Regardless of a worldwide downturn in fintech investments, Singapore’s fintech sector has skilled a big surge in funding for synthetic intelligence (AI) applied sciences.

In accordance with the KPMG Pulse of Fintech H2’23 report, AI fintech funding in Singapore soared to US$333.13 million within the second half of 2023.

This represents a 77 p.c enhance from the US$148.08 million recorded within the first half, culminating in a complete funding of US$481.21 million throughout 24 offers for the yr.

The growth in AI funding has enabled firms to quickly innovate and launch AI-driven merchandise, securing a aggressive edge out there.

Singapore Dominates APAC Fintech Area

Regardless of the worldwide downturn in fintech investments, Singapore’s fintech sector had confirmed exceptional resilience, in line with KPMG Pulse of Fintech H2’23 report.

In 2023, Singapore’s fintech sector raised a complete of US$2.20 billion by way of mergers & acquisitions (M&A), non-public fairness (PE), and enterprise capital (VC) offers.

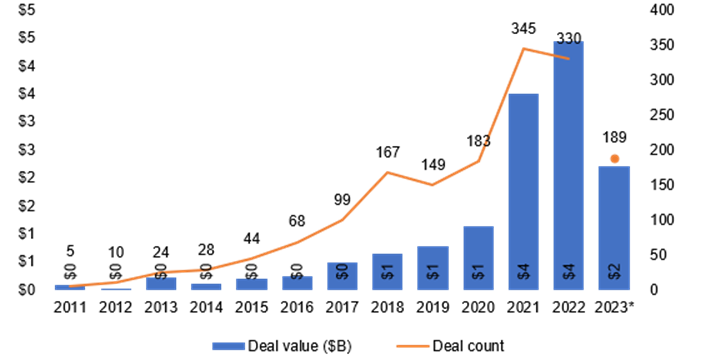

This marks a 68 p.c lower from the US$4.4 billion raised in 2022. Deal exercise considerably declined, with the variety of offers halving to 189 from the earlier yr.

Yr-on yr (2011 – 2023) fintech VC, PE, and M&A exercise in Singapore in US {dollars} (billion)

The slowdown was particularly pronounced within the second half of the yr, with funding falling by 64 p.c, from US$1,455 million throughout 102 offers to US$747 million throughout 87 offers.

This downturn displays the slowest efficiency for fintech funding for the reason that Covid-19 yr of 2020.

Investor sentiment was affected by geopolitical conflicts, excessive rates of interest, and a lackluster exit setting, resulting in elevated scrutiny on potential offers with a give attention to profitability.

Regardless of the worldwide challenges, Singapore has solidified its standing as a number one fintech hub within the Asia Pacific, capturing 21% of all fintech offers within the area in 2023.

The resilience of Singapore’s fintech sector is additional highlighted by vital offers, equivalent to a enterprise capital funding in digital financial institution AnextBank, which topped the checklist by elevating US$359 million.

Measured Method to Fostering the Crypto Area

Regardless of a broader funding slowdown, Singapore’s dedication to nurturing the crypto/blockchain house remained steadfast in H2’23.

New rules have been launched to safeguard buyer belongings and finaliSe the regulatory framework for stablecoins, with Paxos and StraitsX receiving approvals to concern regulated USD and SGD stablecoins.

This cautious regulatory method underscores Singapore’s dedication to balancing innovation with shopper safety within the evolving crypto panorama.

Notable Development and Strategic Shifts in Insurtech and Funds

The insurtech sector in Singapore skilled a exceptional funding surge within the second half of 2023, with a 194 p.c enhance to US$284.1 million from simply US$4.1 million within the first half.

This progress was led by a big early-stage VC spherical for Bolttech, totaling US$246 million. The sector has shifted its focus in direction of the SME market, addressing particular challenges inside the insurance coverage worth chain.

Though the funds sector noticed a substantial drop in annual funding to US$186.13 million in 2023 from US$984.78 million in 2022, it maintained a steady deal quantity, indicating ongoing curiosity and the crucial position of this sector inside the fintech ecosystem.

Warning in Fintech Investments Via Early 2024

The report means that world fintech funding is predicted to stay mushy into the primary half of 2024, on account of ongoing world conflicts and excessive rates of interest.

Nevertheless, as circumstances start to stabilise, investments in AI and B2B options are more likely to choose up, with M&A exercise probably rebounding as traders look towards distressed belongings.

Anton Ruddenklau

“The fintech market floundered considerably in 2023, buffeted by most of the identical points difficult the broader funding local weather. Whereas there have been nonetheless good offers available, traders have been undoubtedly sharpening their pencils—enhancing their give attention to profitability.

Whereas it was a depressed yr for the fintech market general, there have been a couple of notably shiny lights. Proptech, ESG fintech, and traders embraced AI-focused fintechs—which helped notably within the final six months.”

stated Anton Ruddenklau, World Head Fintech and Innovation, Monetary Providers, KPMG Worldwide.