Trash isn’t precisely an exciting funding or ceremonial dinner matter. Whereas everybody was chasing the subsequent sizzling tech inventory or essentially the most promising hashish inventory a decade in the past, a quiet, important service enterprise was methodically turning modest investments into small fortunes. In case you’re seeking to construct a formidable retirement portfolio, typically essentially the most profound knowledge lies not in what’s flashy, however in what’s essentially indispensable.

That is the story of Waste Connections (TSX:WCN), a stellar instance of how a so-called “boring” enterprise can ship spectacular returns. In case you had invested your retirement financial savings on this built-in stable waste companies firm a decade in the past, your endurance can be handsomely rewarded.

Waste Connections inventory: From a merger to a six-fold return

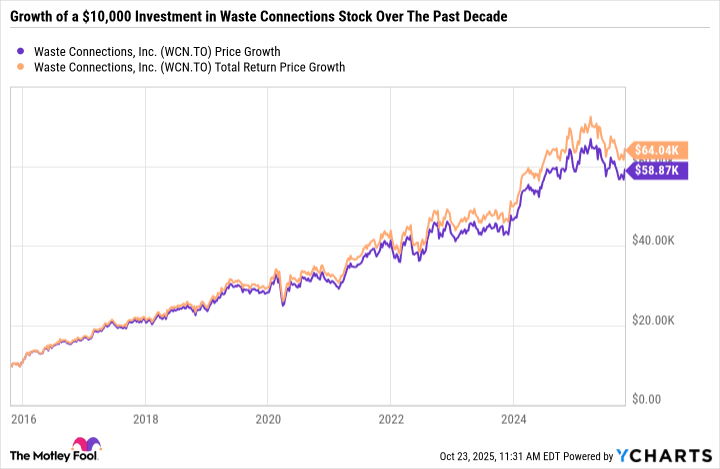

Think about it’s June 2016. United States-based Waste Connections has simply merged with Canada’s Progressive Waste and is listed on the TSX, with shares buying and selling round $60.60. You determine to commit $10,000 to this North American waste assortment and disposal enterprise, trusting within the fixed want for its companies.

Quick ahead to right this moment. That preliminary funding, with dividends faithfully reinvested, would have ballooned to roughly $64,350. Even for those who had merely pocketed the dividends, your capital can be price about $59,160. That’s a greater than six-fold enhance, a testomony to the ability of WCN inventory’s regular, compounding development.

This transformative return is exactly why Waste Connections inventory stands tall among the many high TSX shares to purchase and maintain for the long term.

The engine behind WCN’s development

How did a waste firm obtain such exceptional development? The reply lies in a brilliantly executed, disciplined technique. Waste Connections actively engineers its income and earnings development by a savvy acquisitions-led mannequin. The corporate persistently identifies and acquires smaller, typically much less environment friendly, waste companies. Then, it applies its deep operational experience to enhance their profitability, seamlessly integrating them into its huge community.

This technique continues to be in play right this moment. Following its sturdy third-quarter 2025 earnings report on October 21, the corporate introduced commitments for brand new acquisitions that might add as much as $300 million in annual income. For the primary 9 months of 2025, income climbed 6.5% year-over-year to $7.1 billion. Normalized earnings per share grew 6.3% to $3.86, and the corporate’s adjusted EBITDA margin – a key measure of profitability that stands for Earnings Earlier than Curiosity, Taxes, Depreciation, and Amortization – stays impressively sturdy at 33.8%. The enterprise has very good management over its prices and operations regardless of some impairments throughout the previous quarter.

The ability of a large financial moat

In investing, an “financial moat” refers to a enterprise’s sustainable aggressive benefit. Waste Connections has dug a really broad one. By specializing in offering important companies in secondary, typically rural and suburban markets, it avoids brutal value wars with rivals in main city centres. This strategic focus grants it sturdy pricing energy, permitting it to guard its revenue margins even throughout inflationary durations. It’s a traditional case of a enterprise doing one factor exceptionally properly and being irreplaceable within the communities it serves.

Waste Connections’ 0.8% dividend tells a narrative

Simply this week, Waste Connections introduced an 11.1% enhance to its quarterly money dividend. To a brand new investor, the ensuing annual yield of 0.8% may appear negligible. However right here’s the magic of long-term investing: for an investor who purchased shares a decade in the past at that authentic $60 value, the efficient yield on their preliminary value is a way more respectable 3.2% and rising.

This payout highlights a vital lesson for long-term investing: beginning early and holding by constant dividend raises can rework a tiny preliminary yield into a big passive earnings stream in retirement.

It’s price noting that the inventory isn’t low-cost right this moment, buying and selling at a premium with a ahead price-to-earnings (P/E) ratio of 43.2 that displays the market’s excessive confidence in its future. Whereas this may occasionally give worth hunters a pause, it additionally underscores the standard and reliability the market is prepared to pay for.