This tutorial applies to the EA ‘ MACD Buying and selling’ whose product web page is accessible by clicking on the picture under:

This product permits you to obtain alerts and/or place orders in accordance with your MACD technique. The primary benefits of this EA are:

- It contains extra filters (transferring common, RSI and Pivot Factors filters).

- It has a whole administration of orders (break even, trailing cease, closing earlier than weekend, max misplaced or win / day …).

- It may possibly work with all market watch symbols directly.

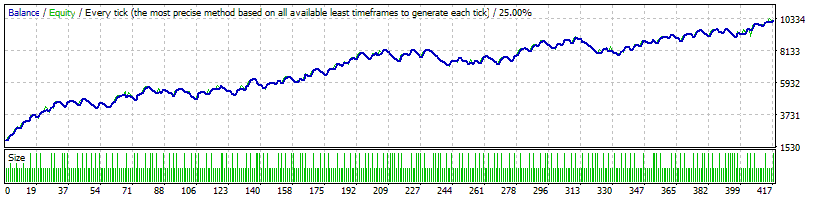

Under is the backtest of this EA for EURUSD (default settings) from 01/01/2020:

Detailed options are described on the product web page. Under is the listing of EA settings with explanations.

-====Basic settings====-

Symbols: symbols for alerts & buying and selling (all or image on the chart)

There are a number of prospects to decide on which symbols must be scanned:

– ‘Solely image on the chart’ : it is best to use this selection for backtests or if you wish to apply the bot on the chart image ;

– ‘All main foreign exchange pairs’ : the bot will scan all 28 main foreign exchange pairs (EUR/USD/GBP/CHF/AUD/NZD/JPY) ;

– ‘Market watch’ : the bot will scan all market watch symbols ;

– ‘Solely symbols listed under’ : solely symbols listed within the area under might be scanned

Symbols to scan or exclude: write right here symbols to scan (‘Solely symbols listed under’ mode) or to exclude (‘All main foreign exchange pairs’ and ‘Market watch’ mode)

Dealer prefix (if needed): just for brokers who use prefixes. For instance, sort m for mEURUSD

Dealer suffix (if needed): just for brokers who use prefixes. For instance, sort m for EURUSDm

If a number of symbols should be entered on this area, they should be separated by commas

Use Timer: outline buying and selling days and hours

Orders will solely be opened on buying and selling days. Nonetheless, orders could be closed/modified even exterior of the established time if a minimum of one of many following parameters is enabled:

– ‘Max % misplaced/day’ ;

– ‘Max % win/day’ ;

– ‘Shut earlier than weekend’ ;

– ‘Shut on reverse crossing’ ;

– ‘Shut order if worth closes above/under a Ma’ ;

– ‘Break even’ ;

– ‘Trailing cease’.

Monday: alerts & buying and selling on Mondays

Tuesday: alerts & buying and selling on Tuesdays

Wednesday: alerts & buying and selling on Wednesdays

Thursday: alerts & buying and selling on Thursdays

Friday: alerts & buying and selling on Fridays

Saturday (crypto): alerts & buying and selling on Saturday (typically for crypto buying and selling)

Sunday (crypto): alerts & buying and selling on Sunday (typically for crypto buying and selling)

Begin time: begin of the session

Finish time: finish of the session

Indicators alerts: terminal and/or smartphone notifs

Buying and selling alerts: terminal and/or smartphone notifs

-====MACD settings====-

MACD Technique: the MACD technique used to obtain alerts and/or place orders

In the intervening time, 2 methods can be found with the EA. Different methods might be applied primarily based on buyer requests. The two methods are as follows:

– MACD crosses sign line:

-> Shopping for situation: the principle MACD line is under the zero line and it crosses the MACD sign line from backside to high

-> Promoting situation: the principle MACD line is above the zero line and it crosses the MACD sign line from high to backside

– MACD crosses zero:

-> Shopping for situation: the principle MACD line crosses the zero line from backside to high

-> Promoting situation: the principle MACD line crosses the zero line from high to backside

Various purchase and promote orders: avoids putting 2 consecutive purchase orders or 2 consecutive promote orders

Timeframe: all MT4 timeframes

Warning! If you wish to use the timeframe of the chart, use the worth “CURRENT”!

In case you use one other worth, the present chart timeframe is not going to have an effect on the MACD calculation.

Quick interval of the MACD: interval for quick common calculation

Sluggish interval of the MACD: interval for gradual common calculation

Sign interval: interval of the MACD sign

MACD utilized worth: CLOSE / OPEN / HIGH / LOW / MEDIAN / TYPICAL / WEIGHTED

-====Filters settings====-

-=Shifting common settings=-

Use a MA: checks if worth is above (purchase sign) or under (promote sign) this MA

Ma timeframe: all MT4 timeframes

Ma interval: interval of the MA

Ma technique: SMA / EMA / SMMA / LWMA

Ma utilized worth: CLOSE / OPEN / HIGH / LOW / MEDIAN / TYPICAL / WEIGHTED

Ma shift: shift of the MA

-=RSI settings=-

Use RSI: checks RSI worth earlier than opening an order

RSI Timeframe: all MT4 timeframes

RSI interval: interval of the RSI filter

RSI utilized worth: CLOSE / OPEN / HIGH / LOW / MEDIAN / TYPICAL / WEIGHTED

RSI shift: shift of the RSI filter

Min RSI worth for a purchase order: purchase order is opened if RSI > this worth

Max RSI worth for a promote order: promote order is opened if RSI < this worth

-=Pivot factors settings=-

Day by day PP: checks if worth is above (purchase sign) or under (promote sign) day by day PP

Weekly PP: checks if worth is above (purchase sign) or under (promote sign) weekly PP

Month-to-month PP: an identical to the earlier parameter for month-to-month PP

Notice: the extra filters applied, the less orders might be opened. In case you discover that there aren’t sufficient open orders, strive disabling some filters.

-====Buying and selling settings====-

-=Basic settings=-

Permit buying and selling: if false, solely alerts are operational

Magic quantity: should be distinctive if different EA are operating

‘Max open orders’, ‘Max % misplaced/day’ and ‘Max % win/day’ are calculated from the magic quantity. For instance, when you’ve got 3 EAs with the identical magic quantity, the entire variety of orders opened would be the sum of the orders opened in these 3 EAs.

Max open orders: max variety of orders opened concurrently (if 0, no max)

Max % misplaced/day: if max worth is reached, the EA open orders are closed and no different order is opened till the subsequent day (if 0, no max)

The calculation is predicated on account steadiness + open orders advantages. With a purpose to velocity up the backtests, the calculation is finished each hour throughout backtests, as a substitute of each minute for an actual buying and selling session.

Max % win/day: if max worth is reached, the EA open orders are closed and no different order is opened till the subsequent day (if 0, no max)

Identical comment than for ‘Max % win/day’.

Max drawdown (in % of fairness): if max worth is reached, the EA open orders are closed and the EA is closed (if 0, no max)

Identical comment than for ‘Max % win/day’, however the calculation is finished each 5 minutes (for backtests and actual buying and selling classes).

Shut earlier than weekend: shut all EA orders on Friday

Closing time earlier than weekend: if ‘Shut earlier than weekend’ is ‘true’

Use cash administration: if ‘true’, lot measurement in % steadiness

Fastened heaps measurement: lot measurement per order (if ‘Use cash administration’ is ‘false’)

Lot measurement in %: % steadiness per order (if ‘Use cash administration’ is ‘true’)

Max unfold: max allowed unfold to open an order (if 0, no max unfold)

Warning: if the worth of the unfold is just too low, no order might be opened! To keep away from any downside, it is suggested to set the worth ‘0’ for the backtests.

Max slippage: max allowed slippage to open an order

Identical comment as ‘Max unfold’.

-=SL & TP settings=-

SL in pips, factors…: cease loss x pips above/under present worth in ‘regular SL’ mode and above/under the chosen Ma in ‘Ma SL’ mode

TP in pips, factors…: take revenue x pips above/under the present worth on the opening of the order whatever the ‘SL mode’ chosen

-=BE/TS/Grid settings=-

Break even: if ‘true’, break even is activated

Break even revenue in pips, factors…: triggers the break even from a sure revenue in pips, factors…

Trailing cease: if ‘true’, trailing cease is activated

Path revenue in pips, factors…: triggers the trailing cease from a sure revenue in pips, factors…

Path distance in pips, factors…: distance in pips, factors… between trailing cease and worth

Path step in pips, factors…: step in pips, factors… for the trailing cease

Open extra orders: an extra order is opened every time the revenue reaches a step

Max extra orders (by image) : ‘Open extra orders’ should be ‘true’

It’s higher to have smaller heaps than for most important orders.

It’s higher to have smaller heaps than for most important orders.

Revenue step in pips, factors… to open an extra order: every time the revenue reaches this step, a brand new order is opened

SL in pips, factors… of extra orders: SL in pips, factors… of the extra orders

TP in pips, factors… of extra orders: TP in pips, factors… of the extra orders

- Earlier than utilizing the ‘All main foreign exchange pairs’ mode, confirm that the 28 main foreign money pairs are current within the “Market Watch” tab of MT4.

- It is suggested to make use of multi-symbol mode for alerts solely. When a worthwhile technique is discovered on an emblem, it’s higher to use it in ‘only_symbol_on_the_chart’ mode.

- The EA works for all sorts of symbols however in some instances (relying on the dealer), diversifications on SL and TP need to be achieved with sure varieties of symbols (apart from foreign exchange and indices). On this case, settings in pips or factors need to be multiplied by 10 to match the right worth. Instance: for a cease lack of $10 on the Oil image the ‘SL in pips, factors…’ parameter should take the worth 100 and never 10 (x10). Checks could be carried out in backtest to search out the fitting worth.

Main foreign exchange pairs :

EURUSD / GBPUSD / USDCHF / AUDUSD / USDCAD / USDJPY / NZDUSD

EURGBP / EURCHF / EURAUD / EURCAD / EURJPY / EURNZD

GBPCHF / GBPAUD / GBPCAD / GBPJPY / GBPNZD

AUDCHF / CADCHF / CHFJPY / NZDCHF

AUDCAD / AUDJPY / AUDNZD

CADJPY / NZDCAD

NZDJPY