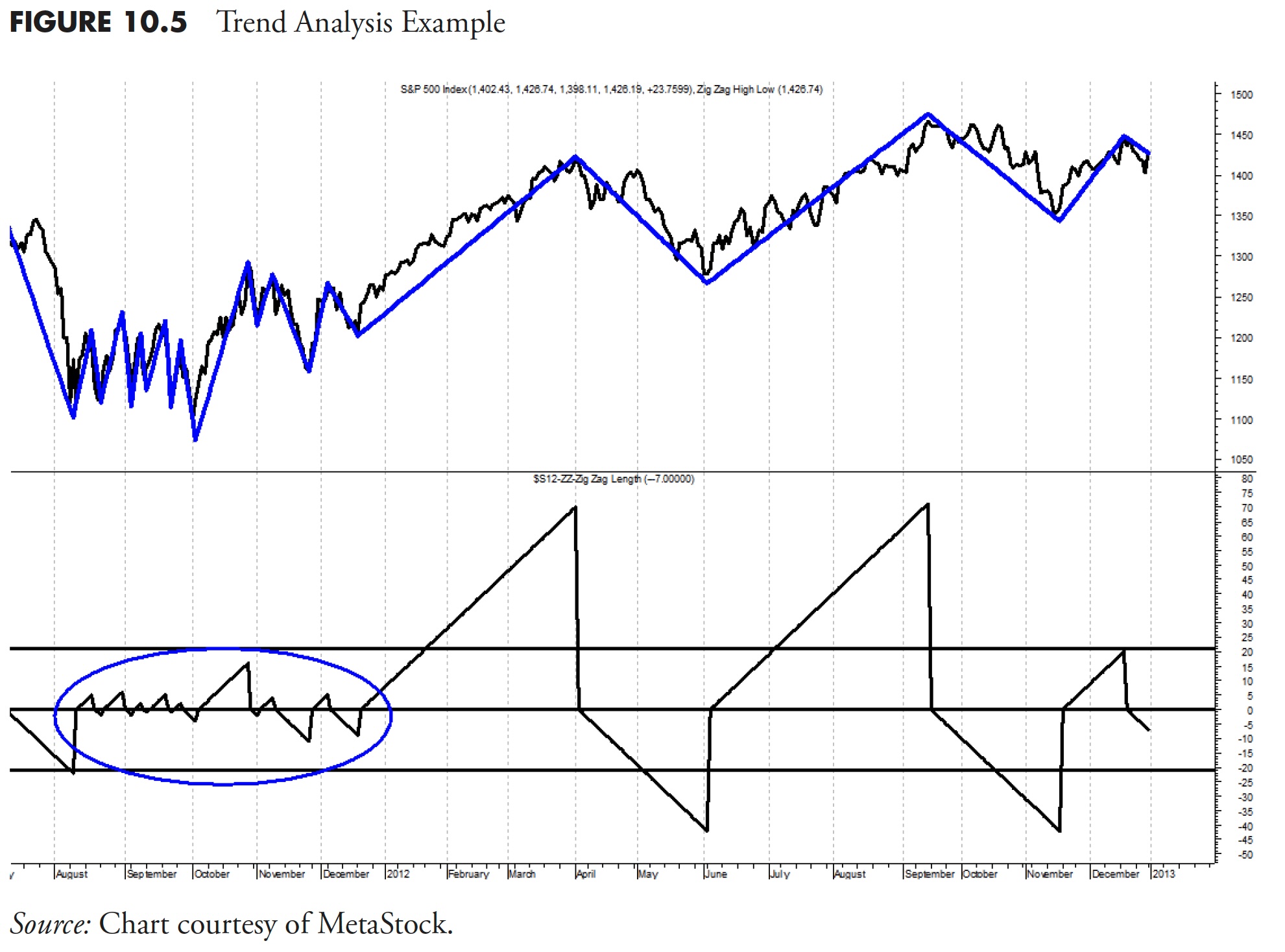

The underside plot in Determine 10.5 reveals the filtered wave by breaking down the up strikes and down strikes after which counting the variety of durations that had been in every transfer. There are three horizontal strains on that plot; the center one is at zero, which is the place the filtered wave modifications path. On this instance, the highest and backside strains are at +21 and -21 durations, which imply that anytime the filtered wave exceeds these strains above or beneath, the pattern has lasted no less than 21 durations. Discover that, on this instance, there was a interval at the start (highlighted) the place the market moved up and down in 5% or better strikes with excessive frequency, however by no means lasted lengthy sufficient to exceed the 21 boundaries. Then, within the second half of the chart, there have been two good strikes that did exceed the 21 boundaries. It is a good instance of a chart the place there was a trendless market (first half) and a trending market (second half). I used the high-low filtered wave of 5 % and 21 days for the minimal size as a result of that’s what I favor to make use of for many pattern evaluation.

The next analysis was carried out utilizing the high-low filtered wave utilizing varied percentages and varied pattern size measures. The analysis was carried out on all kinds of market costs, corresponding to most home indices, most international indices, the entire S&P sectors and business teams; 109 points in all. I supply commentary all through so you possibly can see that this was a strong course of. Any indices or value sequence that’s lacking was in all probability due to an insufficient quantity of information, as you want just a few years of information to find out a sequence’ trendiness. The purpose of this analysis was to find out that markets usually pattern and if there are some markets that pattern higher than others. Following this huge part, the pattern evaluation can be proven utilizing the S&P GICS knowledge on sectors, business teams, and industries.

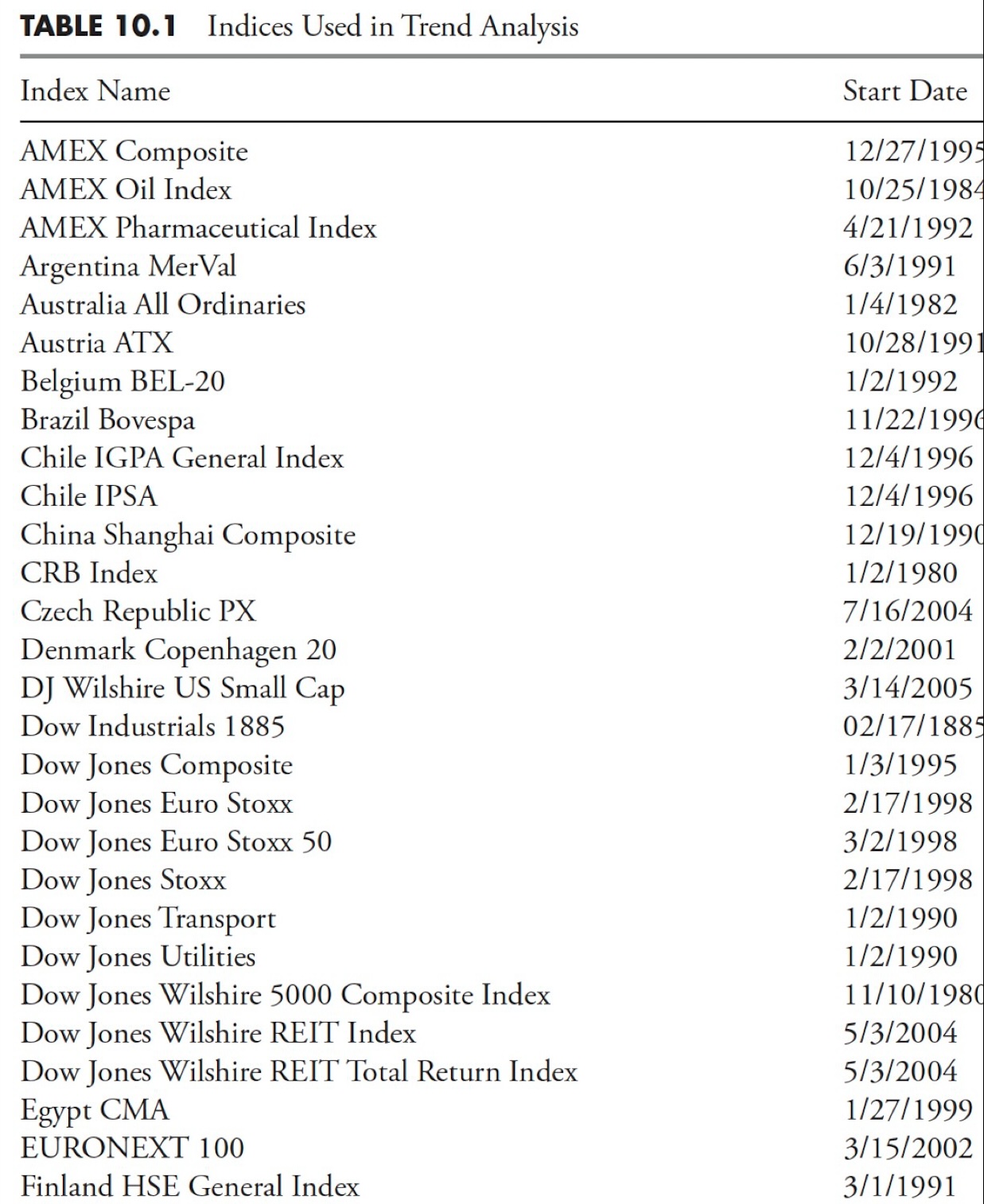

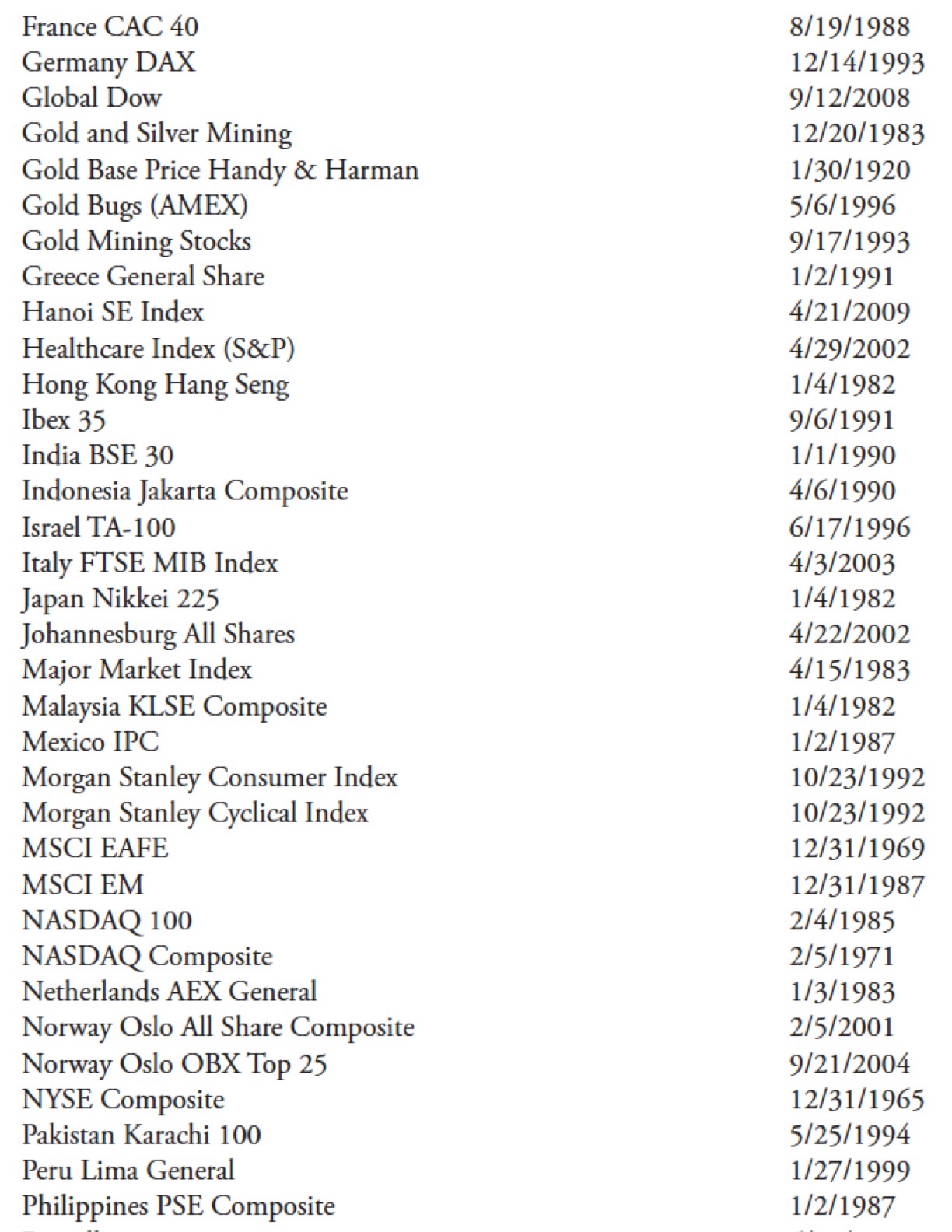

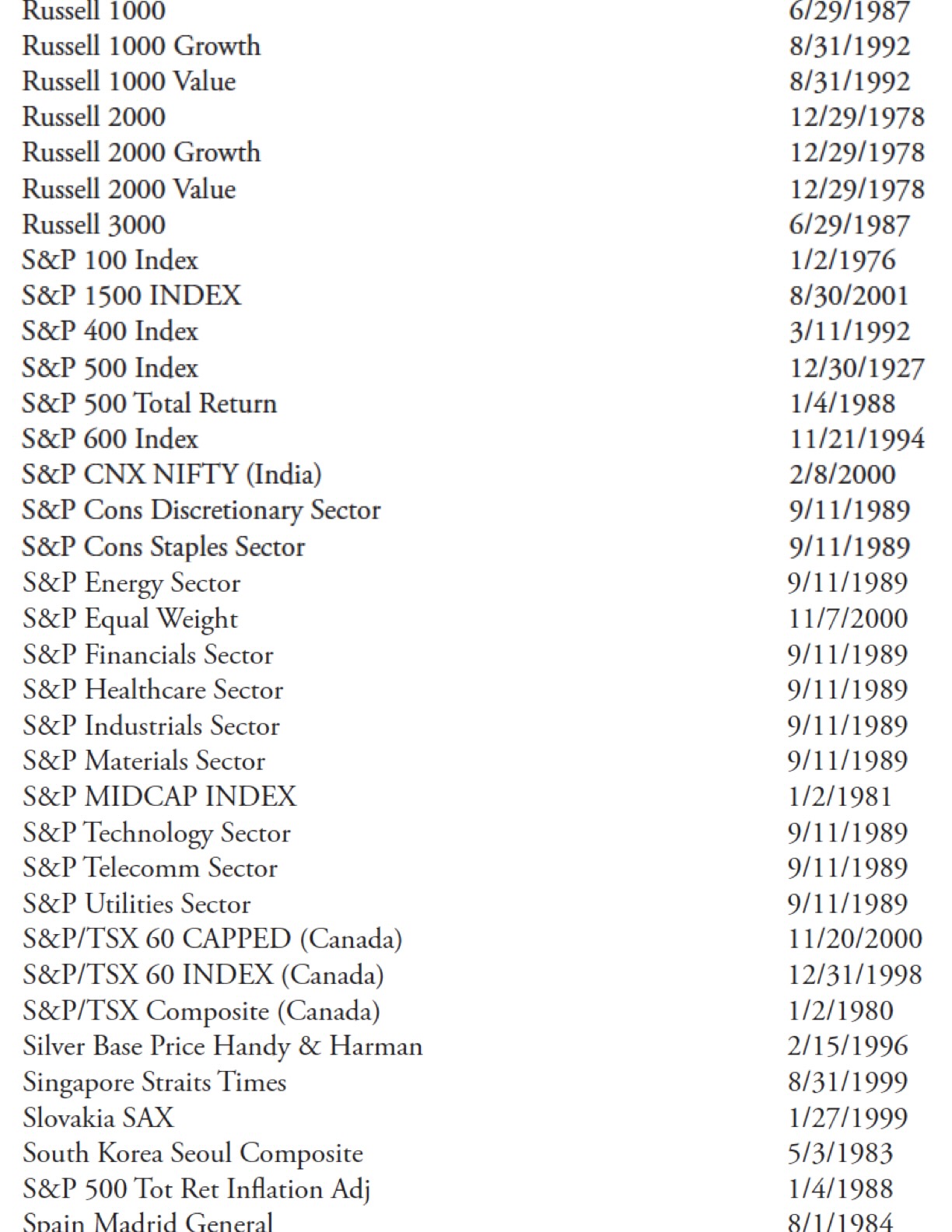

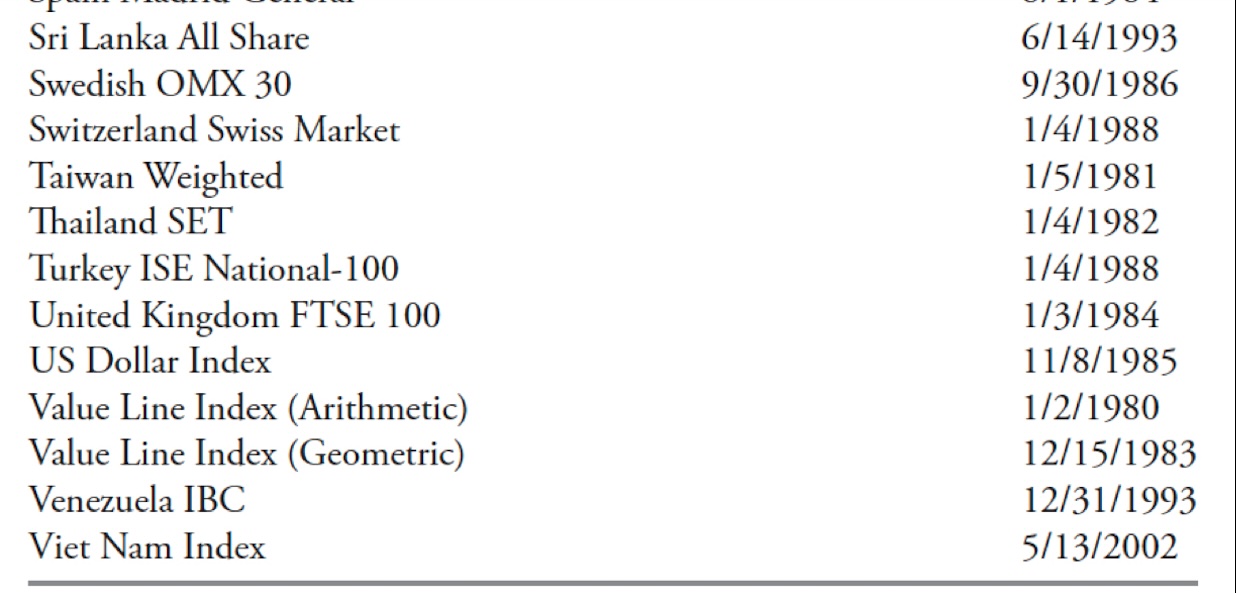

Desk 10.1 is the whole listing of indices used on this examine together with the start date of the information.

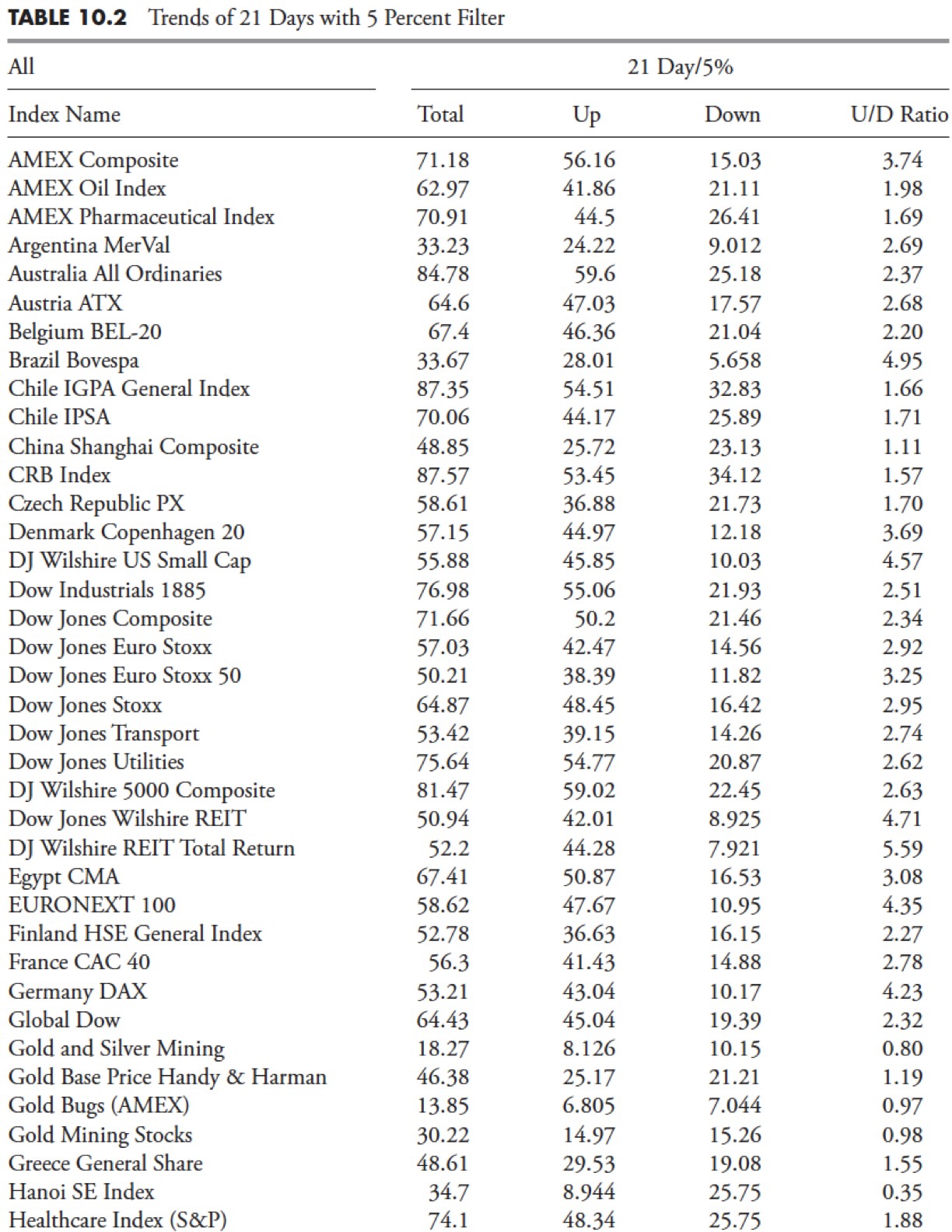

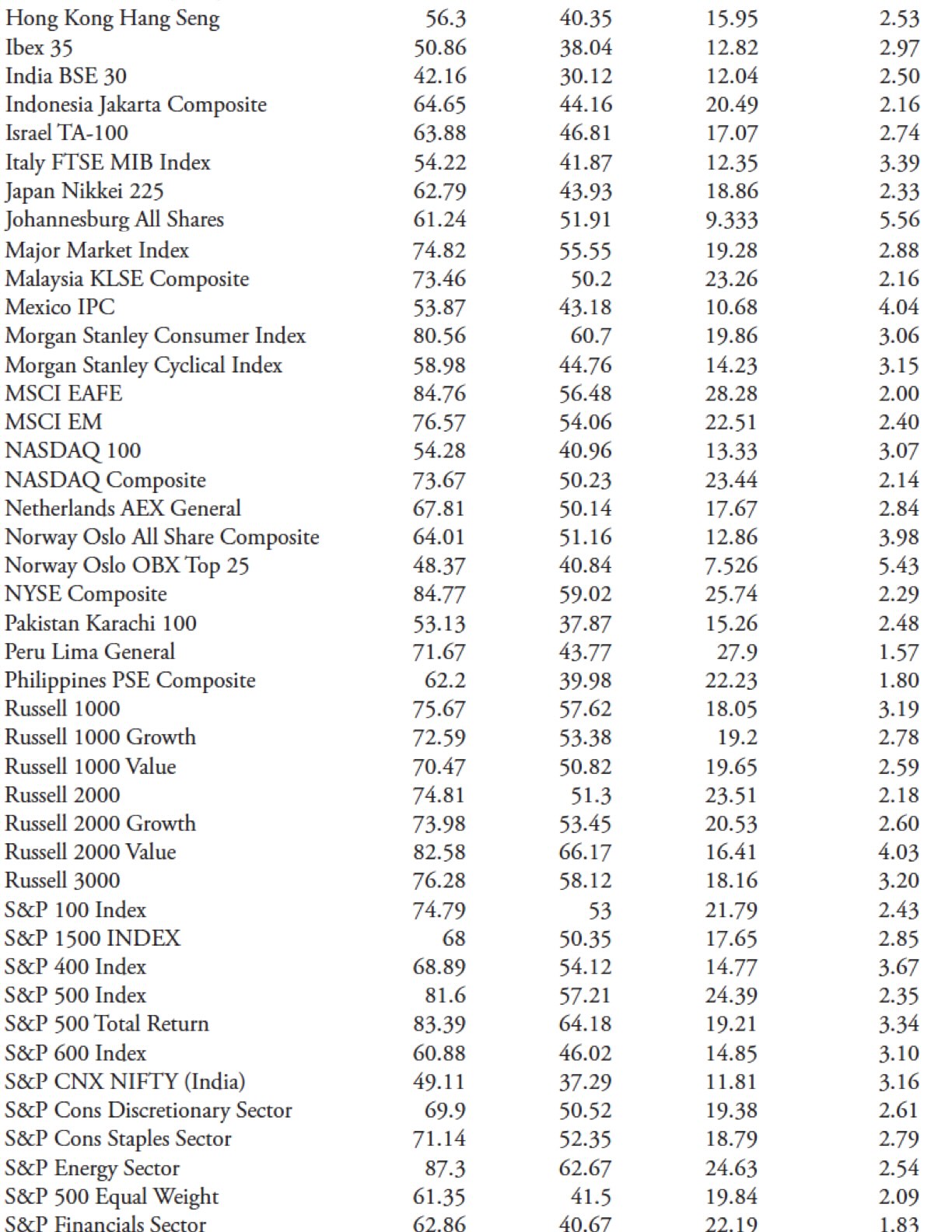

I did a number of units of information runs, however will clarify the method by displaying simply certainly one of them. Desk 10.2 is the information run by means of all 109 indices for the 5% filtered wave and 21 days for the pattern to be recognized. The primary column is the identify of the index (they’re in alphabetical order), whereas the following 4 columns are the outcomes of the information runs for the full pattern share, the uptrend share, the downtrend share, and the ratio of uptrends to downtrends.

The full displays the period of time relative to the quantity of all knowledge accessible that the index was in a pattern mode outlined by the filtered wave and pattern time; within the case beneath, a pattern needed to final no less than 21 days and a transfer of 5% or better. The up measure is simply the proportion of the uptrend relative to the quantity of information. Equally, the downtrend is the proportion of the downtrend to the quantity of information. In the event you add the uptrend and downtrend, you’ll get the full pattern.

The final column is the U/D Ratio, which is merely the uptrend share divided by the downtrend share. In the event you take a look at the primary entry in Desk 10.2, the AMEX Composite traits 71.18 % of the time, with 56.16% of the time in an uptrend and 15.03% of the time in a downtrend. The U/D Ratio is 3.74, which suggests the AMEX Composite traits up virtually 4 (3.74) instances greater than it traits down. You’ll be able to confirm the quantity of information within the Indices Date desk proven early to see if it was satisfactory sufficient for pattern evaluation. It isn’t proven, however the complement of the full would provide the period of time the index was trendless.

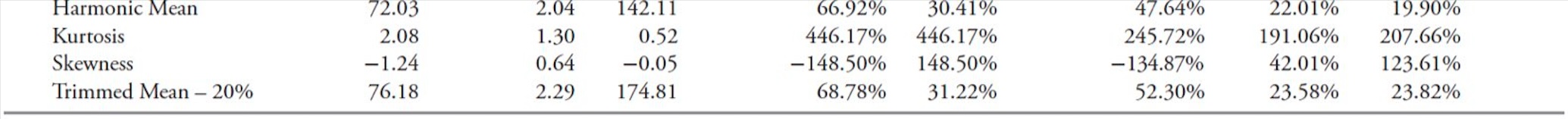

On the backside of every desk is a grouping of statistical measures for the assorted columns. Listed here are the definitions of these statistics:

Imply. In statistics, that is the arithmetic common of the chosen cells. In Excel, that is the Common operate (go determine). It’s a good measure so long as there aren’t any massive outliers within the knowledge being analyzed.

Common deviation. It is a operate that returns the common of absolutely the deviations of information factors from their imply. It may be regarded as a measure of the variability of the information.

Median. This operate measures central tendency, which is the situation of the middle of a bunch of numbers in a statistical distribution. It’s the center variety of a bunch of numbers; that’s, half the numbers have values which might be better than the median, and half the numbers have values which might be lower than the median. For instance, the median of two, 3, 3, 5, 7, and 10 is 4. If there are a variety of values which might be outliers, then median is a greater measure than imply or common.

Minimal. Reveals the worth of the minimal worth of the cells which might be chosen.

Most. Reveals the worth of the utmost worth of the cells which might be chosen.

Sigma. Also called commonplace deviation. It’s a measure of how broadly values are dispersed from their imply (common).

Geometric imply. To start with, it is just good for optimistic numbers and can be utilized to measure progress charges, and so on. It’ll all the time be a smaller quantity than the imply.

Harmonic imply. Merely the reciprocal of the arithmetic imply, or might be acknowledged because the arithmetic imply of the reciprocals. It’s a worth that’s all the time lower than the geometric imply, and just like the geometric imply, can solely be calculated on optimistic numbers and customarily used for charges and ratios.

Kurtosis. This operate characterizes the relative peakedness or flatness of a distribution in contrast with the traditional distribution (bell curve). If the distribution is “tall”, then it displays optimistic kurtosis, whereas a comparatively flat or quick distribution (relative to regular) displays a damaging kurtosis.

Skewness. This characterizes the diploma of symmetry of a distribution about its imply. Constructive skewness displays a distribution that has lengthy tails of optimistic values, whereas damaging skewness displays a distribution with an uneven tail extending towards extra damaging values.

Trimmed imply (20 %). It is a nice operate. It’s the identical because the Imply, however you possibly can choose any quantity or share of numbers (pattern dimension) to be eradicated on the extremes. An effective way to get rid of the outliers in an information set.

Trendiness Dedication Methodology One

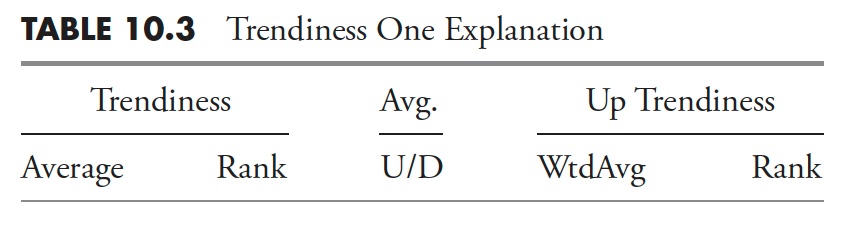

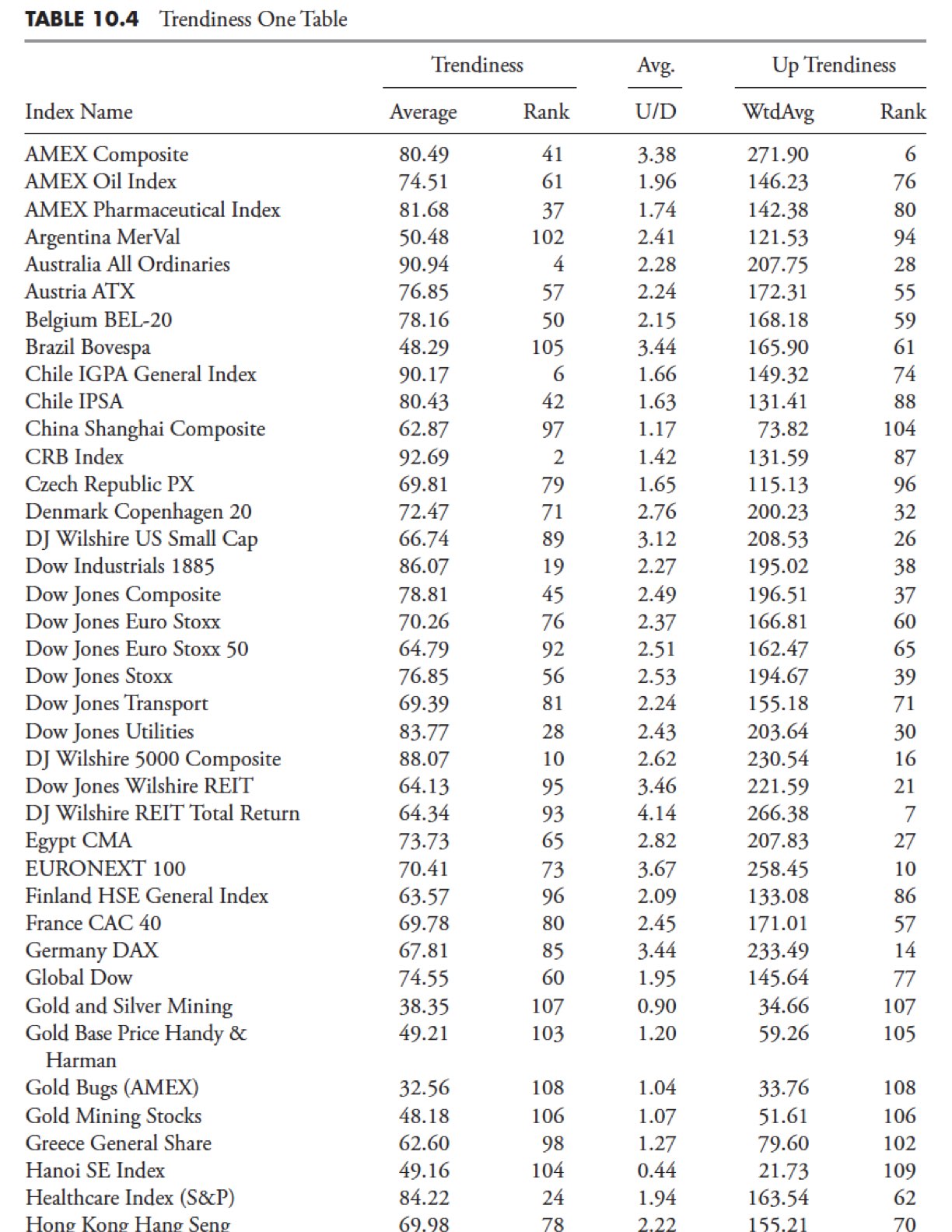

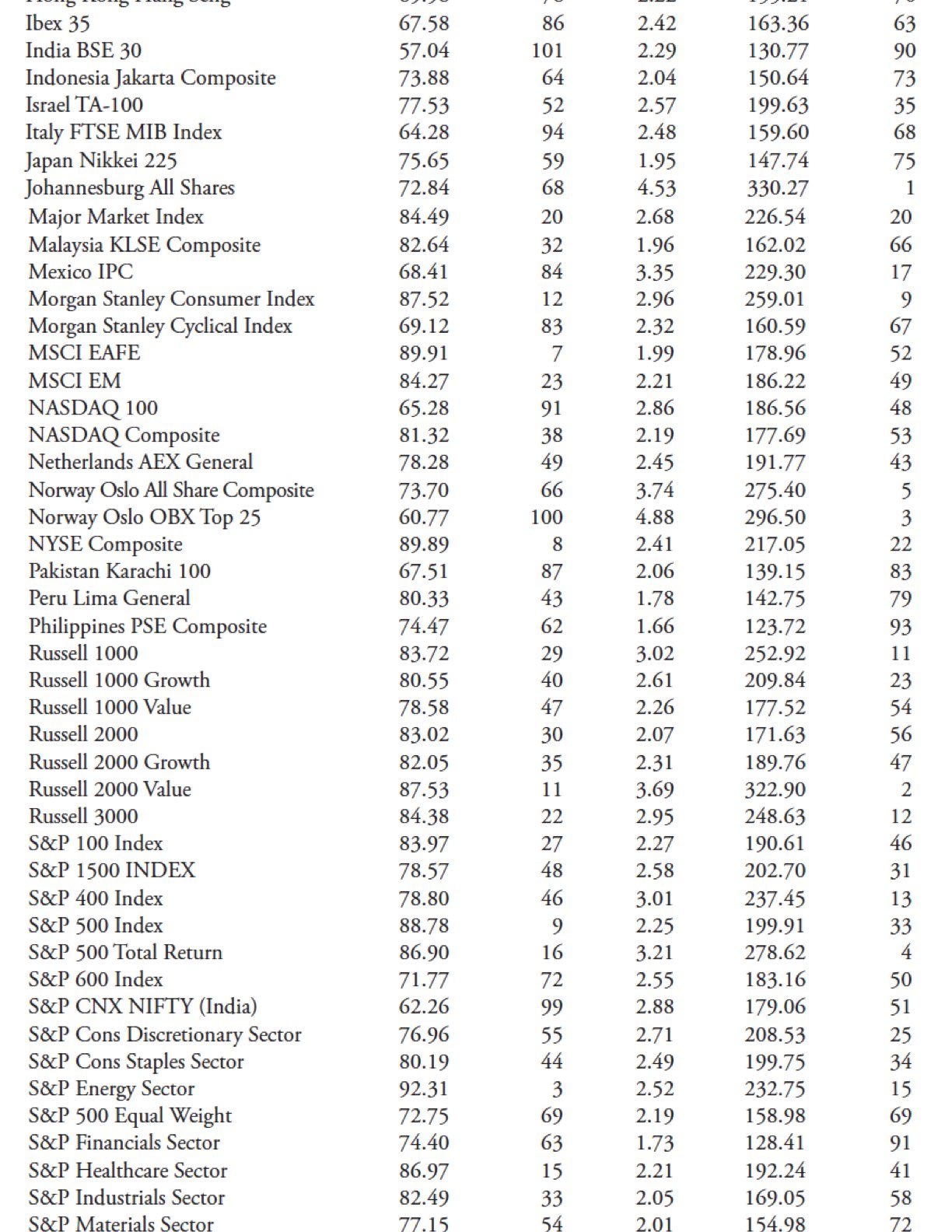

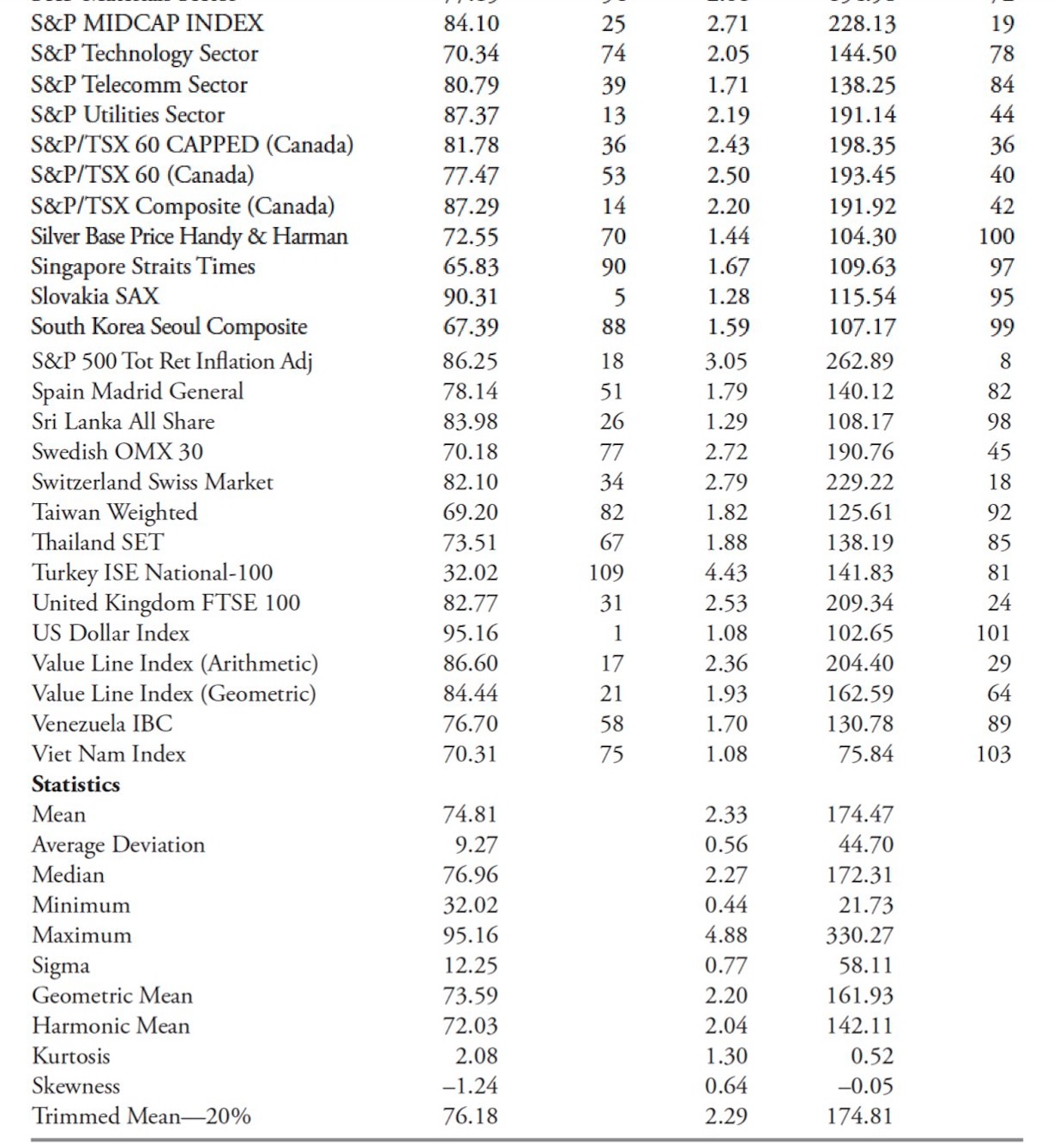

This system for pattern dedication appears to be like on the common of a number of units of uncooked knowledge. An instance of only one set of the information was proven beforehand in Desk 10.2, which appears to be like at a filtered wave of 5% and a minimal pattern size of 21 days. Following Desk 10.3 is a proof of the column headers for Trendiness One within the evaluation tables that comply with.

Trendiness common. That is the easy common of all the full trending expressed as a share. The parts that make up this common are the full trendiness of all of the uncooked knowledge tables, through which the full common is the common of the uptrends and downtrends as a share of the full knowledge within the sequence.

Rank. That is only a numerical rating of the trendiness common, with the most important complete common equal to a rank of 1.

Avg. U/D. That is the common of all of the uncooked knowledge tables’ ratio of uptrends to downtrends. Be aware: If the worth of the Avg. U/D is the same as 1, it signifies that the uptrends and downtrends had been equal. Whether it is lower than 1, then there have been extra downtrends.

Uptrendiness WtdAvg. That is the product of column Trendiness Common and column Avg. U/D. Right here the Complete Trendiness (sum of up and down) is multiplied by their ratio, which provides a weighted portion to the upside when the ratio is excessive. If the common of the full trendiness is excessive and the uptrendiness is significantly bigger than the downtrendiness, then this worth (WtdAvg) can be excessive.

Rank. It is a numerical rating of the Up Trendiness WtdAvg, with the most important worth equal to a rank of 1.

Desk 10.4 reveals the whole outcomes utilizing Trendiness One methodology.

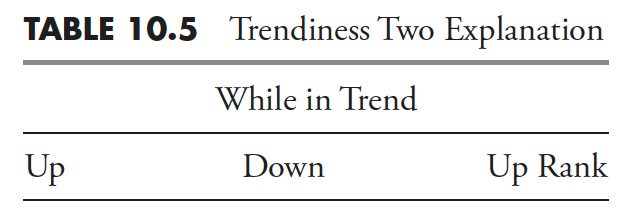

Trendiness Dedication Methodology Two

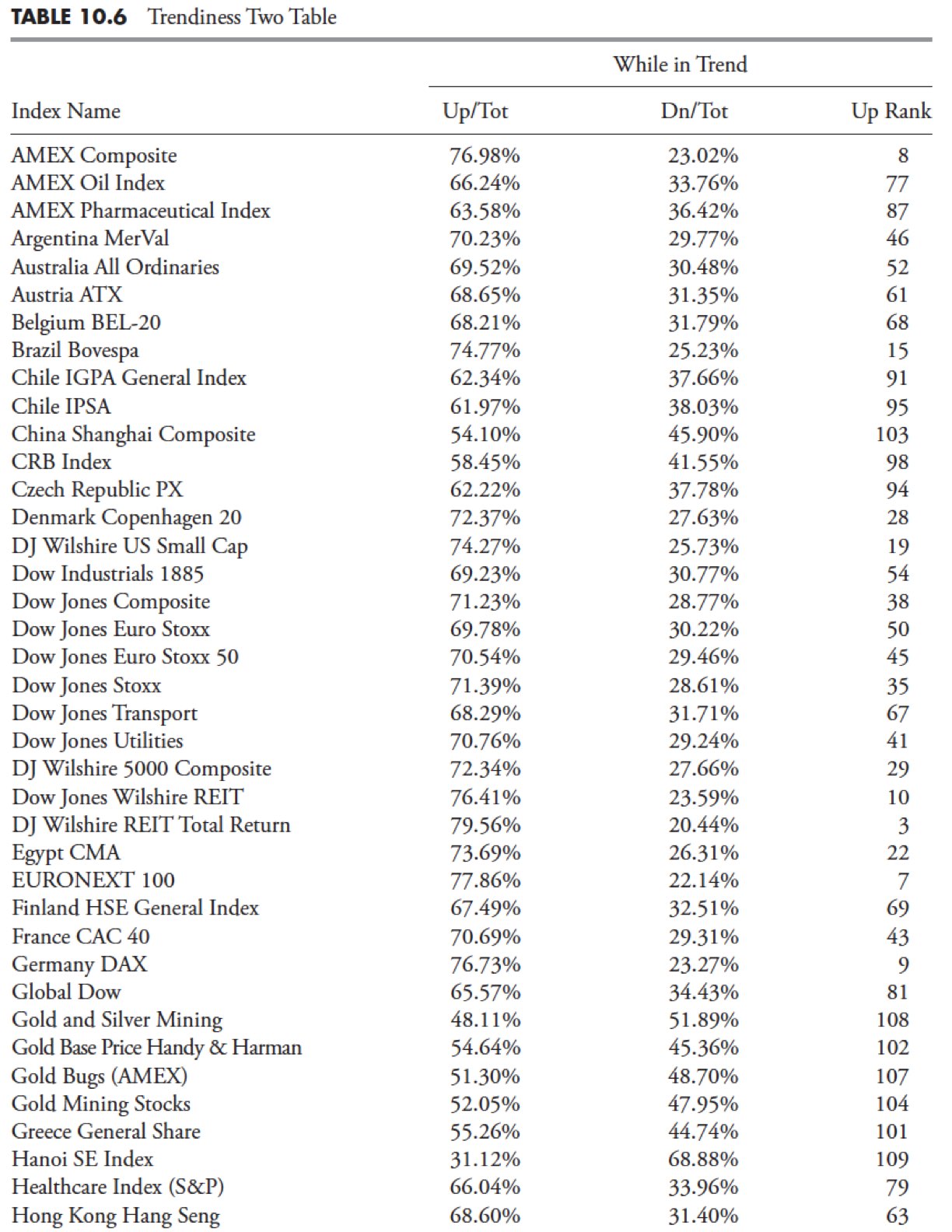

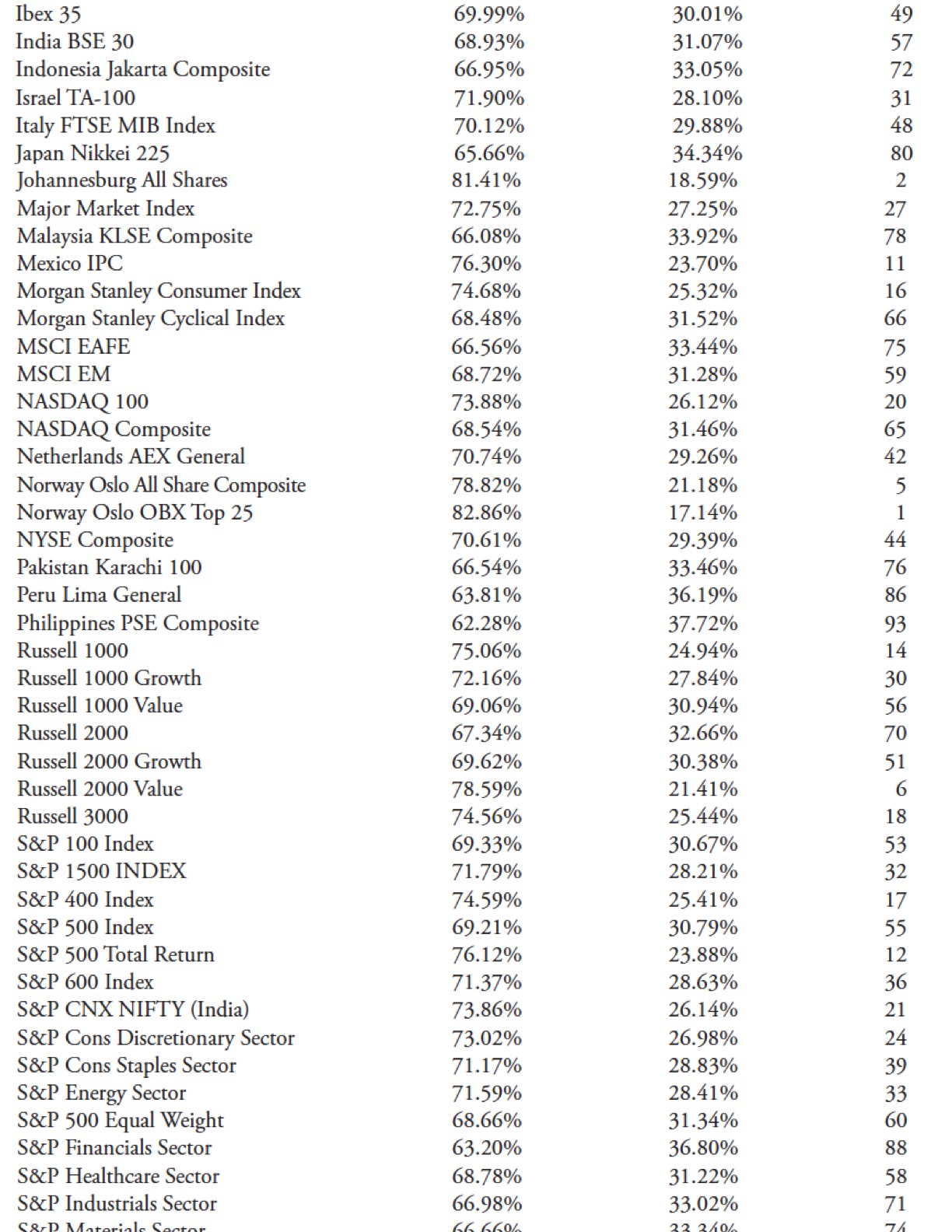

The second technique of pattern dedication makes use of the uncooked knowledge averages. For instance, the up worth is calculated through the use of the uncooked knowledge up common in comparison with the uncooked knowledge complete common, which subsequently means it solely is utilizing the quantity of information that’s trending and never the total knowledge set of the sequence. This manner, the outcomes are dealing solely with the trending portion of the index, and if you concentrate on it, when the minimal pattern size is excessive and the filtered wave is low, there may not be that a lot trending. Desk 10.5 reveals the column headers adopted by their definitions.

Up. That is the common of the uncooked knowledge Up Traits as a share of the Complete Traits.

Down. That is the common of the uncooked knowledge Down Traits as a share of the Complete Traits.

Up rank. That is the numerical rating of the Up column, with the most important worth equal to a rank of 1.

Desk 10.6 reveals the outcomes utilizing Trendiness Two methodology.

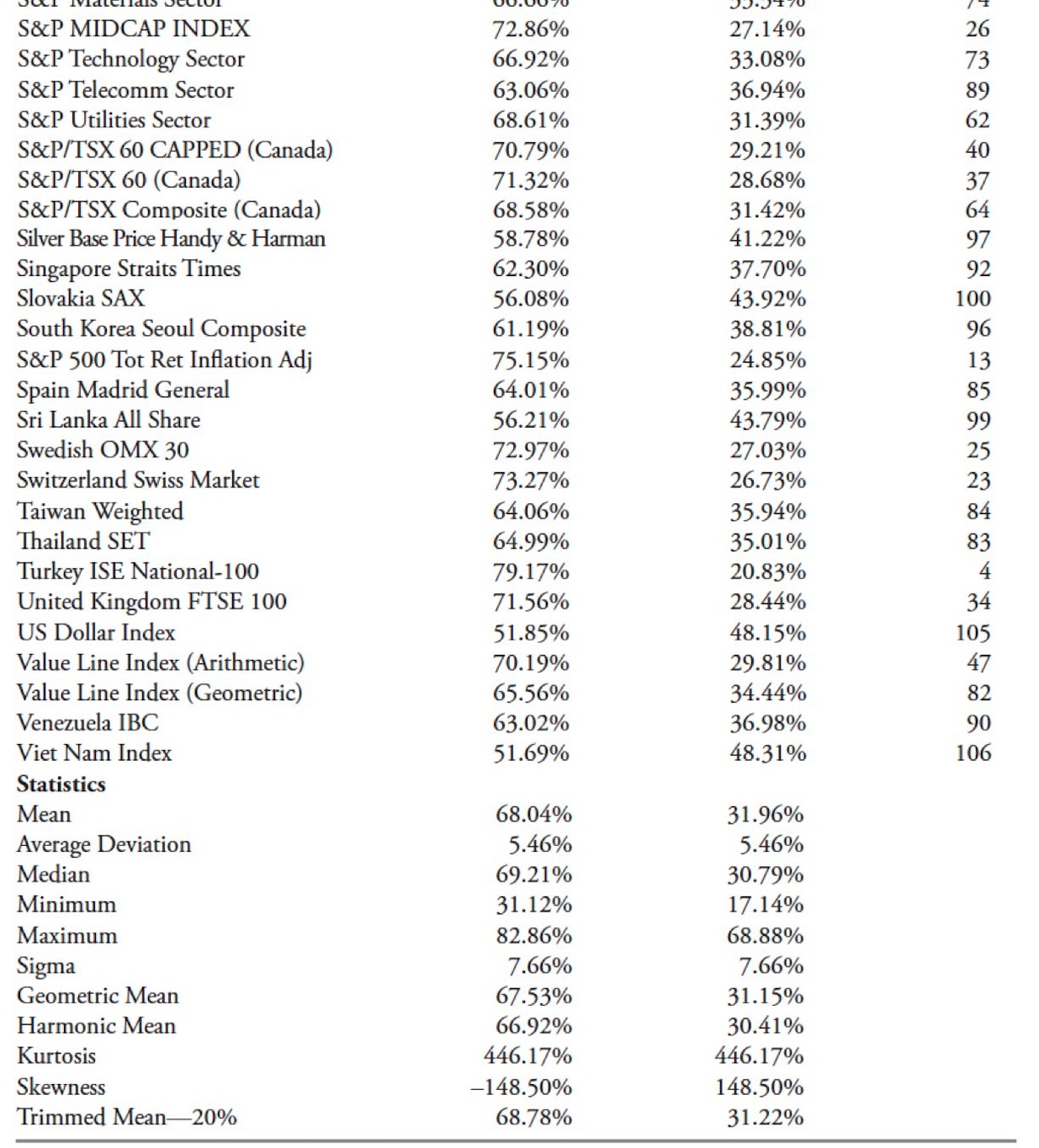

Comparability of the Two Trendiness Strategies

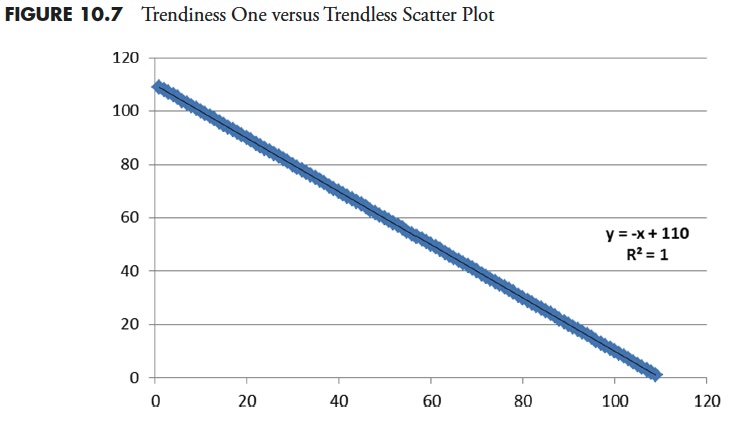

Determine 10.6 compares the rankings utilizing each “Trendiness” strategies. Take note we’re solely utilizing uptrends, downtrends, and a by-product of them, which is up over down ratio. The plot beneath is informally referred to as a scatter plot and offers with the relationships between two units of paired knowledge.

The equation of the regression line is from highschool geometry and follows the expression: y = mx + b, the place m is the slope and b is the y-intercept (the place it crosses the y axis); x is named the impartial variable or the predictor variable and y is the dependent variable or response variable. The expression that defines the regression (linear least squares) reveals that the slope of the road (m) is 0.8904. The road crosses the y (vertical) axis at 6.027, which is b. R^2, which is also called the coefficient of dedication, is 0.7928. From R^2, we will simply see that the correlation R is 0.8904 (sq. root of R^2). We all know it is a extremely optimistic correlation as a result of we will visually confirm it merely from the orientation of the slope. We are able to interpret m as the worth of y when x is zero and we will interpret b as the quantity that y will increase when x will increase by one. From all of this, one can decide the quantity that one variable influences the opposite.

Sorry, I beat this to demise; you possibly can in all probability discover less complicated explanations in a highschool statistics textbook.

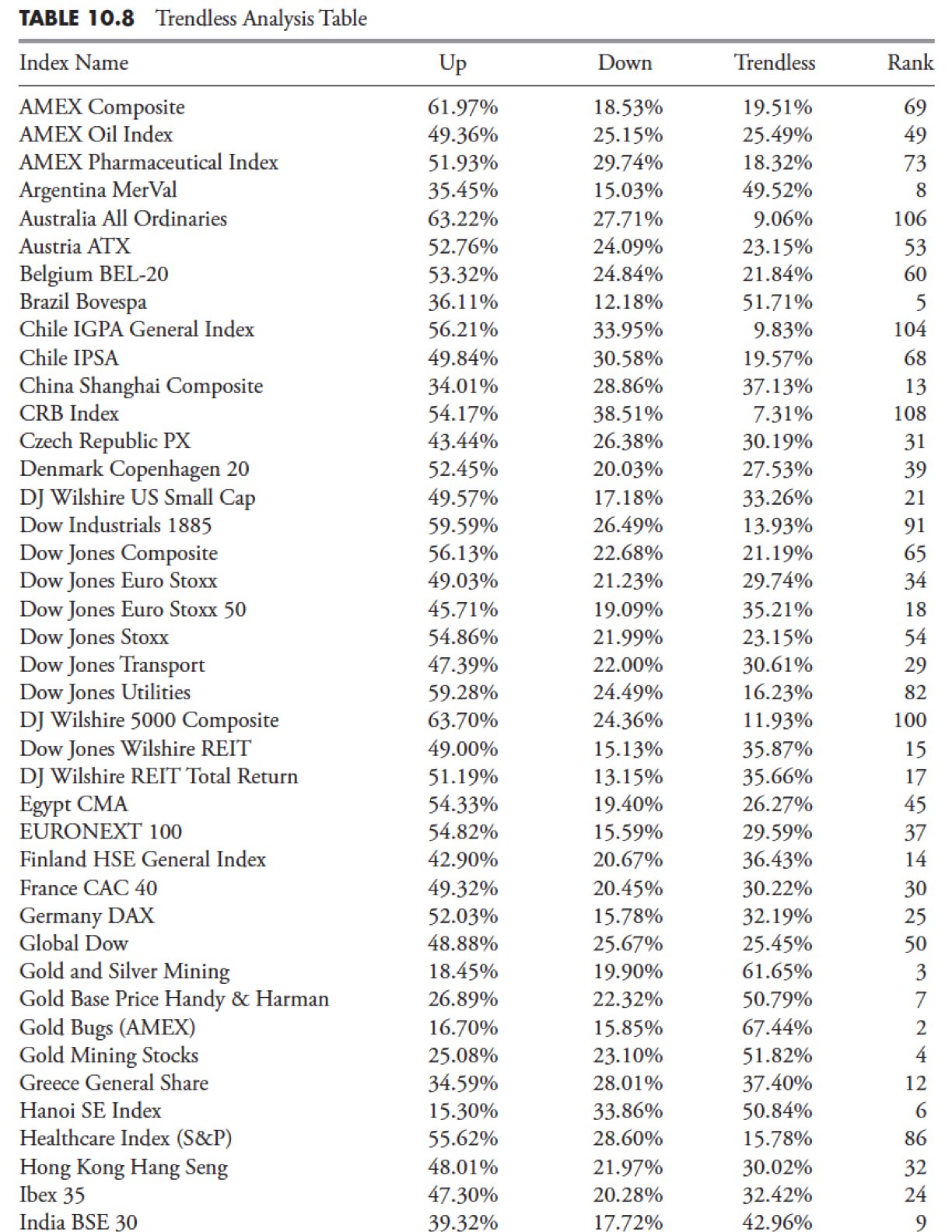

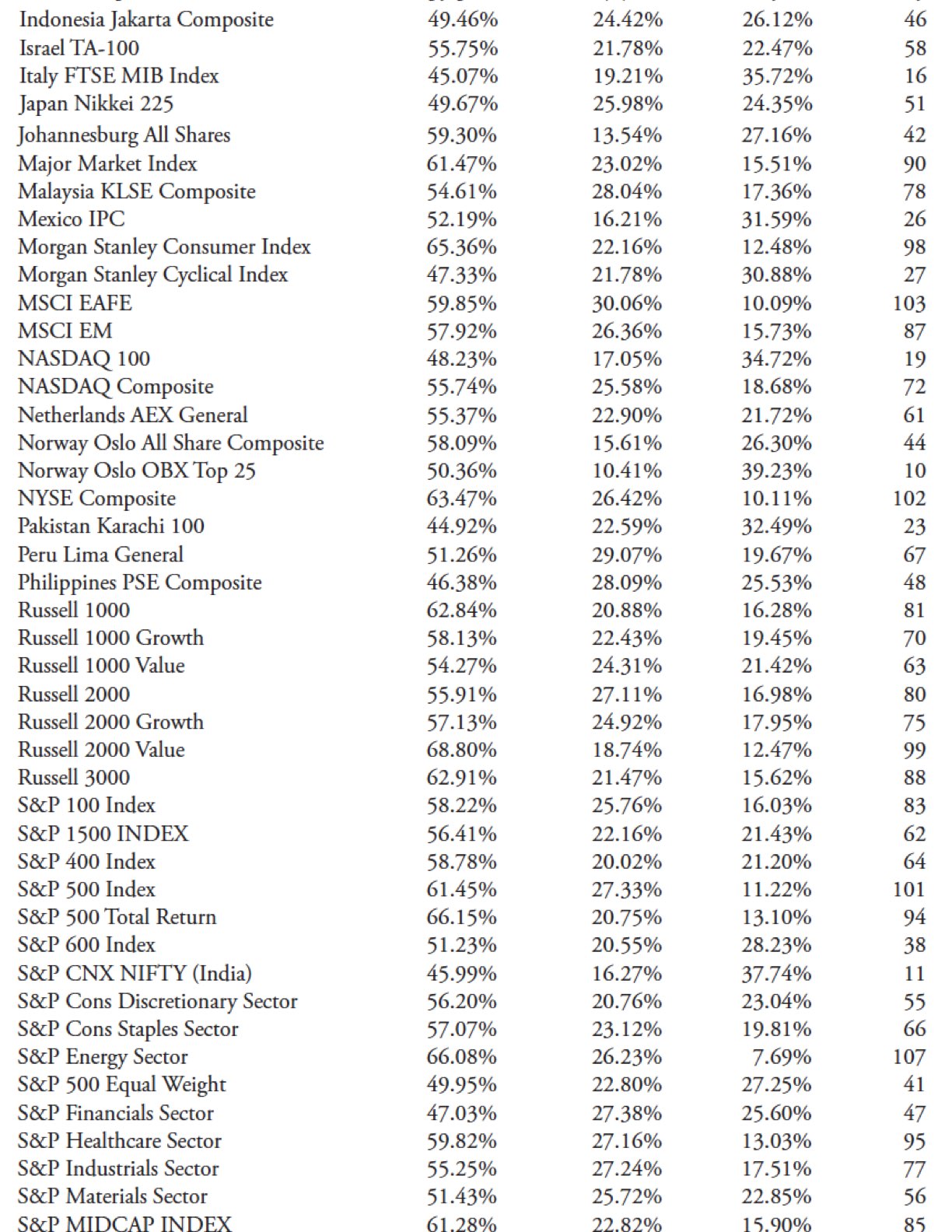

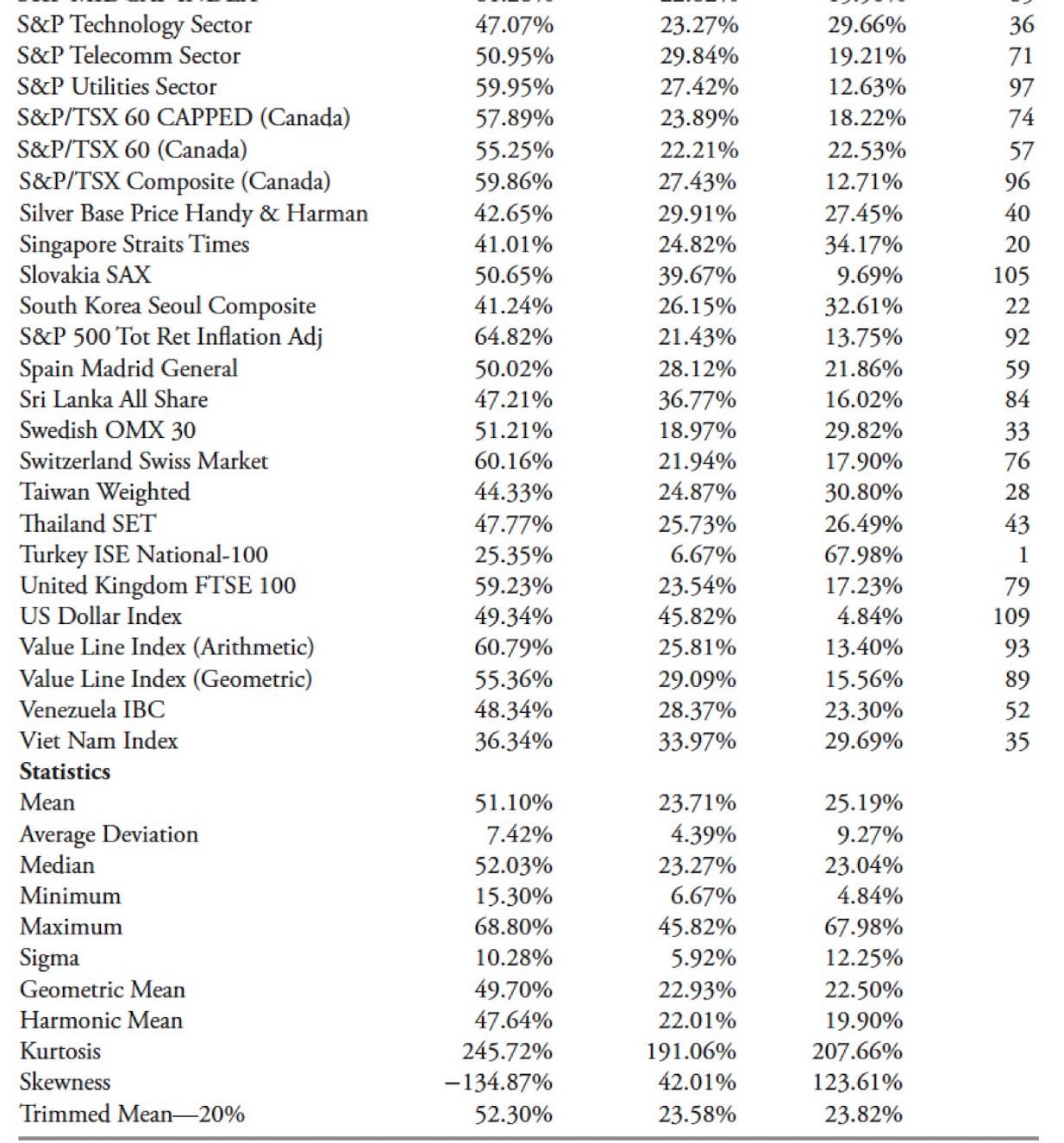

Trendless Evaluation

It is a relatively easy however complementary (intentional spelling) technique that helps to validate the opposite two processes. This technique focuses on the dearth of a pattern, or the quantity of trendless time that’s within the knowledge. The primary two strategies centered on trending, and this one is concentrated on nontrending, all utilizing the identical uncooked knowledge. Figuring out markets that don’t pattern will serve two functions. One is to not use standard trend-following strategies on them, and the opposite is that it may be good for imply reversion evaluation. Desk 10.7 reveals the column headers; the definitions comply with.

Up. That is the Complete Development common from Trendiness One multiplied by the Up Complete from Trendiness Two.

Down. That is the Complete Development common from Trendiness One multiplied by the Down Complete from Trendiness Two.

Trendless. That is the complement of the sum of the Up and Down values (1 – (Up + Down)).

Rank. That is the numerical rank of the Trendless column with the most important worth equal to a rank of 1.

Desk 10.8 reveals the outcomes utilizing the Trendless methodology.

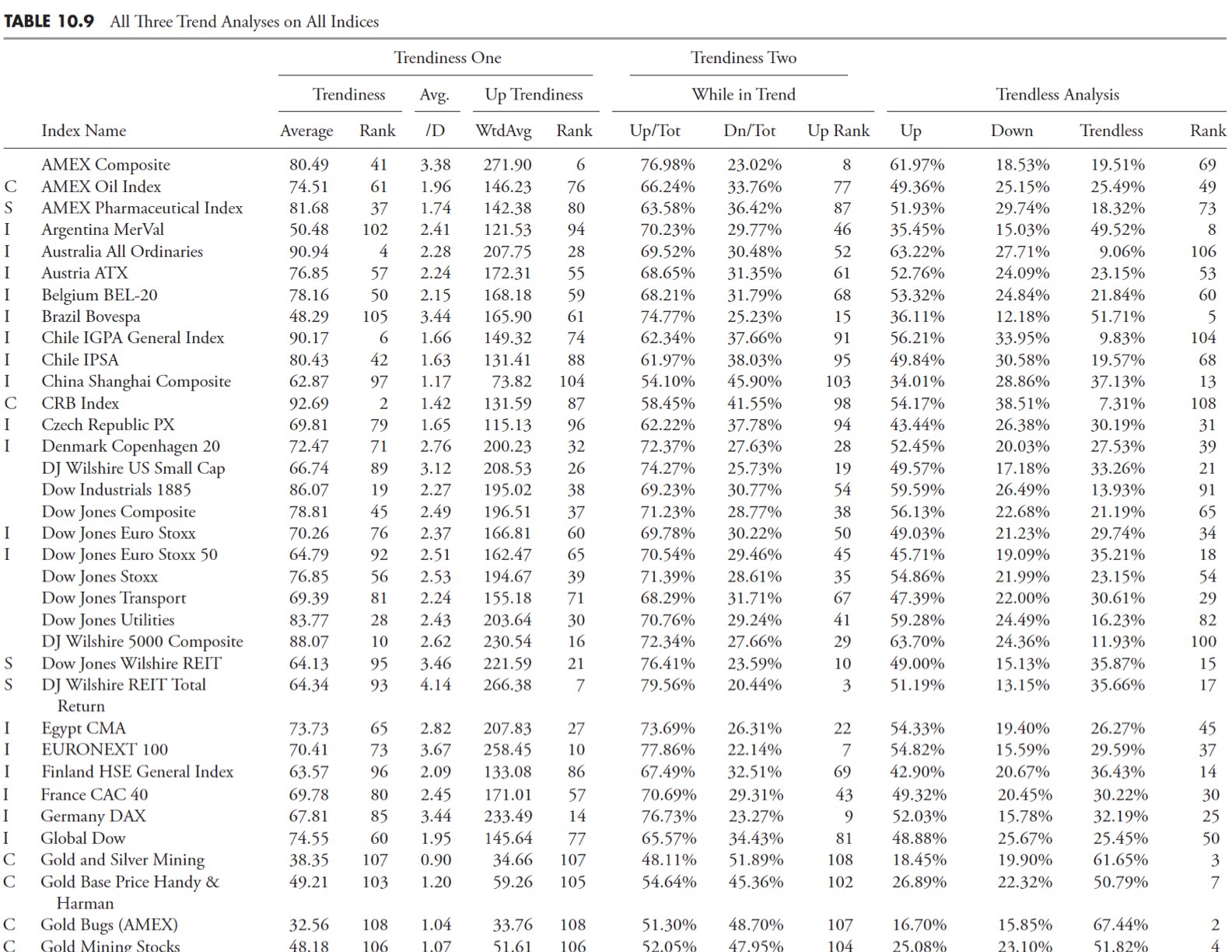

Comparability of Trendiness One Rank and Trendless Rank

Though I believe this was fairly apparent, Determine 10.7 reveals the evaluation math is constant and acceptable. These two sequence ought to basically be inversely correlated, and they’re with coefficient of dedication equal to at least one.

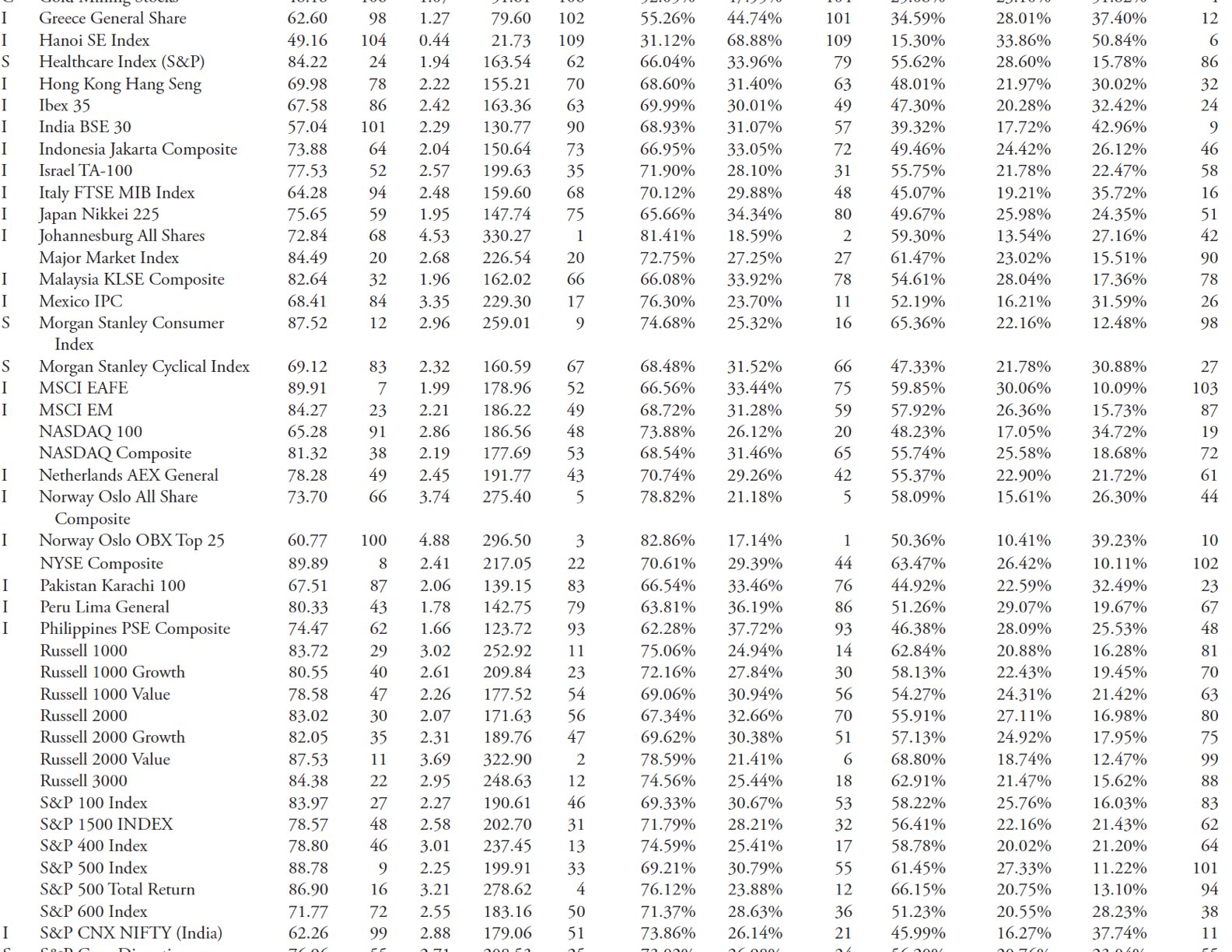

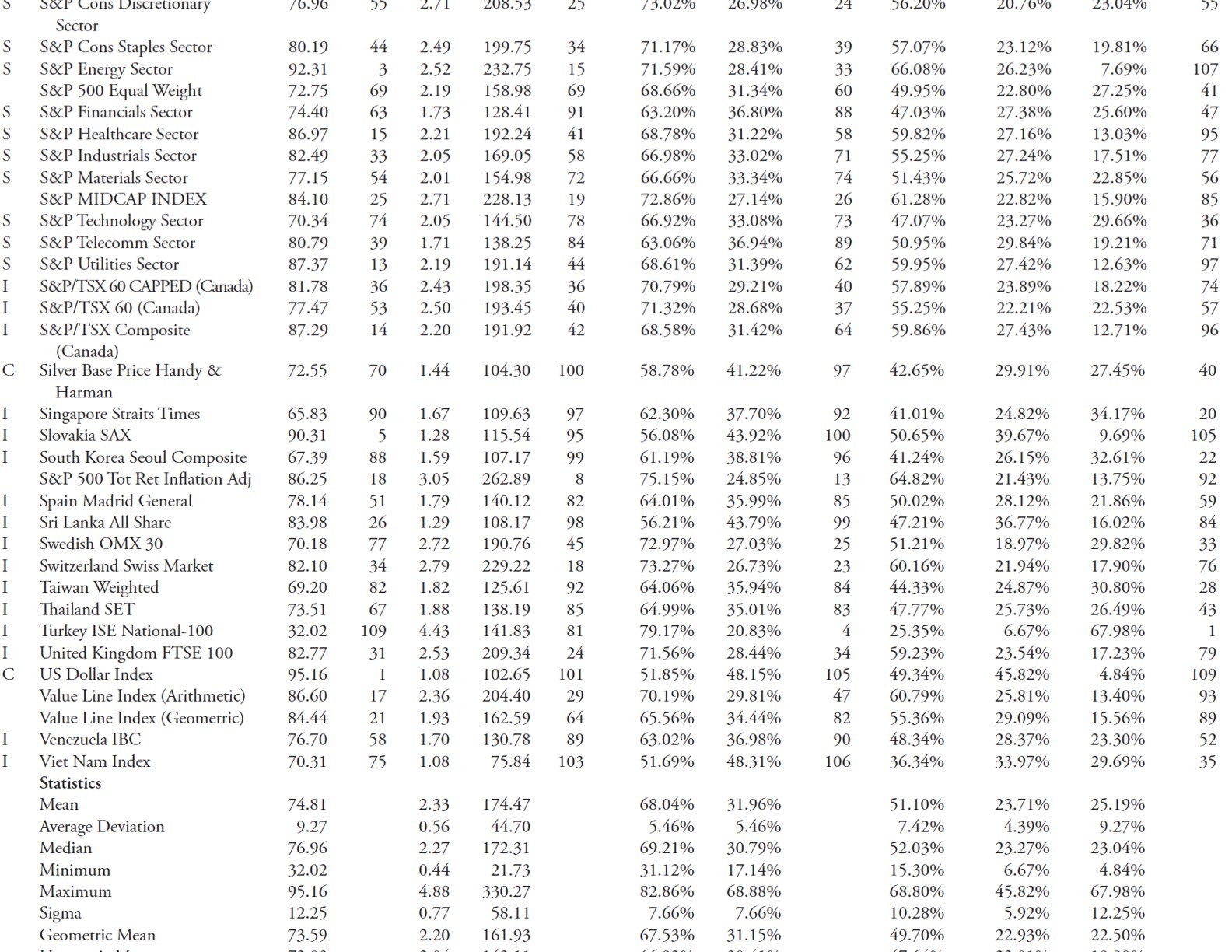

The next tables take the information from the total 109 indices and subdivide it into sectors, worldwide, home, and time frames to make sure there may be robustness throughout quite a lot of knowledge. There are numerous indices that seem in a lot of, if not most of, these tables, however holding knowledge of that kind for comparability with others that aren’t so broadly diversified will improve the analysis.

These tables present all three pattern technique outcomes. This primary desk consists of all of the index knowledge. The remaining ones comprise subsets of the All desk, corresponding to Home, Worldwide, Commodities, Sectors, Information > 2000, Information > 1990, and Information > 1980. The rationale for the information subsets is to make sure there’s a strong evaluation in place throughout varied lengths of information, which suggests a number of bull-and-bear cyclical markets are thought of along with secular markets. The Information > 2000 signifies that the information begins someday previous to 2000 and subsequently completely incorporates the secular bear market that started in 2000.

All Trendiness Evaluation

Desk 10.9 incorporates knowledge from the entire 109 indices within the evaluation. The primary column incorporates letters figuring out the subcategory for every difficulty as follows:

I – Worldwide

S – Sector

C – Commodity

Clean – Home

Development Desk Selective Evaluation

On this part, I’ll exhibit extra particulars on chosen points from Desk 10.9 to indicate how the information may be utilized.

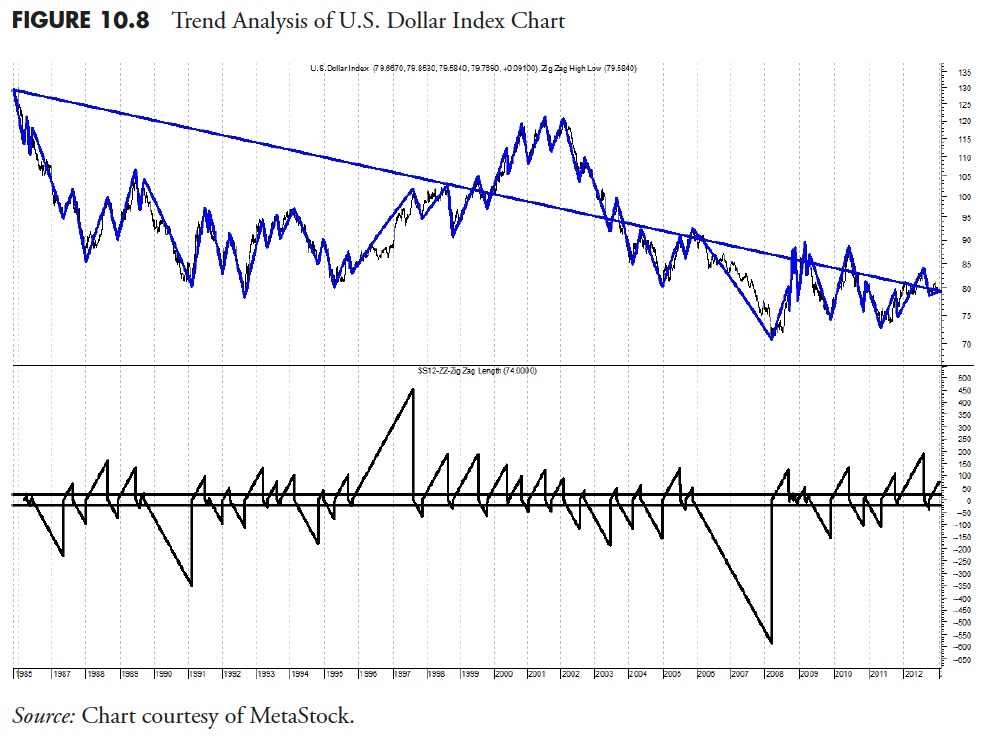

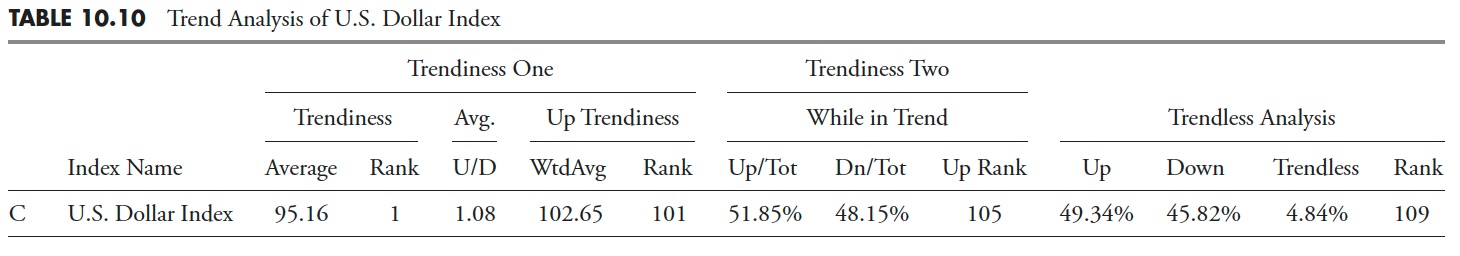

Utilizing the Trendiness One Rank, you possibly can see that the U.S. Greenback Index is primary. You may as well see it’s the worst for being Trendless (final column), which one would anticipate. Nevertheless, when you take a look at the Trendiness One and Trendiness Two Up Ranks, you see that it didn’t rank nicely. This will solely be interpreted that the U.S. Greenback Index is an efficient downtrending difficulty, however not an excellent uptrending one primarily based on this relative evaluation with 109 varied indices. That is made clear from the lengthy trendline drawn from the primary knowledge level to the final knowledge level and is clearly in a downtrend.

Determine 10.8 reveals the U.S. Greenback Index with a 5% filtered wave overlaid on it. The decrease plot reveals the filtered wave of 5% measuring the variety of days throughout every up and down transfer. The 2 horizontal strains are at +21 and -21, which signifies that actions inside that band aren’t counted within the trendiness or trendless calculations. The one distinction between what this chart reveals and what the desk knowledge measures is the truth that the desk is averaging numerous completely different filtered waves and pattern lengths.

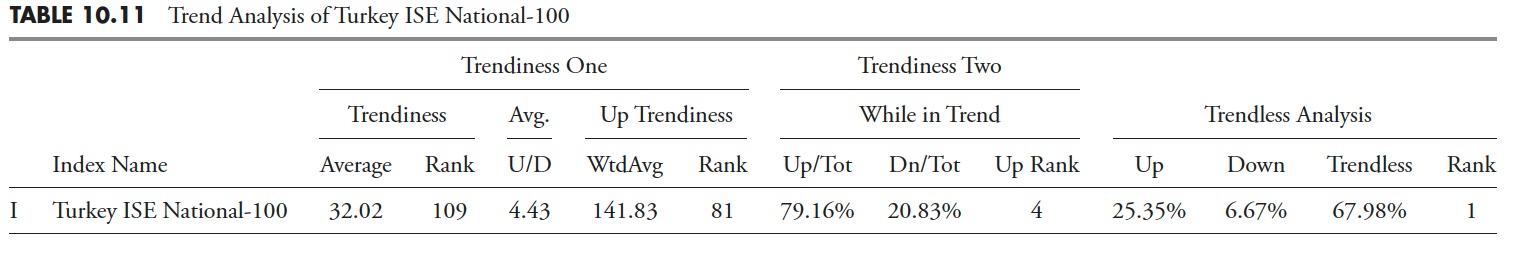

Let’s now take a look at the worst trendiness index and see what we will discover out about it (Desk 10.9). The Trendiness One rank and the Trendless Rank affirm that this isn’t an excellent trending index. Moreover, the Up Trendiness in each One and Two additionally reveals that it ranks low (109 and 81) within the Trendiness One, which is measuring the trendiness primarily based on all the information, and that the rank in Trendiness Two is excessive (4). Do not forget that Trendiness Two solely appears to be like on the trending knowledge, not the entire knowledge. Due to this fact, you possibly can say that this index when in a trending mode, tends to pattern up nicely, however the issue is that it’s not in a trending mode typically (see Desk 10.11).

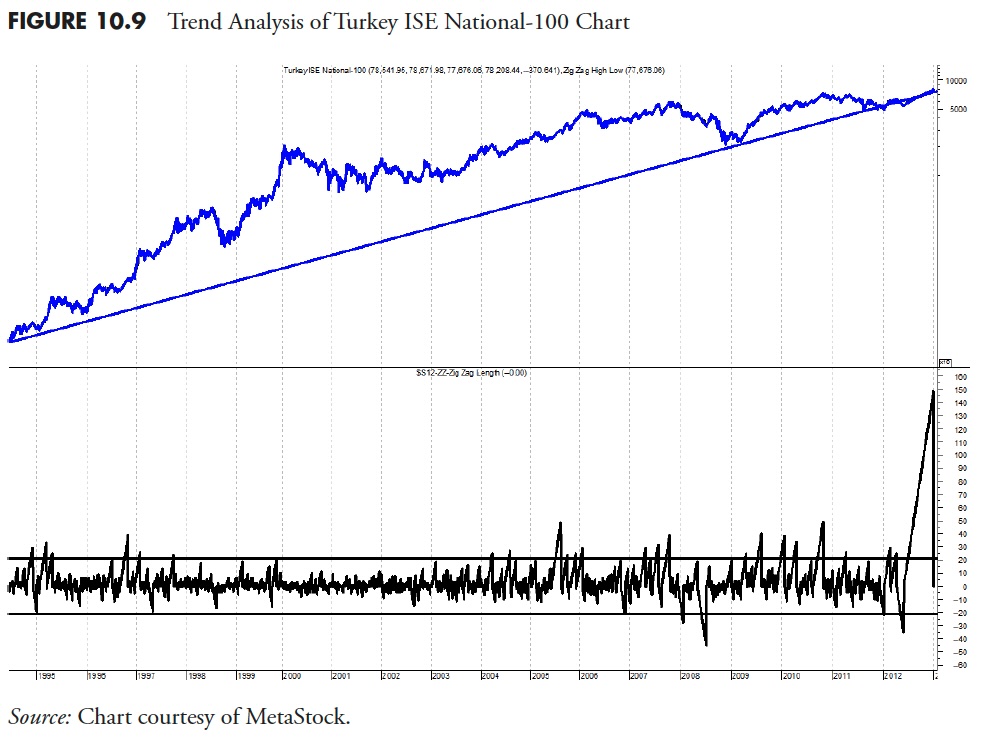

Determine 10.9 reveals the Turkey ISE Nationwide-100 index with the identical format as the sooner evaluation. Discover that it’s usually in an uptrend primarily based on the long-term pattern line. From the underside plot, you possibly can see that there’s little or no motion of traits exterior of the +21 and -21 day bands. Backside line is that this index does not pattern nicely, and is sort of unstable in its value actions; in case you are pattern follower; do not waste your time with this one. A query that may come up is that it’s also clear from the highest plot that it’s in an uptrend, so when you used a bigger filtered wave and/or completely different pattern size, it would yield completely different outcomes. My response to that’s merely: in fact it would, you possibly can match the evaluation to get any outcomes you need, particularly with all this excellent hindsight. Unhealthy strategy to profitable pattern following.

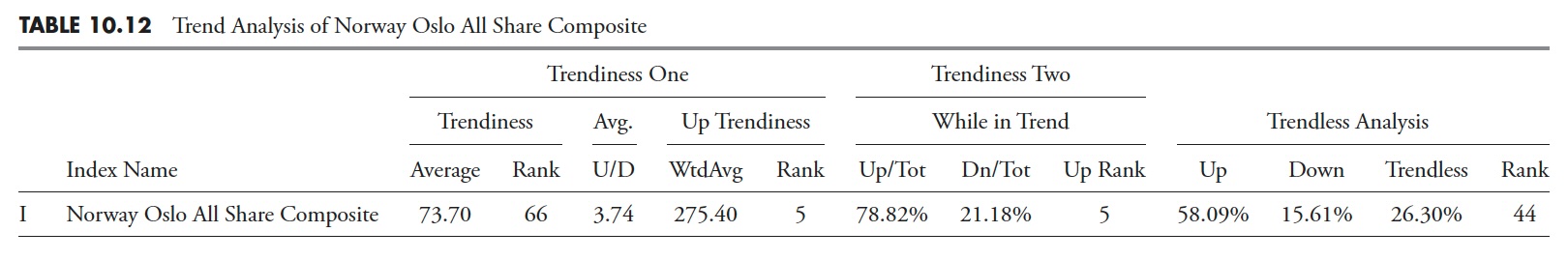

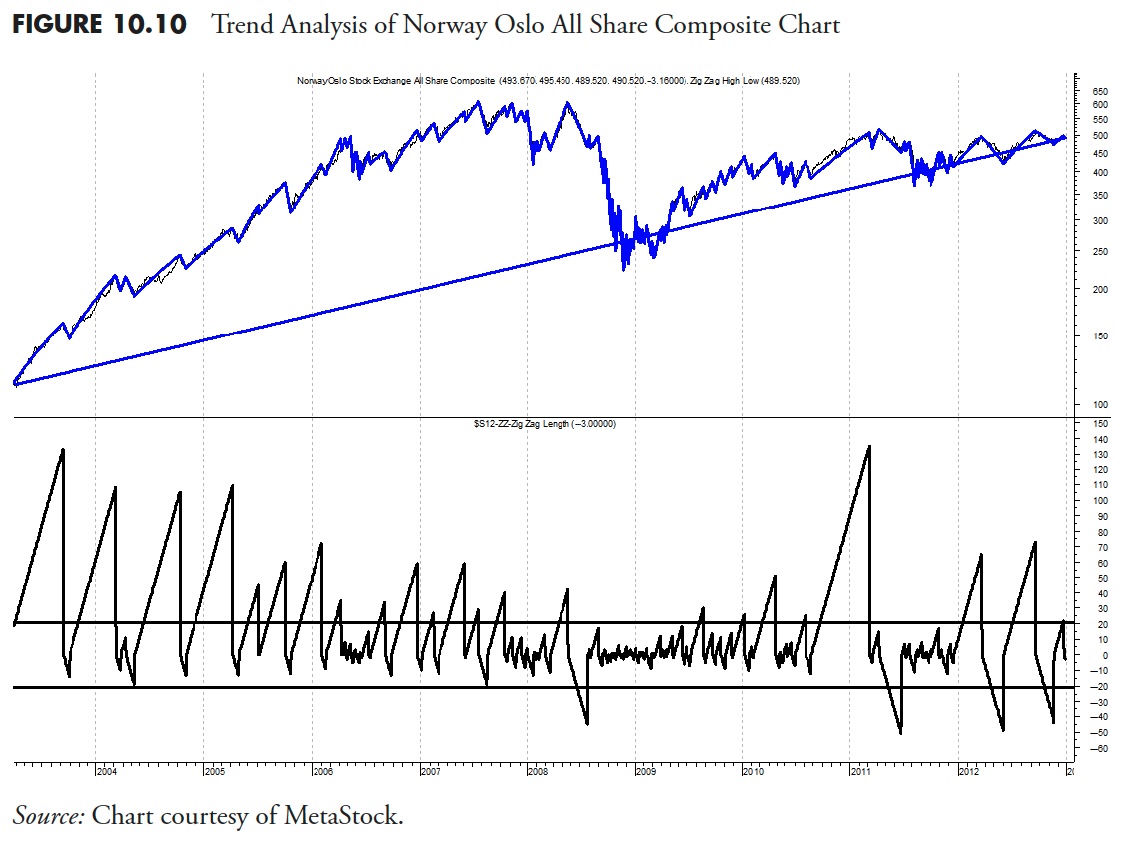

Utilizing the identical knowledge desk, let’s take a look at an index that ranks excessive within the uptrend rankings (Desk 10.9). From the desk it ranks as center of the highway comparatively primarily based on Trendiness One and Trendless rank. Nevertheless, the rank for Up Trendiness One and Trendiness Two Up rank is excessive (each are 5). Which means that many of the trendiness is to the upside with solely reasonable downtrends (see Desk 10.12).

Determine 10.10 reveals the Norway Oslo Index clearly in an uptrend. The underside plot reveals that many of the spikes of pattern size are above the +21 band stage and only a few are beneath the .21 band stage. This confirms the information within the desk.

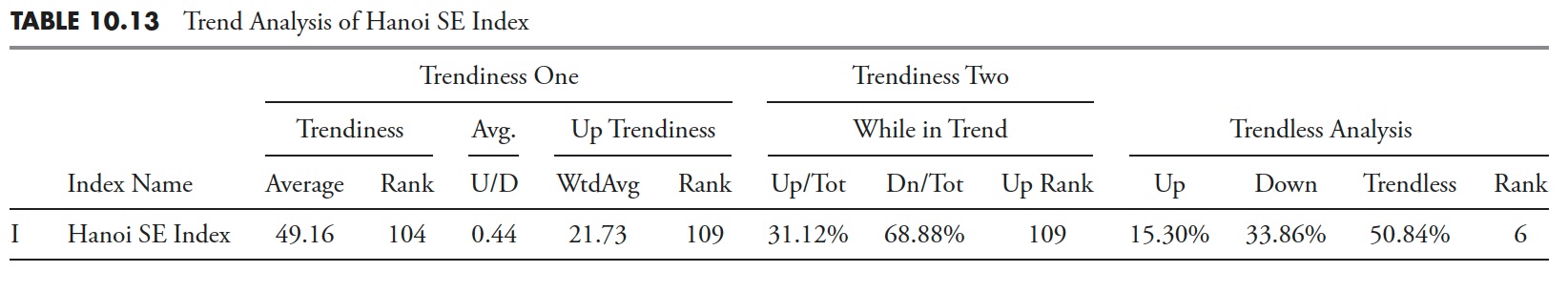

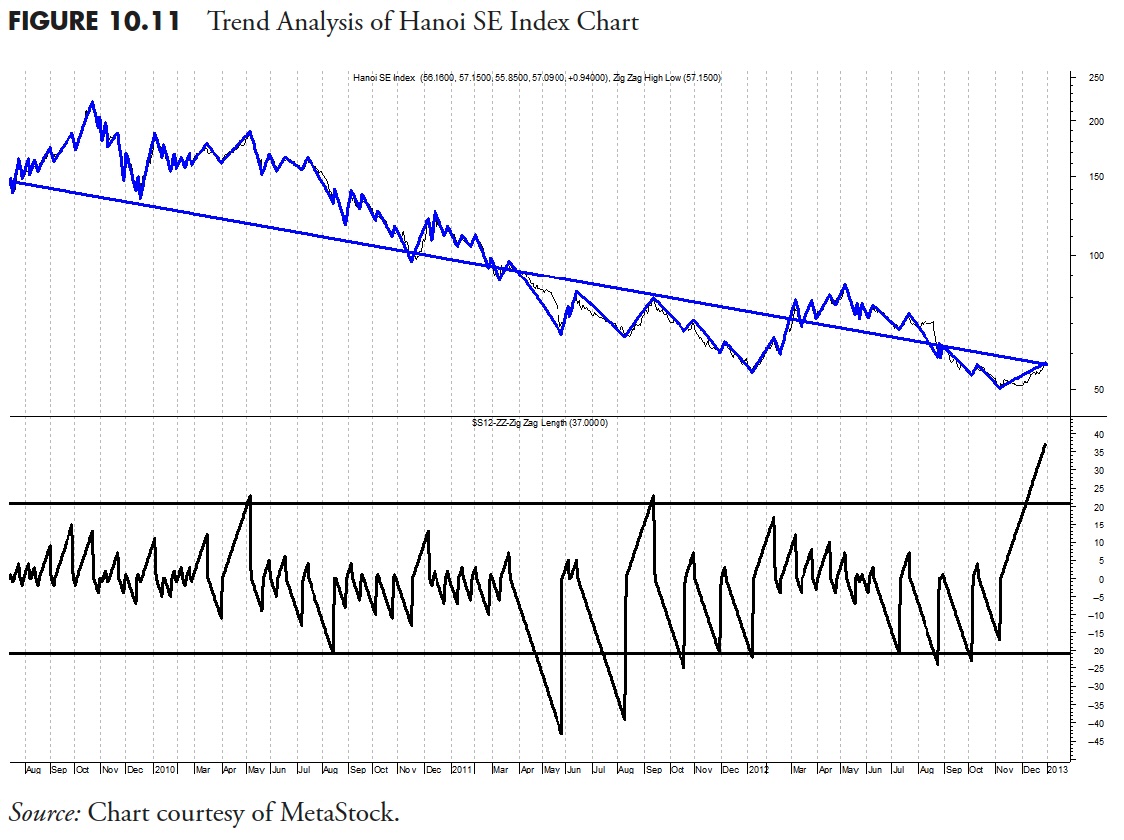

As a way to carry this evaluation to fruition, let’s take a look at the index with the worst uptrend rank (Desk 10.9). From the desk, the Trendiness One and Two Up ranks are lifeless final (109). The Trendiness One general rank is 104, which is sort of final, and the trendless rank is 6, which confirms that knowledge (see Desk 10.13).

Determine 10.11 reveals that the Hanoi SE Index is clearly in a downtrend; nevertheless, the underside plot reveals that only a few traits are exterior the bands. And those that transfer nicely exterior the bands are the downtrends. As earlier than, one can change the evaluation and get desired outcomes, however that’s not the way it must be carried out. One notice, nevertheless, is that this index doesn’t have quite a lot of knowledge in comparison with many of the others and this must be a consideration within the general evaluation.

Thanks for studying this far. I intend to publish one article on this sequence each week. Cannot wait? The guide is on the market right here.