Submitting taxes might be advanced, particularly for partnership enterprise house owners who must file IRS Kind 1065. If what you are promoting is a partnership or a multi-member LLC, you’re in the appropriate place! This information will stroll you thru what you want to find out about Kind 1065 — what it’s, easy methods to file it, and key schedules you’ll want to incorporate. Whether or not you’re new to partnerships or simply want a refresher, we’ve acquired you coated.

At a look:

- Kind 1065 is an informational enterprise tax return utilized by partnerships. It experiences the partnership’s complete revenue, losses, bills, and so on., to the IRS.

- Partnerships don’t pay revenue taxes however go income and losses by way of to their companions, reported on Schedule Okay-1 to every associate.

What’s IRS Kind 1065?

IRS Kind 1065, formally often known as the U.S. Return of Partnership Earnings, is the Inner Income Service (IRS) type utilized by partnerships to report their gross revenue, deductible bills, capital beneficial properties, and different key monetary info. Primarily, it’s the partnership tax return that the IRS makes use of to maintain tabs on a partnership’s enterprise exercise all through the tax 12 months.

Do I must file Kind 1065?

In response to the IRS, a enterprise partnership is 2 or extra folks engaged in a commerce or enterprise who every contribute cash, property, labor, or talent and count on to share within the income and losses collectively.

You should file Kind 1065 in case your small enterprise:

- Is a partnership, together with common partnerships, restricted partnerships, or restricted legal responsibility partnerships (LLPs).

- Is a multi-member LLC that’s handled as a partnership for tax functions.

- Is a nonprofit spiritual group categorised as 501(d).

- Has international companions or has carried out enterprise within the U.S., even when it was organized outdoors of the U.S. (with some exceptions).

How partnerships are taxed

Not like companies, partnerships don’t pay revenue taxes immediately. As a substitute, they function as a pass-through entity, which means the income and losses are “handed by way of” to particular person companions. Whereas Kind 1065 declares the partnership’s losses, deductions, and credit, the partnership should additionally submit Schedule Okay-1 to every associate, who will file it with their private tax returns to report their portion of the partnership’s financials.

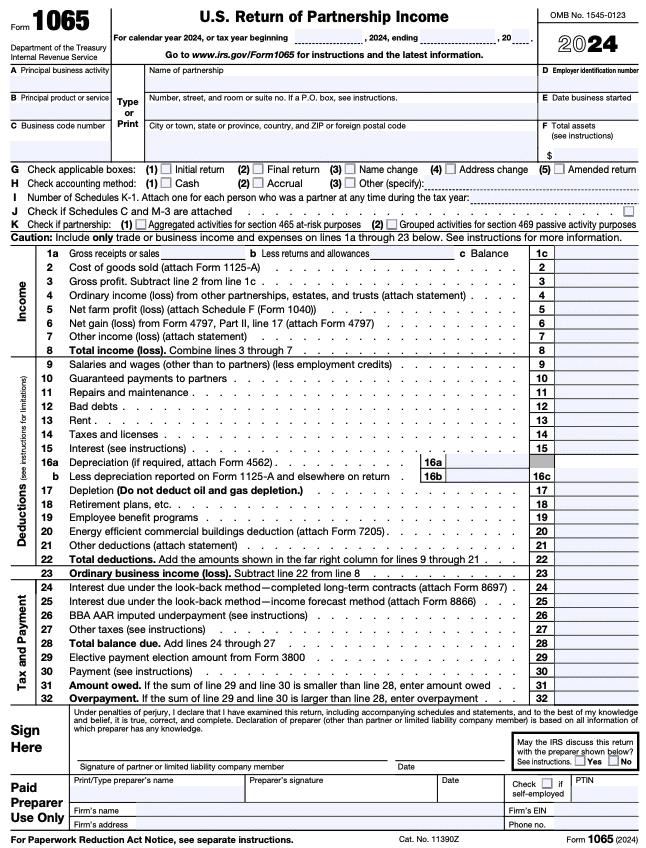

Kind 1065 instance

Right here’s a take a look at what the primary web page of IRS Kind 1065 appears to be like like:

Don’t let the packing containers intimidate you — it’s all simply enterprise info damaged down into clear sections. Right here’s the gist of what every part contains:

- Normal info: That is the place the partnership’s fundamental particulars go, just like the partnership’s title, tackle, and employer identification quantity (EIN). You’ll additionally embrace the kind of partnership and the accounting technique you’re utilizing (money or accrual).

- Earnings: This part contains the partnership’s gross receipts, price of products bought, and different enterprise revenue.

- Deductions: Right here, you report any deductible bills, akin to hire, wages, depreciation, or assured funds to companions. This is a crucial part as a result of it reduces the web revenue that will get handed on to companions.

- Tax and cost: Whereas the partnership itself doesn’t pay revenue tax, sure conditions — like curiosity and underpayments — would possibly require taxes to be paid. If relevant, you’ll report these funds right here.

- Schedule B: This half collects different details about the partnership, together with whether or not the partnership owns any international partnerships and if it made any distributions to companions.

- Stability sheet (Schedule L): The stability sheets are monetary statements for a partnership that present its property, liabilities, and companions’ fairness on the primary and final days of the tax 12 months. These ought to match up with the partnership’s books and data. If there are any variations, you’ll want to connect a press release explaining why.

Kind 1065 would possibly look advanced, however every field ensures the IRS will get an entire image of your partnership’s financials. The extra full and correct your type, the much less likelihood you’ll have the IRS knocking in your door.

Kind 1065 directions

Earlier than you begin submitting, use a complete guidelines, akin to TaxAct’s 1065 Partnership Return tax preparation guidelines, to make sure you’ve acquired all of the tax kinds and extra paperwork you’ll want. Right here’s a high-level breakdown of the steps you’ll must take when submitting Kind 1065:

- Collect monetary info: Gather particular monetary particulars about your partnership, together with revenue, bills, and distributions.

- Accomplice info: Receive info on every associate’s share of the partnership. You’ll want every associate’s title, tackle, and tax ID quantity (SSN or EIN). You’ll additionally want a listing of every associate’s revenue, loss, possession percentages, and different related monetary experiences.

- Full required schedules: Fill out numerous schedules, akin to Schedule Okay-1 for every associate (extra on every schedule beneath).

- File by the deadline: The due date for calendar-year partnerships is usually March 15 until it falls on a weekend or vacation, through which case the deadline is moved to the subsequent enterprise day. For tax 12 months 2025, the calendar-year deadline is March 16, 2026, since March 15 falls on a Sunday. For partnerships utilizing a fiscal 12 months bookkeeping technique, the shape is due by the fifteenth day of the third month following the top of the fiscal 12 months.

- Request a tax extension if essential: Should you want extra time to file, you’ll be able to request a six-month extension by submitting Kind 7004, the Software for Computerized Extension of Time. This can give calendar-year partnerships till Sept. 15 to file. Simply keep in mind, an extension to file isn’t an extension to pay your tax legal responsibility, so if any taxes are owed (like sure self-employment taxes or international funds), these nonetheless must be settled by the unique due date to keep away from penalties.

Essential schedules for Kind 1065

A number of schedules accompany Kind 1065, every offering essential particulars concerning the partnership’s funds. Listed below are a very powerful ones:

- Schedule Okay: This summarizes the partnership’s complete revenue, deductions, credit, and different important tax gadgets for the 12 months.

- Schedule Okay-1: The partnership’s revenue, losses, and credit are divided among the many companions. Every associate will get their very own Schedule Okay-1 reporting their share of the partnership’s revenue to file with their private tax return.

- Schedules Okay-2 and Okay-3: These schedules are used to report worldwide tax gadgets. Most smaller partnerships with out international exercise are exempt. But when even one associate wants foreign-related info, the partnership should present a Okay-2 and/or Okay-3. The IRS expanded exceptions starting in 2025, so many domestic-only partnerships gained’t must file these schedules until requested.

- Schedule L (stability sheet): This schedule experiences the partnership’s stability sheet. It summarizes the partnership’s monetary statements, itemizing its complete property, liabilities, and companions’ capital accounts.

- Schedule M-1: Right here, you reconcile the web revenue reported on the partnership’s books with the revenue reported on Kind 1065.

- Schedule M-2: This schedule tracks any modifications in companions’ capital accounts all year long.

- Schedule M-3: This schedule is required for partnerships with over $10 million in property. It gives extra particulars concerning the partnership’s monetary info.

All partnerships should full Schedule L, M-1, and M-2 until all the next apply:

- The partnership’s complete receipts for the tax 12 months had been lower than $250,000.

- The partnership’s complete property on the finish of the tax 12 months had been lower than $1 million.

- Schedule Okay-1s are filed with the return and given to the companions on or earlier than the due date (together with extensions) for the partnership return.

- The partnership is just not submitting and isn’t required to file Schedule M-3.

The IRS takes accuracy significantly, so at all times guarantee your numbers are proper earlier than submitting something! However you don’t should go it alone — TaxAct Enterprise can assist information you thru the Kind 1065 submitting course of.

FAQs about Kind 1065

How one can file Kind 1065 with TaxAct

Submitting Kind 1065 doesn’t should be sophisticated. TaxAct Enterprise makes it easy so that you can e-file your partnership tax return your self. Merely choose our Partnerships product as proven beneath to get began:

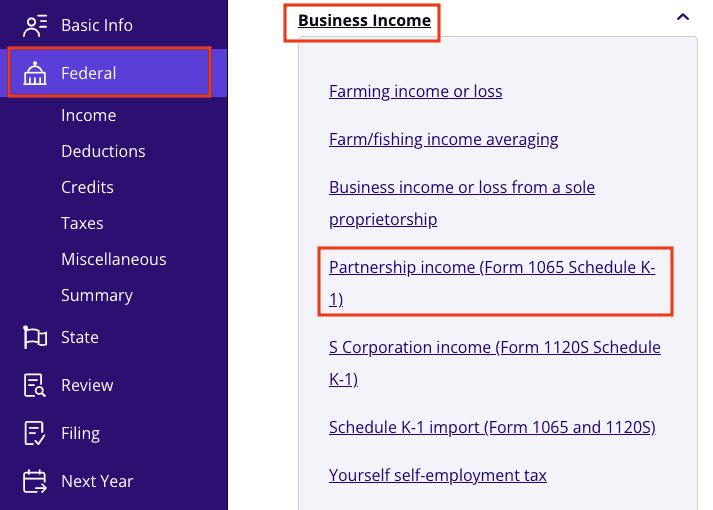

And if you happen to’re a associate needing to file your Schedule Okay-1 along with your private tax return, TaxAct can assist with that, too. Right here’s how one can file your Schedule Okay-1 with TaxAct:

- From inside your TaxAct return (On-line or Desktop), click on Federal (on smaller units, click on within the high left nook of your display, then click on Federal).

- Click on the Enterprise Earnings dropdown, then click on Partnership revenue (Kind 1065 Schedule Okay-1) as proven beneath:

3. Click on + Add Federal Partnership Schedule Okay-1 to create a brand new copy of the shape, or click on Edit to edit a type already created. (Desktop program: click on Assessment as a substitute of Edit).

4. Proceed with the interview course of to enter or evaluate your info.

It’s that straightforward! Whether or not you’re submitting on your partnership or simply your associate’s share of the income, TaxAct is right here to assist streamline the method.

The underside line

Submitting IRS Kind 1065 can appear daunting for a lot of taxpayers, however with the appropriate instruments and help, it doesn’t should be. With TaxAct as your information, you’ll be able to confidently deal with all the things from partnership revenue to associate distributions. Whether or not you’re new to submitting partnership taxes or simply want some steering, we’ll stroll you thru the tax submitting course of so you’ll be able to focus extra on the essential stuff — like working your partnership.

This text is for informational functions solely and never authorized or monetary recommendation.

All TaxAct provides, services are topic to relevant phrases and circumstances.