The best way you worth your accounting companies shouldn’t be arbitrary. The proper accounting pricing technique can successfully imply the distinction between scraping by and strong progress.

If you’re not sure about the best way to set costs that work in your agency, chances are you’ll have to look deeper into pricing psychology and the way different profitable companies make their services extra enticing to prospects who’re greater than prepared to pay for them.

Listed here are widespread pricing methods for accountants and CPAs and suggestions to remember when pricing your companies.

The pricing problem for accounting companies

There are many ways in which accounting companies can proceed when pricing choices. It begins by analyzing every service offered and figuring out its worth to the goal market, maximizing the revenue margin, and remaining aggressive. The advantages of a considerate pricing technique embrace natural progress, stability, and profitability.

As a result of no two shoppers discover the very same worth in accounting companies, many companies provide a menu or bundle pricing. This permits shoppers to decide on the extent of service they need, figuring out what worth they see within the providing. Pricing psychology reveals that shoppers actually need alternative as a result of all of them have particular person needs and wishes. A hierarchy of packages plus custom-made add-ons provides shoppers the data they should perceive how one can greatest assist them.

Widespread pricing methods for accounting companies

Should you’re beginning to consider what pricing technique is sensible in your agency, chances are you’ll think about looking at some widespread pricing constructions different accounting companies use. We’ve rounded up 5 widespread pricing methods and included an summary of among the benefits and drawbacks of every.

1. Value-plus pricing

A fundamental technique for pricing your accounting companies is cost-plus pricing. On this technique, you’re taking what it prices to supply your companies and add a proportion to that quantity to find out how a lot you need to cost shoppers with the intention to make a revenue. Whereas there are benefits of cost-plus pricing, it typically leaves some huge cash on the desk for companies that provide a service slightly than a product.

Benefits

- Easy to implement and straightforward for shoppers to know

- Nonetheless permits for revenue in case your bills are variable

Disadvantages

- Doesn’t take rivals under consideration

- Typically doesn’t seize as a lot worth as shoppers get out of your service

2. Flat-fee pricing

Flat-fee pricing is strictly what it feels like: you cost your shopper a flat price in your companies. Sometimes, your shopper would concentrate on the price to anticipate earlier than you begin any work for them. Flat-fee pricing is totally different from cost-plus pricing in that it doesn’t fluctuate based mostly on what your bills are; it stays fixed irrespective of how a lot time and assets you commit to a venture. This method can work nicely for pricing fundamental or repetitive companies resembling making ready easy tax returns. It doesn’t work as nicely for extra advanced initiatives.

Benefits

- Easy to implement and straightforward for shoppers to know

- You and your shoppers know what to anticipate

Disadvantages

- Rigid

- Doesn’t at all times mirror as a lot worth as shoppers get out of your service

3. Competitors-based pricing

One other technique for pricing your companies is competition-based pricing which entails evaluating your providing to that of your rivals. What are your rivals doing, and what are you able to do to distinguish your self? To face out from the gang you’ll be able to make use of considered one of three modes of competitors:

- Your follow supplies an equal product at a cheaper price than your rivals.

- Your follow can present a greater service or expertise at a worth level equal to your rivals.

- Your follow can present a very superior service or expertise and cost greater than the competitors.

It’s good to pay attention to how your rivals are pricing their companies if for no different cause than so you’ll be able to know the place you fall on this spectrum. Even higher, attempt to be taught from how different accountants are charging for his or her companies. Hold an open thoughts and be ready to vary methods if the change will assist your online business.

Benefits

- Can assist stop dropping out to rivals

- Can assist you market your companies

Disadvantages

- Costs may very well be set too low

- Generally creates a passive mindset towards pricing slightly than proactive

4. Time-based pricing

The time-based pricing method is commonly the default method to pricing for a lot of accounting companies. This long-standing conventional method of billing shoppers requires companies to trace each hour spent on a venture. You then current an inventory of companies carried out together with the hourly fee in your shopper.

Benefits

Disadvantages

- Results in a shock invoice for shoppers on the finish of an engagement

- Doesn’t at all times mirror the worth your agency can provide

5. Valued-based pricing

Worth-based pricing is if you worth your companies based mostly on what your shoppers are prepared to pay, or the worth they understand in your service. Worth-based pricing isn’t all about charging essentially the most, it’s about setting costs based mostly on buyer segments and data you might have in regards to the market.

When you perceive what sort of shoppers are thinking about your companies and know what your rivals cost for a similar companies, you then determine what differentiates your online business. Worth-based pricing is placing a greenback quantity on that differentiation.

Benefits:

- Can enhance shopper loyalty and sentiment if used successfully

- Helps prioritize shoppers

Disadvantages:

- Requires you to know loads about buyer profiles

- Extra advanced to implement

6. Select a pricing technique that matches your values

The best way you cost in your companies should not be an afterthought in the best way you run the remainder of your online business. Let the values and beliefs that information your on a regular basis work inform the best way you construction the charges in your shoppers.

Do you delight your self on being open and clear along with your shoppers? Develop that preferrred right into a price construction that lets the shopper preserve shut monitor of what you’re engaged on and the place they’re spending their cash.

Do you market your agency as a easy, painless accounting resolution? Again that declare up with a easy, no-surprises, flat-fee pricing construction.

Do you’re employed with rich shoppers or giant companies who anticipate an distinctive expertise? Shoppers who anticipate a premium expertise will search for merchandise with a premium price ticket. Set your costs accordingly.

There are numerous different methods you’ll be able to match your pricing construction to your values, every of them distinctive to you and your agency. When completed accurately, it will successfully flip your pricing right into a characteristic that shoppers regard as a bonus slightly than merely a value.

Tricks to keep in mind when pricing your accounting companies

Any worth should mirror worth for the shopper

Worth is what units an accounting agency other than the competitors and that perceived worth influences how a lot shoppers are prepared to pay. The upper the worth, the upper you’ll be able to set your accounting agency’s costs. To shoppers looking for accounting companies, they might place worth in an accountant’s years of expertise, the portfolio of shoppers, business awards, and degree of training. The standard and expertise your accounting agency presents establishes the worth of your service, which can show you how to to set the precise costs.

With regards to setting costs, you’ll be able to’t depend on only one variable. Have a look at quite a few totally different angles, out of your competitors’s costs to the worth of your distinctive companies to your overhead bills, to find your agency’s price. To draw paying shoppers, that you must discover that zone the place shoppers are prepared to pay in your companies, so you’ll be able to generate a powerful buyer base whereas maximizing your revenue.

Take into account worth anchoring

What’s one of the simplest ways to promote a $2,000 watch? Subsequent to a $10,000 watch.

That’s a results of a precept referred to as “anchoring,” and it doesn’t simply apply to watches. Whether or not you notice it or not, you encounter worth anchoring practically each time you store for one thing. It appears to be like like this:

Has anybody ever paid the checklist worth of $28 for this e-book? Not on Amazon. So why trouble displaying it in any respect? The identical cause generic manufacturers are positioned subsequent to costlier identify manufacturers on the grocery retailer and new vehicles are at all times priced “beneath MSRP.” Individuals make buying choices by comparability. Individuals are inclined to measure the worth of a services or products by comparability slightly than by the precise usefulness of the factor.

And that’s the center of worth anchoring. Generally it’s arduous to convey the true worth of a services or products simply by the best way you worth that services or products. Value anchoring provides you a great way to convey that worth by displaying the customer that they’re getting a great deal.

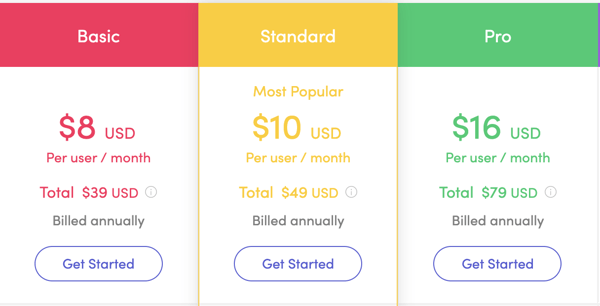

Providing a “discounted worth” isn’t the one (and even greatest) approach to make the most of worth anchoring. Typically the best approach to make use of anchor pricing is to put your commonplace providing subsequent to a number of contrasting choices. Check out Monday’s pricing mannequin for instance of this:

Monday is subtly steering you to the provide they need you to decide on: the Normal plan for $10 monthly. On one finish, $10 doesn’t really feel like a complete lot greater than eight {dollars}, and also you get much more storage and options for the cash. On the opposite finish, the Professional plan consists of a whole lot of options that won’t really feel essential to most customers, so many customers could select to avoid wasting the cash.

This precept interprets nicely to accounting companies. Though you’ll be able to’t do additional taxes for a shopper or incorporate their enterprise twice, you’ll be able to nonetheless design your pricing to make the most of anchor pricing. Along with your commonplace pricing, design some premium pricing packages.

After all, there must be added worth to justify charging the extra worth, however you don’t need to put in double the hours. Add (or lengthen) a guaranty, embrace weekly progress updates over the course of the case, or embrace an in depth report with related forecasts and motion objects. The precise service that units your premium bundle aside isn’t an enormous deal. Keep in mind, the first goal of the premium bundle isn’t to entice individuals to purchase it, however to extra precisely showcase the worth of your commonplace companies.

Select the pricing technique that works in your agency

It’s simple to see how pricing ties in so intently with different points of working a profitable agency. For instance, advertising to potential shoppers should successfully talk your agency’s capability to alleviate their ache factors and showcase how you’ll save them money and time. When your goal market understands the unimaginable worth associated to your agency, they’ll pay for that assurance.

The success of your accounting agency relies upon a lot on implementing a pricing technique that enhances profitability whereas sustaining longevity with out damaging your model. As a substitute of sticking with a secure however short-range pricing technique, develop purposeful costs that may result in extra success.

Wish to see what different accounting companies cost for tax preparation companies? Obtain our 2020 Tax Prep Pricing Information.