Bitcoin’s on-chain image is flashing a uncommon mixture: substantial income throughout cohorts, rising realized capitalization, and file community hashrate—but not one of the price-accelerating euphoria that sometimes marks late-stage bull legs. That’s the central takeaway from CryptoQuant CEO Ki Younger Ju’s newest thread, which parses holder price bases, cohort profitability, leverage, and the evolving function of ETFs and company treasuries in setting the tape.

Is The Bitcoin Bull Run Over?

The headline quantity is startling on its face. “Bitcoin wallets’ avg price foundation is $55.9K, that means holders are up ~93% on common,” Ju wrote, including that realized capitalization climbed by roughly $8 billion this week, a clear learn that “on-chain inflows stay robust.” Realized cap—an alternate valuation measure that sums cash at their final transacted worth fairly than as we speak’s market worth—has traditionally served as a lower-variance proxy for true money-at-work. Its continued rise sometimes implies that contemporary price foundation is being set increased on chain, even when spot stalls.

So why hasn’t worth budged in tandem? Ju’s reply is simple: “Worth hasn’t gone up due to promoting strain, not as a result of demand was weak.” That framing is per a market digesting positive aspects whereas liquidity suppliers and worthwhile cohorts distribute into energy. It additionally helps clarify the co-existence of wholesome inflows with flat worth motion across the $110,000 deal with that Ju cites as the present print.

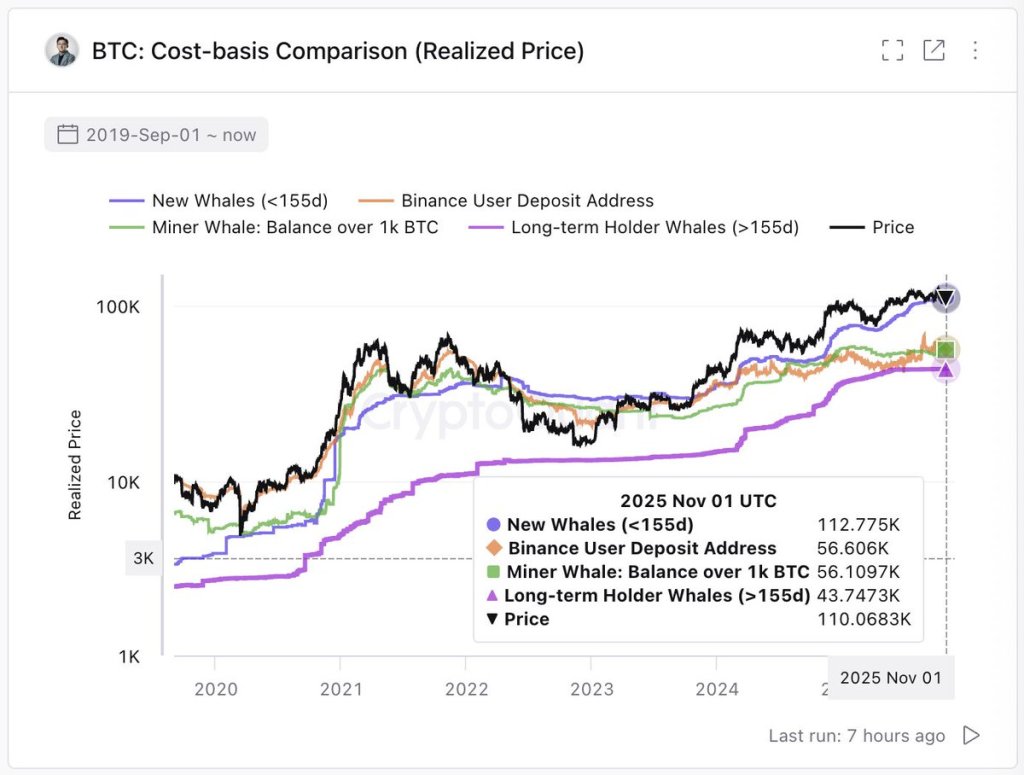

The place the marginal demand is coming from—and the place it has slowed—issues. In accordance with Ju, “New inflows largely come from ETFs and Bitcoin treasury corporations, whereas CEX merchants & miners are sitting on ~2x positive aspects.” He broke out estimated cohort price bases and mark-to-market efficiency as follows: “ETFs / Custodial Wallets: $112K (-1%), Binance Merchants: $56K (+96%), Miners: $56K (+96%), Lengthy-term Whales: $43K (+155%). Present Worth: $110K.”

If these estimates maintain, short-horizon institutional consumers are hovering close to breakeven, whereas long-tenured entities nonetheless carry deep embedded income. That distribution dampens compelled promoting threat on the very prime but additionally withholds the form of contemporary momentum that sometimes arrives when new consumers push decisively into the cash.

Valuation context helps. Ju notes that in pronounced bull phases, market cap tends to outrun realized cap, making a widening “valuation multiplier.” “When the expansion charge hole between market cap and realized cap widens, it reveals a stronger valuation multiplier,” he wrote.

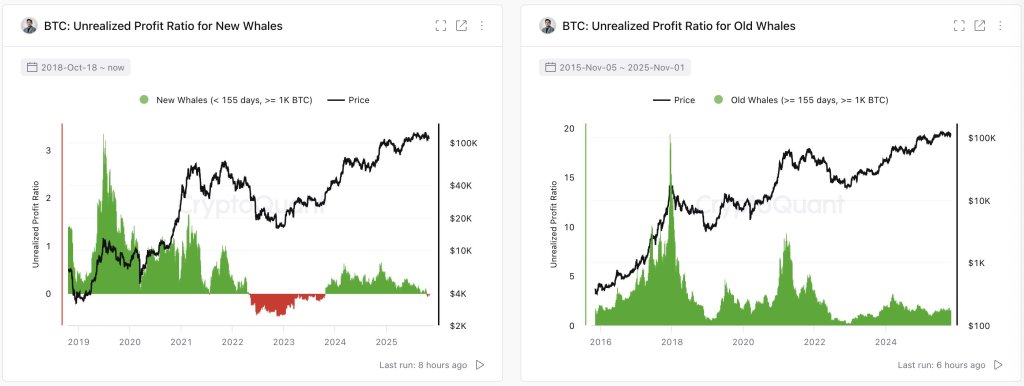

“Roughly $1T in onchain inflows has created a $2T market cap. The hole appears average for now.” A average hole is a double-edged sign: not clearly frothy, but additionally not the form of exuberant enlargement that ends cycles. It enhances Ju’s evaluation of large-holder positioning: “Whales’ unrealized income aren’t excessive.” That situation admits two interpretations he spelled out explicitly: “Hype hasn’t arrived but—we’re nonetheless removed from euphoric sentiment.” Or, “This time is completely different—the market is simply too large for excessive revenue ratios.”

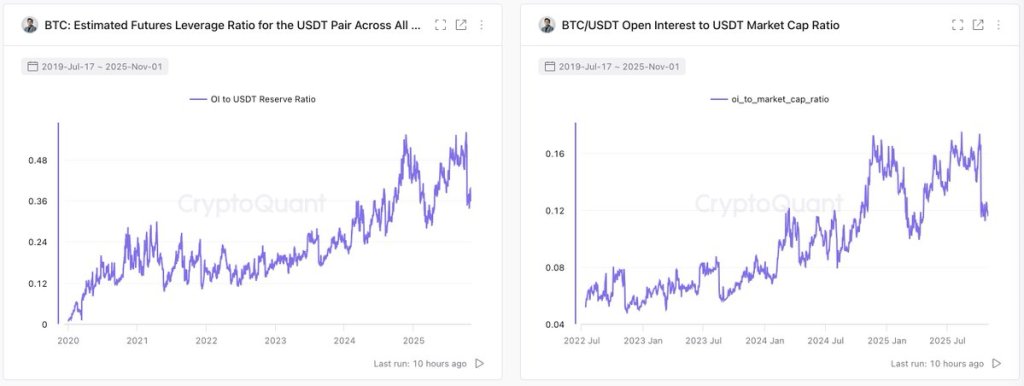

Perpetuals and collateral flows spherical out the microstructure image. Ju highlights a “sharp” drop in BTC shifting from spot-focused venues to futures exchanges—a sign that “whales are not opening new lengthy positions with BTC collateral as actively as earlier than.”

If the marginal lengthy is not pledging cash, the market loses a mechanical supply of bid depth and convexity from collateralized positioning. But leverage itself has not reset: “Bitcoin perp leverage stays excessive regardless of the latest wipeout,” Ju writes, pointing to ratios similar to BTC-USDT perpetual open curiosity relative to change USDT balances and to USDT market cap.

In easy phrases, conviction longs seem much less collateral-heavy in BTC, however system-wide leverage, as proxied by perps, stays elevated versus two years in the past. That mixture can suppress clear trending conduct: fewer collateralized longs to chase upside, however sufficient leverage within the system to impose uneven liquidations.

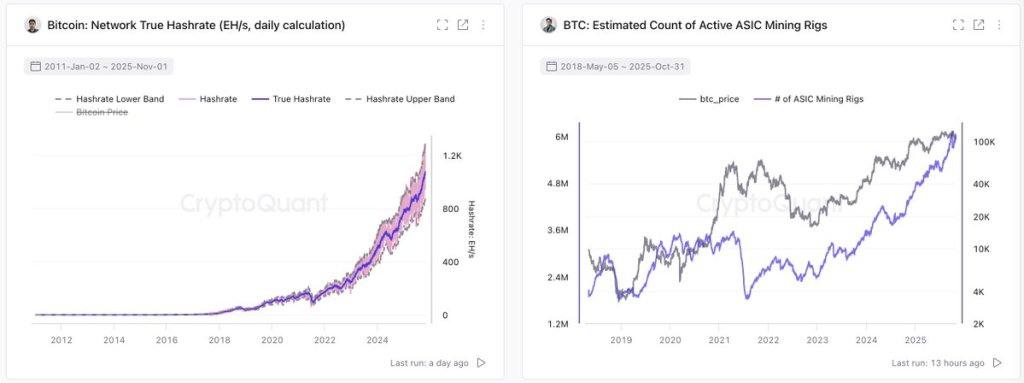

Hashrate and industrial provide traits complicate the narrative additional. “Bitcoin hashrate retains hitting new highs (~5.96M ASICs on-line). Public miners are increasing, not downsizing, which is a transparent long-term bullish sign. The Bitcoin ‘cash vessel’ retains rising.”

Rising hashrate plus increasing public miner fleets sometimes factors to ahead funding and confidence in long-run charge and subsidy economics. It doesn’t, nevertheless, assure short-term worth appreciation; if something, it could actually broaden miner treasury administration wants, interacting with market liquidity in methods which can be neutral-to-price absent contemporary demand.

New Demand Push Wanted

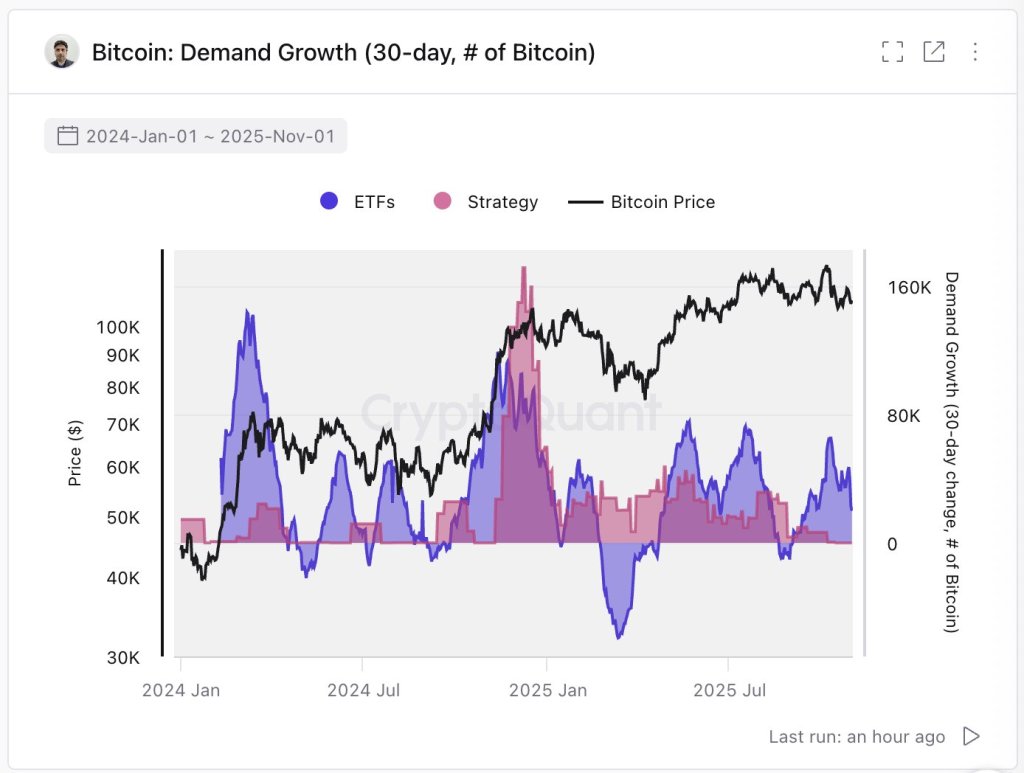

The demand facet, in Ju’s learn, is presently dominated by two channels: “Demand is now pushed largely by ETFs and Technique, each slowing buys not too long ago. If these two channels get well, market momentum doubtless returns.” That may be a clear, falsifiable thesis: if major institutional conduits re-accelerate, spot ought to regain buoyancy; if they continue to be tepid, realized cap can nonetheless grind increased on regular inflows whereas worth chops as distribution absorbs them.

Cohort profitability gives an extra boundary situation for situations. “Brief-term whales (largely ETFs) from the previous 6 months are close to break-even. Lengthy-term whales are up ~53%,” Ju wrote. Traditionally, cycle tops have typically coincided with excessive unrealized revenue ratios for dominant cohorts, creating structural promote strain when each marginal uptick unlocks vital positive aspects.

Ju is successfully saying we aren’t there. On the identical time, he cautions that the market’s regime could have already decoupled from the textbook four-year cadence: “Up to now, the market moved in a transparent four-year cycle of accumulation and distribution between retail buyers and whales. Now it’s more durable to foretell the place and the way a lot new liquidity will enter, making it unlikely for Bitcoin to comply with the identical cyclical sample once more.”

Taken collectively, the thread sketches a market with three defining traits. First, fundamentals of “cash in” look resilient: realized cap rising, holders broadly in revenue, and community safety hitting new highs. Second, microstructure is unspectacular and even a contact cautionary: fewer whales seeding BTC-collateralized longs, whereas system leverage stays excessive sufficient to destabilize clear strikes. Third, the demand baton is concentrated in ETF and company treasury channels which have not too long ago eased off—the very actors whose re-acceleration might reignite momentum.

At press time, BTC traded at $107,609.

Featured picture created with DALL.E, chart from TradingView.com