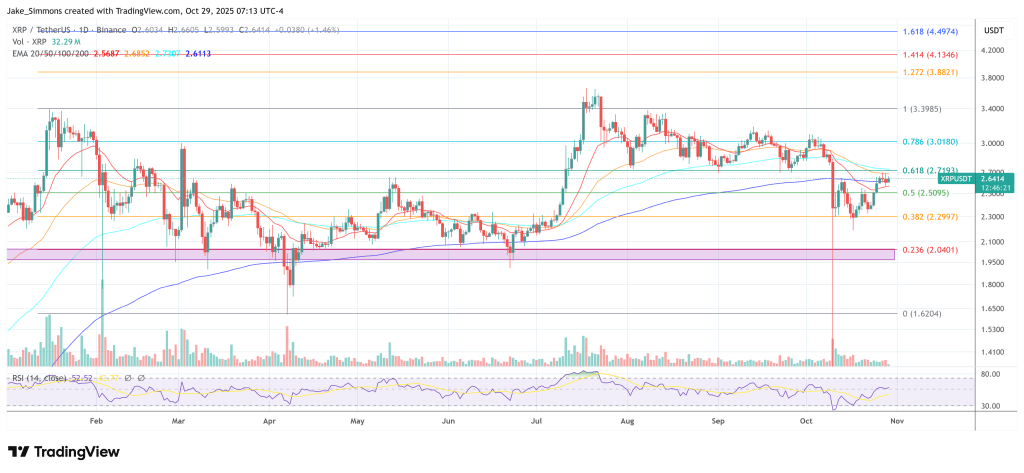

Crypto analyst Ali Martinez has cautioned that XRP could also be approaching one other downswing after the Tom DeMark (TD) Sequential flashed a contemporary promote sign on the every day timeframe. In a brand new video and transcript shared alongside a TradingView chart of the Binance XRP/USDT perpetual contract, Martinez stated, “XRP could possibly be sure for a correction. The TD Sequential Indicator on the every day chart has been remarkably correct in calling XRP’s development reversals over the previous three months, and it has simply flashed one other promote sign.”

Is XRP Poised For A 16%+ Drawdown?

Martinez anchored the decision in a sequence of current TD prints that he argues lined up with notable reversals. “On July twenty second, a promote sign resulted in a 24% correction. On August eighth, a promote sign led to a 17% pullback. On August twenty third, a promote sign resulted in a 13% drop. On September fifteenth, one other promote sign preceded a 13% dip. On September twenty seventh, a purchase sign resulted in a 12% rebound. On October twenty second, a purchase sign led to a 14% surge. Now, the TD Sequential Indicator simply flashed a promote sign, suggesting {that a} pullback could also be underway.”

The above chart depicts the every day candles for the XRP/USDT perpetual on Binance with TD markers annotated on the cited swing factors. It exhibits drawdowns and rebounds near the magnitudes Martinez lists, with bins highlighting approximate strikes of about −23.9%, −17.75%, −12.34% and −12.89% following earlier promote counts, and rebounds of roughly +12.26% and +14.25% after the late-September and late-October purchase indicators.

Associated Studying

The most recent candle is labeled with a brand new “9” promote tag close to the $2.64 space proven on the chart, underscoring the analyst’s warning that the subsequent impulse might skew decrease if the sample persists.

TD Sequential indicators are timing instruments, not directional ensures, and their effectiveness is often judged ex-post by how constantly they seem close to exhaustion factors. Martinez’s argument is empirical and narrowly scoped to the current three-month pattern seen on his chart, the place the recorded indicators coincided with native peaks and troughs to a notable diploma.

Associated Studying

The current setup subsequently pivots on whether or not XRP respects the newest promote print because it did in July, August, and mid-September, or whether or not the market breaks that cadence because it often does in trending environments.

Martinez shouldn’t be projecting targets or durations past the historic analogues he enumerates, and the one specific inference he attracts is that one other corrective part is statistically believable given the current conduct of the TD indicators on the every day chart. Primarily based on the 4 most up-to-date TD promote indicators (−24%, −17%, −13%, −13%), the typical drawdown is ~16.75%, which—utilized to the chart’s present value round $2.64—would indicate potential draw back towards roughly $2.20 if the sample repeats.

At press time, XRP traded at $2.64.

Featured picture created with DALL.E, chart from TradingView.com