Did you obtain Type 1099-Q this tax yr? The Inner Income Service (IRS) requires payers to ship you this tax type if you happen to took distributions from a tax-advantaged schooling funding account resembling a 529 plan or Coverdell schooling financial savings account (ESA). Whether or not you’re a dad or mum or a pupil, we’re right here that will help you perceive this tax type, why you bought it, and whether or not it is advisable report it in your revenue tax return.

At a look:

- Type 1099-Q studies distributions from certified teaching programs like a 529 plan or Coverdell ESA.

- Distributions are usually not taxable if used to pay for certified schooling bills.

- You could owe taxes and penalties in your earnings if you happen to use the distributions for nonqualified

What’s a 1099-Q type?

Type 1099-Q, Funds from Certified Schooling Applications (Beneath Sections 529 and 530), studies distributions from certified teaching programs, together with 529 plans and Coverdell schooling financial savings accounts (Coverdell ESAs or CESAs). Should you’ve been saving for schooling in one in every of these accounts and take cash out, this way tells you and the IRS how a lot you withdrew.

529 plans and Coverdell ESAs defined

CESAs and 529 plans (additionally known as certified tuition applications or QTPs) are tax-advantaged funding accounts meant to assist Individuals pay for certified schooling bills from kindergarten via college. Usually, a dad or mum or different relative opens one in every of these accounts for his or her youngster, who’s the designated beneficiary.

CESAs and QTPs have completely different guidelines for contributions and beneficiaries, however the tax therapy is identical for each. Receiving Type 1099-Q doesn’t robotically imply your distributions are taxable. You’ll be able to withdraw funds tax-free to pay for certified schooling bills like tuition, books, or generally room and board prices. Nevertheless, you could owe taxes and penalties in case your distributions exceed your certified schooling prices or if you happen to spend them on nonqualified bills.

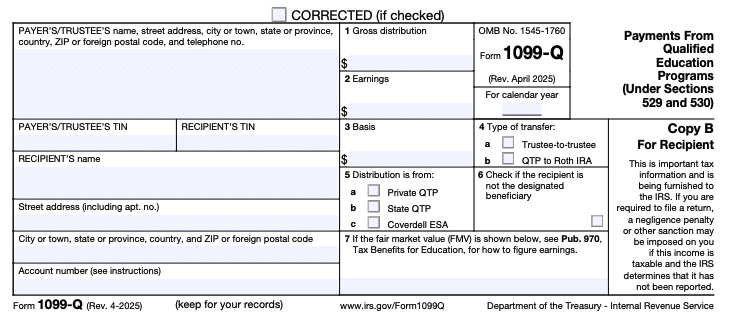

Instance of Type 1099-Q

Let’s take a more in-depth have a look at a 1099-Q instance. That is what the shape seems like:

The shape has just a few bins that comprise key info for taxpayers. Right here’s a fast breakdown:

- First, you’ll see the payer’s title, tackle, cellphone quantity, and tax identification quantity (TIN). You’ll additionally see your info, together with your account quantity.

- Field 1: Gross distribution – That is the overall distribution you obtained up to now yr out of your CESA or QTP within the type of money, tuition credit or certificates, waivers, vouchers, and many others.

- Field 2: Earnings – That is the portion of the distribution that exhibits how a lot cash you produced from your invested contributions.

- Field 3: Foundation – That is your foundation within the gross distribution, or how a lot you contributed to the account, minus your earnings (Field 1 – Field 2 = Field 3).

- Field 4: Trustee-to-trustee switch – This field is checked if the funds had been rolled over or transferred immediately between certified applications. For instance, a QTP to QTP, CESA to CESA, CESA to QTP, or perhaps a QTP to an ABLE account.

- Field 5: This field exhibits the kind of account from which the distribution got here (QTP or CESA).

- Field 6: If this field is checked, it means the distribution was made to an individual apart from the designated beneficiary, such because the account proprietor. For instance, a dad or mum who withdrew funds to spend for his or her youngster’s schooling.

The important thing bins to concentrate on are 1, 2, and three. These bins present you the way a lot was taken out, how a lot of that’s earnings (doubtlessly taxable), and the way a lot your preliminary funding was.

Directions for Type 1099-Q

Acquired your 1099-Q type in hand? Right here’s what you need to do with it:

- Confirm the numbers: First, be certain the knowledge is appropriate. Verify the distribution quantity and double-check that the shape matches what you withdrew. If one thing seems off, contact the plan administrator for clarification.

- Decide if the distribution is taxable: You don’t owe tax on the quantity you used for certified schooling bills. However if you happen to used the distribution for nonqualified bills or it exceeded your certified bills, the earnings portion (Field 2) is topic to revenue tax and certain a ten% penalty.

- Report it in your tax return: If any a part of the distribution is taxable, you could report it as “different revenue” in your federal tax return. TaxAct® can information you thru this course of if you happen to e-file with us.

FAQs about Type 1099-Q

How you can file Type 1099-Q with TaxAct

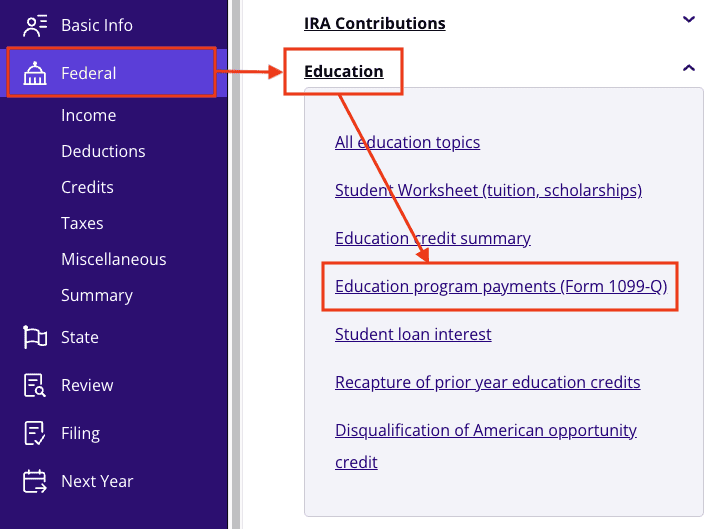

Reporting your 1099-Q type doesn’t must be a headache. Right here’s find out how to enter this way when utilizing our tax preparation software program:

- From inside your TaxAct return (On-line or Desktop), click on Federal. (On smaller gadgets, click on within the high left nook of your display screen, then click on Federal).

- Click on the Schooling dropdown, then click on Schooling program funds (Type 1099-Q), as proven beneath.

3. Click on + Add Type 1099-Q to create a brand new copy of the shape or click on Edit to edit a type already created. (Desktop program: click on Evaluation as an alternative of Edit).

4. Proceed with the interview course of to enter your info.

Straightforward, proper? Taxes won’t be essentially the most thrilling factor in your to-do record, however with TaxAct, they don’t must be the toughest both.

The underside line

Type 1099-Q can appear complicated initially, however with some background information, it’s not that completely different from a easy W-2 type. Whether or not you’re a dad or mum or pupil, understanding the IRS 1099-Q necessities and realizing what’s taxable and what isn’t will assist guarantee a clean tax submitting course of this season. And don’t neglect — TaxAct might help information you thru the 1099-Q reporting course of.

This text is for informational functions solely and never authorized or monetary recommendation.

All TaxAct provides, services and products are topic to relevant phrases and circumstances.