In case you’ve obtained a 1099-LTC tax type this tax yr, it’s doubtless since you have been paid long-term care advantages or accelerated demise advantages, and the Inner Income Service (IRS) needs to learn about it. Whereas these advantages aren’t at all times taxable, it’s vital to grasp what this type means. Let’s break down what’s on the shape, what you might want to do with it, and find out how to report it accurately.

At a look:

- Kind 1099-LTC reviews funds from long-term care insurance coverage insurance policies and accelerated demise advantages.

- Not all the advantages listed on this tax type could also be taxable.

What’s a 1099-LTC type?

IRS Kind 1099-LTC, Lengthy Time period Care and Accelerated Demise Advantages, is what the IRS calls an data return. In case you’ve obtained this type, you doubtless bought a payout from an insurance coverage firm, governmental company, or viatical settlement supplier. These payouts might be from a long-term care (LTC) insurance coverage coverage or, in some instances, early funds of a life insurance coverage contract demise profit.

What are LTC advantages and accelerated demise advantages?

Lengthy-term care insurance coverage advantages cowl medical and private care bills for individuals who grow to be chronically ailing. Equally, insurers might pay accelerated demise advantages in case you’ve been licensed as terminally ailing or chronically ailing by a licensed healthcare practitioner.

The 1099-LTC type helps the IRS observe funds associated to long-term care bills or terminal sicknesses. The excellent news? It’s possible you’ll not want to fret about taxes in your whole quantity of advantages (we’ll get into that somewhat later).

Kind 1099-LTC instance

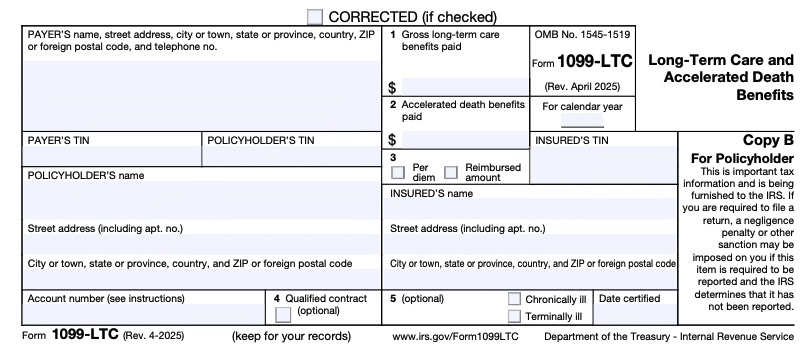

Kind 1099-LTC seems like this:

The payer (the insurance coverage firm or different establishment) sends Copy B to the policyholder who owns the contract and Copy C to the insured (notice that you could be be each the policyholder and the insured). They may even ship a replica of Kind 1099-LTC to the IRS.

Right here’s a breakdown of what’s included on the 1099-LTC type:

- Field 1: Gross long-term care advantages: That is the entire quantity you obtained out of your LTC insurance coverage contract.

- Field 2: Accelerated demise advantages: In case you obtained an early payout of life insurance coverage on account of a terminal sickness, the gross quantity will probably be listed right here.

- Field 3: Per diem vs. Reimbursed quantity: These checked packing containers inform the IRS whether or not the profit payout was primarily based on precise prices incurred or made on a per diem foundation. Per diem signifies you obtained an everyday fastened fee, no matter your precise incurred prices. This field won’t be checked in case you are terminally ailing.

- Field 4: Certified contract: This exhibits whether or not the advantages have been from a certified LTC insurance coverage contract.

- Field 5: This field exhibits if the insured was licensed as a chronically ailing particular person or a terminally ailing particular person and the date licensed.

Your 1099-LTC must also include contact data for the payer, policyholder, or different particulars associated to the fee. You may see:

- The payer’s title, deal with, and cellphone quantity

- The payer’s taxpayer identification quantity (TIN)

- Your title, contact data, and TIN (your TIN is usually your Social Safety quantity)

- The account variety of the coverage

Directions for Kind 1099-LTC

So, what must you do together with your Kind 1099-LTC as a taxpayer? Listed below are some normal directions to observe.

1. Decide in case your funds have been taxable.

First, it’s vital to keep in mind that not all of the quantities reported on Kind 1099-LTC are routinely taxable. Whether or not or not you might want to report it in your tax return relies on the next components:

- Was the fee for long-term care? If sure, you won’t owe taxes on it, particularly if the funds have been for certified LTC companies and didn’t exceed the precise prices of care. For per diem advantages, you may exclude a certain quantity out of your revenue every day. In 2025, the tax-free day by day restrict is $420 (growing to $430 in 2026). Nevertheless, in case you exceed this day by day restrict, you could have to pay taxes on the surplus quantity.

- Was the fee for accelerated demise advantages? Accelerated demise advantages are usually excluded from taxable revenue in case you obtained them since you have been terminally or chronically ailing.

2. Fill out Kind 8853 if wanted.

You’ll have to file Kind 8853, Archer MSAs and Lengthy-Time period Care Insurance coverage Contracts, to say an exclusion for accelerated demise advantages made on a per diem foundation. Don’t fear, although — TaxAct® will stroll you thru the submitting course of step-by-step and pull the right tax kinds for you.

FAQs about Kind 1099-LTC

File Kind 1099-LTC with TaxAct

E-filing your 1099-LTC type with TaxAct is simple to do. When you collect your paperwork, log into your TaxAct account and observe these steps:

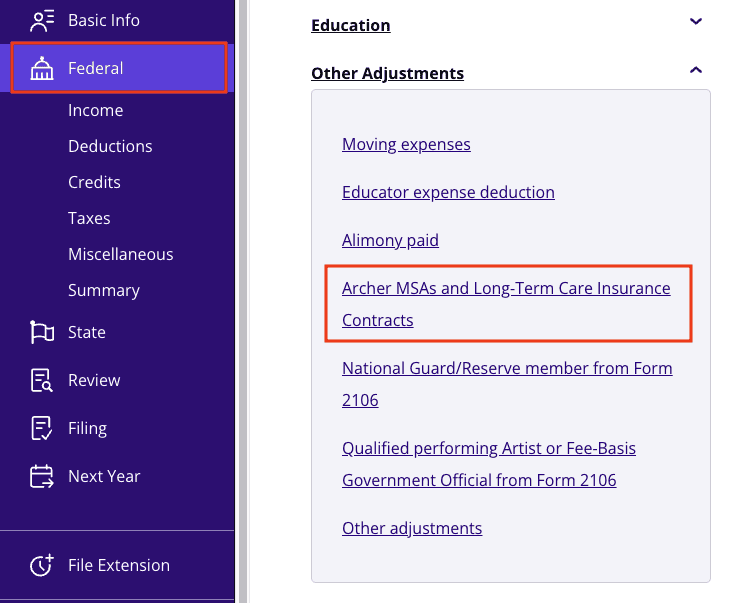

- From inside your TaxAct return (On-line or Desktop), click on Federal. (On smaller units, click on within the high left nook of your display screen, then click on Federal).

- Click on the Different Changes dropdown, then click on Archer MSAs and Lengthy-Time period Care Insurance coverage Contracts as proven under:

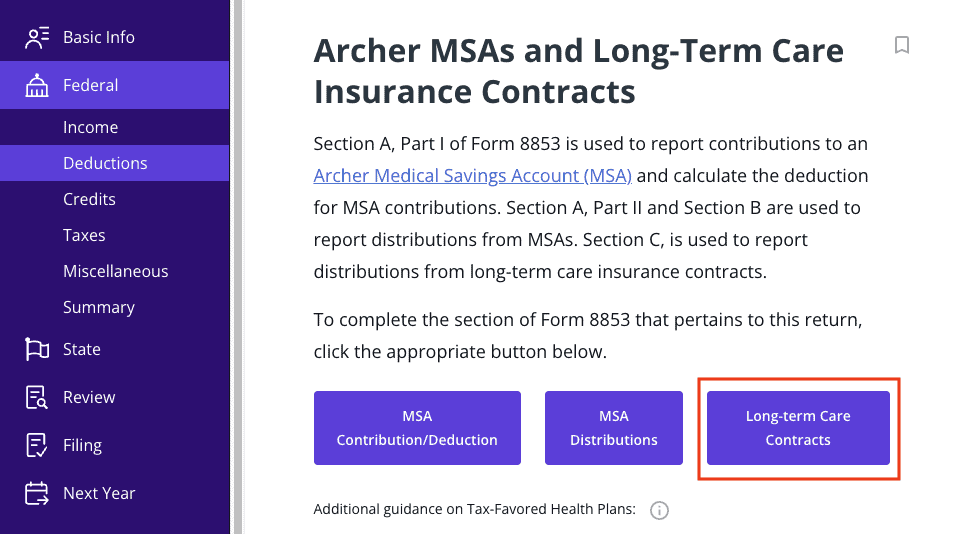

3. Click on Lengthy-term Care Contracts as proven under and proceed the interview course of to enter your data for Part C of Kind 8853.

You’ll then be requested to enter data out of your Kind 1099-LTC one step at a time. For extra data on find out how to report this tax type, head over to our Kind 1099-LTC Assist Heart web page.

The underside line

The 1099-LTC type permits the IRS to trace long-term care or accelerated demise profit funds. Whereas a few of this cash could also be taxable, receiving this type doesn’t routinely imply it can affect your tax invoice. The secret is understanding what to report and when. And with TaxAct in your nook, you’ll have your 1099-LTC and the remainder of your tax submitting paperwork conquered very quickly.

This text is for informational functions solely and never authorized or monetary recommendation.

All TaxAct presents, services and products are topic to relevant phrases and circumstances.