You would possibly obtain Type 1099-S this 12 months in the event you bought a home, some land, or one other piece of property. However what does this way imply on your revenue tax return? Don’t fear — we’ll stroll you thru all the things you could learn about this way, why you bought it, and easy methods to simply e-file it.

At a look:

- Type 1099-S stories actual property transactions, which it’s essential to report in your tax return.

- The individual or entity liable for closing the sale fills out and sends Type 1099-S.

- Promoting property doesn’t routinely imply you owe taxes, as you could qualify for an exclusion.

What’s Type 1099-S?

Type 1099-S, Proceeds from Actual Property Transactions, stories the sale or change of actual property property to the Inside Income Service (IRS). This might embrace any of the next:

- Your principal residence or one other residential constructing

- Developed or undeveloped land (together with air house)

- Condominium models (together with any fixtures or land)

- Industrial or industrial buildings

- Shares in a cooperative housing company

- Non-contingent curiosity in standing timber

Who sends Type 1099-S?

Relying on the precise transaction circumstances, totally different events could also be liable for sending Type 1099-S. In line with IRS directions, the individual liable for closing the transaction needs to be the one to fill out the shape. Typically, this falls on the title firm, escrow firm, or mortgage lender who helped you shut the transaction.

Nevertheless, simply since you bought a bit of property doesn’t routinely imply you owe taxes. Whether or not you’re on the hook is determined by elements like the kind of property, any exclusions you qualify for, and your general capital good points.

IRS Type 1099-S instance

Type 1099-S seems like this:

On the left aspect of the shape, you’ll discover two kinds of contact info:

- The filer: That is the closing agent or entity that despatched you the shape. You’ll see their identify, deal with, and taxpayer identification quantity (TIN).

- The transferor: As the vendor, you’re also called the transferor. You’ll see your individual contact information, account quantity, and TIN (usually your Social Safety quantity or SSN).

Right here’s what the bins on the fitting imply:

- Field 1: Date of closing – The date when the actual property transaction was finalized.

- Field 2: Gross proceeds – The entire quantity you obtained from the property sale.

- Field 3: Handle or authorized description – The property bought or transferred.

- Field 4: Non-cash consideration – If this field is checked, it means you obtained or will obtain providers or property apart from money or notes.

- Field 5: Overseas individual – This field is checked in the event you (the vendor) are a nonresident alien, international partnership, international property, or international belief.

- Field 6: Purchaser’s a part of actual property tax – This field exhibits the remaining actual property tax to be paid by the client for the tax 12 months. As an illustration, say you paid your actual property taxes for the remainder of the 12 months prematurely however bought your principal residence on the finish of October. The customer would then be liable for the ultimate two months of tax funds, indicated on this field.

Directions for Type 1099-S

After you have your Type 1099-S, comply with these steps to make sure you report it appropriately:

- Decide if the transaction is reportable: First, discover out in case your actual property sale qualifies for any exclusions, like the house sale exclusion. TaxAct® can assist you identify whether or not you’ve got a reportable transaction by asking questions concerning the sale.

- Report your capital good points: You probably have a reportable achieve, it’s essential to fill out Type 8949 with info out of your 1099-S. Then, you’ll want to finish Schedule D to formally report capital good points and losses. TaxAct can simplify this course of by filling out the mandatory tax kinds for you step-by-step.

- Examine for state-specific necessities: Some states have their very own tax kinds you could file, so verify along with your state’s tax company. TaxAct may pull info out of your federal revenue tax return to assist streamline the e-filing of your state revenue tax return.

IRS Type 1099-S FAQs

Learn how to file Type 1099-S with TaxAct

You possibly can report your actual property proceeds in TaxAct utilizing varied strategies relying on the kind of property you bought.

Sale of your principal residence:

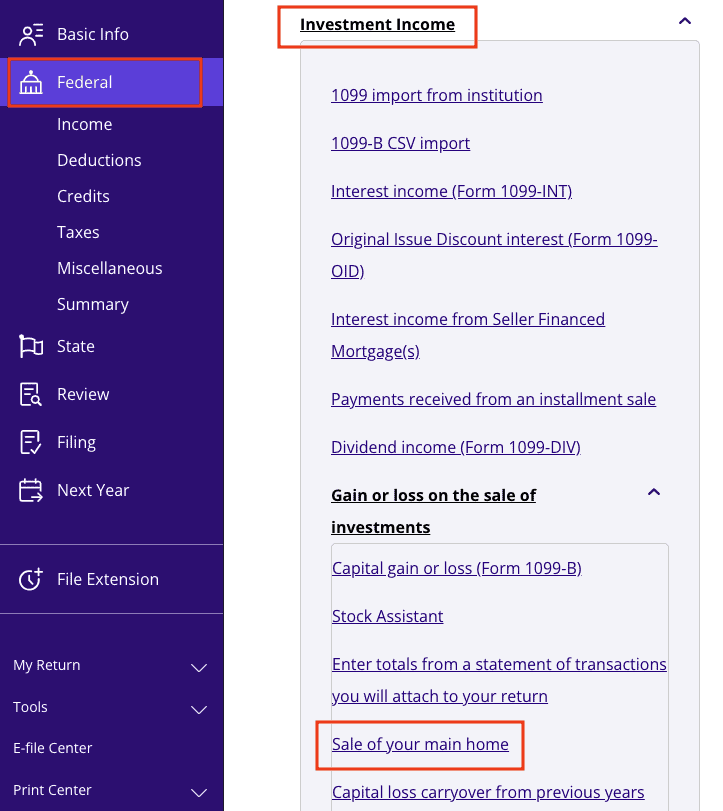

- From inside your TaxAct return (On-line or Desktop), click on Federal (on smaller gadgets, click on within the high left nook of your display, then click on Federal).

- Click on the Funding Revenue dropdown, click on the Acquire or loss on the sale of investments dropdown, then click on Sale of your principal residence.

3. Proceed with the interview course of to enter your info.

Sale of a timeshare, trip residence, or funding property:

A timeshare or trip residence is taken into account a private capital asset and needs to be reported on Schedule D for Capital Good points or Losses. When you revenue from promoting it, it’s essential to report it as revenue. Nevertheless, in the event you expertise a loss from the sale, the IRS doesn’t mean you can deduct that loss.

When you inherit a property that’s thought-about an funding property, any capital achieve or loss needs to be reported on Schedule D. When you incur a loss, the IRS will count on the sale to be reported in your return. On this case, you must enter a price equal to the sale worth in order that the reported achieve/loss is zero (0).

To report the sale of your trip residence, timeshare, or funding property in TaxAct:

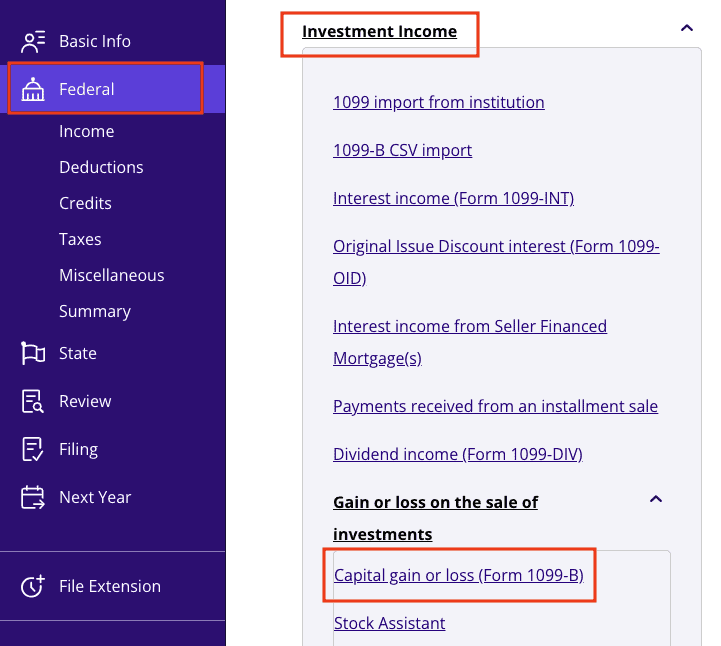

- From inside your TaxAct return (On-line or Desktop), click on Federal (on smaller gadgets, click on within the high left nook of your display, then click on Federal).

- Click on the Funding Revenue dropdown, click on the Acquire or loss on the sale of investments dropdown, then click on Capital achieve or loss (Type 1099-B).

3.Click on + Add Type 1099-B to create a brand new copy of the shape or click on Edit to edit a type already created (desktop program: click on Evaluate as an alternative of Edit).

4. Proceed with the interview course of to enter your info.

Sale of enterprise property (reportable on Type 4797 and Schedule D):

- From inside your TaxAct return (On-line or Desktop), click on Federal (on smaller gadgets, click on within the high left nook of your display, then click on Federal).

- Click on the Enterprise Revenue dropdown, then click on Enterprise revenue or loss from a sole proprietorship (or Farming revenue or loss, if relevant).

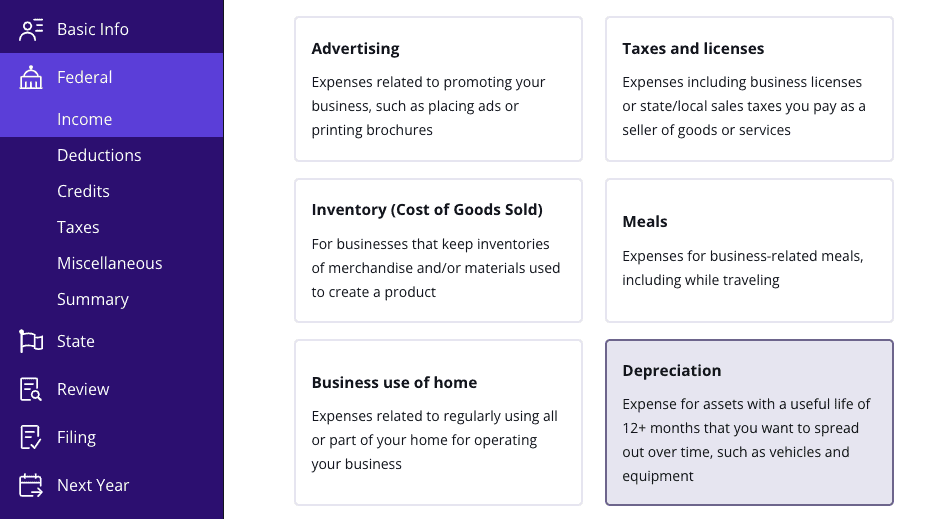

3. Proceed with the interview course of till you attain the display titled Listed below are among the mostly used bills. Choose Depreciation from the checklist as proven under.

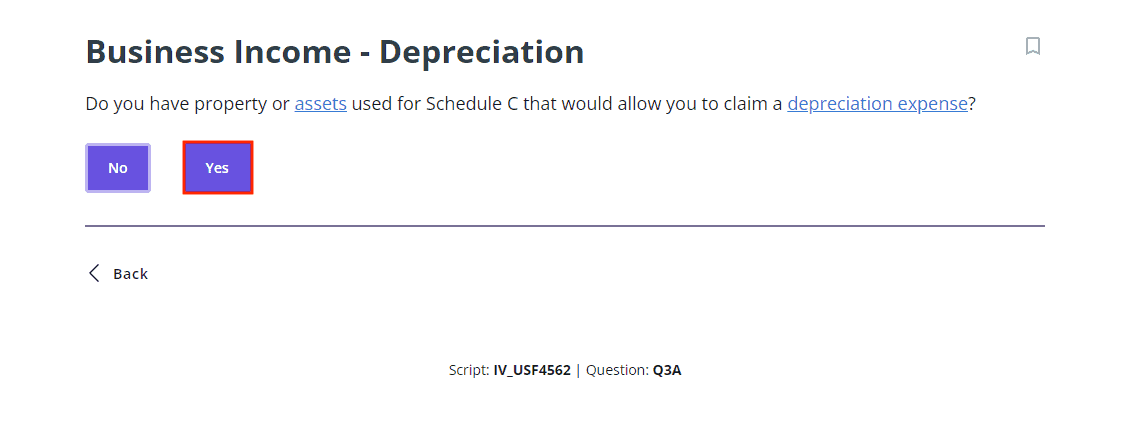

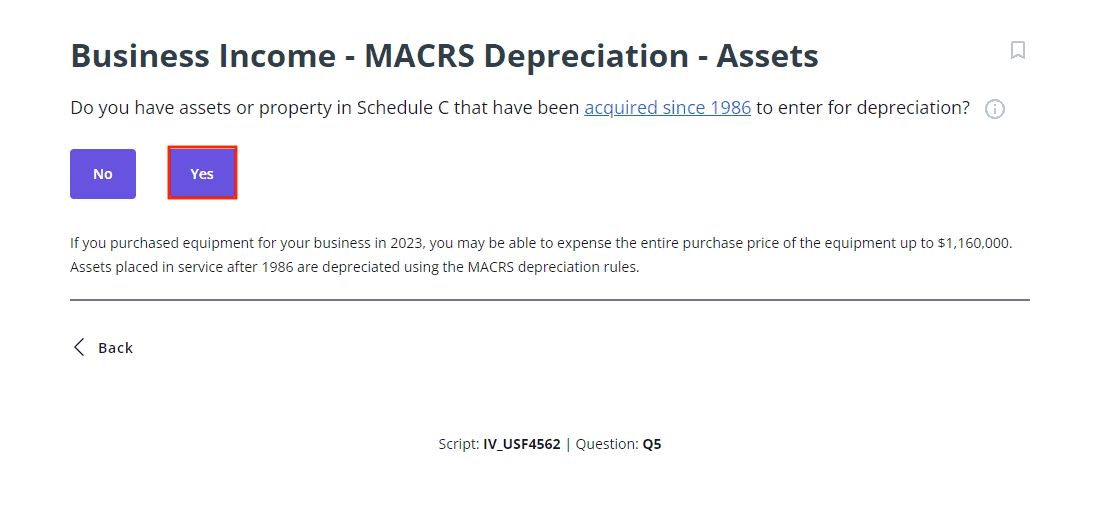

4. On the web page titled Enterprise Revenue – Depreciation, click on Sure to the query proven under.

5. On the display titled Enterprise (or Farm) Revenue – MACRS Depreciation – Property, click on Sure as proven under.

6. Click on Step-by-Step Steering and proceed with the interview course of to enter your info.

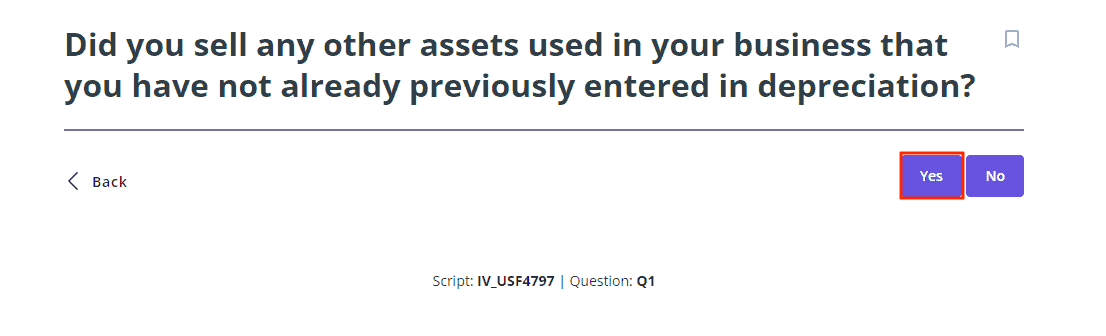

Sale of enterprise property (if the property by no means depreciated):

- Comply with the steps for reporting the sale of enterprise property within the earlier part. After coming into any depreciation and bills, you’ll come to the display proven under. Click on Sure.

2. Proceed with the interview course of to enter info for the asset that you simply bought.

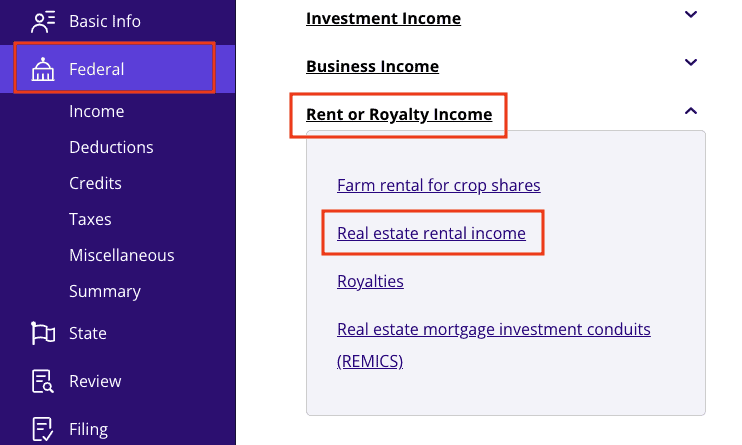

Sale of rental property (reportable on Type 4797 and Schedule D):

- From inside your TaxAct return (On-line or Desktop), click on Federal (on smaller gadgets, click on within the high left nook of your display, then click on Federal).

- Click on the Hire or Royalty Revenue dropdown, then click on Actual property rental revenue.

3.Click on + Add Schedule E, Pg 1 to create a brand new copy of the shape or click on Edit to edit a type already created (desktop program: click on Evaluate as an alternative of Edit).

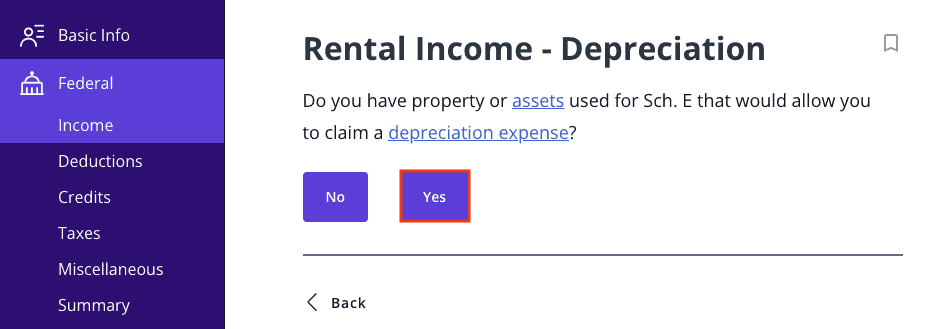

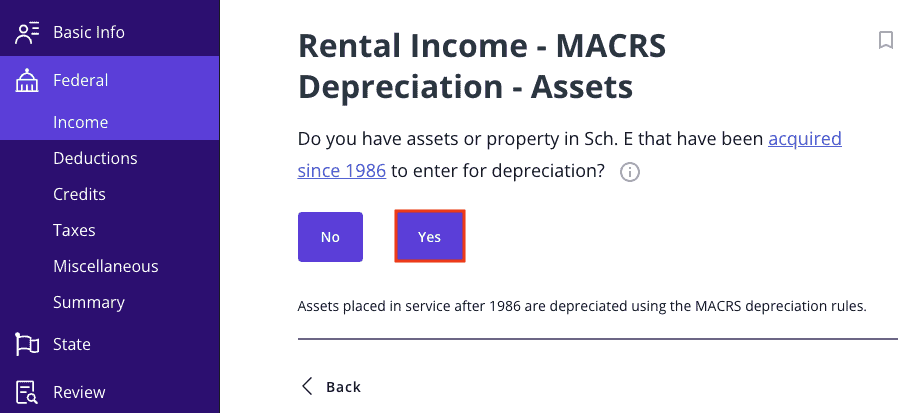

4. Proceed with the interview course of till you attain the display titled Rental Revenue – Depreciation as proven under, then click on Sure.

5. On the display titled Rental Revenue – MACRS Depreciation – Property as proven under, click on Sure.

6. Click on Step-by-Step Steering, and proceed with the interview course of to enter your info.

The underside line

Type 1099-S doesn’t need to be intimidating. Whether or not it’s your first time submitting otherwise you’re a seasoned DIY tax filer, understanding what this way means and easy methods to report it could actually prevent stress and complications throughout tax submitting season. And as at all times, if you file with TaxAct, you possibly can relaxation assured we’ve received the instruments you could deal with your 1099 kinds with out breaking a sweat.

This text is for informational functions solely and never authorized or monetary recommendation.

All TaxAct presents, services and products are topic to relevant phrases and circumstances.