Methods for tax and international commerce professionals to handle tariffs.

Highlights

- The Trump administration’s tariff technique has created financial turbulence, with research projecting destructive impacts like decreased GDP progress, increased client costs, and elevated family tax burdens.

- For tax professionals, tariffs introduce important compliance dangers, notably below UNICAP guidelines (IRC Sec. 263A).

- Commerce professionals should guarantee exact product classification (HTS codes) and make use of mitigation methods like overseas commerce zones (FTZs) to defer or scale back duties.

Tariffs stay firmly within the highlight as one among a number of urgent points going through companies below the Trump administration. And, in latest months, President Trump has shifted his tariff technique into increased gear, additional fueling an already turbulent international commerce surroundings.

Main buying and selling companions and key U.S. allies — together with the European Union (EU), Mexico, China, Brazil, Japan, India, and Canada — have confronted important tariff shifts as retaliation measures, authorized challenges, and negotiation efforts more and more outline at the moment’s tariff panorama.

Tax and commerce professionals want to know the broader financial impacts of tariffs to mitigate dangers, handle prices, and navigate compliance. This text explores how tariffs are impacting the financial system, addresses the tax and trade-specific concerns to bear in mind, and highlights the significance of an built-in tariff response technique.

Bounce to ↓

How tariffs are impacting the financial system

Normal tariff impacts throughout tax and commerce

Subsequent steps for tax and commerce leaders

How tariffs are impacting the financial system

Underneath the Trump administration in 2025, the U.S. financial system feels very like a curler coaster journey as companies and shoppers brace for unpredictable twists and turns fueled, partially, by commerce coverage shifts.

Amid sluggish financial progress, increased client costs, and financial uncertainty, the administration stays resolute in its place that President Trump’s tariff plan is an efficient technique to spice up U.S.-based manufacturing, enhance the commerce steadiness, and, finally, enhance federal authorities income.

Nevertheless, analyses by each the Tax Basis and the Peterson Institute for Worldwide Economics (PIIE) point out that the tariffs below the Trump Administration are taking their toll on U.S. companies and households.

Research challenge that the imposed tariffs will scale back the U.S. progress price by 0.23 share level in 2025 (0.62 share level in 2026), result in a median tax enhance per U.S. family of $1,300 in 2025 ($1,600 tax hike in 2026), and drive inflation roughly one share level increased. Though the rise in inflation could also be non permanent, PIIE means that U.S. worth ranges will stay elevated.

Moreover, the Tax Basis estimates that, over the following decade, Trump’s imposed tariffs will “scale back US GDP by 0.8 p.c, all earlier than overseas retaliation.”

Based on no less than one survey, many People disapprove of Trump’s tariff insurance policies. A Pew Analysis Heart examine carried out in August 2025 discovered that almost all of People consider the long-term results of the administration’s tariff insurance policies might be principally destructive for the nation (55%) and for themselves and their households (additionally 55%).

The impacts are actual, rippling by the financial system, eroding shoppers’ buying energy, and leading to new challenges for firms that depend on international provide chains. To assist handle tax implications, offset increased prices, and reassess sourcing selections, strategic planning is crucial to navigate the affect of tariffs.

Normal tariff impacts throughout tax and commerce

For each tax and commerce leaders, tariffs can create a number of challenges. In at the moment’s ever-changing surroundings, companies are reevaluating learn how to navigate costly tariffs whereas sustaining compliance.

Tax-specific concerns

For tax companies with shoppers concerned in importing items or those that depend on international provide chains, tariffs can have important implications.

For example, when a enterprise shopper imports stock or supplies, the tariffs paid on these imports aren’t instantly deductible. Underneath the IRS’s uniform capitalization (UNICAP) guidelines of IRC Sec. 263A, these prices have to be capitalized as a part of the stock’s whole worth.

If a shopper instantly bills tariffs, they may find yourself underreporting stock values and overstating the price of items offered (COGS). This leads to an surprising tax adjustment. To make sure compliance, you will need to monitor and allocate tariff-related prices correctly.

Take into account the next instance: A enterprise imports $200 million price of products and pays $15 million in tariffs over the course of the 12 months. For inner accounting functions, they file these tariff prices as bills as they happen. Nevertheless, by year-end, $2 million of these tariffs are tied to stock that continues to be unsold and continues to be within the warehouse.

The corporate assumes the quantity is immaterial and doesn’t capitalize the $2 million in its GAAP financials. Nevertheless, throughout tax preparation, the UNICAP guidelines are utilized, which require that $2 million be added to the tax stock.

The result:

- The corporate’s COGS is decreased by $2 million for tax functions.

- Taxable revenue will increase by the identical quantity.

- The corporate’s tax invoice is considerably increased than anticipated.

Client pricing pressures are one other consideration. When hit with tariffs, companies should determine whether or not to move the expense on to their clients, take in it, or make the most of different authorized choices akin to overseas commerce zones (FTZs) to defer duties and mitigate the affect. Their choice can affect profitability, income recognition, and the timing of revenue for tax functions. Serving to shoppers navigate pricing selections and the implications for money movement and tax liabilities is necessary.

Commerce-specific concerns

For international commerce professionals, the turbulent tariff panorama has underscored the necessity to rethink sourcing patterns and ramp up efforts to scale back prices and mitigate dangers. Not solely have tariff charges elevated, however guaranteeing compliance with them has grow to be much more difficult.

Classification

Right this moment, correct product classification is extra necessary than ever, as even minor errors below the Harmonized Tariff Schedule (HTS) may end up in compliance points, penalties, and incorrect fee of duties.

When an organization imports a product, it’s not simply importing that product with one assigned HTS quantity. The elements of that product also can have their very own HTS codes, so the product’s elements should even be considered. Every product can contain a number of codes in addition to probably a further HTS code based mostly on the nation of origin.

Corporations that also depend on conventional strategies like spreadsheets or a custom-made enterprise useful resource planning (ERP) system must rethink their strategy to managing classification correctly.

Take into account, for instance, Thomson Reuters ONESOURCE World Classification with CoCounsel, which automates Harmonized System (HS) and Export Management Classification Quantity (ECCN) classifications with exact codes and responsibility charges. The answer helps firms effectively handle regulatory adjustments, chopping down on time-consuming and error-prone duties for commerce compliance groups.

Tariff mitigation

Corporations can use a number of tariff mitigation instruments, together with overseas commerce zones. An rising variety of firms are adopting overseas commerce zones to ease tariff-related complexities and minimize prices. These areas are specifically designated websites inside 60 miles of a U.S. port of entry that enable companies to maneuver items in and in another country with decrease, deferred, or no customs duties, taxes, or charges.

Inside overseas commerce zones, firms aren’t allowed to have interaction in retail commerce; nonetheless, many different actions are permitted. For example, firms can retailer and distribute items, in addition to repackage, re-label, course of, take a look at, and type them.

Working in overseas commerce zones may end up in a extra environment friendly provide chain, in addition to the next price financial savings and advantages:

- No duties on waste, scrap, or faulty elements

- Delayed fee of duties on items coming into the U.S. market

- Diminished merchandise processing charges (MPFs)

- No duties on imported items which can be later re-exported

In the end, proactive planning is vital for commerce professionals as administration more and more asks them to assume extra strategically and scale back prices.

Subsequent steps for tax and commerce leaders

In at the moment’s financial surroundings, having an built-in tariff response technique isn’t non-compulsory; it’s important.

To mitigate publicity and scale back prices, commerce leaders are reimagining enterprise fashions, methods, and operations. Investing in the correct expertise and information options can present the real-time visibility wanted for making quicker, extra knowledgeable selections. Obtain Company tariffs survey: Mitigating international commerce challenges to study extra.

On the similar time, firms will more and more flip to their accountants for steering on each the tax and monetary implications of tariffs. For accounting companies that provide strategic advisory providers and leverage the ability of AI, this represents important progress alternatives.

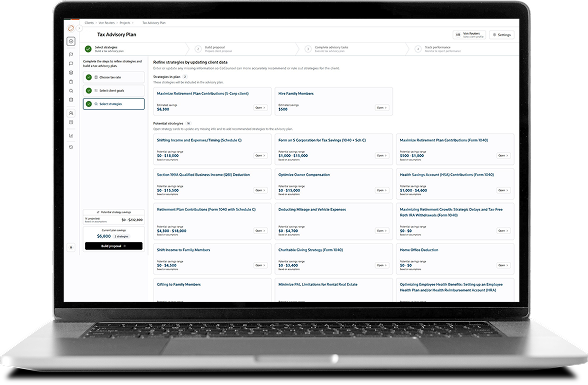

Thomson Reuters Able to Advise is a tax planning device that permits companies to remodel their advisory technique by AI-powered insights, automated workflows, and skilled implementation steering. Find out how your agency can elevate its tax planning advisory providers at the moment.